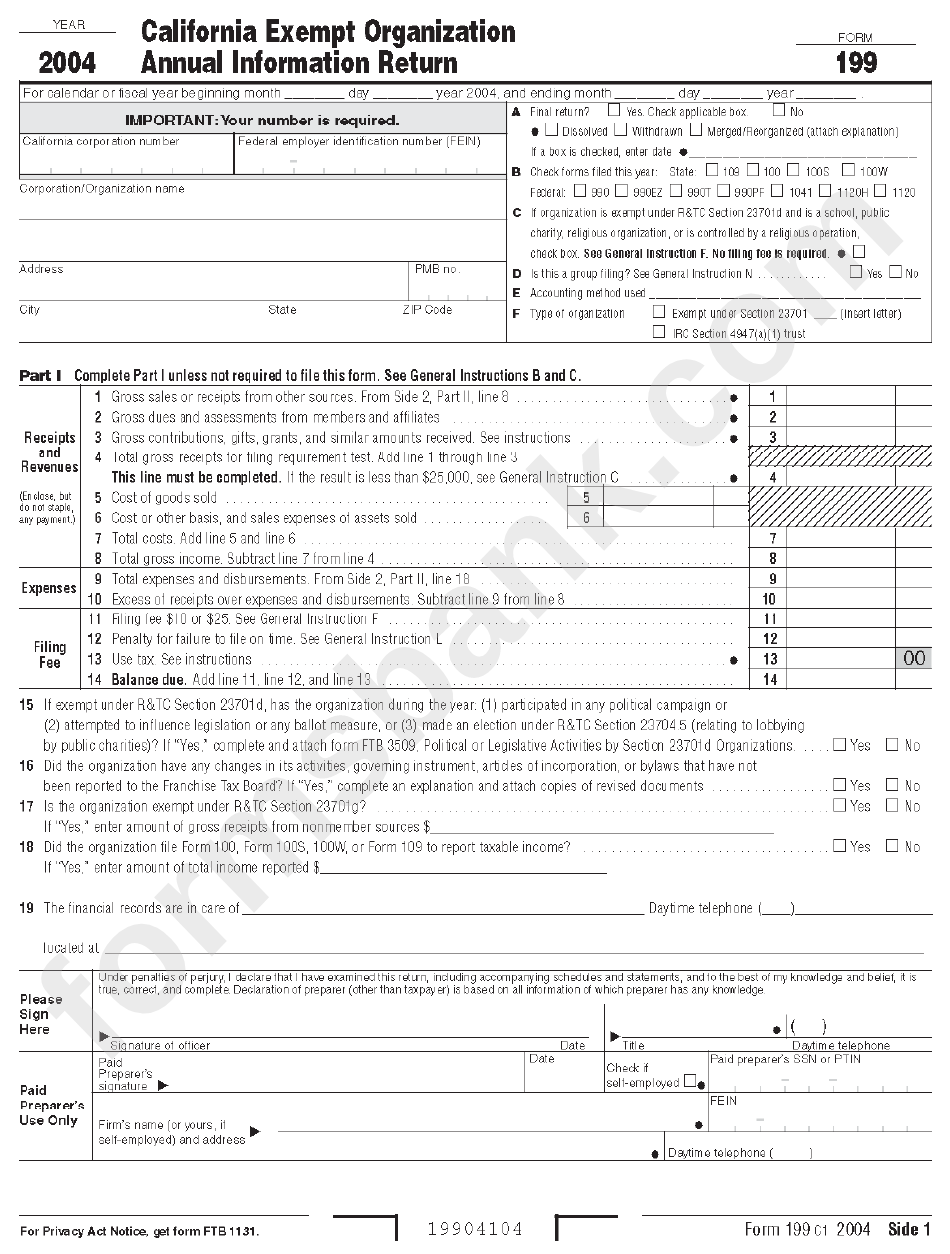

California Form 199

California Form 199 - Signnow allows users to edit, sign, fill and share all type of documents online. Web form 199, california exempt organization annual information return, unless the organization is a nonexempt charitable trust described under general instruction b, who. 1gross sales or receipts from other sources. Ad download or email ftb 199 & more fillable forms, register and subscribe now! Your entity id number or california corporation number. Sign it in a few clicks. What is ca form 199? Type text, add images, blackout confidential details, add comments, highlights and more. Ad download or email ftb 199 & more fillable forms, register and subscribe now! Basic information about your organization.

