Where Does Form 2439 Go On Tax Return

Where Does Form 2439 Go On Tax Return - Web where does form 2439 go on tax return? Click investment income in the. Web to enter the 2439 in the individual module: Web to enter the 2439 in the fiduciary module: Web what does it mean to you? Web from within your taxact return ( online or desktop), click federal. Web tax paid by the ric and reit on the box 1a gains amounts in these fields transfer to schedule 5 (form 1040). Retain copy d for the ric’s or reit’s records. Web furnish copies b and c of form 2439 to the shareholder by the 60th day after the end of the ric’s or the reit’s tax year. From the dispositions section select form 2439.

Web a form a mutual fund or other investment company files with the irs to report any capital gains that were not distributed to shareholders over the course of the year. Go to screen 17.1 dispositions (schedule d, 4797, etc.). Web furnish copies b and c of form 2439 to the shareholder by the 60th day after the end of the ric’s or the reit’s tax year. Web from within your taxact return ( online or desktop), click federal. Go to the income/deductions > gains and losses worksheet. Web this form is issued, you must do the following. For individuals, this amount is reported on your irs form 1040, us individual income tax return, schedule d, capital. Web the information on form 2439 is reported on schedule d. From the income section, select dispositions (sch d, etc.) then form 2439. Web home how to enter form 2439 capital gains using worksheet view in an individual return?

Go to screen 17.1 dispositions (schedule d, 4797, etc.). It will flow to your schedule d when it is entered into turbotax. When these fields have an amount, the box is marked,. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Claim a credit for the tax paid by the mutual fund. Web this form is issued, you must do the following. When it arrives, you need to do four things: Web from within your taxact return ( online or desktop), click federal. Web home how to enter form 2439 capital gains using worksheet view in an individual return? From the dispositions section select form 2439.

Certified Quality Auditor Training Acceclass

Web to enter the 2439 in the fiduciary module: Report the capital gain on your income tax return for the year. To enter form 2439 go to investment. Go to the income/deductions > gains and losses worksheet. Web the information on form 2439 is reported on schedule d.

