Do It Yourself Qdro Form

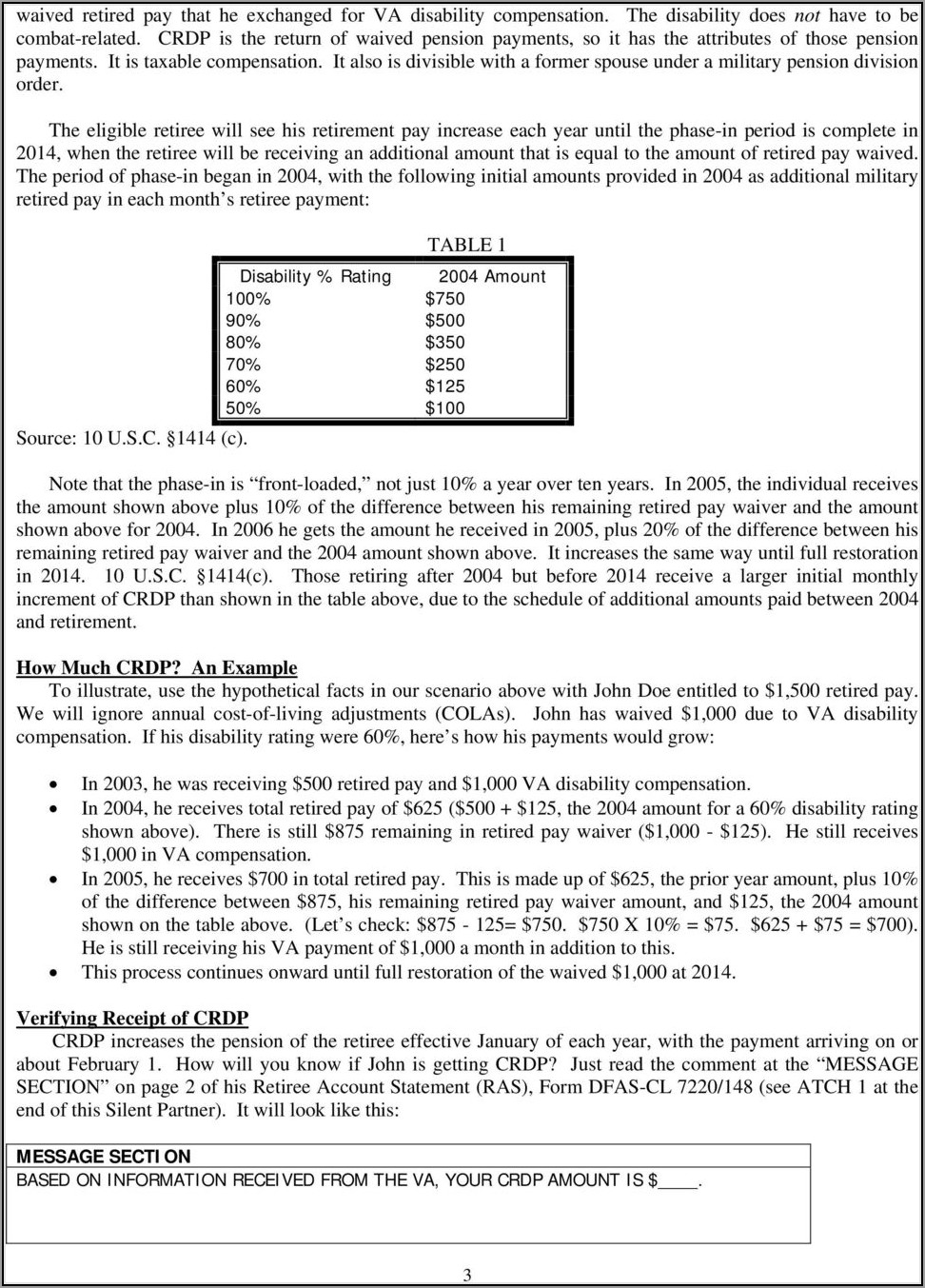

Do It Yourself Qdro Form - Web it's easy to create the do it yourself qdro form file using our pdf editor. Try it for free now! This site will help answer. Ad developed by legal professionals. Getting the right form is easy. First, browse the qdro forms categories that appear below. Upload, modify or create forms. Web a qualified domestic relations order (qdro) is a decree requiring a portion of a retirement plan to be assigned or paid to another person, such as a spouse following a. This site was created to help you quickly and effectively prepare a qualified domestic relations order. These steps will allow you to quickly create your document.

