Where Can I Get Form 15G For Pf Withdrawal

Where Can I Get Form 15G For Pf Withdrawal - You must be aware that tds is applicable on the epf. Click on “online services” and then go to “online claim” and fill in the required details. Many times it has been noticed that epf claim has been rejected as form 15g was not filed. So to be on the safer side please submit form 15g while withdrawing. Then you can fill form 15g epfo. You can easily download it from all the websites. Account number of national saving scheme from. You simply need to login to the epfo portal/banks’. Web you can submit form 15g or form 15h at the following institutions or corporations to ensure no deduction of tds by the deductor: Web during the filing of form 15g for the withdrawals of the pf, the same shall be essential to find out the tds rules concerning the pf withdrawals, under the rule when.

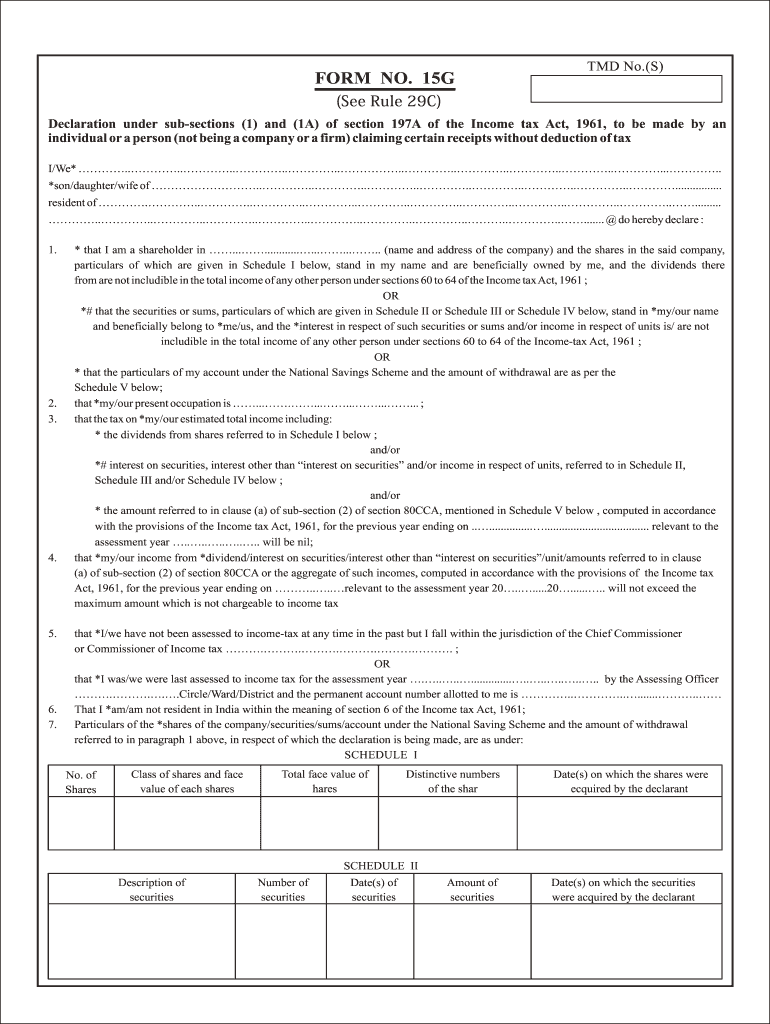

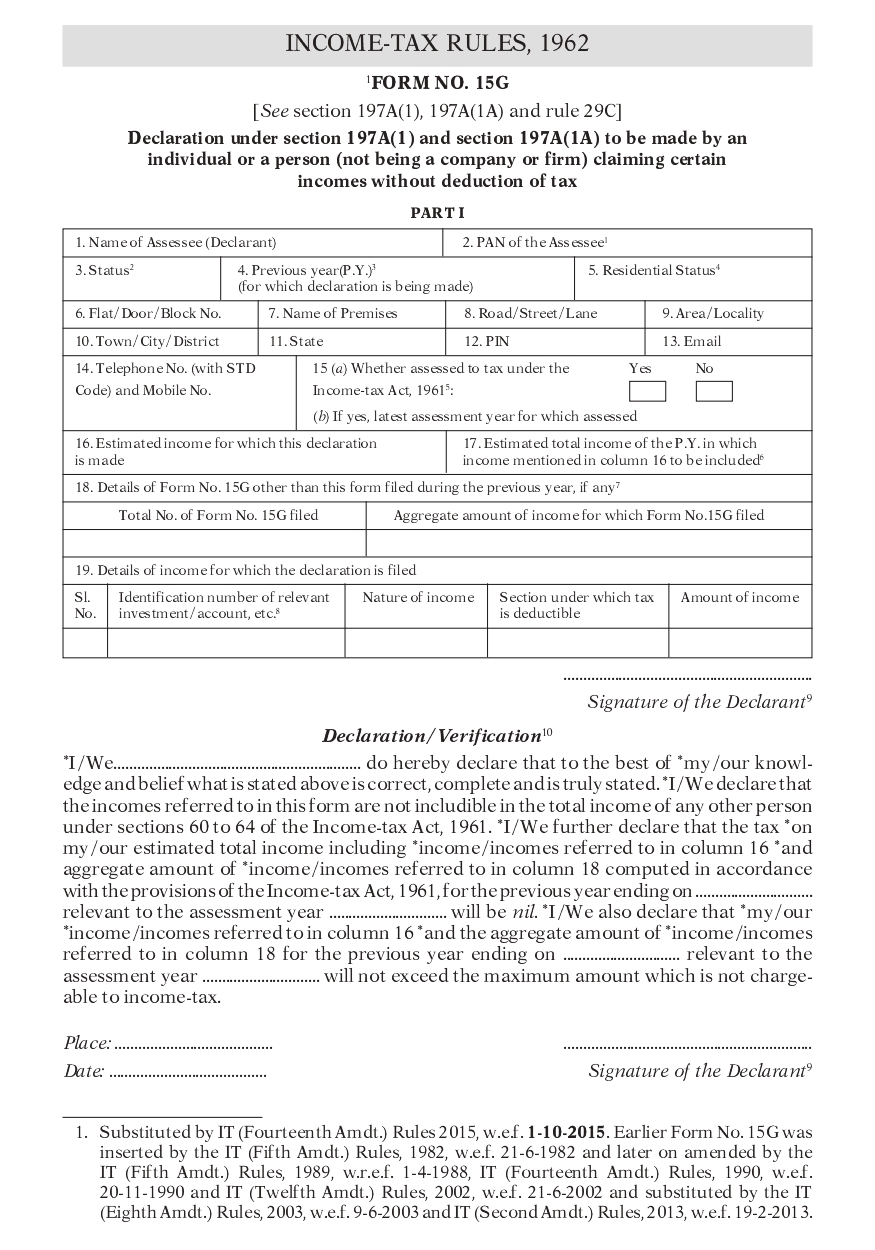

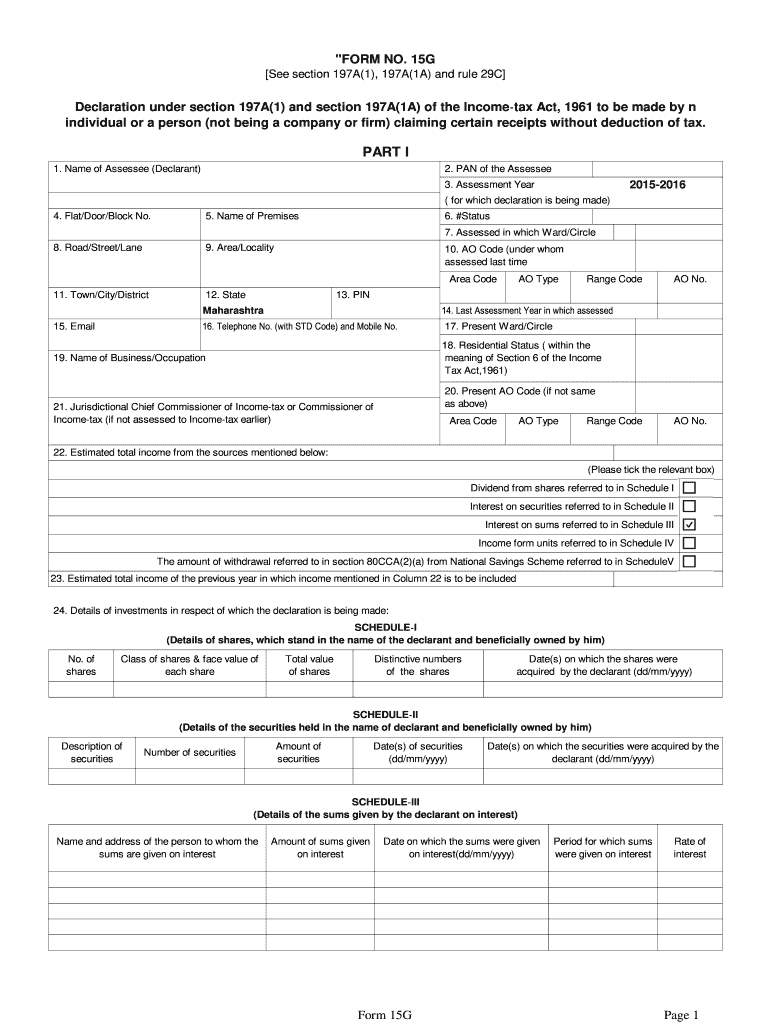

Different iterations of the provided form can be. Web you can submit form 15g for epf withdrawal online. Account number of national saving scheme from. Web for financing a lic policy from the pf account: Web during the filing of form 15g for the withdrawals of the pf, the same shall be essential to find out the tds rules concerning the pf withdrawals, under the rule when. Web how to download form 15g. Click on “online services” and then go to “online claim” and fill in the required details. The epfo online portal and all major banks’ websites provide the epf form 15g. Web the option to submit the properly filled form online is also available on the websites of india’s leading banks. To save tds for any interest generated from epf:

