Where To File Form 5329 By Itself

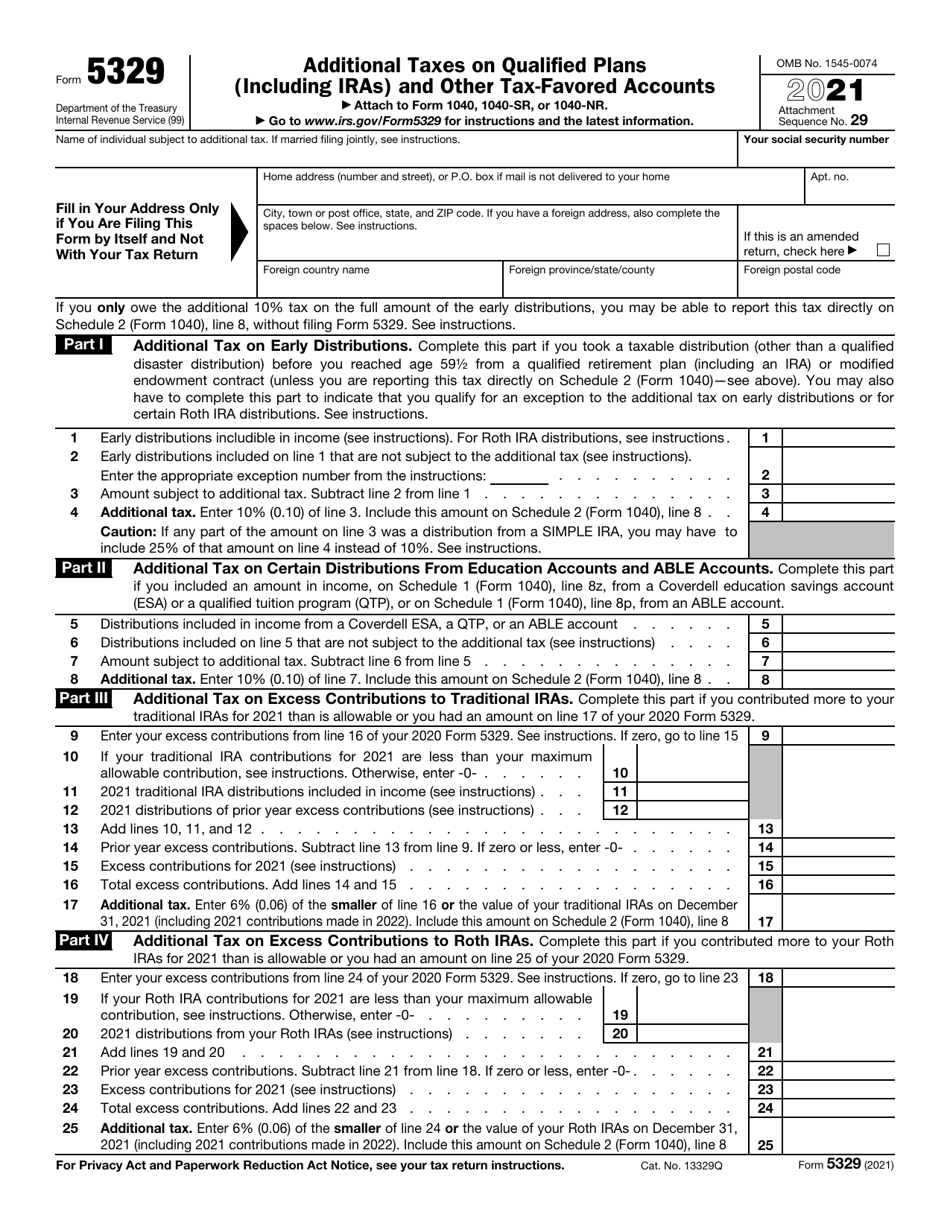

Where To File Form 5329 By Itself - Since you did not file form 5329 in 2018. Web instructions for form 5329 ah xsl/xml page 1 of 8 userid: Complete lines 52 and 53 as instructed. Your social security number fill in your address only if you are. I am filing a form 5329 to request a waiver of the penalty (50% of the missed rmd). Web to enter, review, or delete information for form 5329: Web expert alumni you should have filed form 5329 with your 2018 tax return, which was the year the rmd was not taken. 29 name of individual subject to additional tax. Web how do i file form 5329 with an amended return? My plan is to file the 5329 prior to filing.

