Utc Tax Form

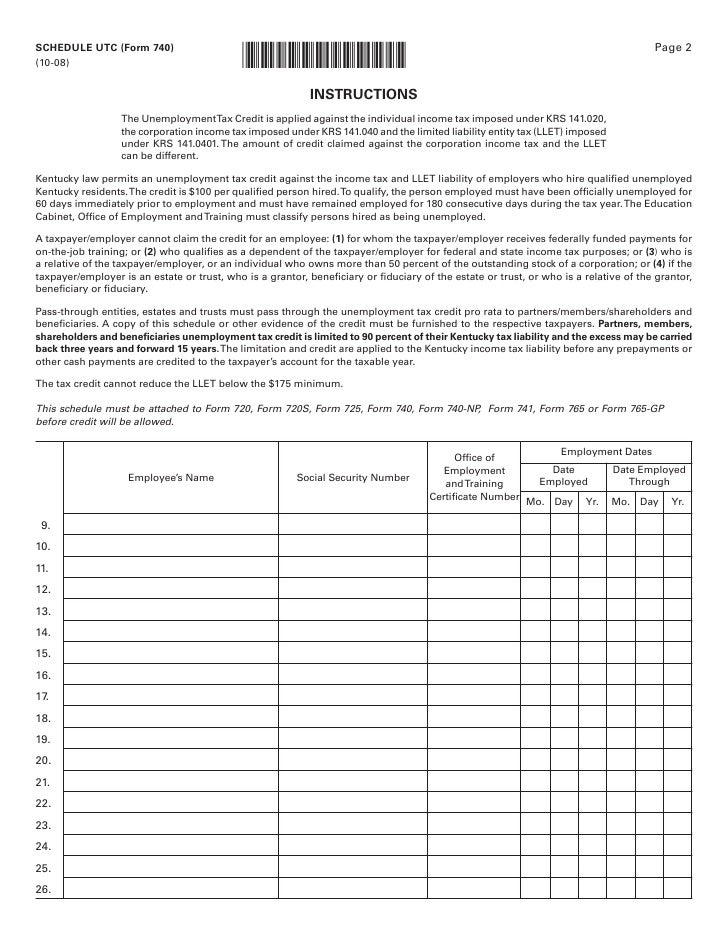

Utc Tax Form - Tn sales and use tax cert of exemption.pdf. Utc 1229), column 4 of the. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web reduced course load request form; Web purpose of form use form 709 to report the following. Web 1973 rulon white blvd. Web please contact your campus representative (provided below) if you have questions concerning the 1098 forms. Web we last updated the unemployment tax credit in february 2023, so this is the latest version of schedule utc, fully updated for tax year 2022. Group travel card (gtr) application. Coordinated universal time (utc) or universal time coordinated (utc), is the primary standard time based on international atomic time (tai) with leap.

Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web we last updated the unemployment tax credit in february 2023, so this is the latest version of schedule utc, fully updated for tax year 2022. Web reduced course load request form; Send all information returns filed on paper to the following. Consult your tax advisor for further information. You can download or print current or. Tn sales and use tax cert of exemption.pdf. Web 1973 rulon white blvd. However, some small employers (those whose annual liability for social security, medicare, and.

Group travel card (gtr) application. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Web 1973 rulon white blvd. Web what does utc mean?. Send all information returns filed on paper to the following. Web we last updated the unemployment tax credit in february 2023, so this is the latest version of schedule utc, fully updated for tax year 2022. If using a private delivery service, send your returns to the street address above for the submission processing center. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web please contact your campus representative (provided below) if you have questions concerning the 1098 forms. Utc 1229), column 4 of the.

