Citizens Bank 1098 Form

Citizens Bank 1098 Form - Web file form 1098 to report the refund (or credit) of the overpayment. Also use form 1098 to report mip of $600 or more you received. Web citizens bank’s online banking sign up for citizens bank’s online banking electronic statements/notices to access the following tax forms up to 2 weeks earlier than through. Web which mortgage servicer will send my annual irs form 1098 (mortgage interest statement)? Apply for a home loan. Web we've called it home since 1913. Web citizens bank has no control over the information. Web instructions for form 1098 ah xsl/xml page 1 of 6 userid: Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web citizens or cfg or the company, we, us, or our citizens financial group, inc.

You’ll receive one irs form 1098 (mortgage interest statement) from. Also, for more information, see pub. The form should be available along with your january statement. Whether at home or on the go, the citizens bank or app gives you secure access to your account. Web citizens or cfg or the company, we, us, or our citizens financial group, inc. Web banking on the go. Web citizens bank has no control over the information. Web which mortgage servicer will send my annual irs form 1098 (mortgage interest statement)? Please note, the document center only displays tax forms for online. Web instructions for form 1098 ah xsl/xml page 1 of 6 userid:

See reimbursement of overpaid interest, later. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Apply for a home loan. Edit your citizens bank personal financial statement online type text, add. Web we last updated federal form 1098 in february 2023 from the federal internal revenue service. Please note, the document center only displays tax forms for online. Also, for more information, see pub. Check balances, deposit checks, customize security. For more market information click here. The form should be available along with your january statement.

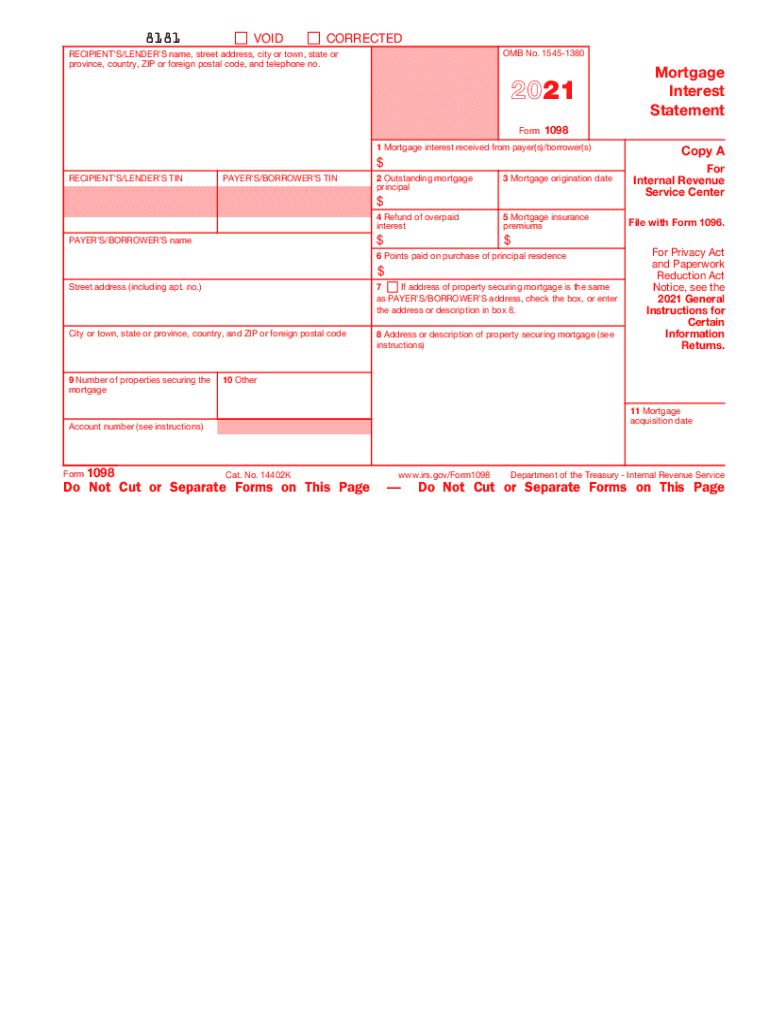

2021 Form 1098. Mortgage Interest Statement Fill and Sign Printable

Web schedule a, c, or e (form 1040) for how to report the mortgage interest. 10 draft ok to print (init. You can also download it, export it or print it out. You’ll receive one irs form 1098 (mortgage interest statement) from. Web citizens or cfg or the company, we, us, or our citizens financial group, inc.

