2017 990 Ez Form

2017 990 Ez Form - Ad access irs tax forms. Keep your nonprofit in irs compliance. Under section 501(c), 527, or 4947(a)(1) of the. Ad do you know which version of form 990 your nonprofit should use? Web short form return of organization exempt from income tax omb no. Corporation trust association other add lines 5b, 6c, and 7b to line 9 to determine gross. Web received a form 990 package in the mail, the organization should file a return without financial data. This form is open to public. Download your modified document, export it to the cloud, print it from the editor, or share it with other participants through a shareable link. Complete, edit or print tax forms instantly.

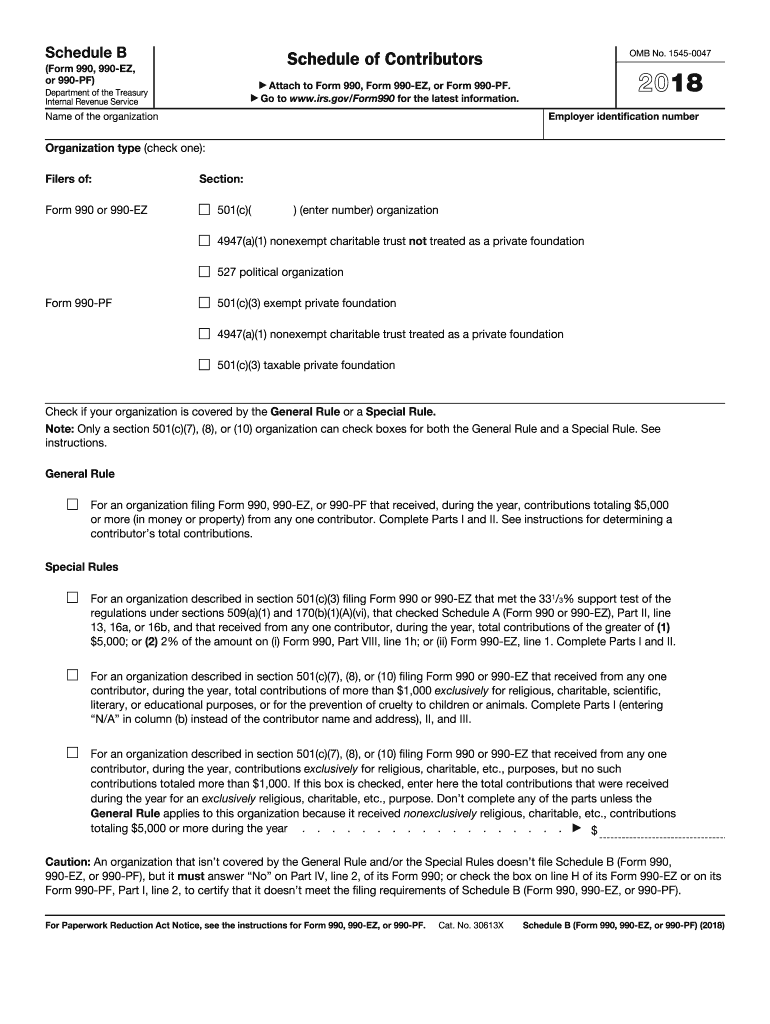

Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Ad access irs tax forms. Web short form return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social. Leverage 1040 tax automation software to make tax preparation more profitable. Some states require a complete return. Web get the 990 ez 2017 form completed. Ad do you know which version of form 990 your nonprofit should use? Who must file most organizations exempt from income tax under section 501(a) must file an annual information return (form 990 or 990. Web short form return of organization exempt from income tax omb no. Web form check the box on line 1a, 2a, 3a, 4a, or 5a, below, and the amount on that line for the return being filed with this form was blank, then leave line 1b, 2b, 3b, 4b, or 5b,.

Keep your nonprofit in irs compliance. Web get the 990 ez 2017 form completed. Corporation trust association other add lines 5b, 6c, and 7b to line 9 to determine gross. Web short form return of organization exempt from income tax omb no. Ad do you know which version of form 990 your nonprofit should use? Leverage 1040 tax automation software to make tax preparation more profitable. Short form return of organization exempt from income tax. Get ready for tax season deadlines by completing any required tax forms today. Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Contact brytebridge for form 990 help.

What is Form 990EZ and Who Qualifies for it? Foundation Group, Inc.

Who must file most organizations exempt from income tax under section 501(a) must file an annual information return (form 990 or 990. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Web received a form 990 package in the mail, the organization should file a return without financial data. Contact brytebridge for form 990.