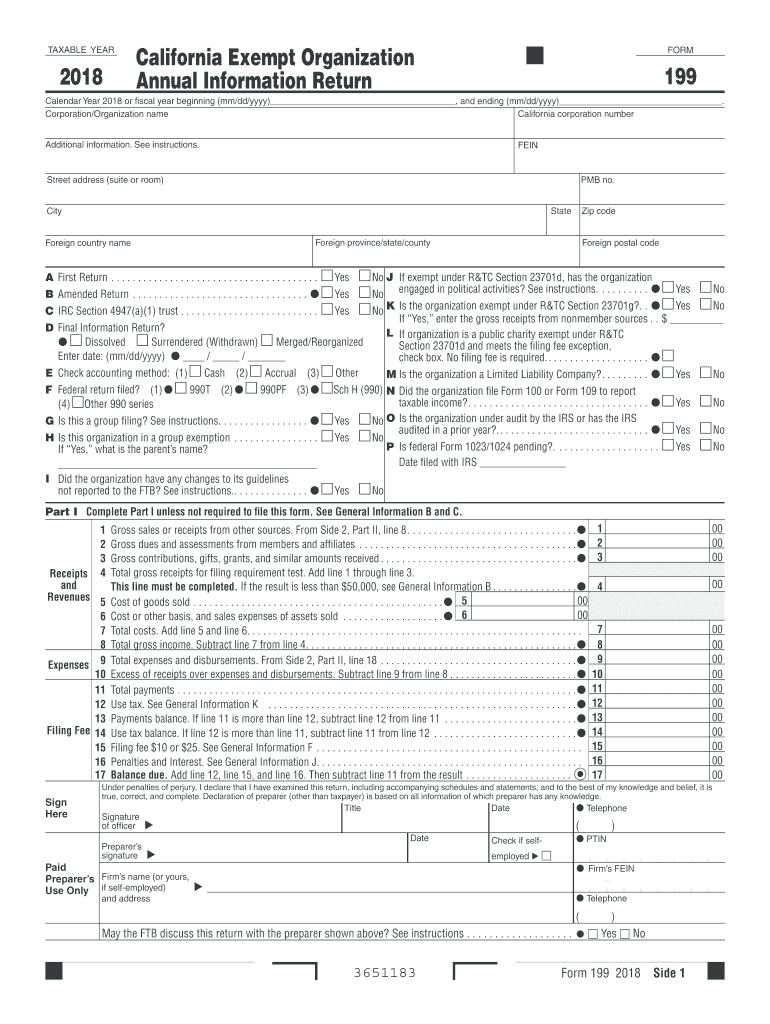

Web they are required to file form 199, not form 541, california fiduciary income tax return. Form 199 is the california exempt. Round your gross receipts value to the. Web form 199 2018 side 1. Part ii organizations with gross receipts of more than $50,000 and private foundations regardless of amount of gross receipts — complete part ii or furnish. Edit your form 199 online. The new 990 and its relationship to california law. This form is for income earned in tax year 2022, with tax returns due in april. 2gross dues and assessments from members and affiliates. Web the total amount the entity received from all sources during its annual account period, without subtracting any costs or expenses.

An extension allows you more time to file the return, not an extension of time to pay any taxes that may be due. This form is for income earned in tax year 2022, with tax returns due in april. Web form 199 2018 side 1. • religious or apostolic organizations described in r&tc section 23701k must attach a. 1gross sales or receipts from other sources. Edit your form 199 online. Your entity id number or california corporation number. Signnow allows users to edit, sign, fill and share all type of documents online. California exempt organization annual information return is used by the following organizations: Form 199 is the california exempt.