You simply need to login to the epfo portal/banks’. Date of declaration, distribution or payment of dividend/withdrawal under the national savings scheme(dd/mm/yyyy) 13. Web you can submit form 15g for epf withdrawal online. Account number of national saving scheme from. Click on the online services option \u2013 claim (form 31, 19, 10c). Then you can fill form 15g epfo. Web criteria your age should be less then 60 years. Web where can you acquire form 15g from? Web the option to submit the properly filled form online is also available on the websites of india’s leading banks. Web you can submit form 15g or form 15h at the following institutions or corporations to ensure no deduction of tds by the deductor:

Perfect Programs Storage 15G FOR PF WITHDRAWAL FREE DOWNLOAD

This facility is available on the unified member portal. Web the option to submit the properly filled form online is also available on the websites of india’s leading banks. The epfo online portal and all major banks’ websites provide the epf form 15g. To save tds for any interest generated from epf: Web during the filing of form 15g for.

Form 15g Download in Word Format Fill Out and Sign Printable PDF

Web you can download pf withdrawal form 15g from the online portal epfo. Web you can submit form 15g for epf withdrawal online. Click on “online services” and then go to “online claim” and fill in the required details. This facility is available on the unified member portal. Web how to get epf form 15g?

EPF Form 15G Download Sample Filled Form 15G For PF Withdrawal GST

Web the option to submit the properly filled form online is also available on the websites of india’s leading banks. So to be on the safer side please submit form 15g while withdrawing. To save tds for any interest generated from epf: Web how to get epf form 15g? Web where can you acquire form 15g from?

Form 15g For Pf Withdrawal Pdf Fill Online, Printable, Fillable

