2022 Form 8880

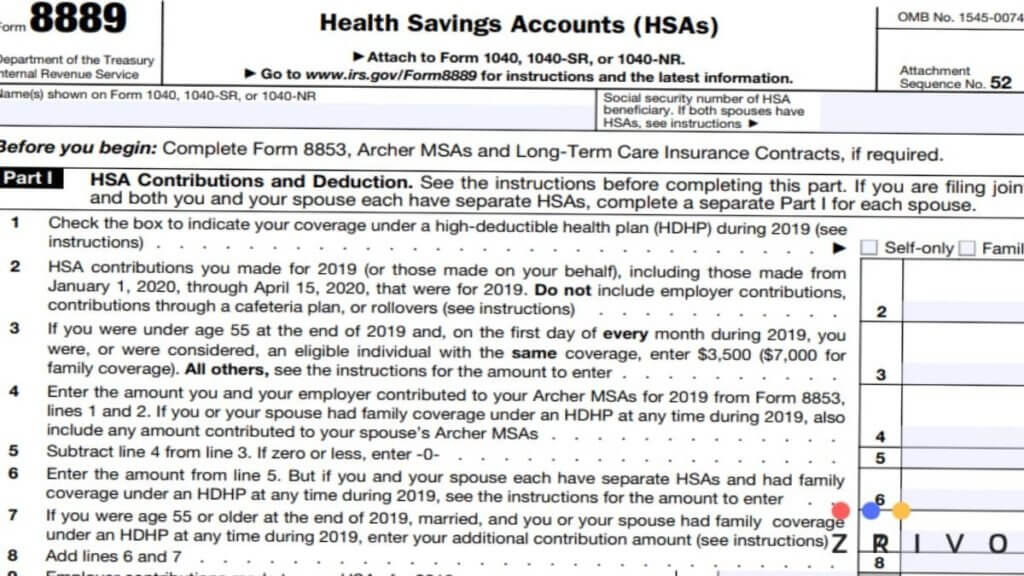

2022 Form 8880 - Web form 8880 is used to compute the credit for qualified retirement savings contributions, also known as the saver's credit. this credit is designed to incentivize. Web how to claim the saver’s credit. Web a retirement savings contribution credit may be claimed for the amount of contributions you, as the designated beneficiary of an able account, make before january 1, 2026, to the. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Fill out the blank fields; Web irs form 8880 is used specifically for the retirement saver’s credit. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Get ready for tax season deadlines by completing any required tax forms today. This credit can be claimed in addition to any ira. Web form 8880 is used to claim the saver's credit, and its instructions have details on figuring the credit correctly.

You were a student if during any part of 5 calendar months of 2022 you: Web irs form 8880 is used specifically for the retirement saver’s credit. In tax year 2020, the most recent year for which. Ad access irs tax forms. Open it with online editor and start altering. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Part i information from extension. Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit for qualified retirement savings contributions, when. Fill out the blank fields; Depending on your adjusted gross income.

Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • june 2, 2023 08:40 am overview are. Web form 8880 not generating credit due to pension distributions in lacerte solved • by intuit • 11 • updated july 12, 2022 this article explains what to do if form. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). This credit can be claimed in addition to any ira. Depending on your adjusted gross income. Get ready for tax season deadlines by completing any required tax forms today. You were a student if during any part of 5 calendar months of 2022 you: Web what is the irs form 8880? As tax season approaches, you’ll need to know where to go to take advantage of the saver’s credit. Ad access irs tax forms.

