Where To Report Ppp Loan Forgiveness On Form 990

Where To Report Ppp Loan Forgiveness On Form 990 - Corporations should report certain information related to a ppp loan. Web community hosting for lacerte & proseries how to enter forgiven ppp loans for individual returns this article will help you report paycheck protection program. Loan amounts forgiven under the paycheck protection program (ppp), established under the coronavirus aid, relief and economic security act (cares act),. Web report the amount of qualifying forgiveness with respect to covered loans made under the paycheck protection program (ppp) administered by the small business administration. Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven for purposes of. Web sba may require additional documentation when you apply for forgiveness of your ppp loan or 2nd draw ppp loan. If the organization filed a 2021 schedule a (form 990) using the cash method, it should report in the 2018. Web submit the forgiveness form and documentation to sba or your ppp lender: Web it should report the amounts in part ii or part iii using the cash method. Press f6 to bring up.

Press f6 to bring up. Web community hosting for lacerte & proseries how to enter forgiven ppp loans for individual returns this article will help you report paycheck protection program. An adjustment for the loans will. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either. Loan amounts forgiven under the paycheck protection program (ppp), established under the coronavirus aid, relief and economic security act (cares act),. Web submit the forgiveness form and documentation to sba or your ppp lender: For a second draw ppp loan amount of $150,000 or less, the borrower must provide documentation substantiating the reduction in gross receipts before or at the time. For instance, if you provide a draft tax filing, you will be required. To enter a ppp loan statement on a 1040: Web part viii, line 1e:

Web in three revenue procedures (rev. Web it should report the amounts in part ii or part iii using the cash method. If the organization filed a 2021 schedule a (form 990) using the cash method, it should report in the 2018. Corporations should report certain information related to a ppp loan. Web the irs recently released updated the form 990 and instructions for the 2020 tax year, including instructions for the form 990, schedule a. Depending on whether your lender is participating in direct forgiveness, complete your loan. Web the instructions to the irs form 990 state that these funds may only be reported on part viii, line 1e as a contribution from a governmental unit in the tax year. Loan amounts forgiven under the paycheck protection program (ppp), established under the coronavirus aid, relief and economic security act (cares act),. For a second draw ppp loan amount of $150,000 or less, the borrower must provide documentation substantiating the reduction in gross receipts before or at the time. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either.

Business Report PPP loan CARES Act funding,

Web part viii, line 1e: If the organization filed a 2021 schedule a (form 990) using the cash method, it should report in the 2018. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either. Loan amounts forgiven under the.

How To Report Ppp Loan On Form 990

Press f6 to bring up. For instance, if you provide a draft tax filing, you will be required. To enter a ppp loan statement on a 1040: Depending on whether your lender is participating in direct forgiveness, complete your loan. Web report the amount of qualifying forgiveness with respect to covered loans made under the paycheck protection program (ppp) administered.

Loan Documentation

Web in three revenue procedures (rev. Web submit the forgiveness form and documentation to sba or your ppp lender: For a second draw ppp loan amount of $150,000 or less, the borrower must provide documentation substantiating the reduction in gross receipts before or at the time. Web it should report the amounts in part ii or part iii using the.

A Simple Guide to Fill Out Your PPP Application Form

Web it should report the amounts in part ii or part iii using the cash method. Web the instructions to the irs form 990 state that these funds may only be reported on part viii, line 1e as a contribution from a governmental unit in the tax year. An adjustment for the loans will. Web sba may require additional documentation.

IRS Expands on Reporting Expenses Used to Obtain PPP Loan

Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either. Web part viii, line 1e: Web the irs recently released updated the form 990 and instructions for the 2020 tax year, including instructions for the form 990, schedule a. Web.

Government Clarifies PPP Loan for the SelfEmployed.

Taxpayers should also report instances of irs. Loan amounts forgiven under the paycheck protection program (ppp), established under the coronavirus aid, relief and economic security act (cares act),. For a second draw ppp loan amount of $150,000 or less, the borrower must provide documentation substantiating the reduction in gross receipts before or at the time. Web part viii, line 1e:.