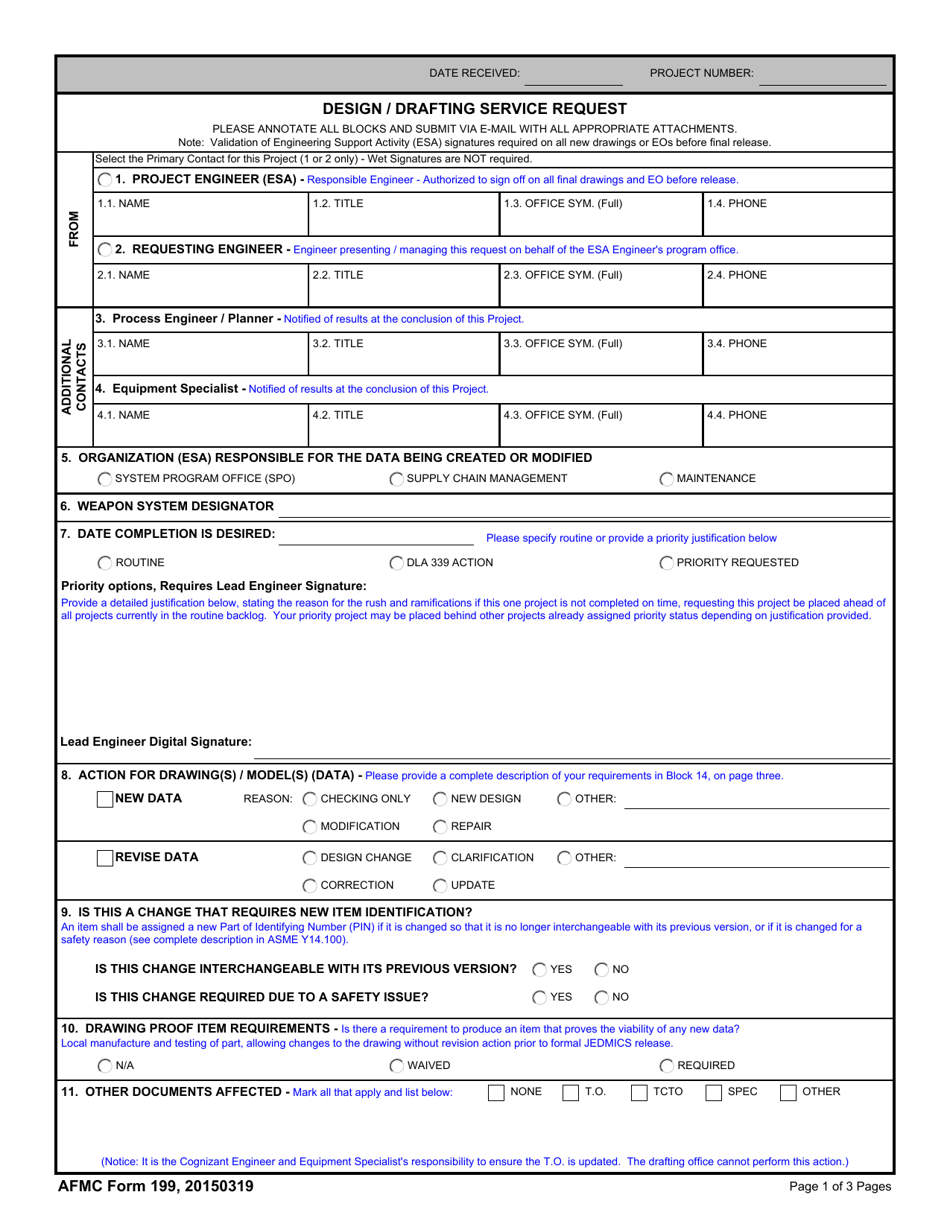

AFMC Form 199 Download Fillable PDF or Fill Online Design/Drafting

Your entity id number or california corporation number. Type text, add images, blackout confidential details, add comments, highlights and more. Signnow allows users to edit, sign, fill and share all type of documents online. Sign it in a few clicks. You have 20 minutes to complete.

