Where Do I Mail Form 720

Where Do I Mail Form 720 - Form 730 tax on wagering. The pcori fee is due by july 31st. Web the affordable care act requires a minimal fee to be paid by companies based on the average number of participants covered by your company's peoplekeep hra plan in the previous year. Electronic payments must be initiated before july 29th. Form 720 is used by taxpayers to report liability by irs number and to pay the excise taxes listed on the form. June 2023) department of the treasury internal revenue service. Forms can be submitted online 24 hours per day. Mail form 720 directly to the irs. Web the aca requires applicable employers to report and pay the fee once a year, using form 720 for the quarterly federal excise tax return that you can get from irs.gov. See the instructions for form 720.

The pcori fee is due by july 31st. Quarterly federal excise tax return. Web send form 720 to: Web the affordable care act requires a minimal fee to be paid by companies based on the average number of participants covered by your company's peoplekeep hra plan in the previous year. Form 730 tax on wagering. Form 720 is used by taxpayers to report liability by irs number and to pay the excise taxes listed on the form. Sign and date the return. See the instructions for form 720. Also, if you have no tax to report, enter “none” on form 720, part iii, line 3; Web there are two ways to file:

Form 7004, application for automatic extension of time to file certain business income tax,. Also, if you have no tax to report, enter “none” on form 720, part iii, line 3; Electronic payments must be initiated before july 29th. If you offered an hra to your employees in 2022, you will need to. Web the affordable care act requires a minimal fee to be paid by companies based on the average number of participants covered by your company's peoplekeep hra plan in the previous year. Web the aca requires applicable employers to report and pay the fee once a year, using form 720 for the quarterly federal excise tax return that you can get from irs.gov. Web there are two ways to file: Taxpayers will be required to submit their electronic excise tax forms through an approved transmitter/software developer. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Form 730 tax on wagering.

Form 720 Printable PDF Sample

Where and how do i access the electronic form 720 returns? The pcori fee is due by july 31st. Web the aca requires applicable employers to report and pay the fee once a year, using form 720 for the quarterly federal excise tax return that you can get from irs.gov. The fee is fixed annually by the internal revenue service.

What Is IRS Form 720? Calculate, Pay Excise Tax NerdWallet

Also, if you have no tax to report, enter “none” on form 720, part iii, line 3; Taxpayers will be required to submit their electronic excise tax forms through an approved transmitter/software developer. When you file form 720, you must also pay your. For instructions and the latest information. If you aren't reporting a tax that you normally report, enter.

Electronic Filing for IRS Tax Form 720 at

Mail form 720 directly to the irs. Web the aca requires applicable employers to report and pay the fee once a year, using form 720 for the quarterly federal excise tax return that you can get from irs.gov. Where and how do i access the electronic form 720 returns? Web form 720 quarterly federal excise tax return. Web the affordable.

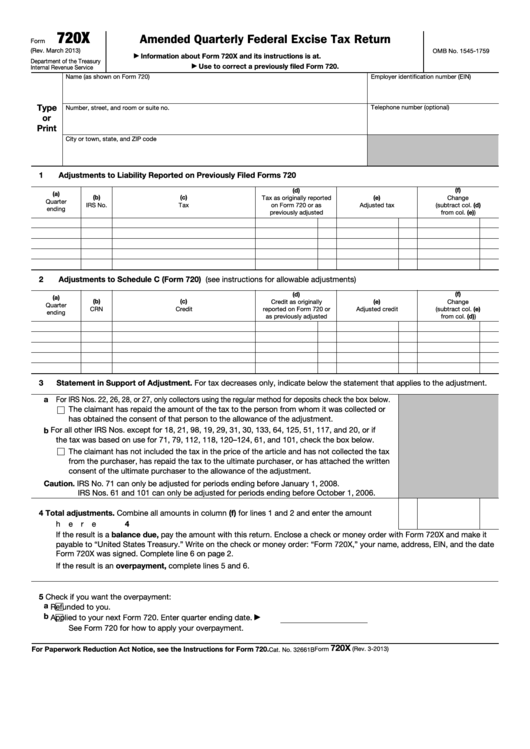

Fillable Form 720X Amended Quarterly Federal Excise Tax Return

Form 730 tax on wagering. See the instructions for form 720. Form 720 is used by taxpayers to report liability by irs number and to pay the excise taxes listed on the form. Where and how do i access the electronic form 720 returns? When you file form 720, you must also pay your.