Web you can download pf withdrawal form 15g from the online portal epfo. Many times it has been noticed that epf claim has been rejected as form 15g was not filed. To save tds for any interest generated from epf: It is very easy to get form 15g to reduce the burden of tds deduction. The epfo online portal and.

Breanna Withdrawal Form 15g Part 2 Filled Sample

Web criteria your age should be less then 60 years. Web you can submit form 15g for epf withdrawal online. Click on “online services” and then go to “online claim” and fill in the required details. Web how to download form 15g. Web how to fill form 15g for pf withdrawal login to epfo uan unified portal for members.

Form 15G & 15H What is Form 15G? How to Fill Form 15G for PF Withdrawal

Account number of national saving scheme from. Click on “online services” and then go to “online claim” and fill in the required details. Web answer (1 of 2): To save tds for any interest generated from epf: Different iterations of the provided form can be.

[PDF] Form 15H For PF Withdrawal PDF Download PDFfile

To save tds for any interest generated from epf: Web how to fill form 15g for pf withdrawal login to epfo uan unified portal for members. Web during the filing of form 15g for the withdrawals of the pf, the same shall be essential to find out the tds rules concerning the pf withdrawals, under the rule when. Web you.

Sample Filled Form 15G & 15H for PF Withdrawal in 2020

To save tds for any interest generated from epf: Web how to download form 15g. Then you can fill form 15g epfo. Web you can submit form 15g for epf withdrawal online. Web how to fill form 15g for pf withdrawal login to epfo uan unified portal for members.

How to Fill Form 15G for PF Withdrawal in 2021 YouTube

Web criteria your age should be less then 60 years. So to be on the safer side please submit form 15g while withdrawing. Many times it has been noticed that epf claim has been rejected as form 15g was not filed. You simply need to login to the epfo portal/banks’. Web how to fill form 15g for pf withdrawal login.

