Can You Handwrite A 1099 Nec Form

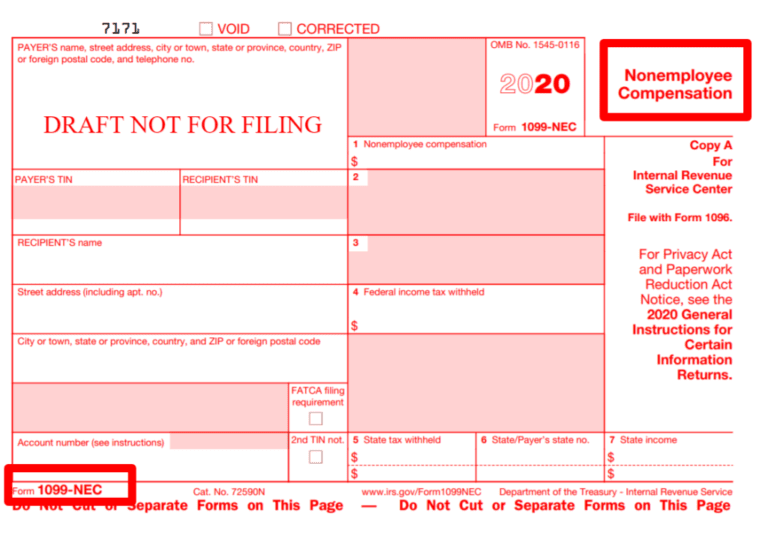

Can You Handwrite A 1099 Nec Form - Check out these filing options: But there are some exceptions, including legal, medical, and health care. Do not miss the deadline. For 2020 tax returns, the due date is february 1, 2021. However, if you’re thinking about handwriting a 1099 form, we urge you to. Web the social security administration shares the information with the internal revenue service. This means that if you've. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. If you are required to file a return, a negligence penalty or. Report payments made of at least $600 in the course of.

Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Do not miss the deadline. Check out these filing options: Get ready for tax season deadlines by completing any required tax forms today. Web federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs. Report payments made of at least $600 in the course of. This means that if you've. Web the social security administration shares the information with the internal revenue service. For 2020 tax returns, the due date is february 1, 2021. If you are required to file a return, a negligence penalty or.

However, if you’re thinking about handwriting a 1099 form, we urge you to. For 2020 tax returns, the due date is february 1, 2021. Report payments made of at least $600 in the course of. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Do not miss the deadline. If you are required to file a return, a negligence penalty or. Check out these filing options: This means that if you've. Get ready for tax season deadlines by completing any required tax forms today. But there are some exceptions, including legal, medical, and health care.

Form 1099NEC & your handmade business The YarnyBookkeeper

However, if you’re thinking about handwriting a 1099 form, we urge you to. But there are some exceptions, including legal, medical, and health care. This means that if you've. Web the social security administration shares the information with the internal revenue service. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms.

How To Fill Out A 1099 Nec Form By Hand Charles Leal's Template

Report payments made of at least $600 in the course of. This means that if you've. Check out these filing options: Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Web the social security administration shares the information with the internal revenue service.

Why did the IRS make the new 1099 NEC Form?

But there are some exceptions, including legal, medical, and health care. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Report payments made of at least $600 in the course of. Check out these filing options: If you are required to file a return, a negligence penalty or.

W9 vs 1099 IRS Forms, Differences, and When to Use Them

This means that if you've. But there are some exceptions, including legal, medical, and health care. Web the social security administration shares the information with the internal revenue service. If you are required to file a return, a negligence penalty or. Get ready for tax season deadlines by completing any required tax forms today.

Can You Handwrite a 1099 Form? And Other Tax Form Questions Answered

This means that if you've. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Check out these filing options: Get ready for tax season deadlines by completing any required tax forms today. For 2020 tax returns, the due date is february 1, 2021.