Form 199 California Exempt Organization Annual Information Return

Your entity id number or california corporation number. Web form 199 2018 side 1. Web expresstaxexempt now supports form 199 and offers the best filing solution for california nonprofits. Edit your form 199 online. From side 2, part ii, line 8.

California Form 199 2019 CA Form 199, 199N Instructions

1gross sales or receipts from other sources. Web form 199 2018 side 1. Part ii organizations with gross receipts of more than $50,000 and private foundations regardless of amount of gross receipts — complete part ii or furnish. You have 20 minutes to complete. Draw your signature, type it,.

2015 Form CA FTB 199 Instructions Fill Online, Printable, Fillable

Draw your signature, type it,. Sign it in a few clicks. Basic information about your organization. Web form 199 2018 side 1. Web the total amount the entity received from all sources during its annual account period, without subtracting any costs or expenses.

California Form 199 2019 CA Form 199, 199N Instructions

You have 20 minutes to complete. Type text, add images, blackout confidential details, add comments, highlights and more. The new 990 and its relationship to california law. • religious or apostolic organizations described in r&tc section 23701k must attach a. 2gross dues and assessments from members and affiliates.

California HOA & Condo Tax Returns Tips to Stay Compliant [Template]

This form is for income earned in tax year 2022, with tax returns due in april. Web they are required to file form 199, not form 541, california fiduciary income tax return. Type text, add images, blackout confidential details, add comments, highlights and more. Web expresstaxexempt now supports form 199 and offers the best filing solution for california nonprofits. Web.

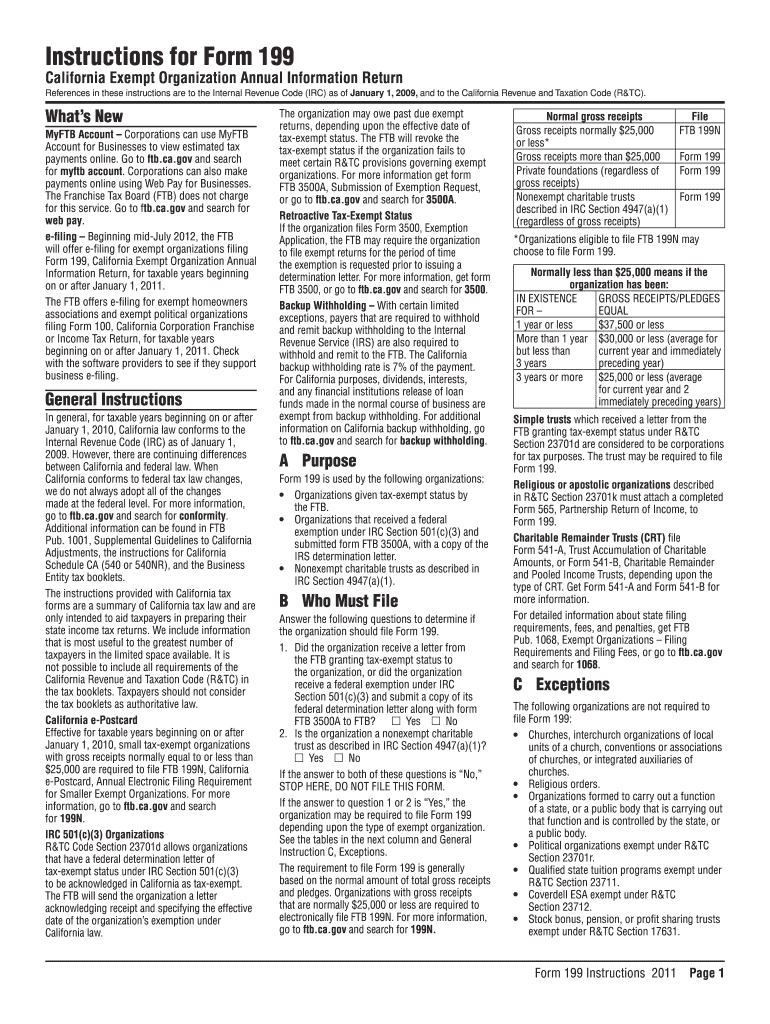

Instructions for Form 199 California Franchise Tax Board Fill out

Edit your form 199 online. 1gross sales or receipts from other sources. You have 20 minutes to complete. Web california form 199 has two versions, ftb 199n and form 199. Sign it in a few clicks.

