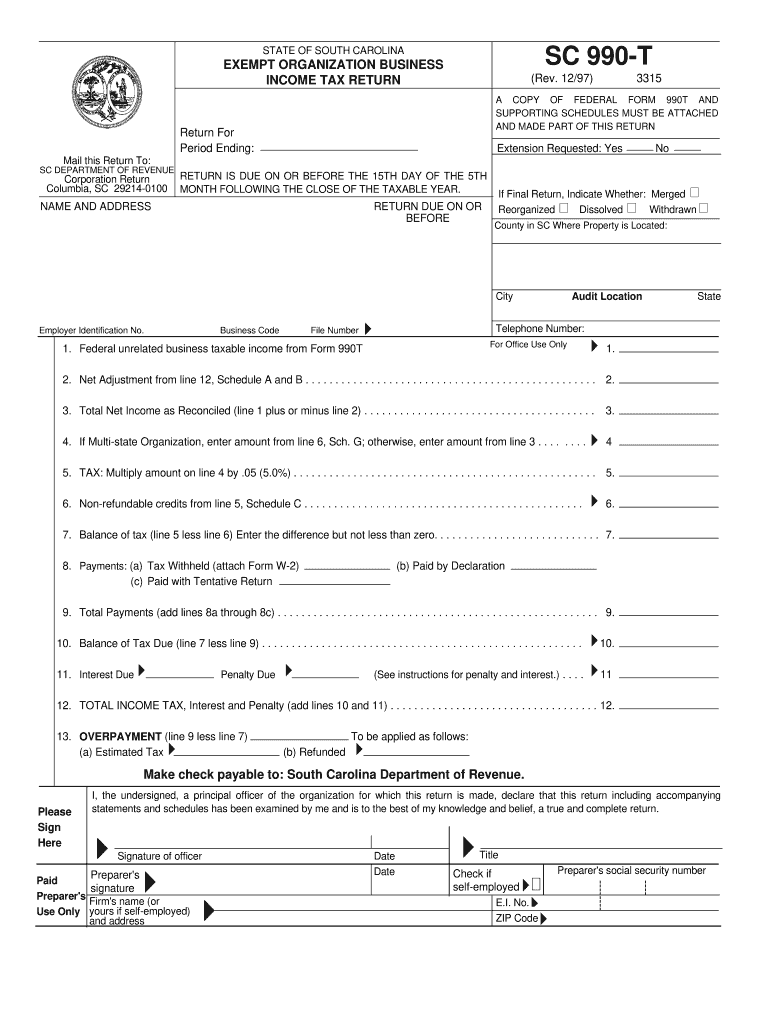

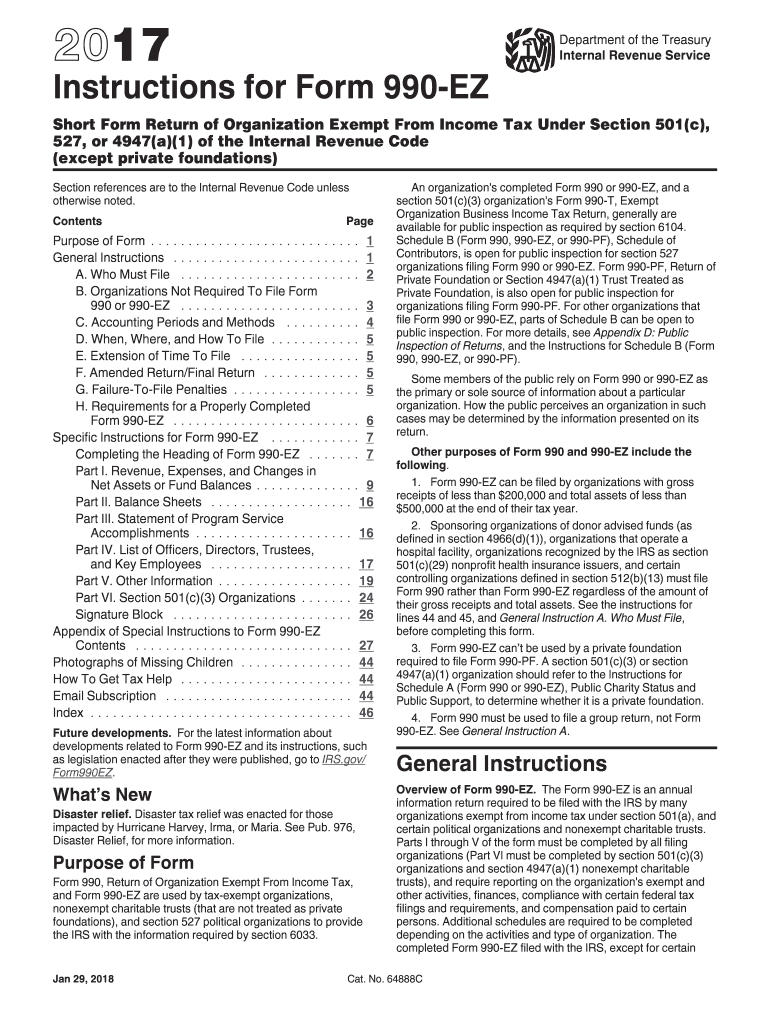

990-T Form

990-T Form - A 990t is the form ira holders must use to report their retirement account assets. A quick & easy breakdown. Web department of the treasury internal revenue service exempt organization business income tax return (and proxy tax under section 6033(e)) for calendar year 2022 or other tax year beginning, 2022, and ending , 20 go to www.irs.gov/form990t for instructions and the latest information. For instructions and the latest information. Unrelated business taxable income from an unrelated trade or business. An organization must pay estimated tax if it expects its tax for the year to be $500 or more. See when, where, and how to file, later, for more information.

See when, where, and how to file, later, for more information. A quick & easy breakdown. A 990t is the form ira holders must use to report their retirement account assets. For instructions and the latest information. Unrelated business taxable income from an unrelated trade or business. Web department of the treasury internal revenue service exempt organization business income tax return (and proxy tax under section 6033(e)) for calendar year 2022 or other tax year beginning, 2022, and ending , 20 go to www.irs.gov/form990t for instructions and the latest information. An organization must pay estimated tax if it expects its tax for the year to be $500 or more.

A 990t is the form ira holders must use to report their retirement account assets. For instructions and the latest information. An organization must pay estimated tax if it expects its tax for the year to be $500 or more. Unrelated business taxable income from an unrelated trade or business. Web department of the treasury internal revenue service exempt organization business income tax return (and proxy tax under section 6033(e)) for calendar year 2022 or other tax year beginning, 2022, and ending , 20 go to www.irs.gov/form990t for instructions and the latest information. See when, where, and how to file, later, for more information. A quick & easy breakdown.