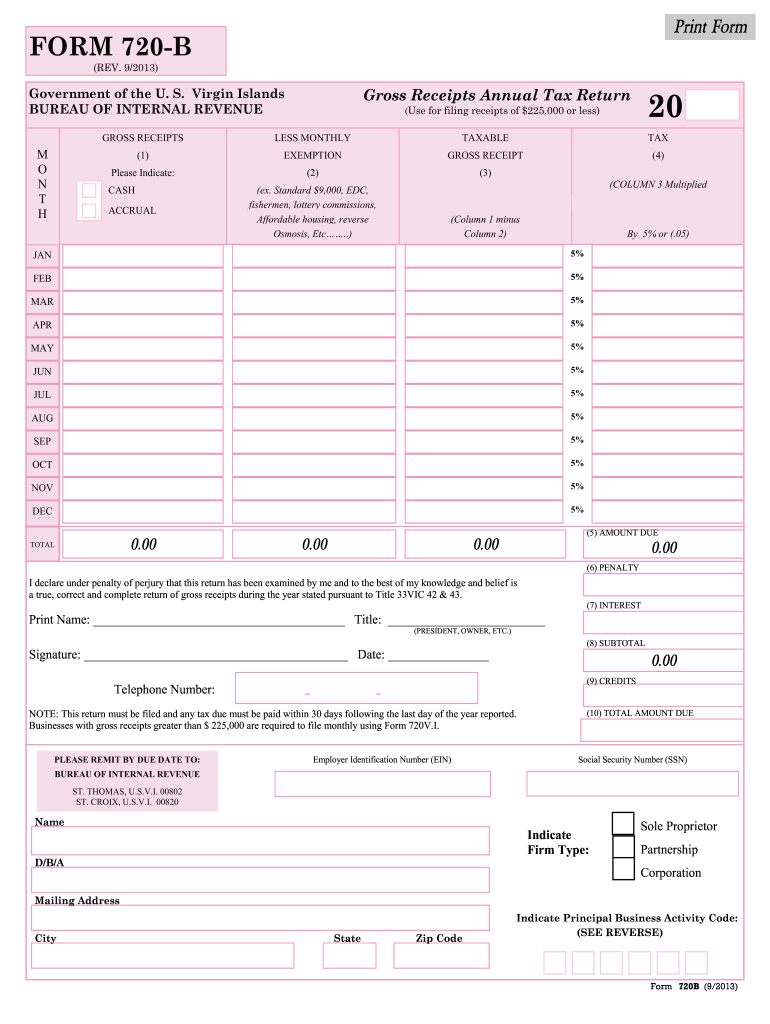

20132022 Form VI 720B Fill Online, Printable, Fillable, Blank pdfFiller

For instructions and the latest information. Forms can be submitted online 24 hours per day. Web the affordable care act requires a minimal fee to be paid by companies based on the average number of participants covered by your company's peoplekeep hra plan in the previous year. If you offered an hra to your employees in 2022, you will need.

Form 720 Quarterly Federal Excise Tax Return

For instructions and the latest information. When you file form 720, you must also pay your. Web the aca requires applicable employers to report and pay the fee once a year, using form 720 for the quarterly federal excise tax return that you can get from irs.gov. Quarterly federal excise tax return. Web there are two ways to file:

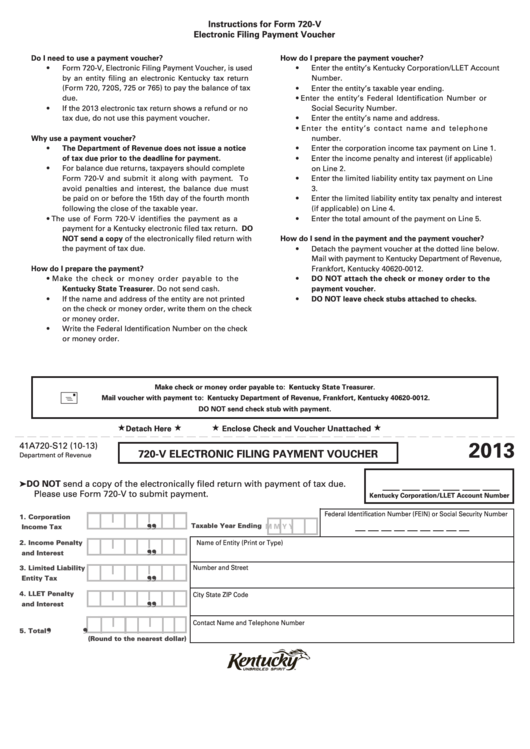

Form 720V Electronic Filing Payment Voucher 2013 printable pdf

Web for information on the fee, see the questions and answers and chart summary. Form 720 is used by taxpayers to report liability by irs number and to pay the excise taxes listed on the form. Mail form 720 directly to the irs. See the instructions for form 720. The fee is fixed annually by the internal revenue service (irs).