If married filing jointly, see instructions. My plan is to file the 5329 prior to filing. Your social security number fill in your address only if you are. The excess contributions plus earnings attributable to the excess contributions. Web i missed an rmd from my ira in 2018. There are three reasons someone might need to file form 5329. Web when and where to file. The additional tax on early distributions doesn't apply to qualified. Web the types of accounts covered by the form for distributions include: I am filing a form 5329 to request a waiver of the penalty (50% of the missed rmd).

Web i missed an rmd from my ira in 2018. If you don’t have to file a 2022. Web to enter, review, or delete information for form 5329: > if you do not have any other changes and have not previously filed > a federal income tax return for the prior year, file the prior year's > version of. From within your taxact return (online or desktop), click federal. Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. If married filing jointly, see instructions. Complete lines 52 and 53 as instructed. I am filing a form 5329 to request a waiver of the penalty (50% of the missed rmd). The additional tax on early distributions doesn't apply to qualified.

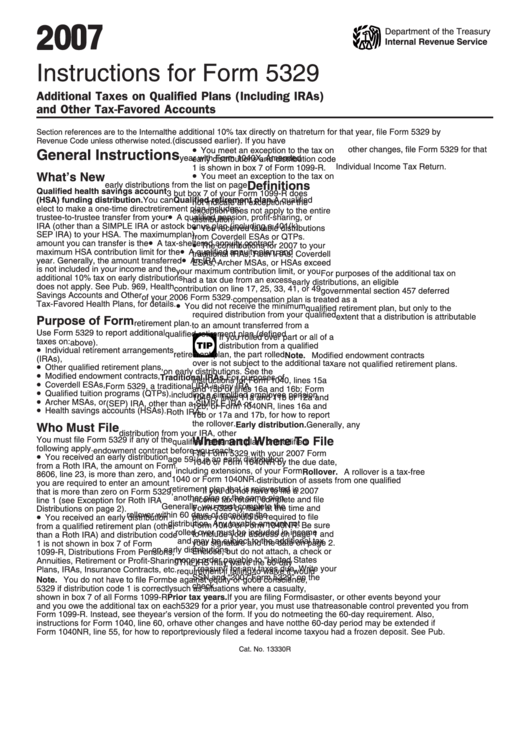

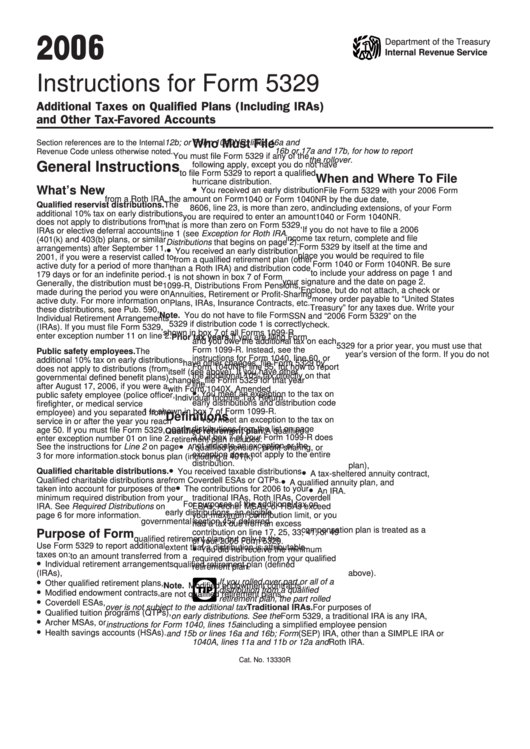

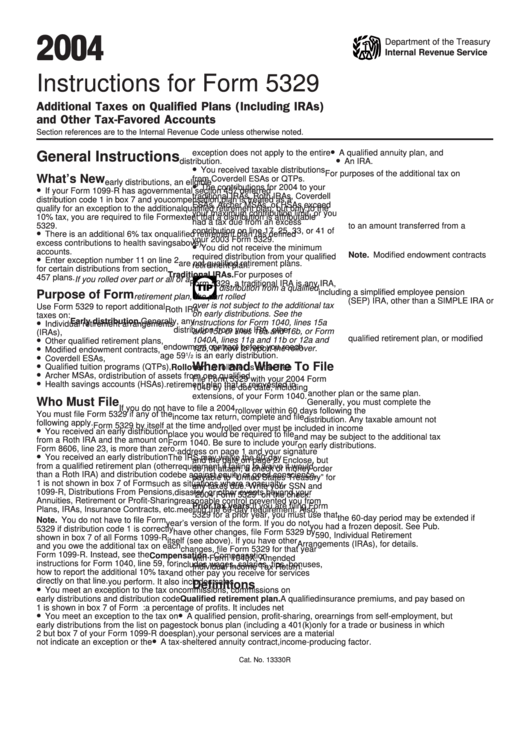

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Web expert alumni you should have filed form 5329 with your 2018 tax return, which was the year the rmd was not taken. Complete lines 52 and 53 as instructed. My plan is to file the 5329 prior to filing. Web the types of accounts covered by the form for distributions include: Web when and where to file.

Form 5329 Instructions & Exception Information for IRS Form 5329

Complete lines 52 and 53 as instructed. Your social security number fill in your address only if you are. Since you did not file form 5329 in 2018. There are three reasons someone might need to file form 5329. The excess contributions plus earnings attributable to the excess contributions.