DH 680 Form

In tax year 2020, the most recent year for which. Fill out the blank fields; This credit can be claimed in addition to any ira. Part i information from extension. Web per irs instructions for form 8880, page 2:

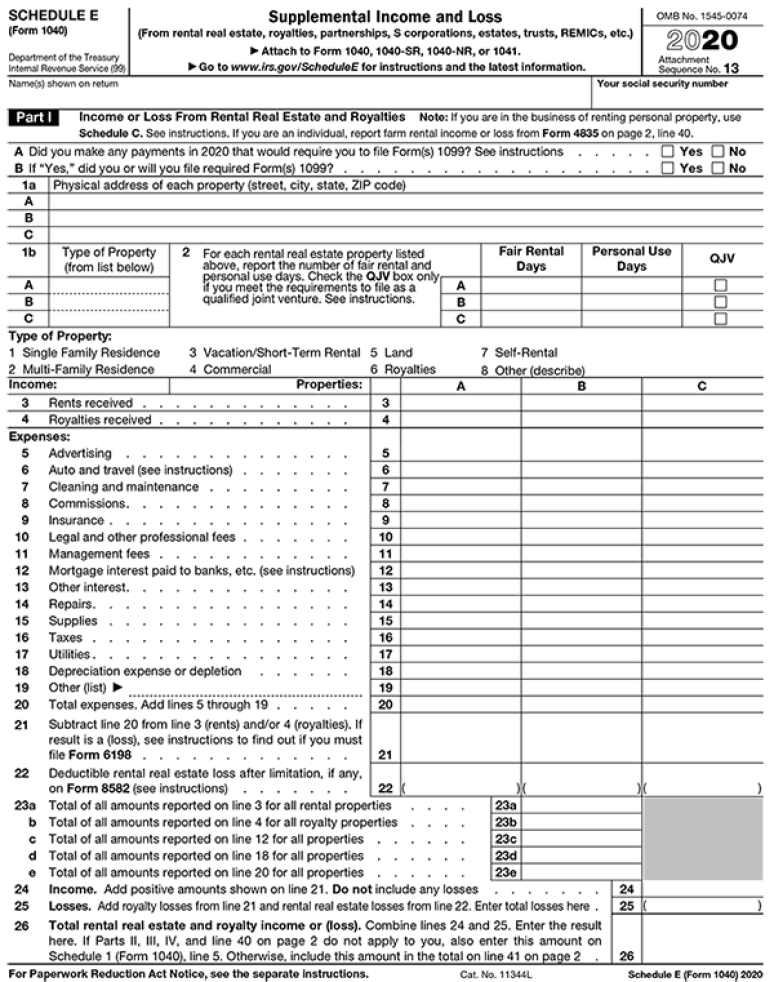

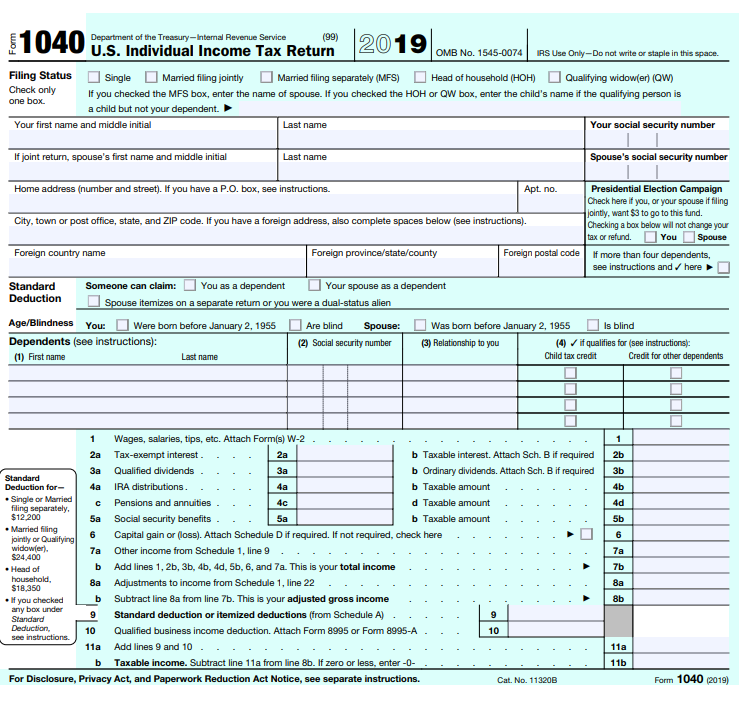

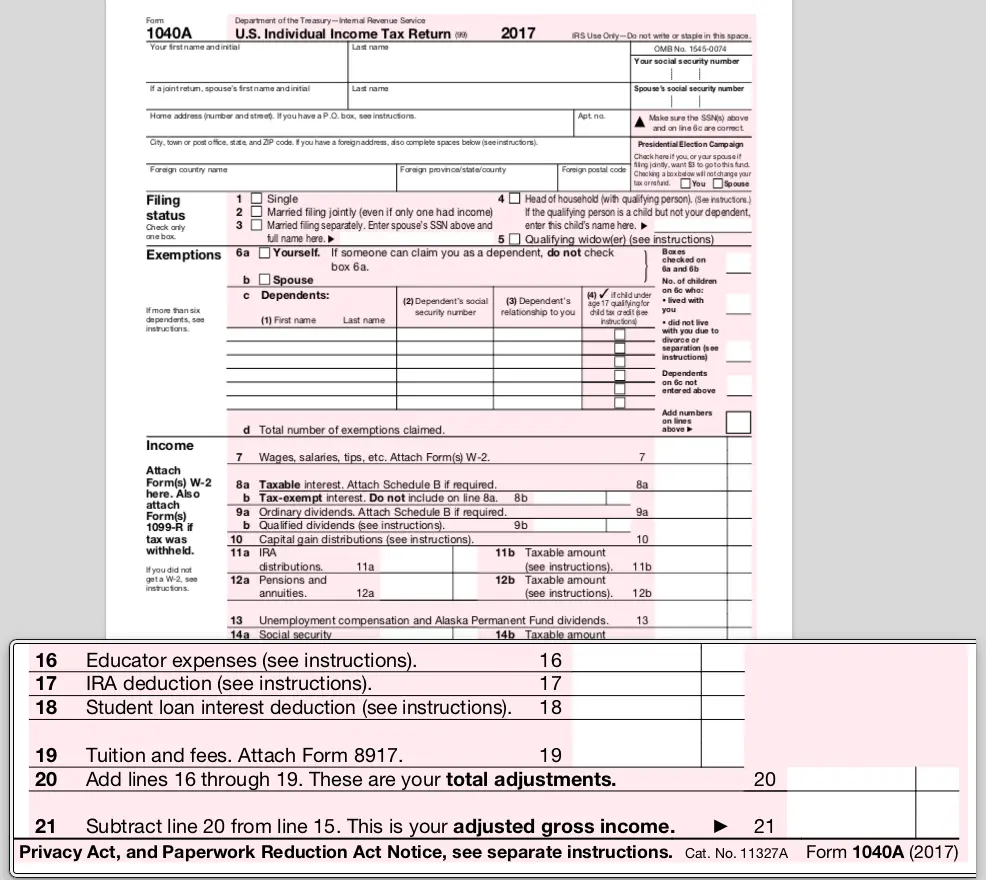

Form 1040 2022 Example Calendar Printable

Web irs form 8880 is used specifically for the retirement saver’s credit. Web a retirement savings contribution credit may be claimed for the amount of contributions you, as the designated beneficiary of an able account, make before january 1, 2026, to the. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • june.

Form 8880 Tax Incentives For Retirement Account —

Web get the irs 8880 you require. You were a student if during any part of 5 calendar months of 2022 you: Open it with online editor and start altering. Complete, edit or print tax forms instantly. Web how to claim the saver’s credit.

USE 2020 TAX SCHEDULE AND PLEASE FILL OUT THE SAME

Web irs form 8880 is used specifically for the retirement saver’s credit. Web get the irs 8880 you require. Web form 8880 not generating credit due to pension distributions in lacerte solved • by intuit • 11 • updated july 12, 2022 this article explains what to do if form. Web form 8880 is used to claim the saver's credit,.