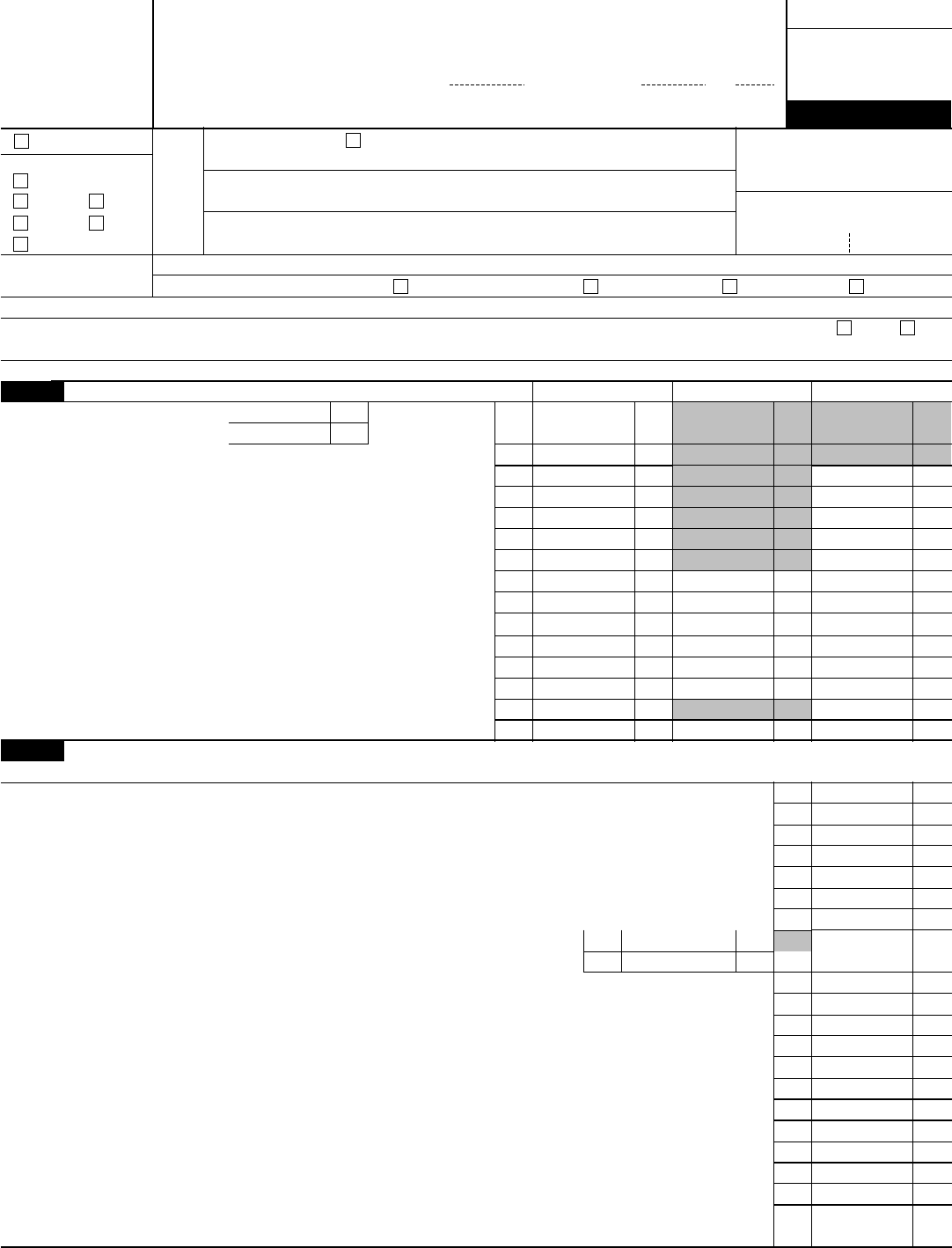

990 T Form Fill Out and Sign Printable PDF Template signNow

An organization must pay estimated tax if it expects its tax for the year to be $500 or more. See when, where, and how to file, later, for more information. A 990t is the form ira holders must use to report their retirement account assets. A quick & easy breakdown. Web department of the treasury internal revenue service exempt organization.