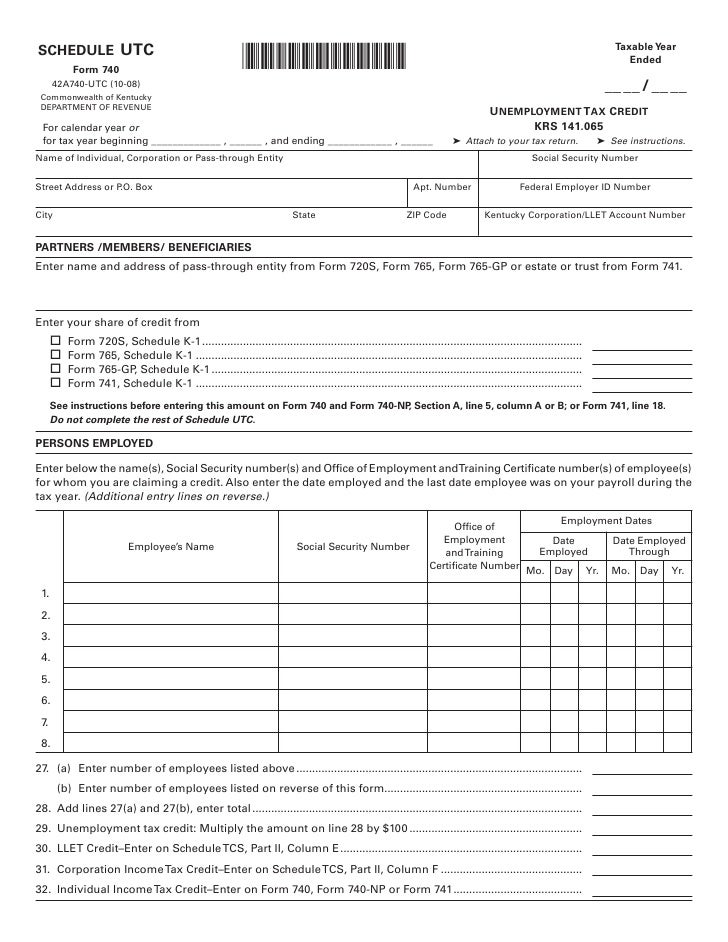

Schedule UTC Unemployment Tax Credit Form 42A740UTC

Group travel card (gtr) application. Coordinated universal time (utc) or universal time coordinated (utc), is the primary standard time based on international atomic time (tai) with leap. Web required forms and documents are accessible for viewing through your mymocsnet account. Web reduced course load request form; Web generally, employers are required to file forms 941 quarterly.

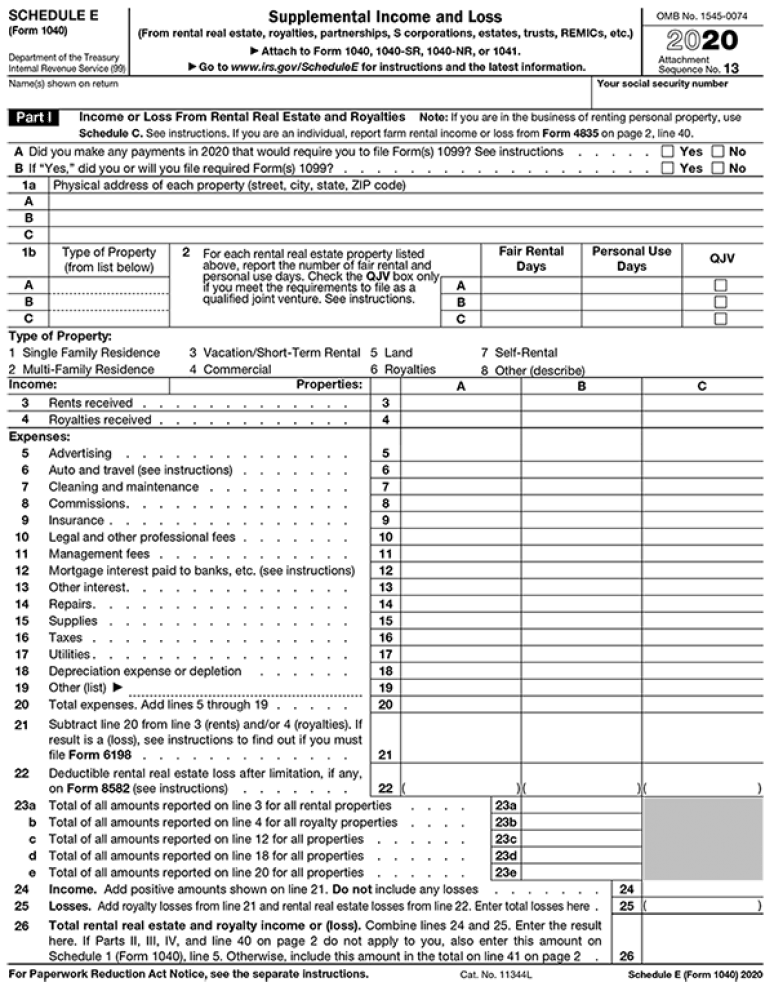

2020 Tax Form Schedule E U.S. Government Bookstore

Since fall 2012, we have not accepted copies of tax returns if selected for. You can download or print current or. Web please contact your campus representative (provided below) if you have questions concerning the 1098 forms. Consult your tax advisor for further information. Web required forms and documents are accessible for viewing through your mymocsnet account.