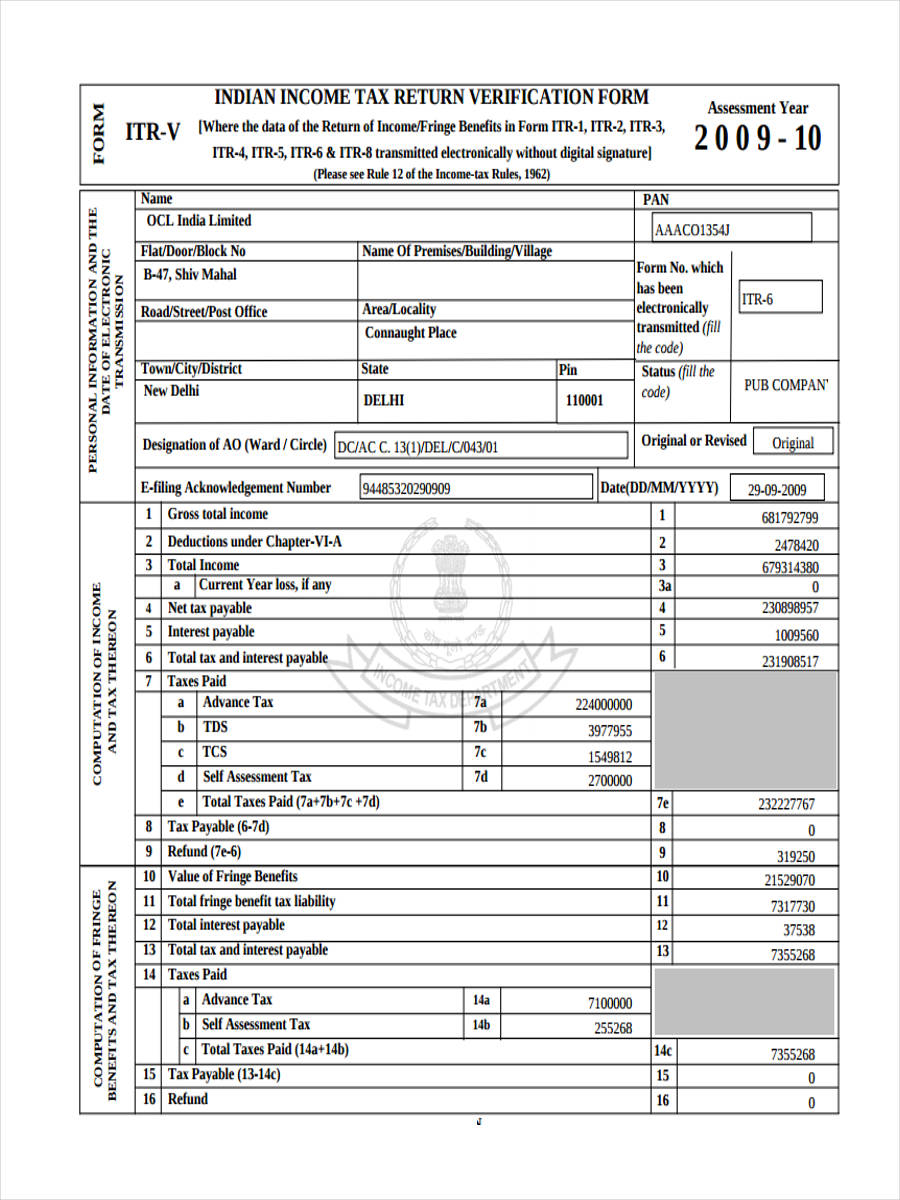

FREE 8+ Sample Tax Verification Forms in PDF

For individuals, this amount is reported on your irs form 1040, us individual income tax return, schedule d, capital. From the dispositions section select form 2439. Retain copy d for the ric’s or reit’s records. Web to enter the 2439 in the fiduciary module: Go to screen 17.1 dispositions (schedule d, 4797, etc.).

Take These Steps Now to Make the 2020 Tax Season Much Easier The

To enter form 2439 go to investment. Go to the income/deductions > gains and losses worksheet. Click investment income in the. Web to enter form 2439 capital gains, complete the following: Web furnish copies b and c of form 2439 to the shareholder by the 60th day after the end of the ric’s or the reit’s tax year.

How To Get Thru To Irs 2021 IRS Pin Protection in 2021 Business 2

Web where does form 2439 go on tax return? Web the information on form 2439 is reported on schedule d. To print revised proofs requested for paperwork reduction act notice, see back of copy a. Web a form a mutual fund or other investment company files with the irs to report any capital gains that were not distributed to shareholders.

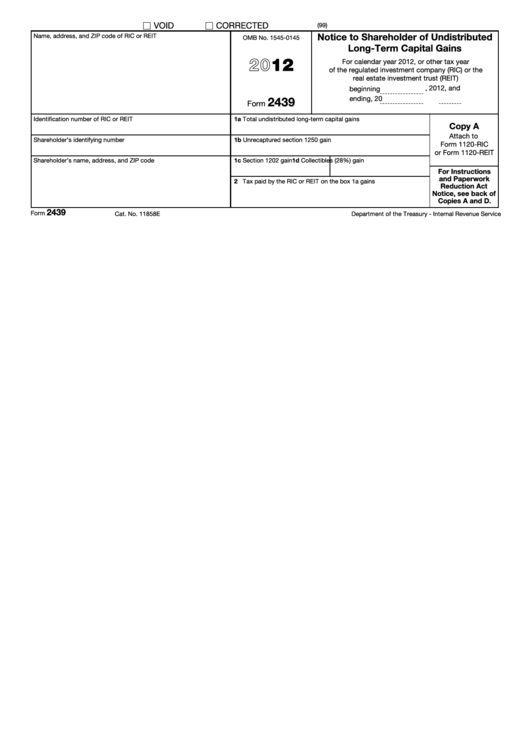

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

From the income section, select dispositions (sch d, etc.) then form 2439. For individuals, this amount is reported on your irs form 1040, us individual income tax return, schedule d, capital. Web this form is issued, you must do the following. Web furnish copies b and c of form 2439 to the shareholder by the 60th day after the end.

What is a Consolidated Tax Return? (with picture)

Web to enter the 2439 in the individual module: Go to the input return; Go to screen 17.1 dispositions (schedule d, 4797, etc.). 11858e form 2439 (1991) 2 i.r.s. To print revised proofs requested for paperwork reduction act notice, see back of copy a.