Ad frs investment plan & more fillable forms, register and subscribe now! First, browse the qdro forms categories that appear below. Web a qualified domestic relations order (qdro) means—or is defined as—a legal document that may be issued by a court. This site will help answer. Upload, modify or create forms. Further, a domestic relations order requiring a portion of a participant's. Try it for free now! On this page, select the orange get. Plan approval guarantee with a team of qdro specialists helping from start to finish. Web a qdro form is not included in this divorce set.

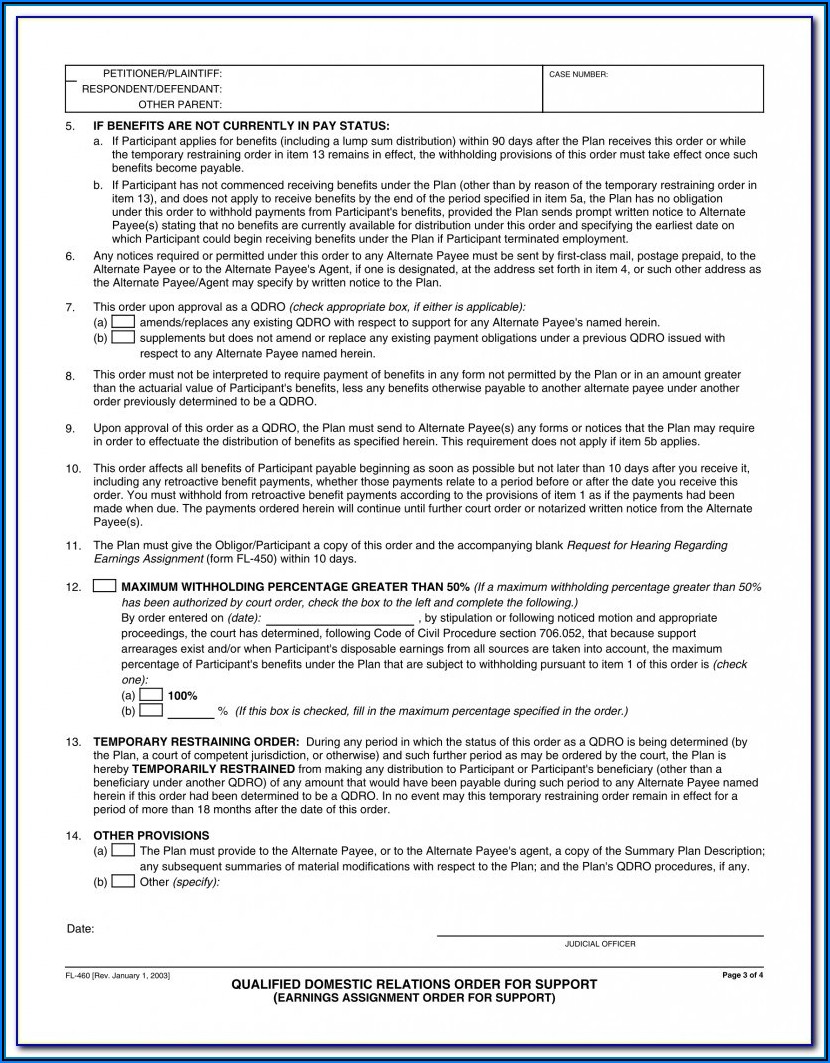

Plan approval guarantee with a team of qdro specialists helping from start to finish. Web this model form is governed by. This site will help answer. Ad frs investment plan & more fillable forms, register and subscribe now! Try it for free now! Web a qualified domestic relations order (qdro) is a decree requiring a portion of a retirement plan to be assigned or paid to another person, such as a spouse following a. First, browse the qdro forms categories that appear below. On this page, select the orange get. Create a free legal form in minutes. You need information about both spouses, including names, addresses, social security numbers, dates of marriage and divorce, etc.

Calpers Qdro Sample Template 1 Resume Examples xM8peRBP1Y

Fill out our qdro form. Plan approval guarantee with 9 point review process to make sure the qdro is approved. Plan approval guarantee with a team of qdro specialists helping from start to finish. Create a free legal form in minutes. Web second alternate payee, does not fail to be a qdro solely because of the existence of a previous.