What Is Agi On Tax Form

Part i information from extension. Web get the irs 8880 you require. This credit can be claimed in addition to any ira. This is where you’ll report your income to determine eligibility and all of the contributions you. Web irs form 8880 is used specifically for the retirement saver’s credit.

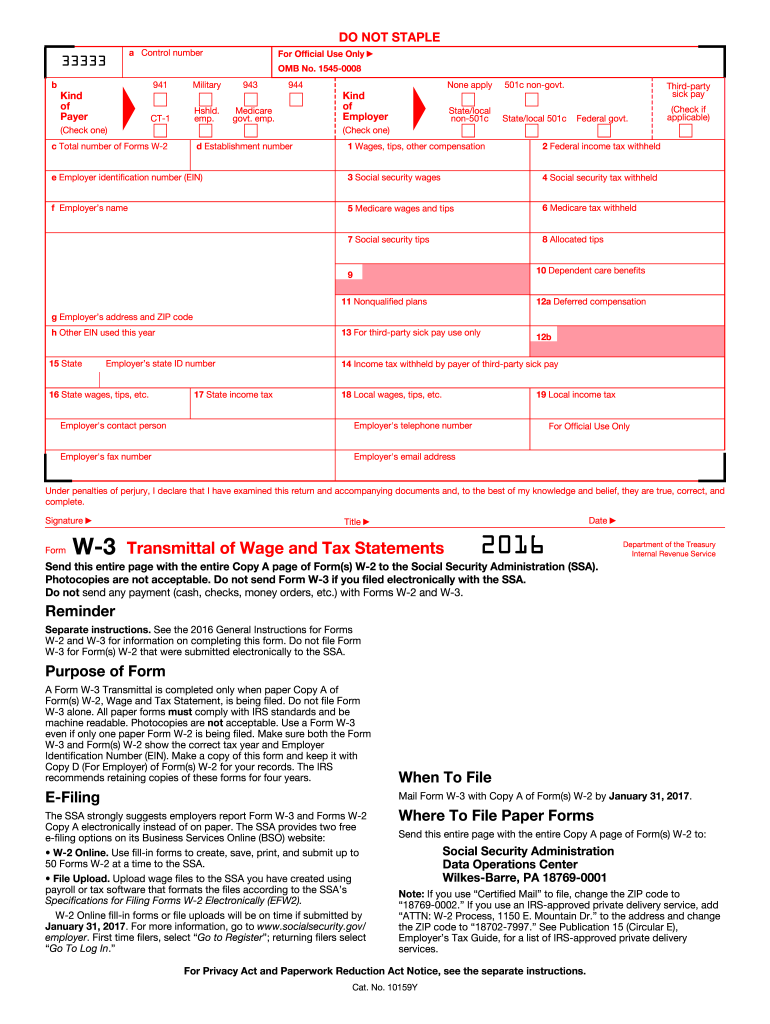

IRS W3 2016 Fill out Tax Template Online US Legal Forms

Web get the irs 8880 you require. Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit for qualified retirement savings contributions, when. Open it with online editor and start altering. Web how to claim the saver’s credit. Get ready for tax season deadlines by completing any required.

Credit Limit Worksheet 8880 —

Ad access irs tax forms. Web irs form 8880 is used specifically for the retirement saver’s credit. In tax year 2020, the most recent year for which. You were a student if during any part of 5 calendar months of 2022 you: Get ready for tax season deadlines by completing any required tax forms today.

Taxable Social Security Worksheet 2021

Web get the irs 8880 you require. Get ready for tax season deadlines by completing any required tax forms today. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web form 8880 is used to claim the saver's credit, and its instructions have details on figuring.