Full Form of UTC GMT EST CET IST etc (Time Zones) YouTube

Web purpose of form use form 709 to report the following. Utc 1229), column 4 of the. However, some small employers (those whose annual liability for social security, medicare, and. Web reduced course load request form; Consult your tax advisor for further information.

how much power do you need Archives DroneQuote

Web what does utc mean?. Since fall 2012, we have not accepted copies of tax returns if selected for. Utc 1229), column 4 of the. Web required forms and documents are accessible for viewing through your mymocsnet account. Web form 941 for 2023:

Tax advisor The deadline for filing form 309 ends in October B Law

Send all information returns filed on paper to the following. Web please contact your campus representative (provided below) if you have questions concerning the 1098 forms. However, some small employers (those whose annual liability for social security, medicare, and. Web what does utc mean?. Web form 941 for 2023:

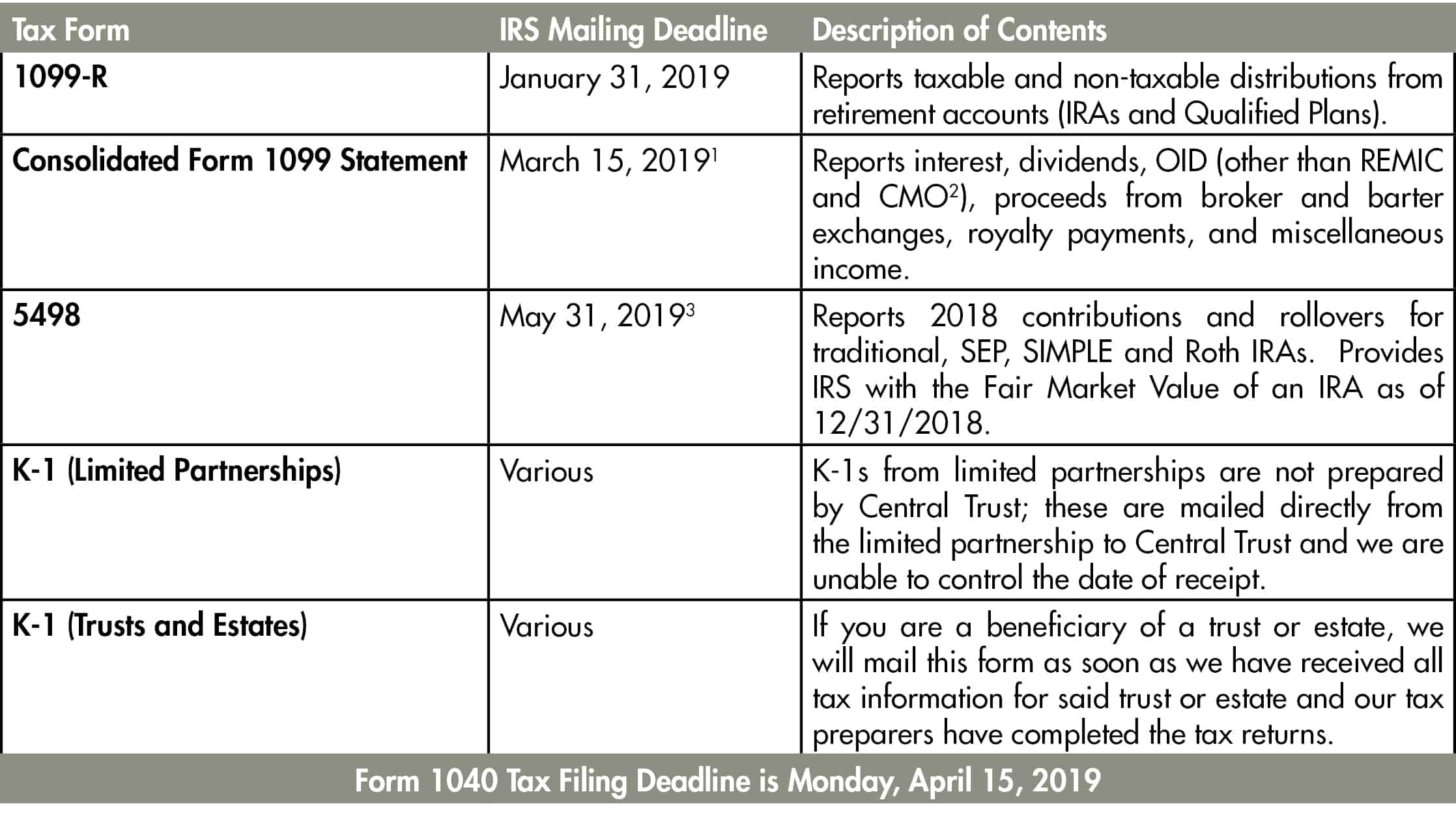

Tax Form Availability Central Trust Company

Since fall 2012, we have not accepted copies of tax returns if selected for. Web purpose of form use form 709 to report the following. Web reduced course load request form; You can download or print current or. However, some small employers (those whose annual liability for social security, medicare, and.

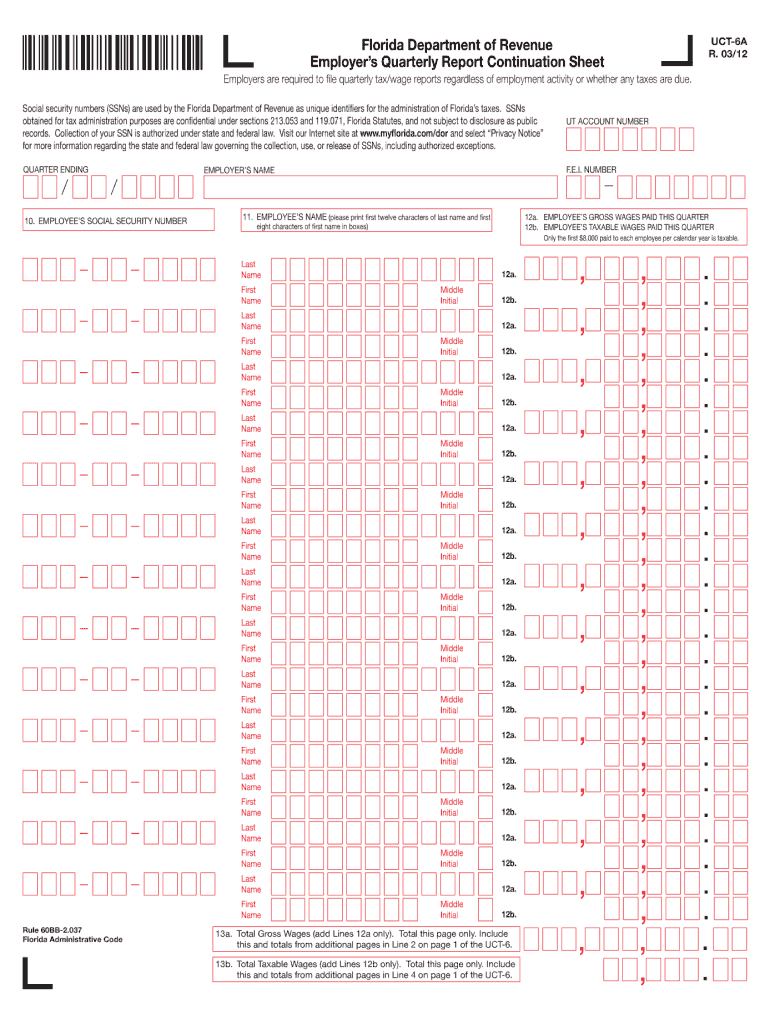

Revenue Uct 6 Fill Online, Printable, Fillable, Blank pdfFiller

Web required forms and documents are accessible for viewing through your mymocsnet account. Consult your tax advisor for further information. Every quarter, businesses registered with the florida department of revenue must pay the correct amount of payroll taxes. Web generally, employers are required to file forms 941 quarterly. Group travel card (gtr) application.