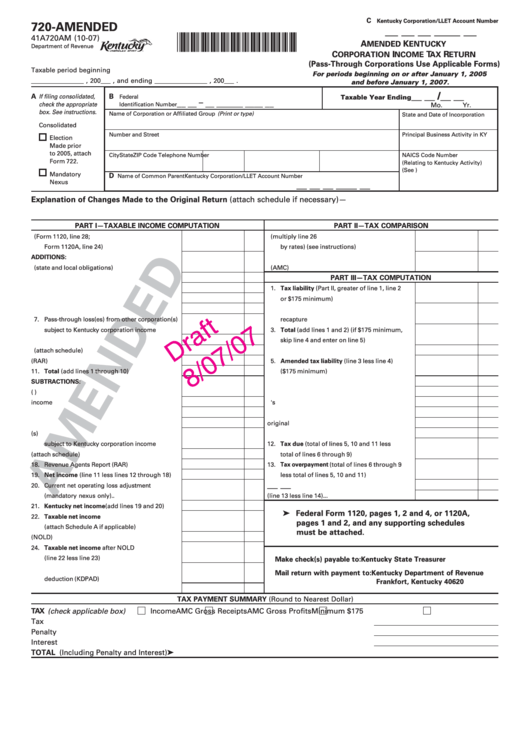

Form 720Amended Amended Kentucky Corporation Tax Return

Sign and date the return. If you aren't reporting a tax that you normally report, enter a zero on the appropriate line on form 720, part i or ii. See the instructions for form 720. Also, if you have no tax to report, enter “none” on form 720, part iii, line 3; The pcori fee is due by july 31st.