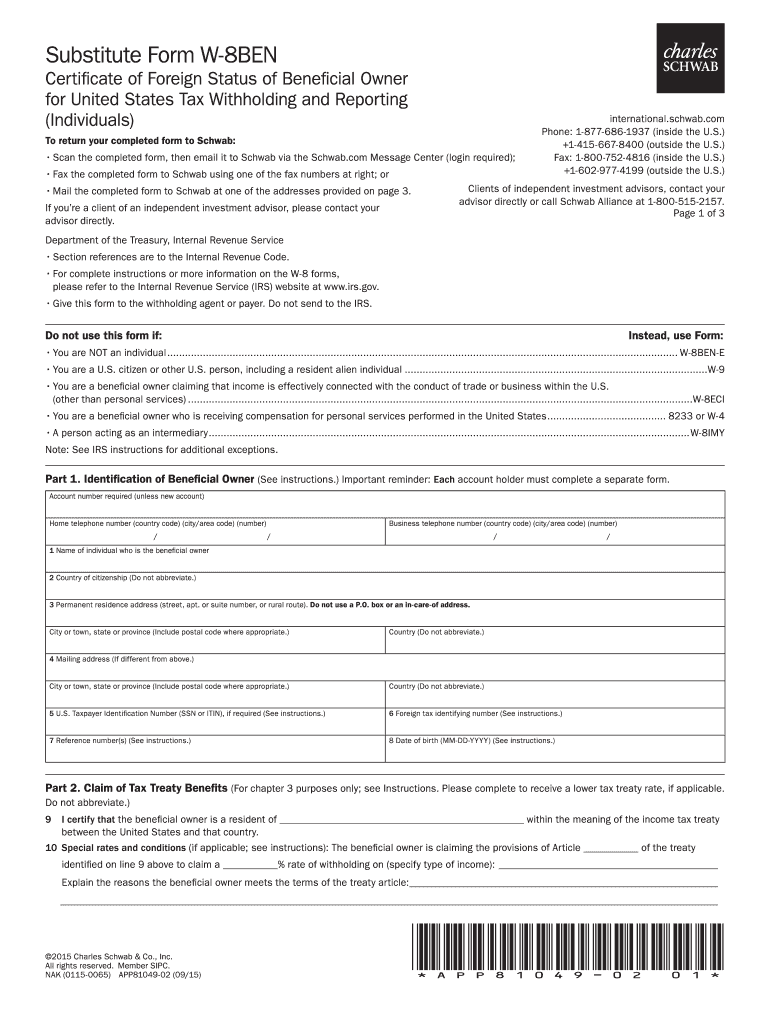

Charles Schwab Tax Forms Fill Out and Sign Printable PDF Template

In tax year 2020, the most recent year for which. This is where you’ll report your income to determine eligibility and all of the contributions you. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Written by a turbotax expert • reviewed by a turbotax cpa.

2022 Form IRS 8880 Fill Online, Printable, Fillable, Blank pdfFiller

Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web per irs instructions for form 8880, page 2: As tax season approaches, you’ll need to know where to go to take advantage of the saver’s credit. Web irs form 8880 is used specifically for the retirement.

Written By A Turbotax Expert • Reviewed By A Turbotax Cpa Updated For Tax Year 2022 • June 2, 2023 08:40 Am Overview Are.

Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Depending on your adjusted gross income. Web irs form 8880 is used specifically for the retirement saver’s credit. Web what is the irs form 8880?

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web see form 8880, credit for qualified retirement savings contributions, for more information. Web we last updated the credit for qualified retirement savings contributions in december 2022, so this is the latest version of form 8880, fully updated for tax year 2022. Web per irs instructions for form 8880, page 2: Fill out the blank fields;

Engaged Parties Names, Places Of Residence And Phone Numbers Etc.

This credit can be claimed in addition to any ira. In order to claim the saver’s. Web get the irs 8880 you require. As tax season approaches, you’ll need to know where to go to take advantage of the saver’s credit.

Web Form 8880 Is Used To Claim The Saver's Credit, And Its Instructions Have Details On Figuring The Credit Correctly.

Web form 8880 is used to compute the credit for qualified retirement savings contributions, also known as the saver's credit. this credit is designed to incentivize. Ad complete irs tax forms online or print government tax documents. Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit for qualified retirement savings contributions, when. Ad access irs tax forms.