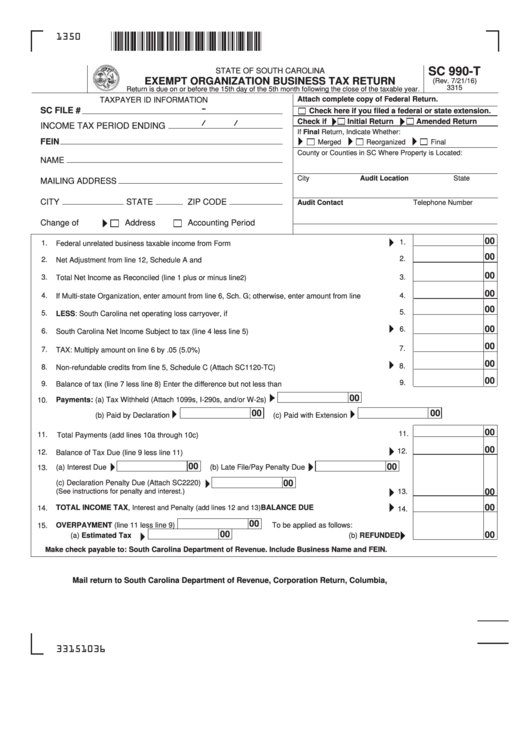

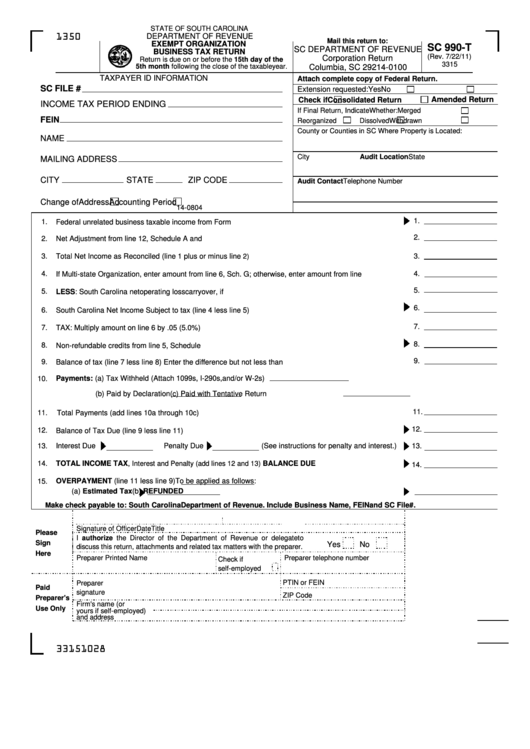

Form Sc 990T Exempt Organization Business Tax Return 2016

Web department of the treasury internal revenue service exempt organization business income tax return (and proxy tax under section 6033(e)) for calendar year 2022 or other tax year beginning, 2022, and ending , 20 go to www.irs.gov/form990t for instructions and the latest information. See when, where, and how to file, later, for more information. For instructions and the latest information..

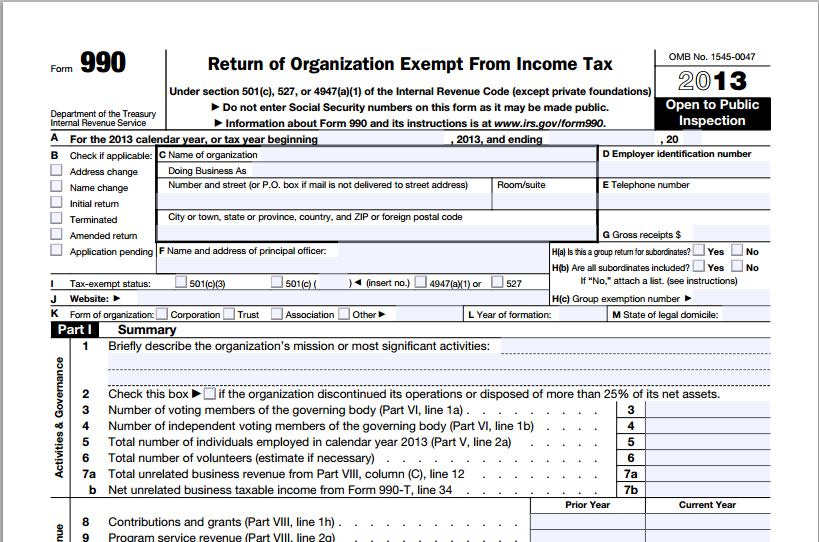

IRS Form 990T, UBTI and UDFI IRA Financial Group

For instructions and the latest information. Unrelated business taxable income from an unrelated trade or business. An organization must pay estimated tax if it expects its tax for the year to be $500 or more. A 990t is the form ira holders must use to report their retirement account assets. A quick & easy breakdown.

Form 990T Exempt Organization Business Tax Return (and proxy…

Web department of the treasury internal revenue service exempt organization business income tax return (and proxy tax under section 6033(e)) for calendar year 2022 or other tax year beginning, 2022, and ending , 20 go to www.irs.gov/form990t for instructions and the latest information. See when, where, and how to file, later, for more information. A 990t is the form ira.

