Which 1099 Form Do Legal Fees Go On

Which 1099 Form Do Legal Fees Go On - Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. That means lawyers must issue the form to an expert. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Who gets one and how it works a. This time dastardly defendant issues a check for 60. I see to enter 1099 misc in. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. That way, alice may only receive a form 1099 for her fees, not also for her client’s money. The form reports the interest income you. Web the basic reporting rule is that each person paying $600 or more in the course of business must report it on form 1099.

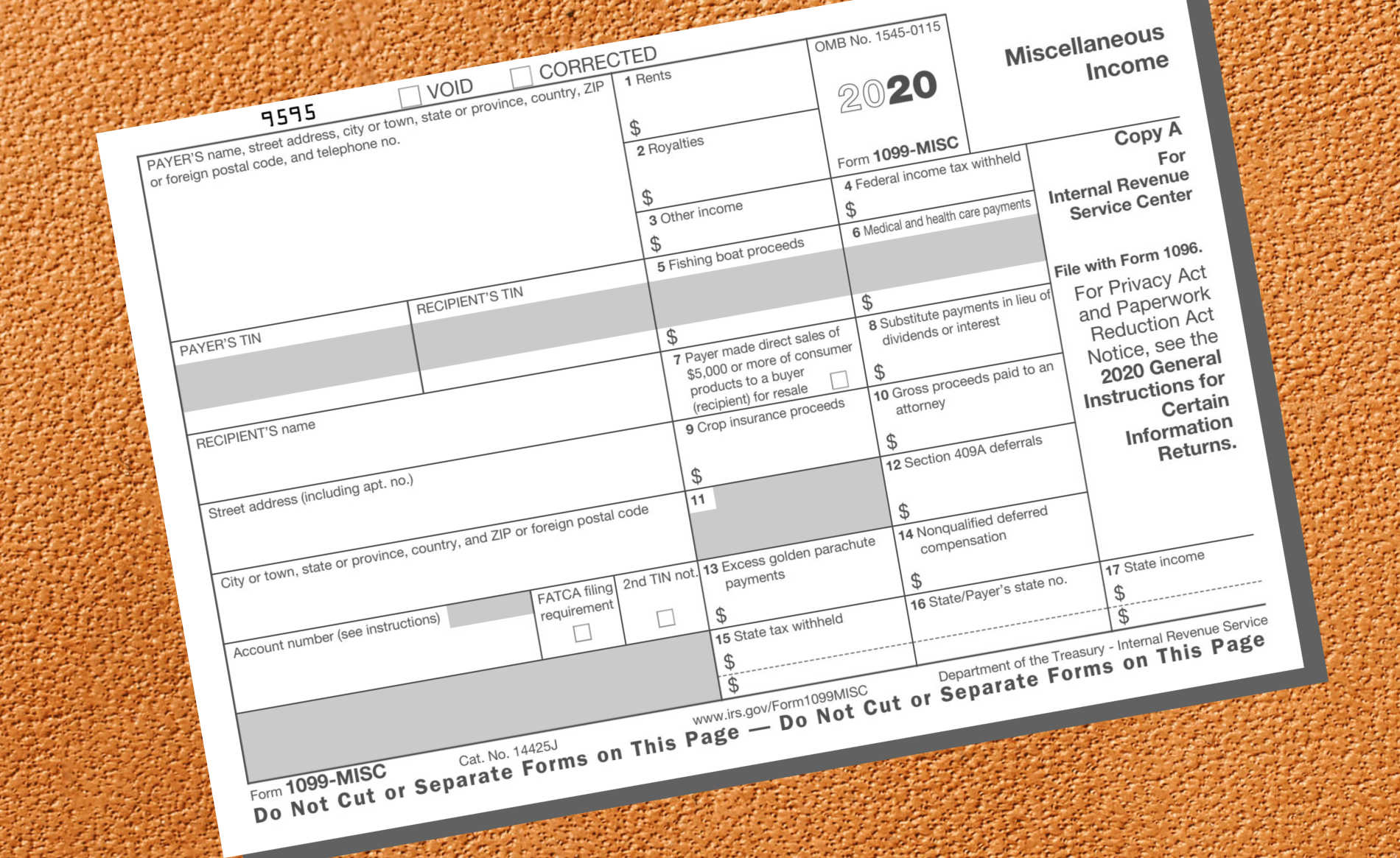

Who should receive a 1099 form? Web if you made the payment for legal services that the lawyer rendered to you in connection with your trade or business, you report the payment in box 1 of irs form. The form reports the interest income you. At least $10 in royalties or broker. Web the basic reporting rule is that each person paying $600 or more in the course of business must report it on form 1099. Who gets one and how it works a. Web level 1 1099 misc for reimbursement of legal fees title company sent 1099 misc for reimbursement of legal fees through settlement. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from february 28 to. That way, alice may only receive a form 1099 for her fees, not also for her client’s money.

At least $10 in royalties or broker. I see to enter 1099 misc in. The form reports the interest income you. That way, alice may only receive a form 1099 for her fees, not also for her client’s money. Who should receive a 1099 form? Who gets one and how it works a. That means lawyers must issue the form to an expert. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from february 28 to. Web level 1 1099 misc for reimbursement of legal fees title company sent 1099 misc for reimbursement of legal fees through settlement.

