941 Form 2020 3Rd Quarter

941 Form 2020 3Rd Quarter - Check the type of return you’re correcting. Ad upload, modify or create forms. October, november, december name (not your trade name) calendar year (also check quarter). Web don’t miss your 2020 form 941 third quarter deadline here’s everything you need to know to file form 941 from start to finish with taxbandits today! The lines 13b, 24, and 25 are not. Web they were $45 in the second quarter of 2020, $85 in the third quarter and $75 in the fourth quarter. Under these facts, you would qualify for the second and third. Complete, edit or print tax forms instantly. October, november, december go to www.irs.gov/form941ss for instructions and the latest. Web enter your ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order.

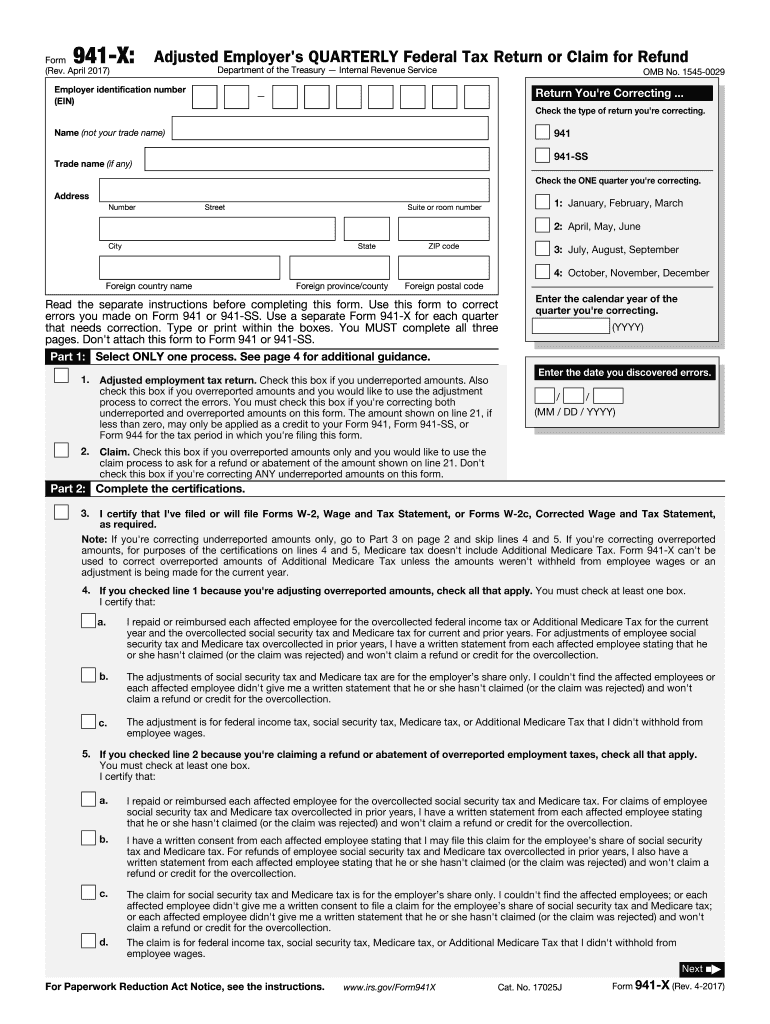

Check the type of return you’re correcting. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Following that, the irs has finalized the form 941 for the 3rd and 4th quarters. Web in the 3rd quarter: Ad upload, modify or create forms. Complete, edit or print tax forms instantly. Try it for free now! Web enter your ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. October, november, december go to www.irs.gov/form941ss for instructions and the latest. July 2020) employer’s quarterly federal tax return 950120 omb no.

Web 941 only to report taxes for the quarter ending march 31, 2021. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Those returns are processed in. The june 2021 revision of form 941 should be used for the second, third, and fourth quarters of 2021. October, november, december go to www.irs.gov/form941ss for instructions and the latest. Try it for free now! Web in the 3rd quarter: Let's make sure we updated quickbooks to. Complete, edit or print tax forms instantly. The lines 13b, 24, and 25 are not.