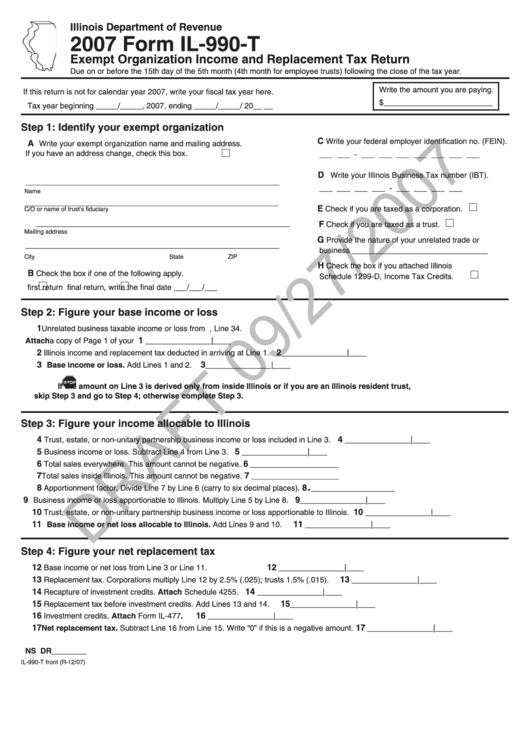

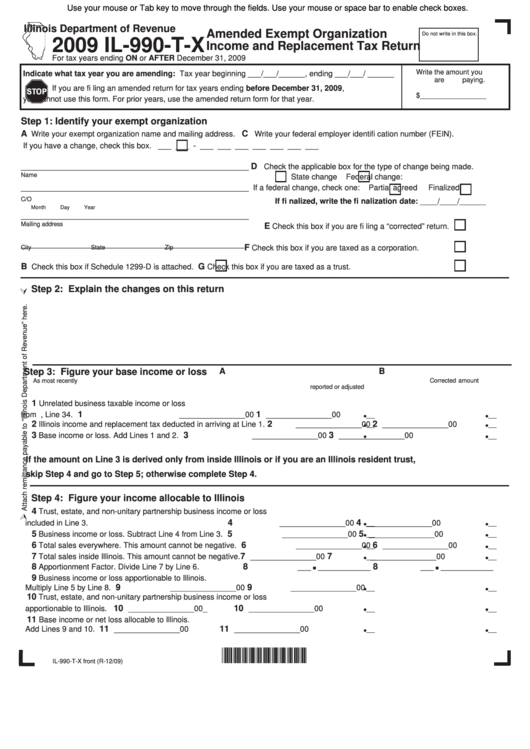

Form Il990T Draft Exempt Organization And Replacement Tax

Web department of the treasury internal revenue service exempt organization business income tax return (and proxy tax under section 6033(e)) for calendar year 2022 or other tax year beginning, 2022, and ending , 20 go to www.irs.gov/form990t for instructions and the latest information. A quick & easy breakdown. For instructions and the latest information. Unrelated business taxable income from an.

Form 990 Preparation Service 501(c)(3) Tax Services in Tampa

A 990t is the form ira holders must use to report their retirement account assets. An organization must pay estimated tax if it expects its tax for the year to be $500 or more. See when, where, and how to file, later, for more information. Unrelated business taxable income from an unrelated trade or business. A quick & easy breakdown.

Form 990 T Fillable Fill Out and Sign Printable PDF Template signNow

Web department of the treasury internal revenue service exempt organization business income tax return (and proxy tax under section 6033(e)) for calendar year 2022 or other tax year beginning, 2022, and ending , 20 go to www.irs.gov/form990t for instructions and the latest information. For instructions and the latest information. A quick & easy breakdown. Unrelated business taxable income from an.

Form 990T Edit, Fill, Sign Online Handypdf

Unrelated business taxable income from an unrelated trade or business. Web department of the treasury internal revenue service exempt organization business income tax return (and proxy tax under section 6033(e)) for calendar year 2022 or other tax year beginning, 2022, and ending , 20 go to www.irs.gov/form990t for instructions and the latest information. For instructions and the latest information. A.

Form Sc 990T Exempt Organization Business Tax Return printable pdf

An organization must pay estimated tax if it expects its tax for the year to be $500 or more. For instructions and the latest information. Unrelated business taxable income from an unrelated trade or business. Web department of the treasury internal revenue service exempt organization business income tax return (and proxy tax under section 6033(e)) for calendar year 2022 or.

Fillable Form Il990TX Amended Exempt Organization And

A quick & easy breakdown. A 990t is the form ira holders must use to report their retirement account assets. An organization must pay estimated tax if it expects its tax for the year to be $500 or more. Unrelated business taxable income from an unrelated trade or business. Web department of the treasury internal revenue service exempt organization business.

Web Department Of The Treasury Internal Revenue Service Exempt Organization Business Income Tax Return (And Proxy Tax Under Section 6033(E)) For Calendar Year 2022 Or Other Tax Year Beginning, 2022, And Ending , 20 Go To Www.irs.gov/Form990T For Instructions And The Latest Information.

See when, where, and how to file, later, for more information. Unrelated business taxable income from an unrelated trade or business. For instructions and the latest information. An organization must pay estimated tax if it expects its tax for the year to be $500 or more.

A Quick & Easy Breakdown.

A 990t is the form ira holders must use to report their retirement account assets.