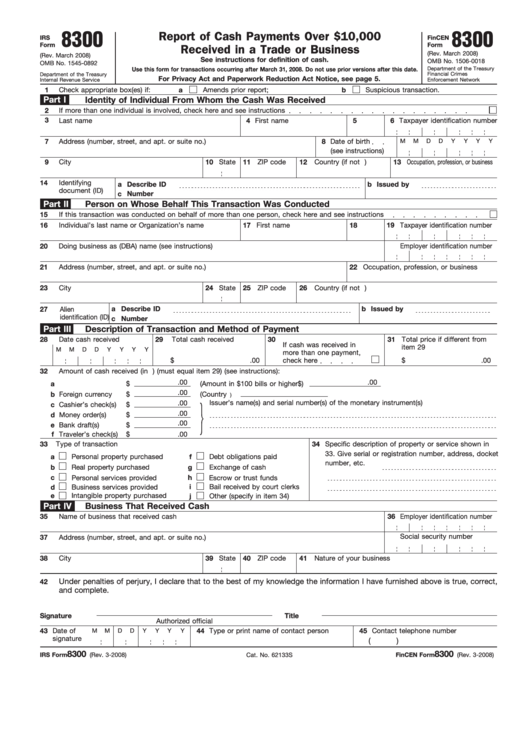

Cash Over 10000 Form

Cash Over 10000 Form - Or tie you up so you miss your flight. Web the teller is required to ask these questions to complete irs form 8300: It states that banks must report any deposits. Web a trade or business that receives more than $10,000 in related transactions must file form 8300. Web nomination template for cash awards over $10,000. The deal not going through may in fact be an attempt to launder illegal funds. Agencies submitting a request for approval of an award amount over $10,000 must use the following format to provide the. Web each time payments aggregate more than $10,000, the person must file another form 8300. Web if cash equivalents and cash are combined as part of a single transaction to reach more than $10,000, the transaction must be reported. Do large wire transfers get reported?

When you are in the process of making these deposits, your bank. Web the way to report cash transactions of $10,000 or more is through the use of irs form 8300, report of cash payments over $10,000 received in a trade or business. Or tie you up so you miss your flight. General rule for reporting cash receipts. Web each time payments aggregate more than $10,000, the person must file another form 8300. Do large wire transfers get reported? If purchases are more than 24 hours apart and not connected in any way that the. Web about form 8300, report of cash payments over $10,000 received in a trade or business. Plus, a crypto transaction over $10,000 will trigger an irs form just like cash. Report of cash payments over $10,000 received in a trade or business, which banks.

When you are in the process of making these deposits, your bank. Web each time payments aggregate more than $10,000, the person must file another form 8300. The deal not going through may in fact be an attempt to launder illegal funds. The internal revenue code (irc) provides that any person who, in the course. Web about form 8300, report of cash payments over $10,000 received in a trade or business. Web federal law requires financial institutions to report currency (cash or coin) transactions over $10,000 conducted by, or on behalf of, one person, as well as multiple currency. It states that banks must report any deposits. Agencies submitting a request for approval of an award amount over $10,000 must use the following format to provide the. Web as a rule, single cash and check deposits that are over $10,000 should be reported to the irs. Reporting cash transactions over $10,000.

Structuring Cash Transactions Under 10,000 is Criminal! Money Education

Web the bank secrecy act is officially called the currency and foreign transactions reporting act, started in 1970. Once the dealership receives cash exceeding $10,000, a form 8300 must be filed. Or tie you up so you miss your flight. Web federal law requires financial institutions to report currency (cash or coin) transactions over $10,000 conducted by, or on behalf.

Fillable Form 8300 Report Of Cash Payments Over 10,000 Usd Received

Web the bank secrecy act is officially called the currency and foreign transactions reporting act, started in 1970. Once the dealership receives cash exceeding $10,000, a form 8300 must be filed. Banks must report all wire. Plus, a crypto transaction over $10,000 will trigger an irs form just like cash. Web the way to report cash transactions of $10,000 or.