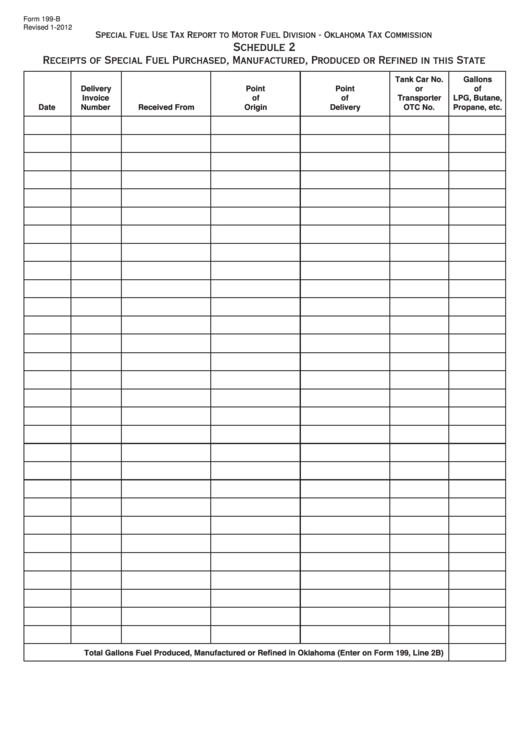

Fillable Form 199B Schedule 2 Receipts Of Special Fuel Purchased

Web they are required to file form 199, not form 541, california fiduciary income tax return. Ad download or email ftb 199 & more fillable forms, register and subscribe now! 1gross sales or receipts from other sources. California exempt organization annual information return is used by the following organizations: Web form 199, california exempt organization annual information return, unless the.

CA FTB 199 2018 Fill out Tax Template Online US Legal Forms

Edit your form 199 online. Sign it in a few clicks. The new 990 and its relationship to california law. Web they are required to file form 199, not form 541, california fiduciary income tax return. Web form 199, california exempt organization annual information return, unless the organization is a nonexempt charitable trust described under general instruction b, who.