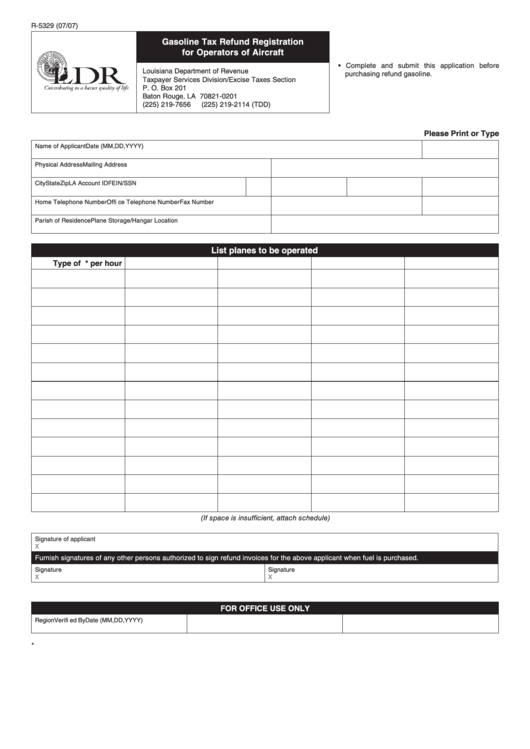

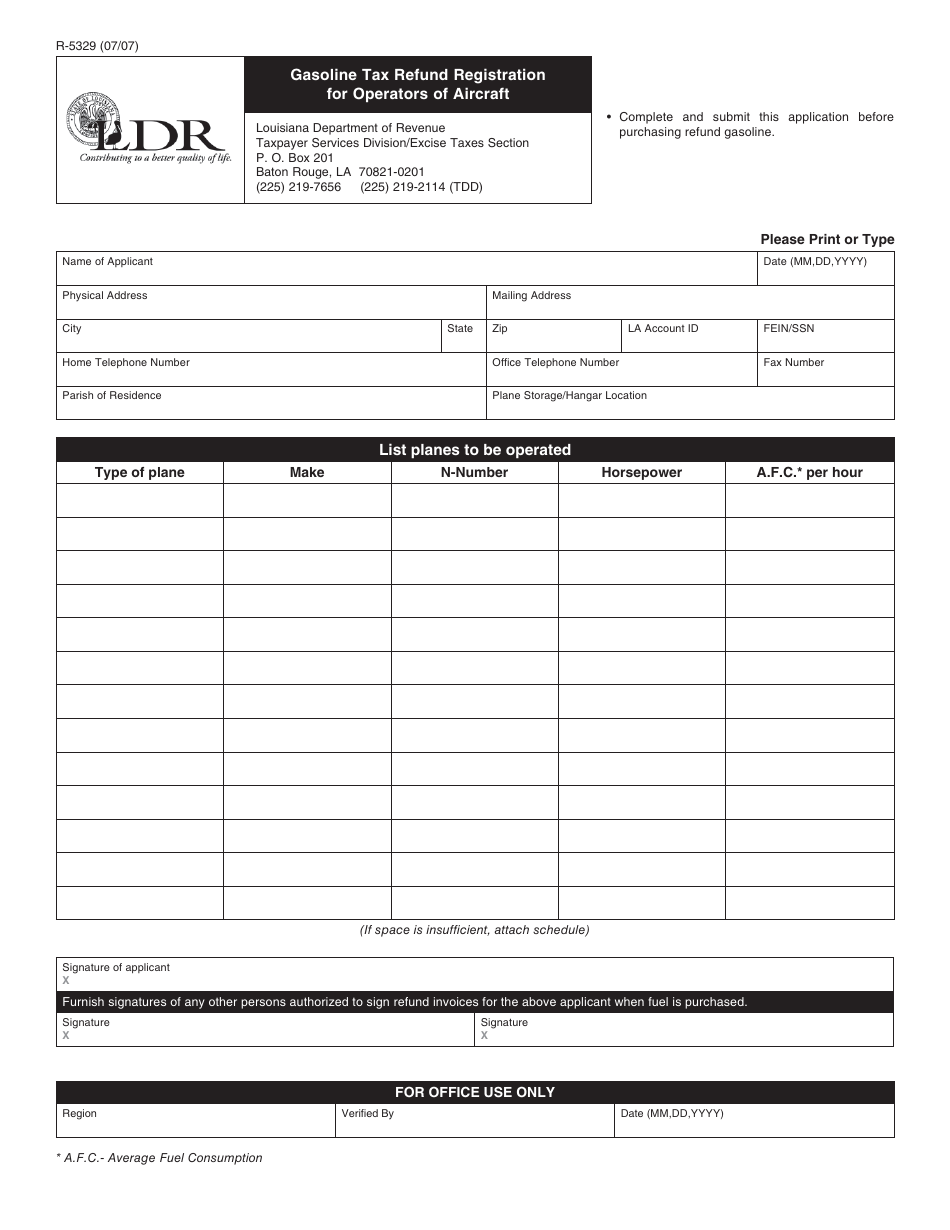

Form R5329 Gasoline Tax Refund Registration For Operators Of

Remember to make the necessary. Web expert alumni you should have filed form 5329 with your 2018 tax return, which was the year the rmd was not taken. First complete the steps detailed in completing amended returns in ultratax cs. Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Use form.