Fillable IRS Form 990EZ Free Printable PDF Sample FormSwift

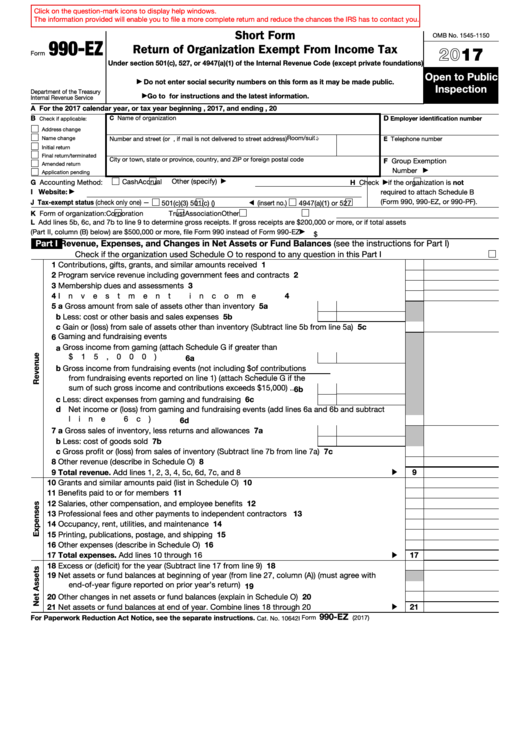

Who must file most organizations exempt from income tax under section 501(a) must file an annual information return (form 990 or 990. This form is open to public. Under section 501(c), 527, or 4947(a)(1) of the. Web short form return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations).

Form 990 or 990EZ (Sch N) Liquidation, Termination, Dissolution, or

Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Complete, edit or print tax forms instantly. Ad access irs tax forms. Contact brytebridge for form 990 help. Web form check the box on line 1a, 2a, 3a, 4a, or 5a, below, and the amount on that line for the return.

Top 18 Form 990 Ez Templates free to download in PDF format

Web short form return of organization exempt from income tax omb no. Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Complete, edit or print tax forms instantly. Web get the 990 ez 2017 form completed. Get ready for tax season deadlines by completing any required tax forms today.

Irs Form 990 Ez 2017 Form Resume Examples xm1enmrKrL

Web get the 990 ez 2017 form completed. Corporation trust association other add lines 5b, 6c, and 7b to line 9 to determine gross. Who must file most organizations exempt from income tax under section 501(a) must file an annual information return (form 990 or 990. Download your modified document, export it to the cloud, print it from the editor,.

Form 990 Schedule O Fill Out and Sign Printable PDF Template signNow

Web get the 990 ez 2017 form completed. Complete, edit or print tax forms instantly. Ad do you know which version of form 990 your nonprofit should use? Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Contact brytebridge for form 990 help.

Form 990EZ for nonprofits updated Accounting Today

Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Who must file most organizations exempt from income tax under section 501(a) must file an annual information return (form 990 or 990. Contact brytebridge for form 990 help. Department of the treasury internal revenue service. Download your modified document, export it.

What Is The Form 990EZ and Who Must File It?

Leverage 1040 tax automation software to make tax preparation more profitable. Web received a form 990 package in the mail, the organization should file a return without financial data. Download your modified document, export it to the cloud, print it from the editor, or share it with other participants through a shareable link. Web short form return of organization exempt.

form 990 ez schedule g 2017 Fill Online, Printable, Fillable Blank

Some states require a complete return. Leverage 1040 tax automation software to make tax preparation more profitable. Ad do you know which version of form 990 your nonprofit should use? Web get the 990 ez 2017 form completed. Ad access irs tax forms.