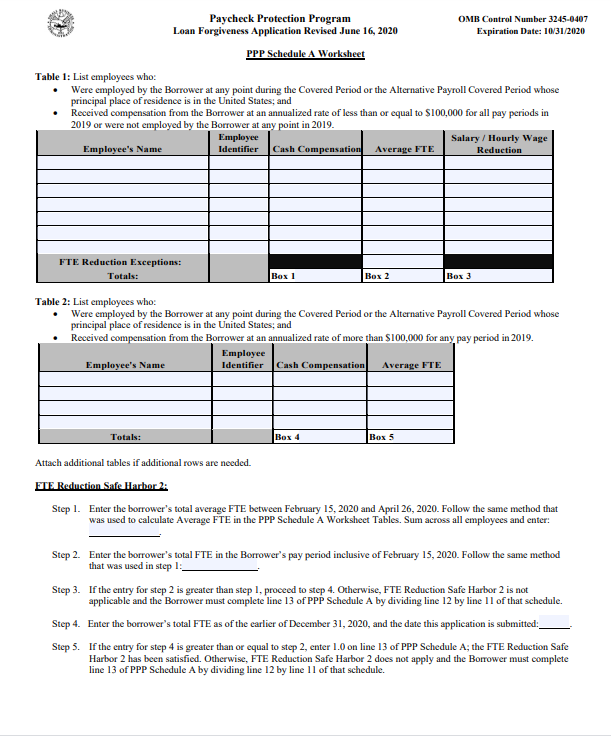

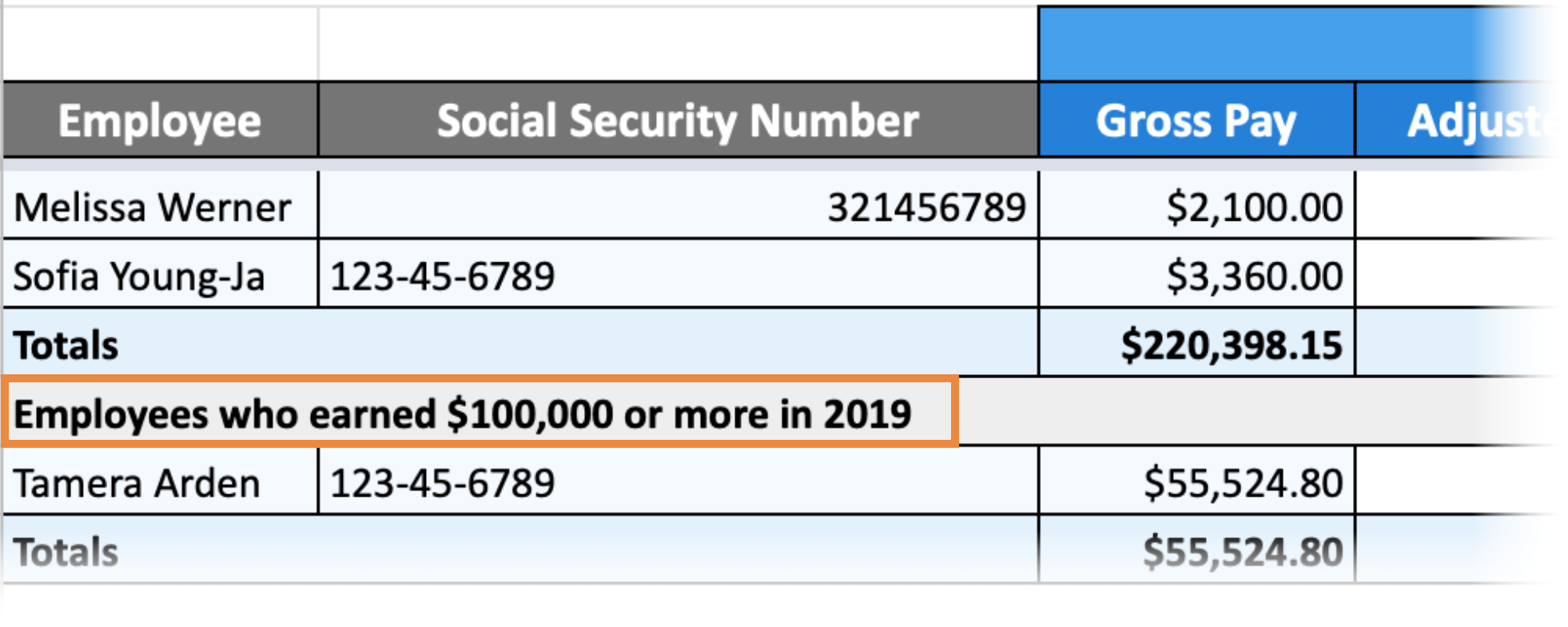

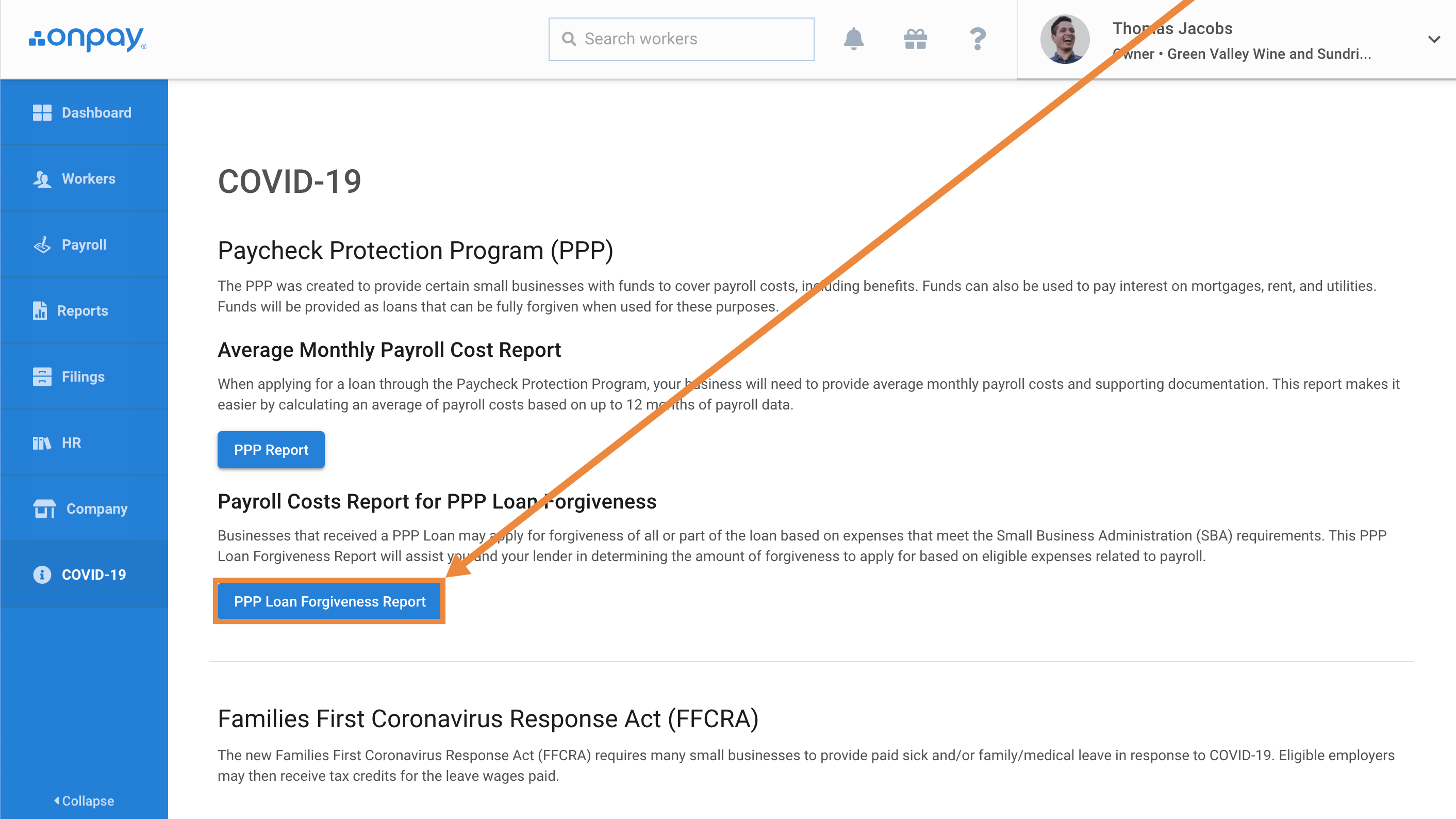

How to run a PPP Loan Report in OnPay Help Center Home

Web community hosting for lacerte & proseries how to enter forgiven ppp loans for individual returns this article will help you report paycheck protection program. For a second draw ppp loan amount of $150,000 or less, the borrower must provide documentation substantiating the reduction in gross receipts before or at the time. Web it should report the amounts in part.

Understanding PPP Loan Application and Instructions

Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either. For instance, if you provide a draft tax filing, you will be required. Web part viii, line 1e: Taxpayers should also report instances of irs. To enter a ppp loan.

How to run a PPP Loan Report in OnPay Help Center Home

Loan amounts forgiven under the paycheck protection program (ppp), established under the coronavirus aid, relief and economic security act (cares act),. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either. Web submit the forgiveness form and documentation to sba.

Feds Release PPP Loan Application YourSource News

Taxpayers should also report instances of irs. Web community hosting for lacerte & proseries how to enter forgiven ppp loans for individual returns this article will help you report paycheck protection program. If the organization filed a 2021 schedule a (form 990) using the cash method, it should report in the 2018. Web the irs recently released updated the form.

Web Part Viii, Line 1E:

Loan amounts forgiven under the paycheck protection program (ppp), established under the coronavirus aid, relief and economic security act (cares act),. Depending on whether your lender is participating in direct forgiveness, complete your loan. Taxpayers should also report instances of irs. To enter a ppp loan statement on a 1040:

Web The Instructions To The Irs Form 990 State That These Funds May Only Be Reported On Part Viii, Line 1E As A Contribution From A Governmental Unit In The Tax Year.

Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either. For instance, if you provide a draft tax filing, you will be required. Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven for purposes of. Web sba may require additional documentation when you apply for forgiveness of your ppp loan or 2nd draw ppp loan.

Web Submit The Forgiveness Form And Documentation To Sba Or Your Ppp Lender:

Web the irs recently released updated the form 990 and instructions for the 2020 tax year, including instructions for the form 990, schedule a. Press f6 to bring up. An adjustment for the loans will. Web it should report the amounts in part ii or part iii using the cash method.

For A Second Draw Ppp Loan Amount Of $150,000 Or Less, The Borrower Must Provide Documentation Substantiating The Reduction In Gross Receipts Before Or At The Time.

Corporations should report certain information related to a ppp loan. If the organization filed a 2021 schedule a (form 990) using the cash method, it should report in the 2018. Web in three revenue procedures (rev. Web report the amount of qualifying forgiveness with respect to covered loans made under the paycheck protection program (ppp) administered by the small business administration.