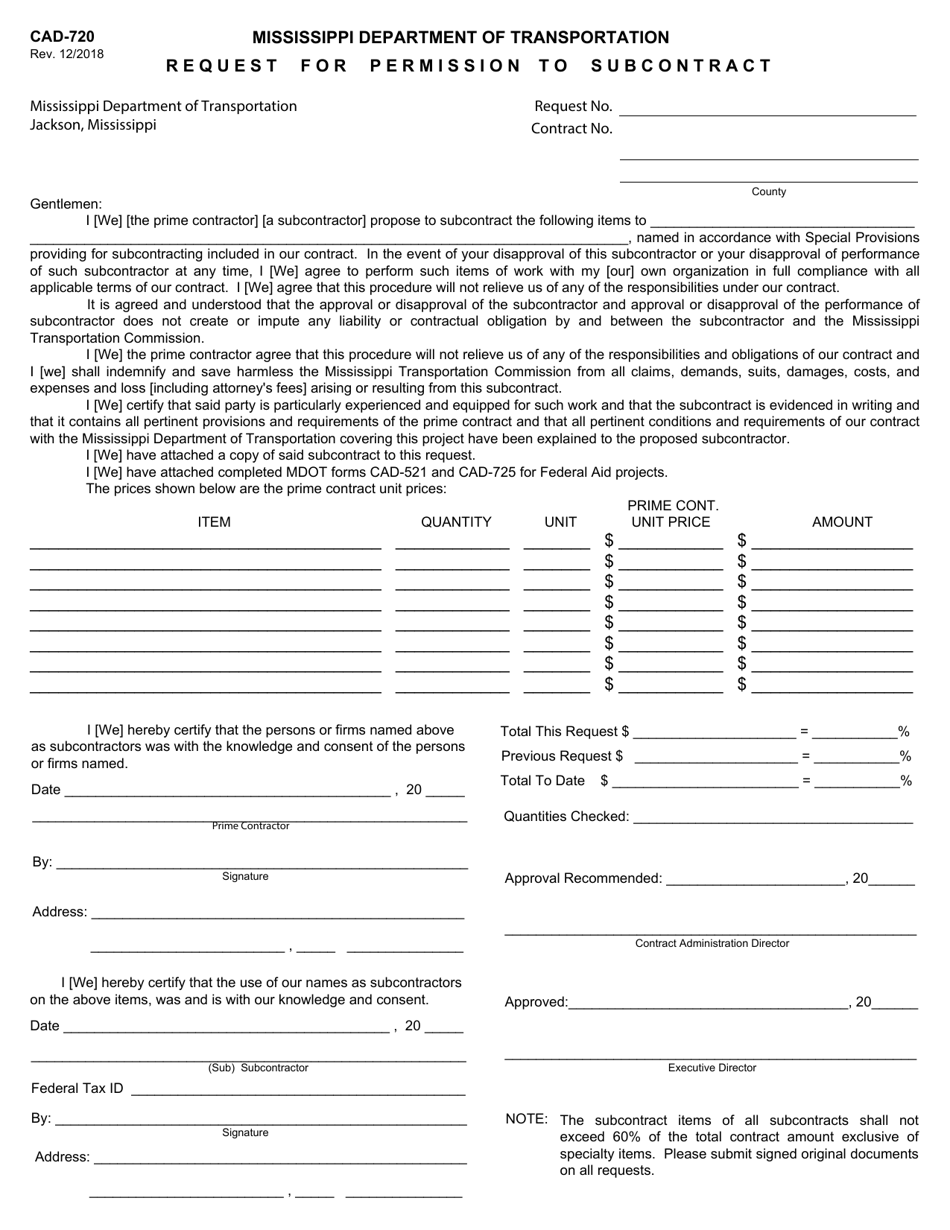

Form CAD720 Download Fillable PDF or Fill Online Request for

Mail form 720 directly to the irs. Sign and date the return. Form 7004, application for automatic extension of time to file certain business income tax,. Web for information on the fee, see the questions and answers and chart summary. June 2023) department of the treasury internal revenue service.

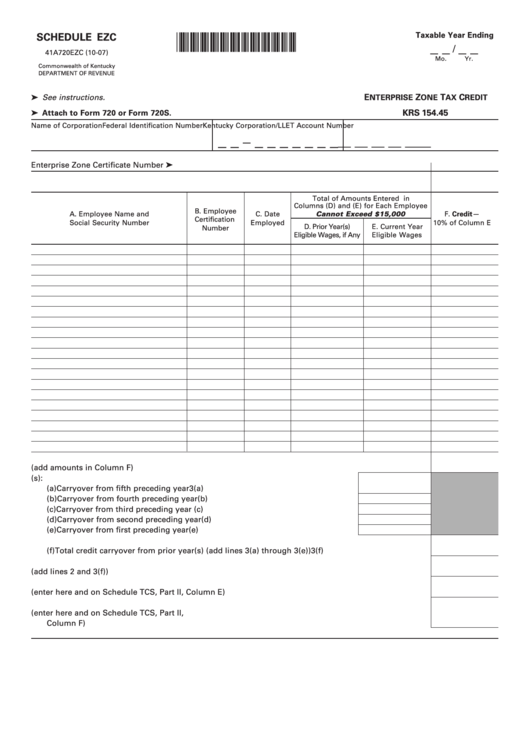

Form 720 Schedule Ezc Enterprise Zone Tax Credit printable pdf download

If you offered an hra to your employees in 2022, you will need to. The fee is fixed annually by the internal revenue service (irs) and adjusted each year for inflation. Form 730 tax on wagering. When you file form 720, you must also pay your. Web for information on the fee, see the questions and answers and chart summary.

Quarterly Federal Excise Tax Return.

Web the aca requires applicable employers to report and pay the fee once a year, using form 720 for the quarterly federal excise tax return that you can get from irs.gov. Also, if you have no tax to report, enter “none” on form 720, part iii, line 3; Web form 720 quarterly federal excise tax return. Where and how do i access the electronic form 720 returns?

The Pcori Fee Is Due By July 31St.

Form 7004, application for automatic extension of time to file certain business income tax,. Electronic payments must be initiated before july 29th. June 2023) department of the treasury internal revenue service. The fee is fixed annually by the internal revenue service (irs) and adjusted each year for inflation.

Taxpayers Will Be Required To Submit Their Electronic Excise Tax Forms Through An Approved Transmitter/Software Developer.

Web there are two ways to file: Mail form 720 directly to the irs. If you aren't reporting a tax that you normally report, enter a zero on the appropriate line on form 720, part i or ii. Sign and date the return.

Web Send Form 720 To:

Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Form 730 tax on wagering. Web for information on the fee, see the questions and answers and chart summary. See the instructions for form 720.