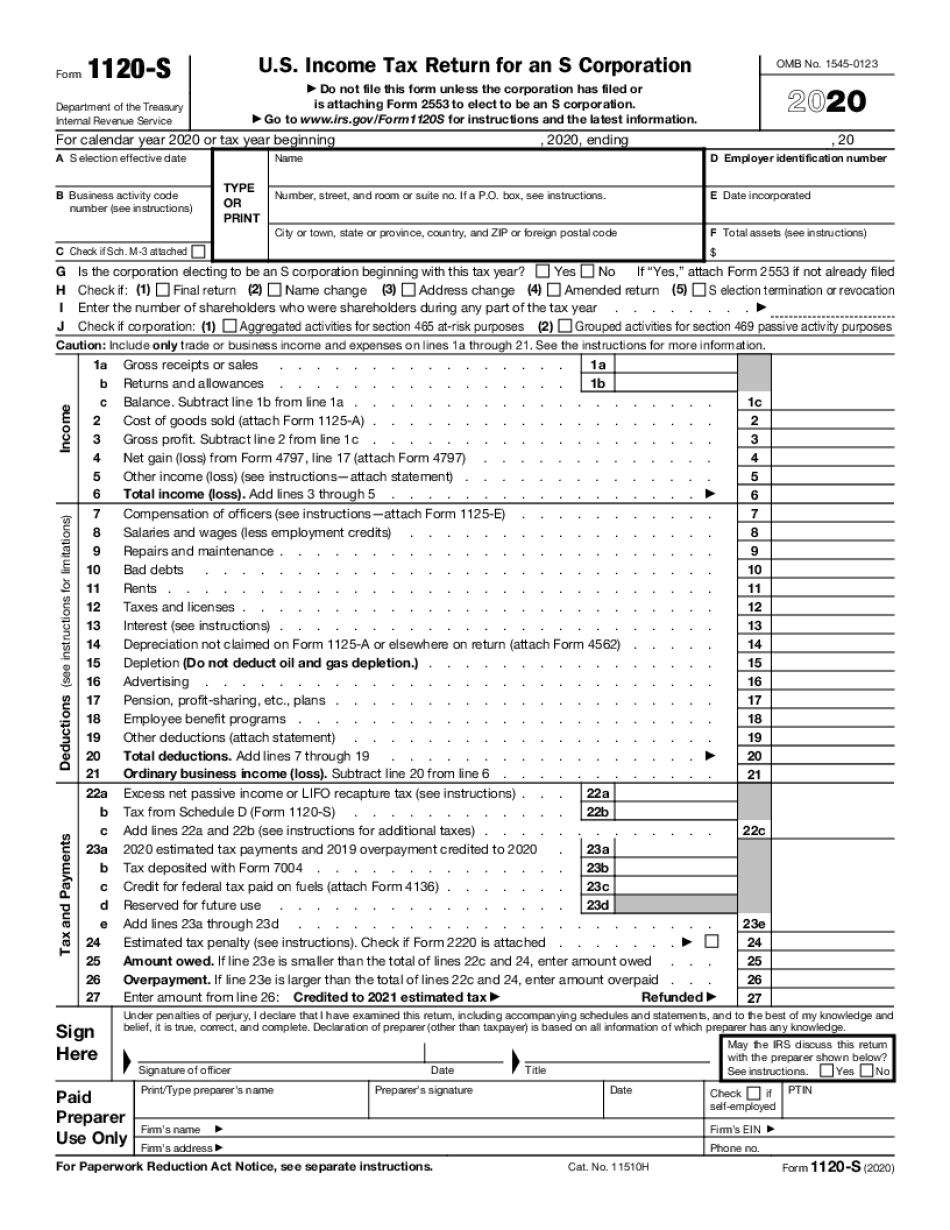

sample s corp tax return Fill Online, Printable, Fillable Blank

Go to the input return; Web what does it mean to you? Web this form is issued, you must do the following. Web a form a mutual fund or other investment company files with the irs to report any capital gains that were not distributed to shareholders over the course of the year. Go to screen 17.1 dispositions (schedule d,.

Fillable Form 2439 Notice To Shareholder Of Undistributed LongTerm

Go to the input return; Web the information on form 2439 is reported on schedule d. Web furnish copies b and c of form 2439 to the shareholder by the 60th day after the end of the ric’s or the reit’s tax year. Report the capital gain on your income tax return for the year. Web to enter form 2439.

100 Years Ago Tax, Tax, Tax

Web to enter form 2439 capital gains, complete the following: Retain copy d for the ric’s or reit’s records. For individuals, this amount is reported on your irs form 1040, us individual income tax return, schedule d, capital. Web furnish copies b and c of form 2439 to the shareholder by the 60th day after the end of the ric’s.

Paper selfassessment tax return deadline reminder PKB Accountants

When it arrives, you need to do four things: Web from within your taxact return ( online or desktop), click federal. When these fields have an amount, the box is marked,. Web where does form 2439 go on tax return? Form 2439 is a form used by the irs to request an extension of time to file a return.

Go To The Income/Deductions > Gains And Losses Worksheet.

Web home how to enter form 2439 capital gains using worksheet view in an individual return? 11858e form 2439 (1991) 2 i.r.s. Web to enter the 2439 in the individual module: To enter form 2439 go to investment.

Web A Form A Mutual Fund Or Other Investment Company Files With The Irs To Report Any Capital Gains That Were Not Distributed To Shareholders Over The Course Of The Year.

Go to the input return; Retain copy d for the ric’s or reit’s records. Complete copies a, b, c, and d of form 2439 for each owner. From the income section, select dispositions (sch d, etc.) then form 2439.

It Will Flow To Your Schedule D When It Is Entered Into Turbotax.

Form 2439 is a form used by the irs to request an extension of time to file a return. Claim a credit for the tax paid by the mutual fund. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Go to screen 17.1 dispositions (schedule d, 4797, etc.).

Web Where Does Form 2439 Go On Tax Return?

For individuals, this amount is reported on your irs form 1040, us individual income tax return, schedule d, capital. Web furnish copies b and c of form 2439 to the shareholder by the 60th day after the end of the ric’s or the reit’s tax year. To print revised proofs requested for paperwork reduction act notice, see back of copy a. Report the capital gain on your income tax return for the year.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)