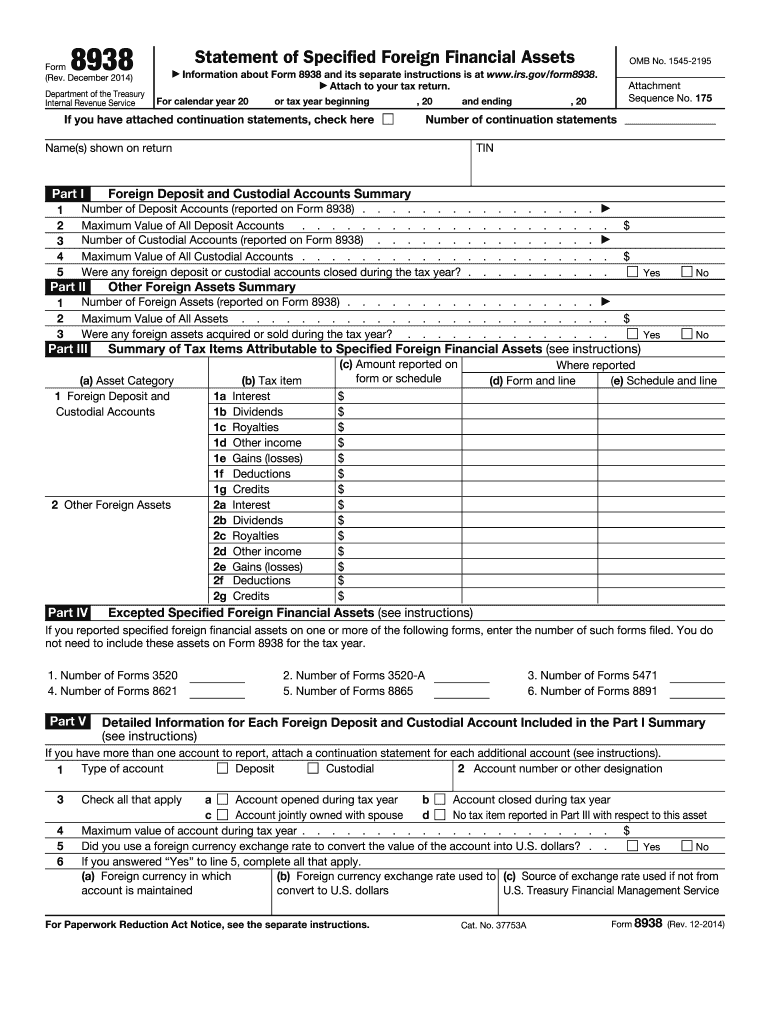

2014 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Web generally, employers are required to file forms 941 quarterly. Every quarter, businesses registered with the florida department of revenue must pay the correct amount of payroll taxes. Group travel card (gtr) application. Send all information returns filed on paper to the following. If using a private delivery service, send your returns to the street address above for the submission.

What You Need to Know About the 1099K Updates Aldridge Borden and

Web we last updated the unemployment tax credit in february 2023, so this is the latest version of schedule utc, fully updated for tax year 2022. Since fall 2012, we have not accepted copies of tax returns if selected for. Send all information returns filed on paper to the following. Web generally, employers are required to file forms 941 quarterly..

Schedule UTC Unemployment Tax Credit Form 42A740UTC

Tn sales and use tax cert of exemption.pdf. Web reduced course load request form; Web form 941 for 2023: Web required forms and documents are accessible for viewing through your mymocsnet account. Coordinated universal time (utc) or universal time coordinated (utc), is the primary standard time based on international atomic time (tai) with leap.

March 2023) Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal Revenue Service 950122.

Web current students and new students who have attended orientation should complete the following form to change their major, minor and/or catalog year. Utc 1229), column 4 of the. Web reduced course load request form; Web 1973 rulon white blvd.

Web This Page Provides The Addresses For Taxpayers And Tax Professionals To Mail Paper Forms 1096 To The Irs.

Web please contact your campus representative (provided below) if you have questions concerning the 1098 forms. Consult your tax advisor for further information. Send all information returns filed on paper to the following. Since fall 2012, we have not accepted copies of tax returns if selected for.

Tn Sales And Use Tax Cert Of Exemption.pdf.

Web purpose of form use form 709 to report the following. Web what does utc mean?. Group travel card (gtr) application. You can download or print current or.

Web Generally, Employers Are Required To File Forms 941 Quarterly.

Web required forms and documents are accessible for viewing through your mymocsnet account. Coordinated universal time (utc) or universal time coordinated (utc), is the primary standard time based on international atomic time (tai) with leap. Every quarter, businesses registered with the florida department of revenue must pay the correct amount of payroll taxes. However, some small employers (those whose annual liability for social security, medicare, and.