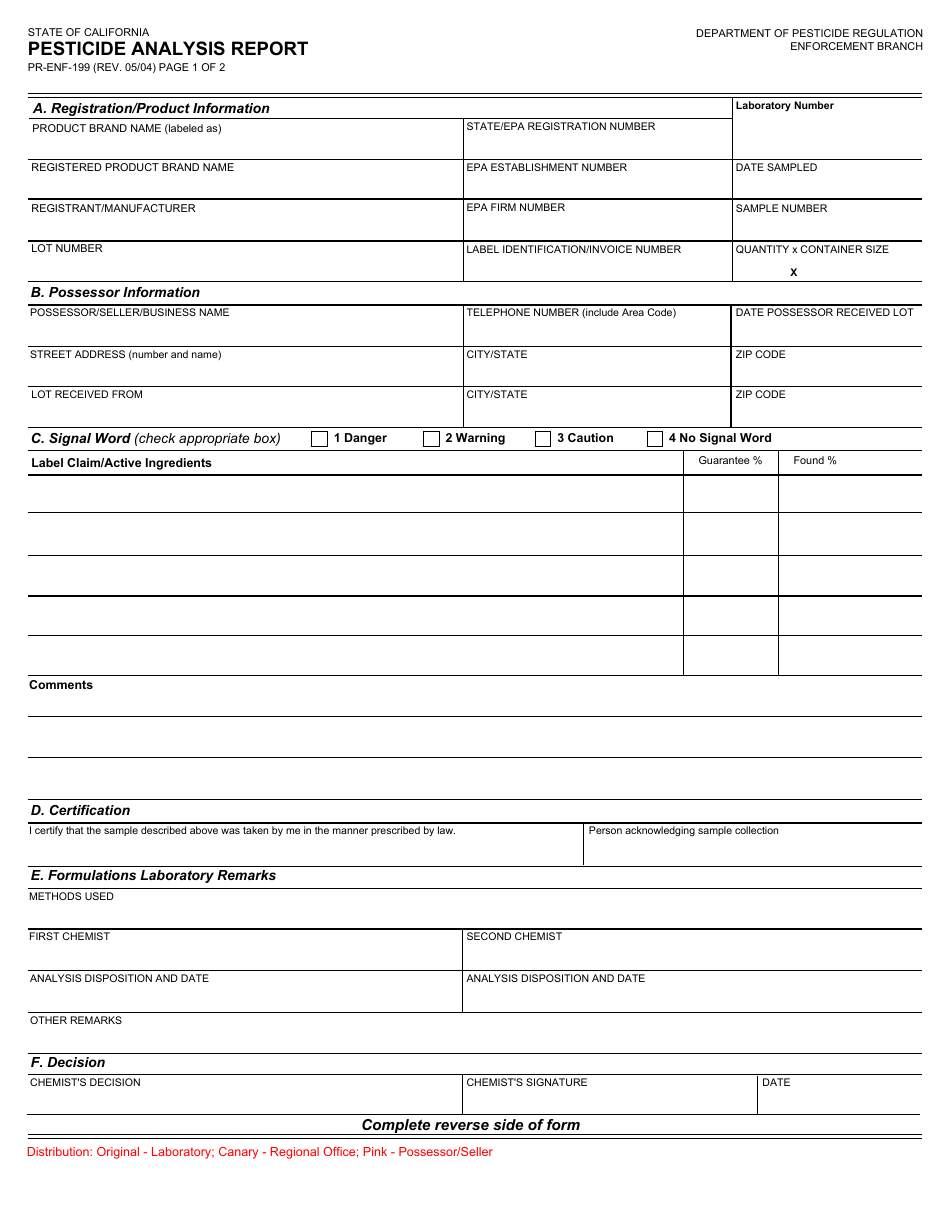

Form PRENF199 Download Fillable PDF or Fill Online Pesticide Analysis

2gross dues and assessments from members and affiliates. Ad download or email ftb 199 & more fillable forms, register and subscribe now! From side 2, part ii, line 8. Web the total amount the entity received from all sources during its annual account period, without subtracting any costs or expenses. Web california form 199 has two versions, ftb 199n and.

Sign It In A Few Clicks.

Web california form 199 has two versions, ftb 199n and form 199. Type text, add images, blackout confidential details, add comments, highlights and more. California exempt organization annual information return is used by the following organizations: Basic information about your organization.

What Is Ca Form 199?

Ad download or email ftb 199 & more fillable forms, register and subscribe now! You have 20 minutes to complete. Web they are required to file form 199, not form 541, california fiduciary income tax return. Web form 199, california exempt organization annual information return, unless the organization is a nonexempt charitable trust described under general instruction b, who.

The New 990 And Its Relationship To California Law.

Web expresstaxexempt now supports form 199 and offers the best filing solution for california nonprofits. Web form 199, california exempt organization annual information return, unless the organization is a nonexempt charitable trust described under general instruction. Signnow allows users to edit, sign, fill and share all type of documents online. Draw your signature, type it,.

2Gross Dues And Assessments From Members And Affiliates.

Round your gross receipts value to the. Edit your form 199 online. From side 2, part ii, line 8. Web we last updated california form 199 in january 2023 from the california franchise tax board.

![California HOA & Condo Tax Returns Tips to Stay Compliant [Template]](https://hoatax.com/wp-content/uploads/2017/08/CA-filing-fee-1024x786.png)