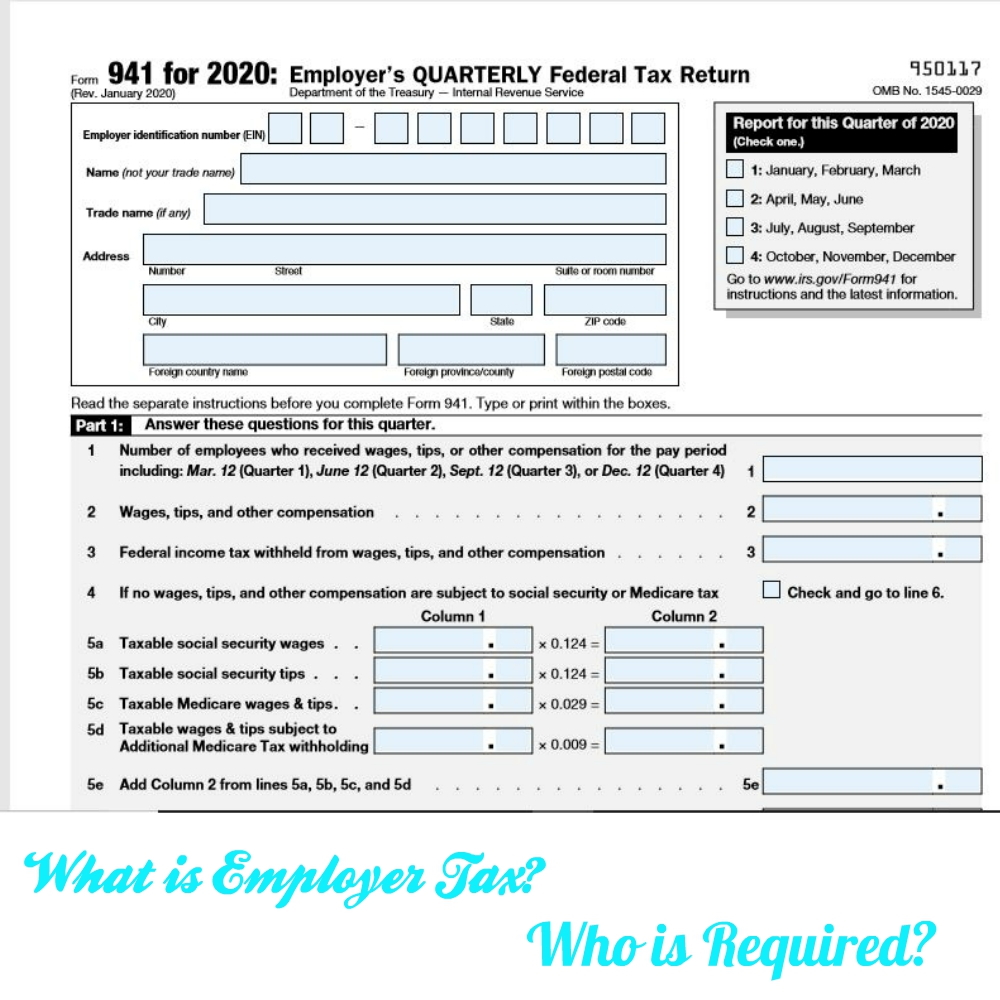

How to fill out IRS Form 941 2019 PDF Expert

Following that, the irs has finalized the form 941 for the 3rd and 4th quarters. Under these facts, you would qualify for the second and third. Those returns are processed in. Ad upload, modify or create forms. Complete, edit or print tax forms instantly.