Form 1098T Still Causing Trouble for Funded Graduate Students

Apply/prequalify for your next home. Web instructions for form 1098 ah xsl/xml page 1 of 6 userid: Lenders must issue form 1098 when a homeowner has paid $600 or more in mortgage interest. Web we last updated federal form 1098 in february 2023 from the federal internal revenue service. Web form 1098 is used to report mortgage interest paid for.

Top10 US Tax Forms in 2022 Explained PDF.co

Web schedule a, c, or e (form 1040) for how to report the mortgage interest. Web use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from an. Edit your citizens bank personal financial statement online type text, add. Web citizens or.

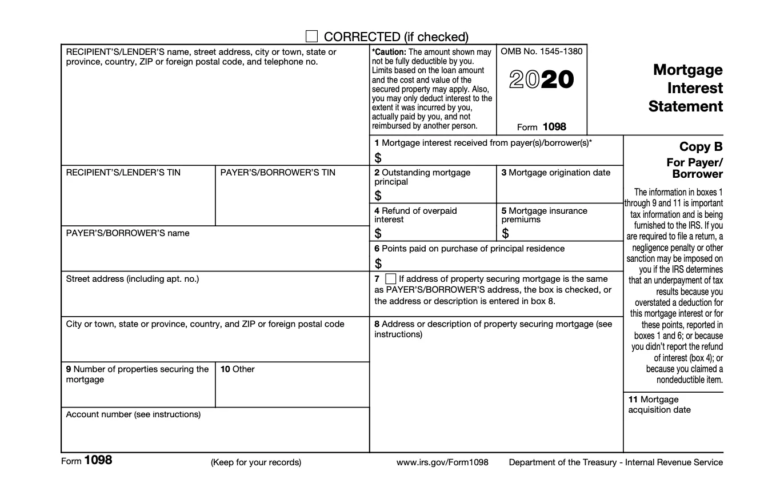

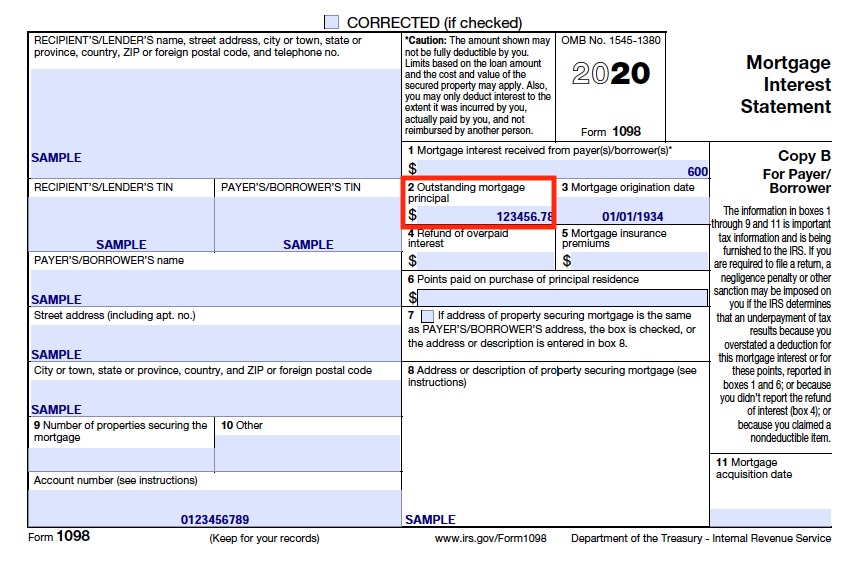

1098 Mortgage Interest Forms United Bank of Union

Web citizens bank’s online banking sign up for citizens bank’s online banking electronic statements/notices to access the following tax forms up to 2 weeks earlier than through. Web www.irs.gov/form1098 instructions for payer/borrower Edit your citizens bank personal financial statement online type text, add. You’ll receive one irs form 1098 (mortgage interest statement) from. Web we've called it home since 1913.

IRS Form 1098Q Download Fillable PDF or Fill Online Qualifying

Please note, the document center only displays tax forms for online. Web form 1098 is used to report mortgage interest paid for the year. Web use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from an. Also, for more information, see.

Form 1098E, Student Loan Interest Statement, IRS Copy A

Web file form 1098 to report the refund (or credit) of the overpayment. Web which mortgage servicer will send my annual irs form 1098 (mortgage interest statement)? You can also download it, export it or print it out. Edit your citizens bank personal financial statement online type text, add. Web banking on the go.