1099 Legal Fees The Simple Guide To File

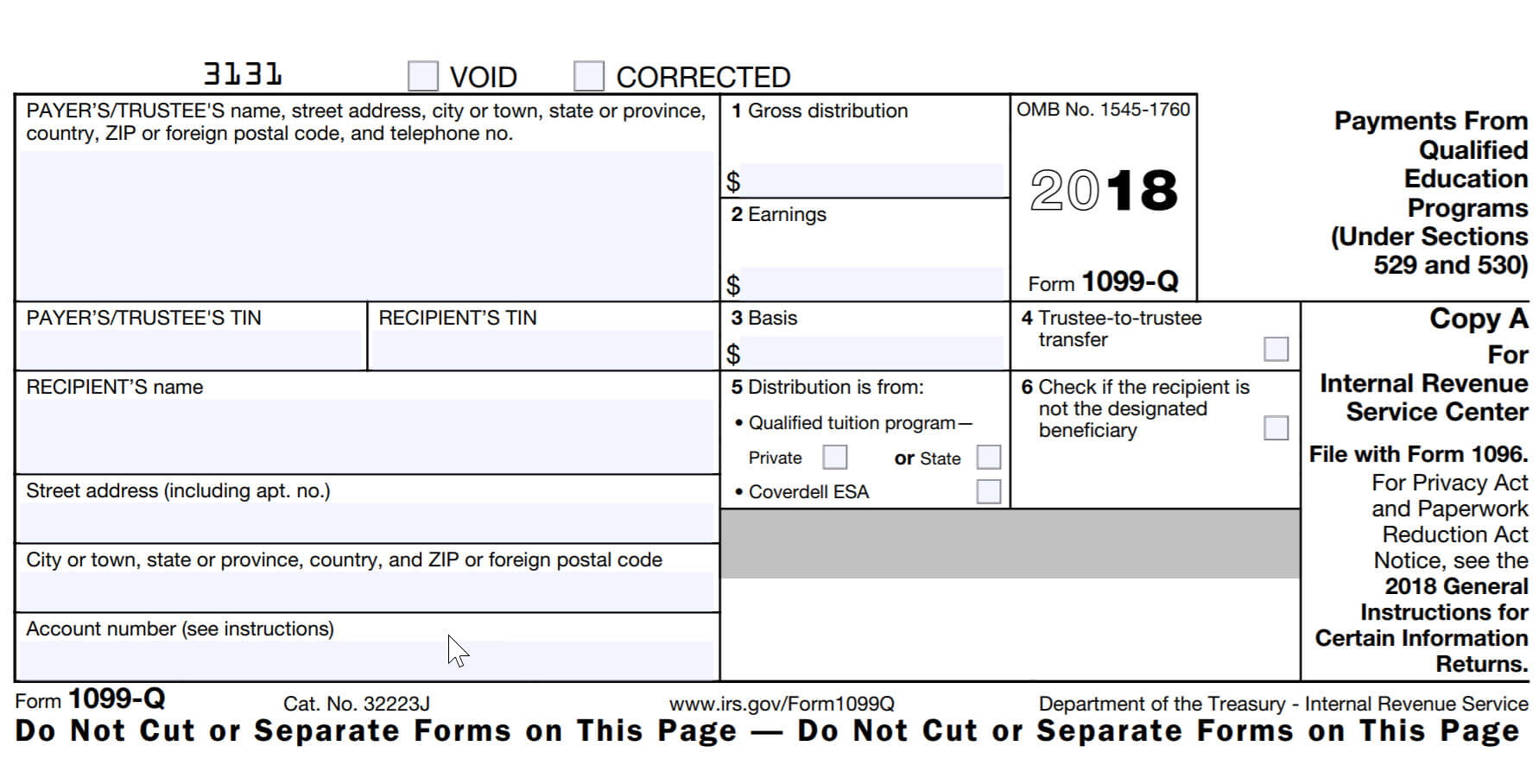

The form reports the interest income you. Who should receive a 1099 form? At least $10 in royalties or broker. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web taxes what is an irs 1099 form?

How Do I Get A Form 1099 From Opm Faxed 20202021 Fill and Sign

Web taxes what is an irs 1099 form? At least $10 in royalties or broker. Who should receive a 1099 form? Web the basic reporting rule is that each person paying $600 or more in the course of business must report it on form 1099. Web watch newsmax live for the latest news and analysis on today's top stories, right.

What Is a 1099?

Who should receive a 1099 form? Web if you made the payment for legal services that the lawyer rendered to you in connection with your trade or business, you report the payment in box 1 of irs form. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. That means lawyers must issue the.

1099 Form Printable 2018 MBM Legal

At least $10 in royalties or broker. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. That means lawyers must issue the form to an expert. 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from february 28 to. That way, alice may only receive a form 1099.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from february 28 to. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web if you made the payment for legal services that the lawyer rendered to you in connection with your trade or business, you report the payment.

Understanding 1099 Form Samples

That way, alice may only receive a form 1099 for her fees, not also for her client’s money. Who gets one and how it works advertiser disclosure what is an irs 1099 form? At least $10 in royalties or broker. Web if you made the payment for legal services that the lawyer rendered to you in connection with your trade.

Ssa 1099 Form 20202022 Fill and Sign Printable Template Online US

This time dastardly defendant issues a check for 60. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Who gets one and how it works a. At least $10 in royalties or broker. Web taxes what is an irs 1099 form?

Free Printable 1099 Misc Forms Free Printable

Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web level 1 1099 misc for reimbursement of legal fees title company sent 1099 misc for reimbursement of legal fees through settlement. Who gets one and how it works a. Ap leaders rely on iofm’s expertise to keep them up to date on changing.

DoItYourself 1099s, Done Right Moxie Bookkeeping and Coaching Inc.

Who gets one and how it works a. At least $10 in royalties or broker. 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from february 28 to. That means lawyers must issue the form to an expert. Web level 1 1099 misc for reimbursement of legal fees title company sent 1099 misc for reimbursement.

Florida 1099 Form Online Universal Network

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Who gets one and how it works advertiser disclosure what is an irs 1099 form? Web the basic reporting rule is that each person paying $600 or more in the course of business must report it on form 1099. At least $10 in royalties.

201, Accelerated The Due Date For Filing Form 1099 That Includes Nonemployee Compensation (Nec) From February 28 To.

At least $10 in royalties or broker. The form reports the interest income you. Who gets one and how it works advertiser disclosure what is an irs 1099 form? Who gets one and how it works a.

Web Watch Newsmax Live For The Latest News And Analysis On Today's Top Stories, Right Here On Facebook.

Web taxes what is an irs 1099 form? I see to enter 1099 misc in. Web if you made the payment for legal services that the lawyer rendered to you in connection with your trade or business, you report the payment in box 1 of irs form. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations.

This Time Dastardly Defendant Issues A Check For 60.

Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web level 1 1099 misc for reimbursement of legal fees title company sent 1099 misc for reimbursement of legal fees through settlement. That way, alice may only receive a form 1099 for her fees, not also for her client’s money. Web the basic reporting rule is that each person paying $600 or more in the course of business must report it on form 1099.

Who Should Receive A 1099 Form?

That means lawyers must issue the form to an expert.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)