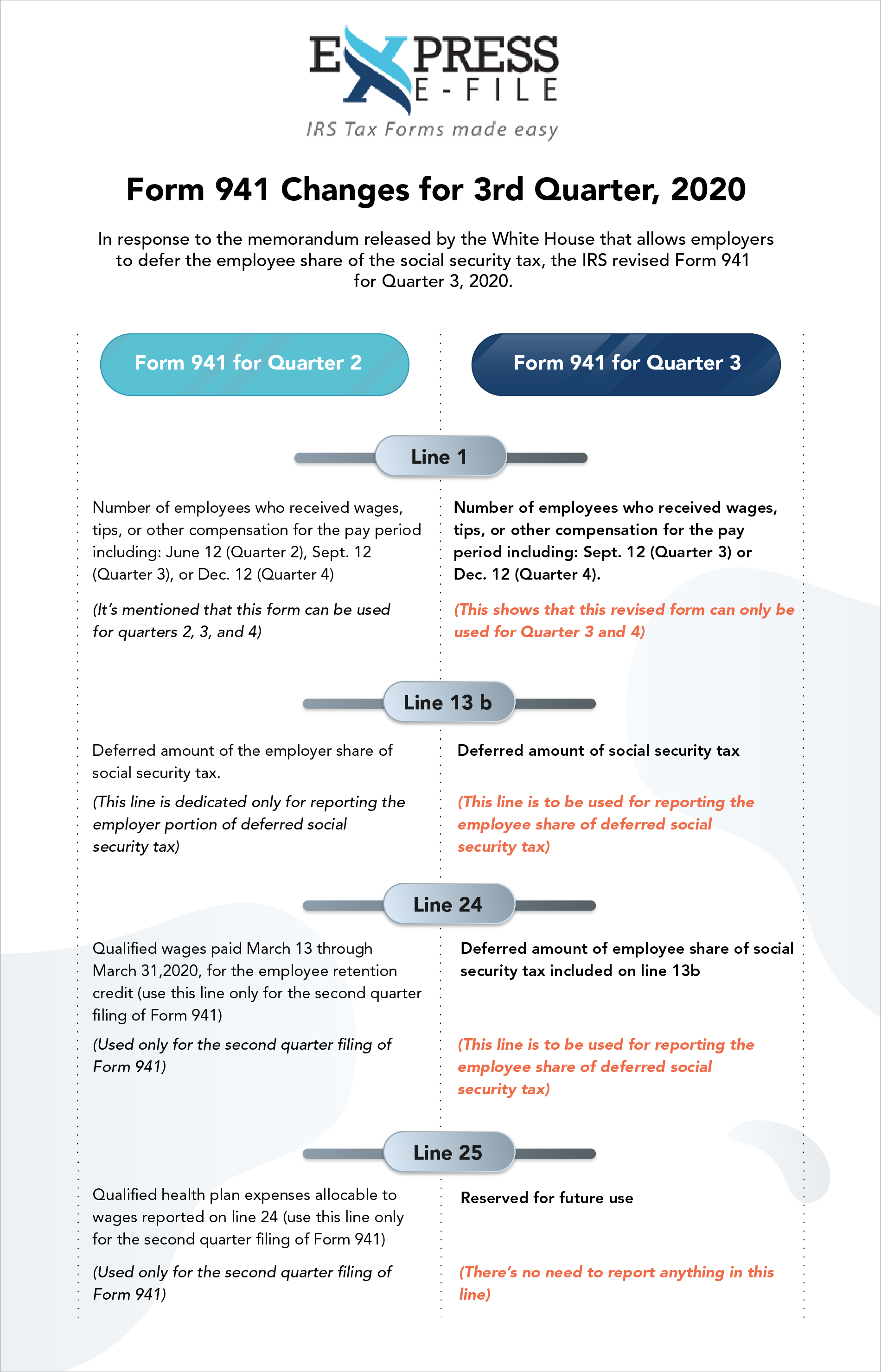

What You Need to Know About 3rd Quarter IRS Form 941 Changes 2020

Check the type of return you’re correcting. The june 2021 revision of form 941 should be used for the second, third, and fourth quarters of 2021. Ad upload, modify or create forms. October, november, december go to www.irs.gov/form941ss for instructions and the latest. Those returns are processed in.