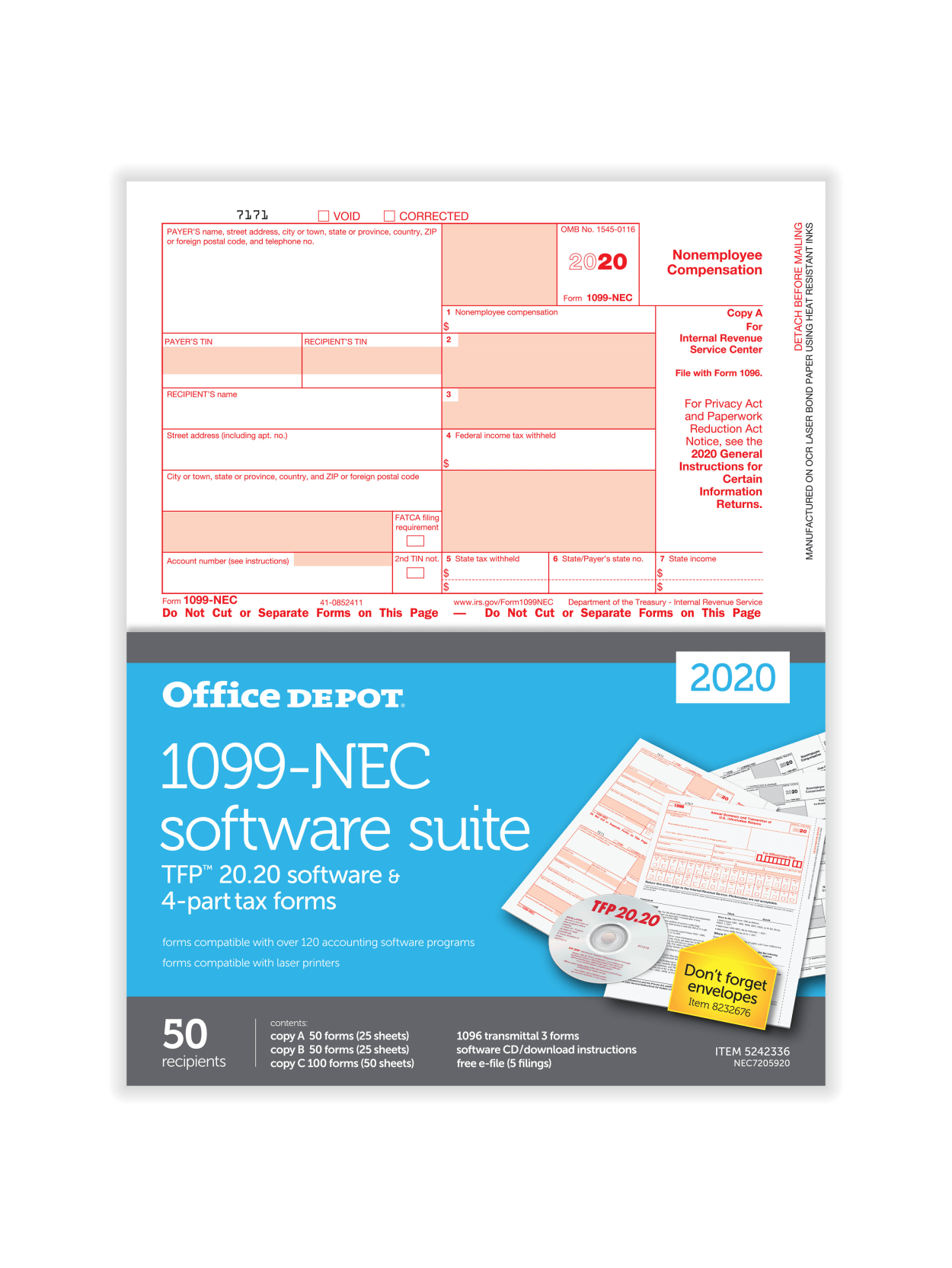

1099NEC Software to Create, Print & EFile IRS Form 1099NEC

However, if you’re thinking about handwriting a 1099 form, we urge you to. Report payments made of at least $600 in the course of. Web federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs. If you are required to file a return, a negligence penalty or. Check out these.

The New 1099NEC Form Education, Lins, Business tips

Web the social security administration shares the information with the internal revenue service. This means that if you've. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. But there are some exceptions, including legal, medical, and health care. Web federal income tax withheld copy b for recipient this is important tax information and is.

How To File Form 1099NEC For Contractors You Employ VacationLord

If you are required to file a return, a negligence penalty or. But there are some exceptions, including legal, medical, and health care. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. For 2020 tax returns, the due date is february 1, 2021. Do not miss the deadline.

For the Love of 1099s! Preparing for JD Edwards YearEnd Circular

Do not miss the deadline. This means that if you've. But there are some exceptions, including legal, medical, and health care. For 2020 tax returns, the due date is february 1, 2021. Web federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs.

How do I Access 1099NEC form Files for Use with Sage Checks & Forms?

Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Web the social security administration shares the information with the internal revenue service. Do not miss the deadline. For 2020 tax returns, the due date is february 1, 2021. Check out these filing options:

Ad Register And Subscribe Now To Work On Irs Nonemployee Compensation & More Fillable Forms.

Web federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs. Get ready for tax season deadlines by completing any required tax forms today. However, if you’re thinking about handwriting a 1099 form, we urge you to. But there are some exceptions, including legal, medical, and health care.

If You Are Required To File A Return, A Negligence Penalty Or.

This means that if you've. Do not miss the deadline. For 2020 tax returns, the due date is february 1, 2021. Report payments made of at least $600 in the course of.

Web The Social Security Administration Shares The Information With The Internal Revenue Service.

Check out these filing options: