Federal Form 8886

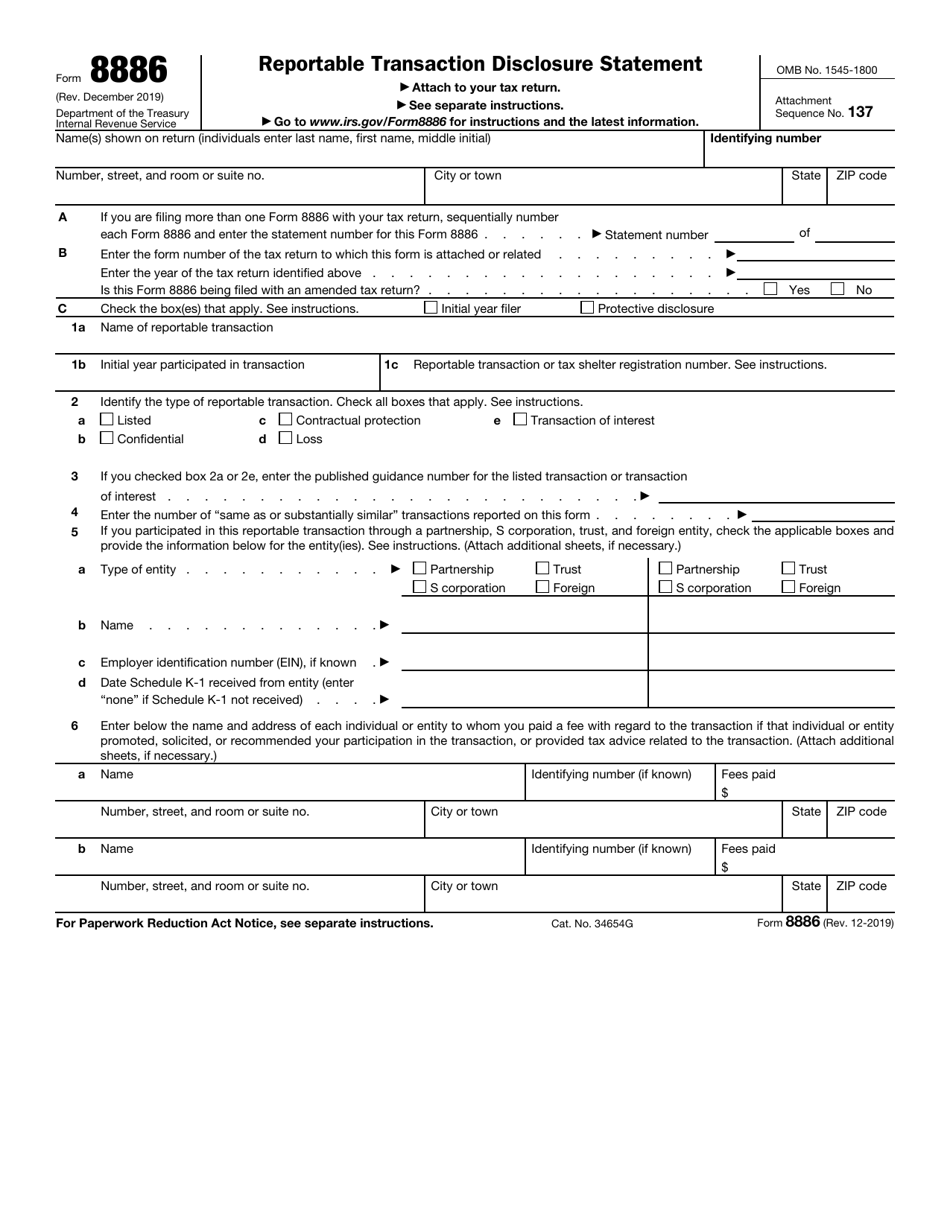

Federal Form 8886 - Attach to your tax return. Name, address, ssn, and residency; Web if you claim a deduction, credit, or other tax benefit related to a reportable transaction and are required to submit federal form 8886, reportable transaction disclosure statement. Web we last updated the reportable transaction disclosure statement in february 2023, so this is the latest version of form 8886, fully updated for tax year 2022. Web 3671223 form 568 2022 side 1 limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is. Web if you were required to file form 8886 (or a similar form prescribed by the irs) with your federal income tax return and did not include the form in the supporting. Web to file a federal tax return or information return must file form 8886. Web federal form 8886 is required to be attached to any return on which a deduction, loss, credit, or any other tax benefit is claimed or is reported, or any income the s corporation. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886.