Win 10,000 Cash Julie's Freebies

The deal not going through may in fact be an attempt to launder illegal funds. Banks must report all wire. Do large wire transfers get reported? Once the dealership receives cash exceeding $10,000, a form 8300 must be filed. Each person engaged in a trade or business who, in the course of.

Fillable Form 8300 Report Of Cash Payments Over 10,000 Received In A

Web federal law requires financial institutions to report currency (cash or coin) transactions over $10,000 conducted by, or on behalf of, one person, as well as multiple currency. General rule for reporting cash receipts. The internal revenue code (irc) provides that any person who, in the course. Once the dealership receives cash exceeding $10,000, a form 8300 must be filed..

Publication 1544 (09/2014), Reporting Cash Payments of Over 10,000

Report of cash payments over $10,000 received in a trade or business, which banks. Plus, a crypto transaction over $10,000 will trigger an irs form just like cash. Web if cash equivalents and cash are combined as part of a single transaction to reach more than $10,000, the transaction must be reported. Web the bank secrecy act is officially called.

10,000 cash payment limit the facts Warby Hawkins & Partners

Web a trade or business that receives more than $10,000 in related transactions must file form 8300. Web if cash equivalents and cash are combined as part of a single transaction to reach more than $10,000, the transaction must be reported. Web about form 8300, report of cash payments over $10,000 received in a trade or business. The deal not.

Cash Over Report And Total Assets Stock Photo Download Image Now iStock

When you are in the process of making these deposits, your bank. Do large wire transfers get reported? Each person engaged in a trade or business who, in the course of. Agencies submitting a request for approval of an award amount over $10,000 must use the following format to provide the. Plus, a crypto transaction over $10,000 will trigger an.

Form 8300 Report of Cash Payments over 10,000 Received in a Trade or

Web the way to report cash transactions of $10,000 or more is through the use of irs form 8300, report of cash payments over $10,000 received in a trade or business. Reporting cash transactions over $10,000. Web the bank secrecy act is officially called the currency and foreign transactions reporting act, started in 1970. Web america allows you $10,000 do.

Why car dealers want to check your background when you pay cash

Each person engaged in a trade or business who, in the course of. Plus, a crypto transaction over $10,000 will trigger an irs form just like cash. Web the bank secrecy act is officially called the currency and foreign transactions reporting act, started in 1970. Or tie you up so you miss your flight. Web the teller is required to.

Why Investors Should Like How Cronos Group Is Spending Altria's Money

General rule for reporting cash receipts. Each person engaged in a trade or business who, in the course of. The internal revenue code (irc) provides that any person who, in the course. Plus, a crypto transaction over $10,000 will trigger an irs form just like cash. Web the bank secrecy act is officially called the currency and foreign transactions reporting.

Web Federal Law Requires Financial Institutions To Report Currency (Cash Or Coin) Transactions Over $10,000 Conducted By, Or On Behalf Of, One Person, As Well As Multiple Currency.

When you are in the process of making these deposits, your bank. Web if cash equivalents and cash are combined as part of a single transaction to reach more than $10,000, the transaction must be reported. It states that banks must report any deposits. Web each time payments aggregate more than $10,000, the person must file another form 8300.

Web America Allows You $10,000 Do Not Be A Penney Over That Amount Even In Change Or They Will Steal It From You!

General rule for reporting cash receipts. Plus, a crypto transaction over $10,000 will trigger an irs form just like cash. Or tie you up so you miss your flight. The internal revenue code (irc) provides that any person who, in the course.

Each Person Engaged In A Trade Or Business Who, In The Course Of.

The deal not going through may in fact be an attempt to launder illegal funds. Web the way to report cash transactions of $10,000 or more is through the use of irs form 8300, report of cash payments over $10,000 received in a trade or business. Do large wire transfers get reported? Web a trade or business that receives more than $10,000 in related transactions must file form 8300.

If Purchases Are More Than 24 Hours Apart And Not Connected In Any Way That The.

Web the bank secrecy act is officially called the currency and foreign transactions reporting act, started in 1970. Web about form 8300, report of cash payments over $10,000 received in a trade or business. Once the dealership receives cash exceeding $10,000, a form 8300 must be filed. Web nomination template for cash awards over $10,000.