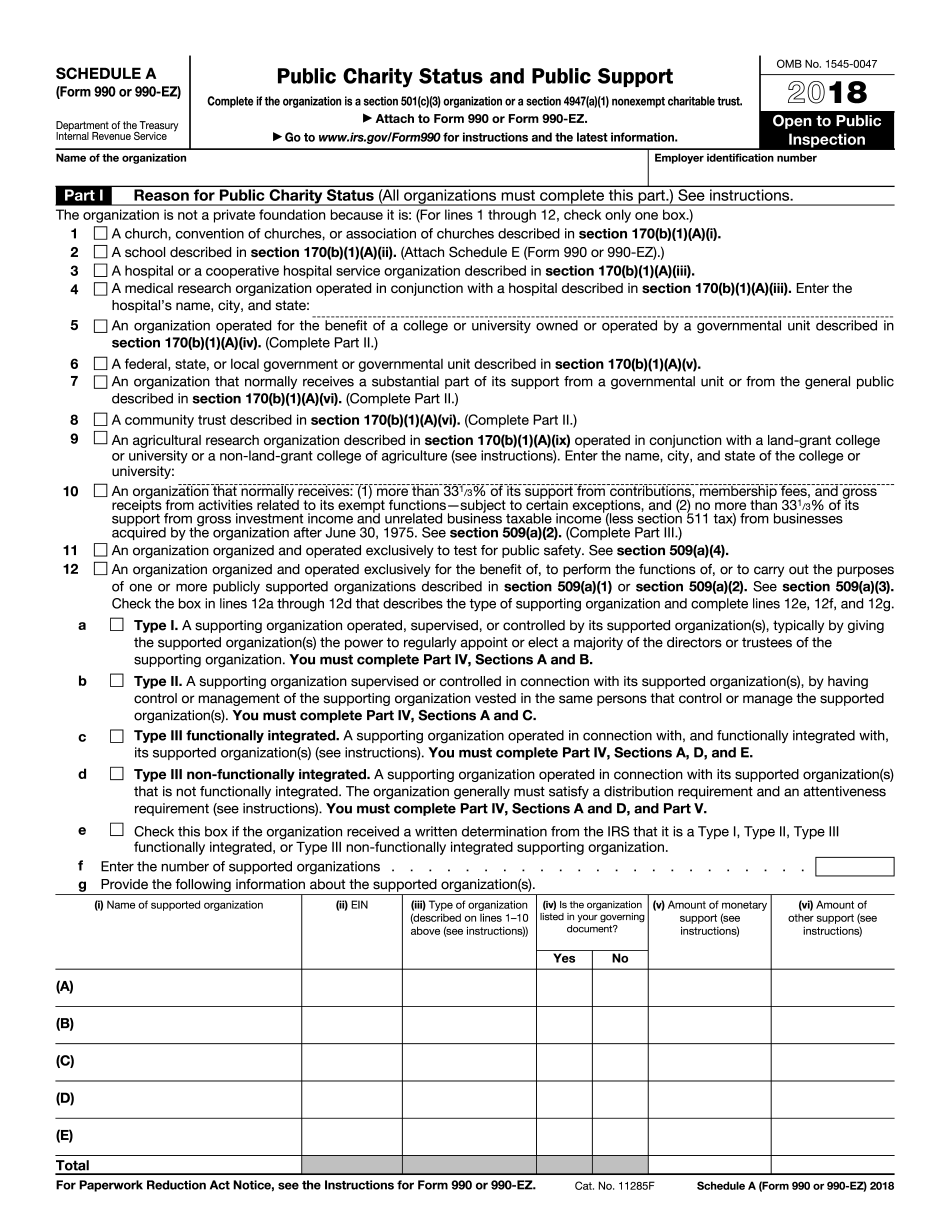

990 ez schedule a 2017 Fill Online, Printable, Fillable Blank form

Web short form return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social. Some states require a complete return. Ad access irs tax forms. Leverage 1040 tax automation software to make tax preparation more profitable. Contact brytebridge for form 990 help.

Complete, Edit Or Print Tax Forms Instantly.

Web form check the box on line 1a, 2a, 3a, 4a, or 5a, below, and the amount on that line for the return being filed with this form was blank, then leave line 1b, 2b, 3b, 4b, or 5b,. Under section 501(c), 527, or 4947(a)(1) of the. Download your modified document, export it to the cloud, print it from the editor, or share it with other participants through a shareable link. Corporation trust association other add lines 5b, 6c, and 7b to line 9 to determine gross.

Ad Access Irs Tax Forms.

Short form return of organization exempt from income tax. Web short form return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social. Leverage 1040 tax automation software to make tax preparation more profitable. Get ready for tax season deadlines by completing any required tax forms today.

Keep Your Nonprofit In Irs Compliance.

This form is open to public. Ad do you know which version of form 990 your nonprofit should use? Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Who must file most organizations exempt from income tax under section 501(a) must file an annual information return (form 990 or 990.

Web Received A Form 990 Package In The Mail, The Organization Should File A Return Without Financial Data.

Department of the treasury internal revenue service. Web short form return of organization exempt from income tax omb no. Web get the 990 ez 2017 form completed. Some states require a complete return.