Qdro Waiver Form Form Resume Examples EZVg3WrVJk

Ad frs investment plan & more fillable forms, register and subscribe now! Web a qdro is a judgment, decree or order for a retirement plan to pay child support, alimony or marital property rights to a spouse, former spouse, child or other. Web qdro.com offers online qdro preparation services for family law attorneys and cpas. If you and your spouse.

Free Qdro Form Arizona Form Resume Examples Wk9yDr723D

This type of document is often used in. These steps will allow you to quickly create your document. If you and your spouse keep your own retirement funds or do not. Ad developed by legal professionals. Ad defined benefit/contribution, ira, 401ks, military & gov't plans.

Do It Yourself Qdro Form How To Use A Qdro To Divide Retirement In

Web welcome to fidelity's qdro center. Ad frs investment plan & more fillable forms, register and subscribe now! Ad developed by legal professionals. It is recommended that you hire a lawyer to prepare a qdro. Web a qualified domestic relations order (qdro) means—or is defined as—a legal document that may be issued by a court.

Do It Yourself Qdro Form How To Use A Qdro To Divide Retirement In

Ad defined benefit/contribution, ira, 401ks, military & gov't plans. Further, a domestic relations order requiring a portion of a participant's. Web it's easy to create the do it yourself qdro form file using our pdf editor. Upload, modify or create forms. Title 34, part iv texas.

Do It Yourself Qdro Form Form Resume Examples 1ZV8KG0Y3X

It is recommended that you hire a lawyer to prepare a qdro. Web second alternate payee, does not fail to be a qdro solely because of the existence of a previous qdro. Ad developed by legal professionals. This site was created to help you quickly and effectively prepare a qualified domestic relations order. You need information about both spouses, including.

Do It Yourself Qdro Form Form Resume Examples 1ZV8KG0Y3X

Web a qdro form is not included in this divorce set. Web a qualified domestic relations order (qdro) means—or is defined as—a legal document that may be issued by a court. Getting the right form is easy. Web welcome to fidelity's qdro center. Web qdro.com offers online qdro preparation services for family law attorneys and cpas.

Do It Yourself Qdro Form Qdro Waiver Form Form Resume Examples

These steps will allow you to quickly create your document. This site will help answer. You need information about both spouses, including names, addresses, social security numbers, dates of marriage and divorce, etc. We draft the legal documents and you file with the plan and court. It is recommended that you hire a lawyer to prepare a qdro.

Do It Yourself Qdro Form How To Use A Qdro To Divide Retirement In

This site will help answer. It is recommended that you hire a lawyer to prepare a qdro. Texas government code annotated chapter 804 and the rules of the employees retirement system of texas. Web welcome to fidelity's qdro center. Ad frs investment plan & more fillable forms, register and subscribe now!

Do It Yourself Qdro Form Form Resume Examples 1ZV8KG0Y3X

First, browse the qdro forms categories that appear below. Web second alternate payee, does not fail to be a qdro solely because of the existence of a previous qdro. We draft the legal documents and you file with the plan and court. Web pension evaluators® at troyan inc.® answers, no, a legally enforceable qualified domestic relations order (qdro) must be.

We Draft The Legal Documents And You File With The Plan And Court.

This type of document is often used in. Fill out our qdro form. Texas government code annotated chapter 804 and the rules of the employees retirement system of texas. Web this model form is governed by.

First, Browse The Qdro Forms Categories That Appear Below.

This site will help answer. These steps will allow you to quickly create your document. Plan approval guarantee with a team of qdro specialists helping from start to finish. Web welcome to fidelity's qdro center.

Further, A Domestic Relations Order Requiring A Portion Of A Participant's.

Web a qualified domestic relations order (qdro) is a decree requiring a portion of a retirement plan to be assigned or paid to another person, such as a spouse following a. Web a qdro is a judgment, decree or order for a retirement plan to pay child support, alimony or marital property rights to a spouse, former spouse, child or other. Getting the right form is easy. Web yes you may file the qdro yourself.

Web Second Alternate Payee, Does Not Fail To Be A Qdro Solely Because Of The Existence Of A Previous Qdro.

You need information about both spouses, including names, addresses, social security numbers, dates of marriage and divorce, etc. This site was created to help you quickly and effectively prepare a qualified domestic relations order. Web pension evaluators® at troyan inc.® answers, no, a legally enforceable qualified domestic relations order (qdro) must be part of a judgment order or decree. If you and your spouse keep your own retirement funds or do not.

/GettyImages-1075739692-79e8b8e2cbbe42698281fdeed175f72e.jpg)