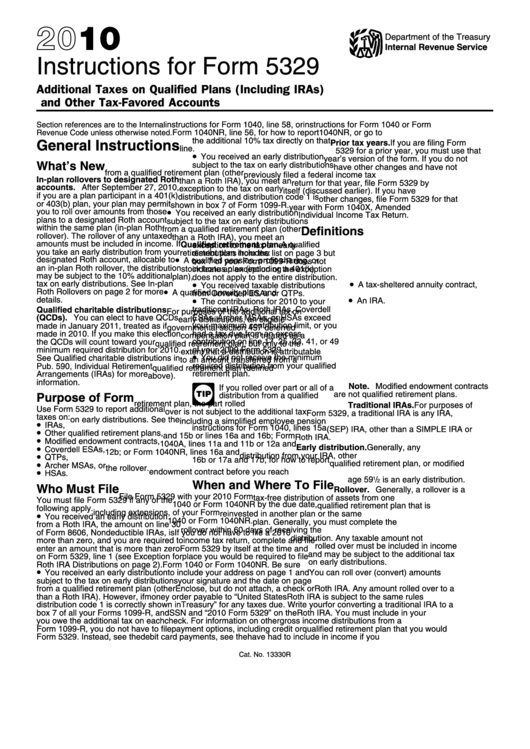

Instructions For Form 5329 2010 printable pdf download

Web if you believe you qualify for this relief, attach a statement of explanation and file form 5329 as follows. The excess contributions plus earnings attributable to the excess contributions. Web how do i file form 5329 with an amended return? 29 name of individual subject to additional tax. Remember to make the necessary.