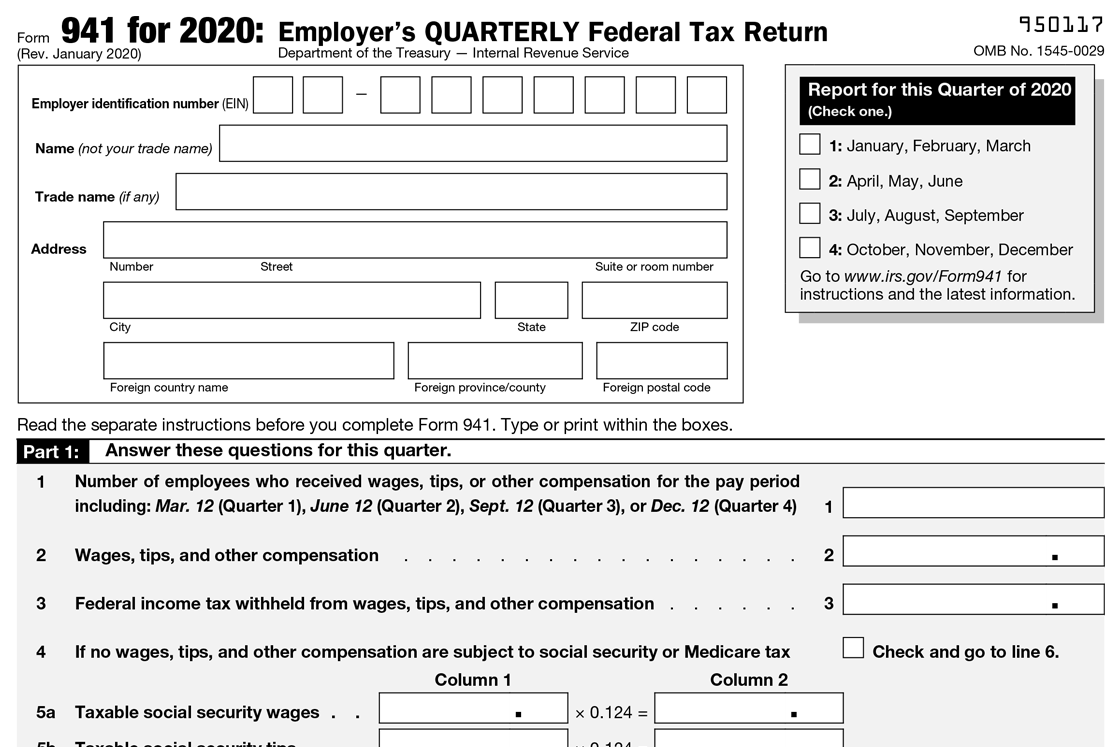

Update Form 941 Changes Regulatory Compliance

Web enter your ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Ad upload, modify or create forms. Ad upload, modify or create forms. Check the type of return you’re correcting. Try it for free now!

Update on IRS Form 941 Changes Effective Immediately

Web enter your ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. The lines 13b, 24, and 25 are not. Ad upload, modify or create forms. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions.

Form 941 Changes for 3rd Quarter 2020

Those returns are processed in. Complete, edit or print tax forms instantly. July 2020) employer’s quarterly federal tax return 950120 omb no. See the instructions for line 36. Web they were $45 in the second quarter of 2020, $85 in the third quarter and $75 in the fourth quarter.

2020 Form 941 Employer’s Quarterly Federal Tax Return What is

Complete, edit or print tax forms instantly. Web they were $45 in the second quarter of 2020, $85 in the third quarter and $75 in the fourth quarter. See the instructions for line 36. Ad upload, modify or create forms. Those returns are processed in.

What is the IRS Form 941? Form 941 Instructions and Information

Try it for free now! Ad upload, modify or create forms. See the instructions for line 36. The june 2021 revision of form 941 should be used for the second, third, and fourth quarters of 2021. Web don’t miss your 2020 form 941 third quarter deadline here’s everything you need to know to file form 941 from start to finish.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Try it for free now! The june 2021 revision of form 941 should be used for the second, third, and fourth quarters of 2021. Let's make sure we updated quickbooks to. Web 941 only to report taxes for the quarter ending march 31, 2021. Under these facts, you would qualify for the second and third.

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

Form 941 is used by employers. Ad upload, modify or create forms. Check the type of return you’re correcting. The lines 13b, 24, and 25 are not. Those returns are processed in.

Let's Make Sure We Updated Quickbooks To.

October, november, december name (not your trade name) calendar year (also check quarter). The lines 13b, 24, and 25 are not. Web this august, the irs released the draft of form 941 with the expected changes. Web 941 only to report taxes for the quarter ending march 31, 2021.

Web Enter Your Ein, “Form 941,” And The Tax Period (“1St Quarter 2023,” “2Nd Quarter 2023,” “3Rd Quarter 2023,” Or “4Th Quarter 2023”) On Your Check Or Money Order.

Ad upload, modify or create forms. Those returns are processed in. Web in the 3rd quarter: Web i've checked here on our end and there's no reported case where can't access the 941 forms for the third quarter.

Complete, Edit Or Print Tax Forms Instantly.

October, november, december go to www.irs.gov/form941ss for instructions and the latest. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Form 941 is used by employers. The june 2021 revision of form 941 should be used for the second, third, and fourth quarters of 2021.

Following That, The Irs Has Finalized The Form 941 For The 3Rd And 4Th Quarters.

July 2020) employer’s quarterly federal tax return 950120 omb no. Try it for free now! Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web they were $45 in the second quarter of 2020, $85 in the third quarter and $75 in the fourth quarter.