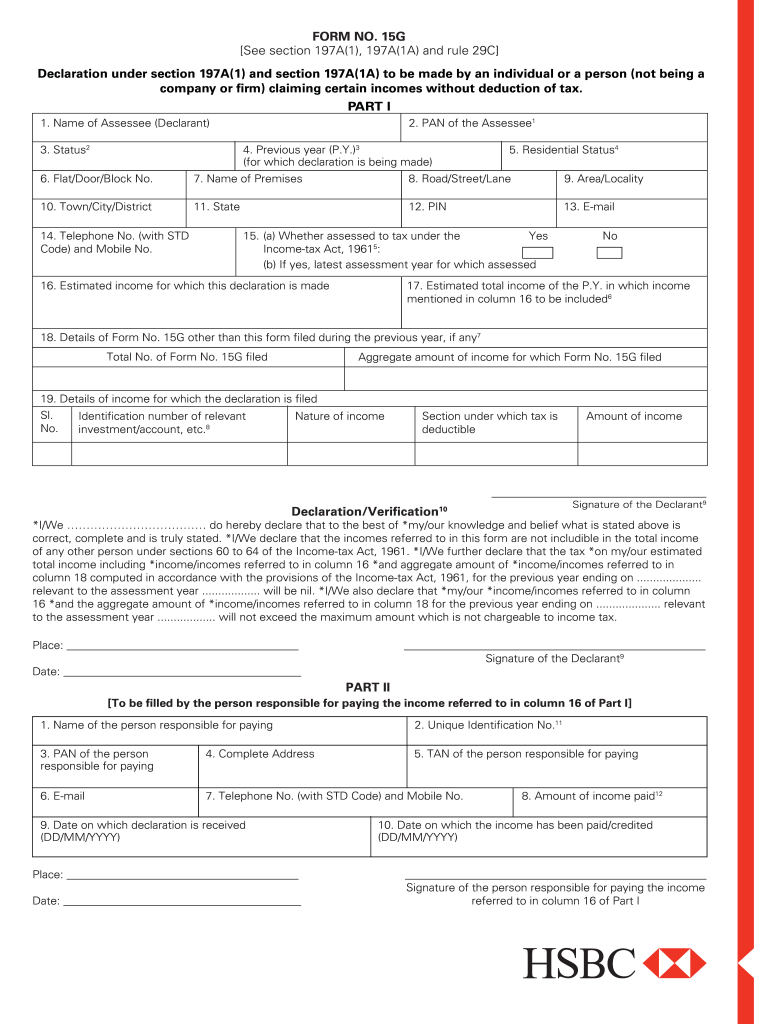

HSBC Form 15G 20152022 Fill and Sign Printable Template Online US

Web for financing a lic policy from the pf account: It is very easy to get form 15g to reduce the burden of tds deduction. Web where can you acquire form 15g from? You can easily download it from all the websites. You must be aware that tds is applicable on the epf.

Click On The Online Services Option \U2013 Claim (Form 31, 19, 10C).

Many times it has been noticed that epf claim has been rejected as form 15g was not filed. Web criteria your age should be less then 60 years. Account number of national saving scheme from. Then you can fill form 15g epfo.

Web Where Can You Acquire Form 15G From?

Click on “online services” and then go to “online claim” and fill in the required details. Different iterations of the provided form can be. Web during the filing of form 15g for the withdrawals of the pf, the same shall be essential to find out the tds rules concerning the pf withdrawals, under the rule when. You can easily download it from all the websites.

Web You Can Submit Form 15G For Epf Withdrawal Online.

The epfo online portal and all major banks’ websites provide the epf form 15g. Form 15g for reduction in tds burden can be downloaded for free from the website of all major banks in india. You simply need to login to the epfo portal/banks’. Web how to fill form 15g for pf withdrawal login to epfo uan unified portal for members.

It Is Very Easy To Get Form 15G To Reduce The Burden Of Tds Deduction.

Date of declaration, distribution or payment of dividend/withdrawal under the national savings scheme(dd/mm/yyyy) 13. Web for financing a lic policy from the pf account: Web you can submit form 15g or form 15h at the following institutions or corporations to ensure no deduction of tds by the deductor: Web the option to submit the properly filled form online is also available on the websites of india’s leading banks.

![[PDF] Form 15H For PF Withdrawal PDF Download PDFfile](https://pdffile.co.in/wp-content/uploads/pdf-thumbnails/2021/07/small/form-15h-for-pf-withdrawal-847.jpg)