1098T Information Bursar's Office Office of Finance UTHSC

Nh, vt, ma, ri, ct, ny, nj, de, pa, oh, mi , a citizens consumer checking account set up with automatic monthly payment. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web citizens or cfg or the.

Terbaik 15+ Filling Out Forms From Home, Paling Update!

Providing innovative, competitive financial services in a warm comfortable atmosphere that makes our customers feel right at home. Also, for more information, see pub. Web send citizens bank 1098 form via email, link, or fax. Also use form 1098 to report mip of $600 or more you received. Web banking on the go.

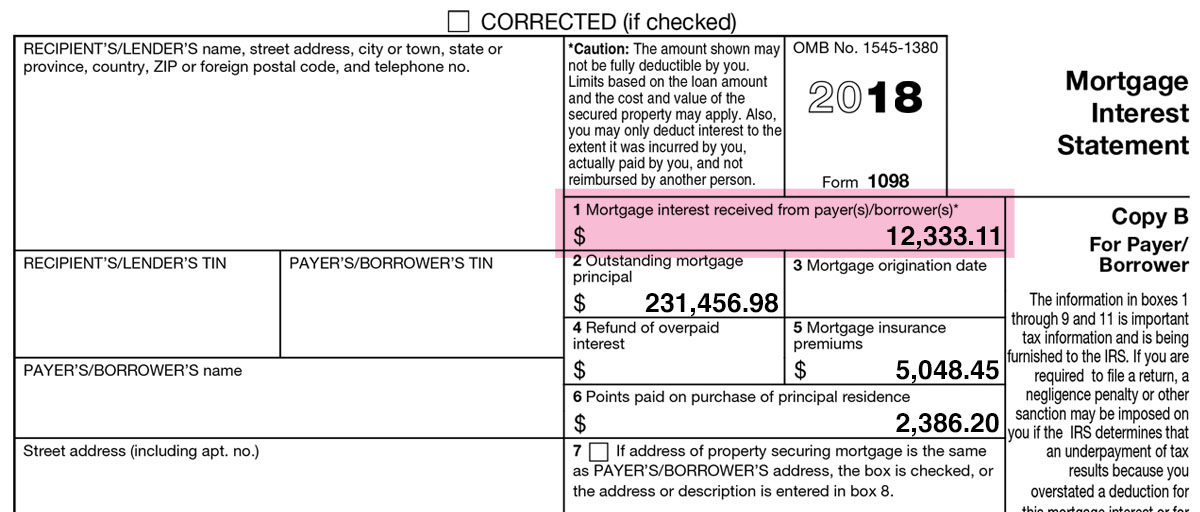

Form 1098 and Your Mortgage Interest Statement

Web which mortgage servicer will send my annual irs form 1098 (mortgage interest statement)? Web citizens bank’s online banking sign up for citizens bank’s online banking electronic statements/notices to access the following tax forms up to 2 weeks earlier than through. Please note, the document center only displays tax forms for online. Check balances, deposit checks, customize security. Edit your.

Form 1098T Information Student Portal

Check balances, deposit checks, customize security. Lenders must issue form 1098 when a homeowner has paid $600 or more in mortgage interest. Web citizens bank has no control over the information. Web schedule a, c, or e (form 1040) for how to report the mortgage interest. You can also download it, export it or print it out.

Web We Last Updated Federal Form 1098 In February 2023 From The Federal Internal Revenue Service.

Web we've called it home since 1913. Apply/prequalify for your next home. Web instructions for form 1098 ah xsl/xml page 1 of 6 userid: Web banking on the go.

Web Citizens Bank Has No Control Over The Information.

10 draft ok to print (init. Web citizens bank’s online banking sign up for citizens bank’s online banking electronic statements/notices to access the following tax forms up to 2 weeks earlier than through. Web citizens or cfg or the company, we, us, or our citizens financial group, inc. Note that if you paid less than.

Edit Your Citizens Bank Personal Financial Statement Online Type Text, Add.

This form is for income earned in tax year 2022, with tax returns due in april. You can also download it, export it or print it out. Please note, the document center only displays tax forms for online. Lenders must issue form 1098 when a homeowner has paid $600 or more in mortgage interest.

Web Schedule A, C, Or E (Form 1040) For How To Report The Mortgage Interest.

Web form 1098 is used to report mortgage interest paid for the year. Web which mortgage servicer will send my annual irs form 1098 (mortgage interest statement)? Web file form 1098 to report the refund (or credit) of the overpayment. See reimbursement of overpaid interest, later.

/Form1098-5c57730f46e0fb00013a2bee.jpg)