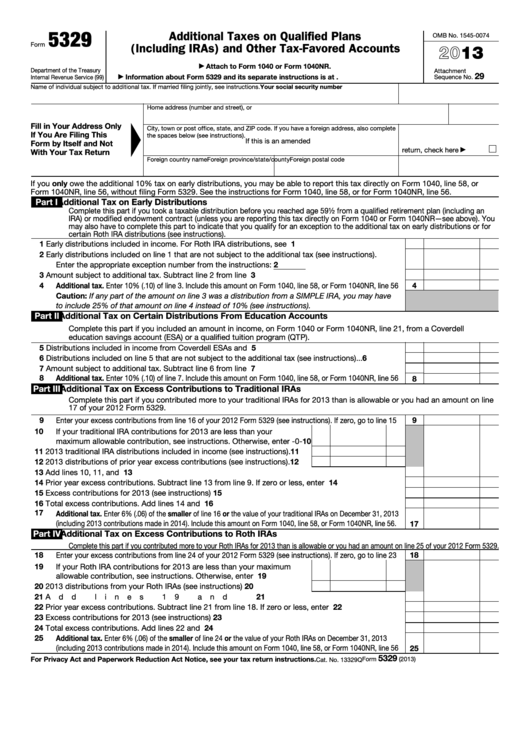

Fillable Form 5329 Additional Taxes On Qualified Plans (Including

Complete lines 52 and 53 as instructed. Web instructions for form 5329 ah xsl/xml page 1 of 8 userid: > if you do not have any other changes and have not previously filed > a federal income tax return for the prior year, file the prior year's > version of. 9.5 draft ok to print (init. From within your taxact.

IRS Form 5329 Download Fillable PDF or Fill Online Additional Taxes on

Your social security number fill in your address only if you are. Web i missed an rmd from my ira in 2018. I am filing a form 5329 to request a waiver of the penalty (50% of the missed rmd). If married filing jointly, see instructions. Web when and where to file.

Form R5329 Download Printable PDF or Fill Online Gasoline Tax Refund

If you don’t have to file a 2022. Web when and where to file. Web i missed an rmd from my ira in 2018. There are three reasons someone might need to file form 5329. Web the types of accounts covered by the form for distributions include:

Turbotax 2017 tax year garrymls

Web i missed an rmd from my ira in 2018. Your social security number fill in your address only if you are. My plan is to file the 5329 prior to filing. If you don’t have to file a 2022. > if you do not have any other changes and have not previously filed > a federal income tax return.

Instructions For Form 5329 Additional Taxes On Qualified Plans

Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Web instructions for form 5329 ah xsl/xml page 1 of 8 userid: 29 name of individual subject to additional tax. First complete the steps detailed in completing amended returns in ultratax cs. My plan is to file the 5329 prior to filing.

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Web when and where to file. The additional tax on early distributions doesn't apply to qualified. I am filing a form 5329 to request a waiver of the penalty (50% of the missed rmd). Web if you believe you qualify for this relief, attach a statement of explanation and file form 5329 as follows. Web to enter, review, or delete.

Web To Enter, Review, Or Delete Information For Form 5329:

I am filing a form 5329 to request a waiver of the penalty (50% of the missed rmd). Web instructions for form 5329 ah xsl/xml page 1 of 8 userid: 9.5 draft ok to print (init. Web if you believe you qualify for this relief, attach a statement of explanation and file form 5329 as follows.

The Additional Tax On Early Distributions Doesn't Apply To Qualified.

If you don’t have to file a 2022. Web i missed an rmd from my ira in 2018. Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. First complete the steps detailed in completing amended returns in ultratax cs.

29 Name Of Individual Subject To Additional Tax.

Complete lines 52 and 53 as instructed. Use form 5329 to report additional taxes on iras, other qualified. The excess contributions plus earnings attributable to the excess contributions. Your social security number fill in your address only if you are.

Remember To Make The Necessary.

If married filing jointly, see instructions. Since you did not file form 5329 in 2018. > if you do not have any other changes and have not previously filed > a federal income tax return for the prior year, file the prior year's > version of. My plan is to file the 5329 prior to filing.