Web 3671223 form 568 2022 side 1 limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership. A reportable transaction is generally a transaction of a type that the irs has determined as having a potential for tax avoidance or evasion. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is. The instructions to form 8886 (available at irs.gov) provide a specific explanation of what. Web the instructions to form 8886, reportable transaction disclosure statement. Attach to your tax return. However, a regulated investment company (ric) (as defined in section 851) or an investment vehicle that is at. Web form ct‑8886, along with federal form 8886, reportable transaction disclosure statement, including all supplemental statements and any required federal schedule. Web federal form 8886, reportable transaction disclosure statement, must be attached to any return on which the partnership has claimed or reported income from, or a deduction,. Web federal form 8886 is required to be attached to any return on which a deduction, loss, credit, or any other tax benefit is claimed or is reported, or any income the s corporation.

Web we last updated the reportable transaction disclosure statement in february 2023, so this is the latest version of form 8886, fully updated for tax year 2022. Web federal form 8886, reportable transaction disclosure statement, must be attached to any return on which the partnership has claimed or reported income from, or a deduction,. Web 3671223 form 568 2022 side 1 limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership. Web attach federal form 8886, reportable transaction disclosure statement, to the back of the california return along with any other supporting schedules. A reportable transaction is generally a transaction of a type that the irs has determined as having a potential for tax avoidance or evasion. If this is the first time the. Web form ct‑8886, along with federal form 8886, reportable transaction disclosure statement, including all supplemental statements and any required federal schedule. The instructions to form 8886 (available at irs.gov) provide a specific explanation of what. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is. December 2019) department of the treasury internal revenue service.

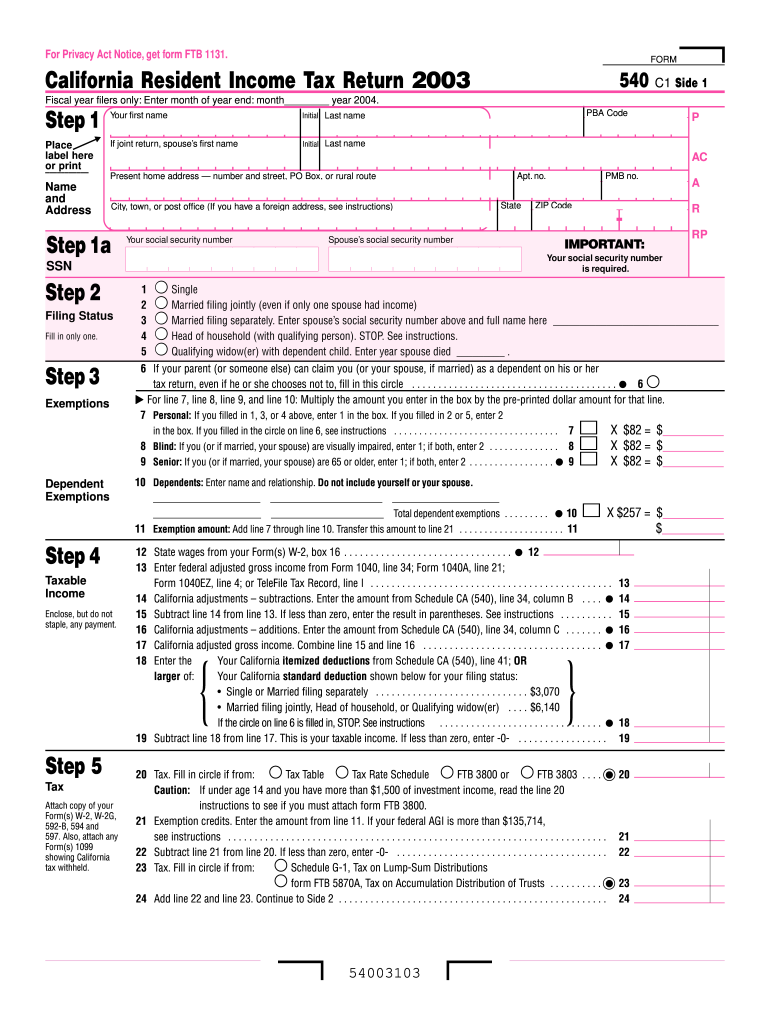

2003 Form CA FTB 540 Fill Online, Printable, Fillable, Blank PDFfiller

When it comes to international tax planning and avo. Web to file a federal tax return or information return must file form 8886. Web we last updated the reportable transaction disclosure statement in february 2023, so this is the latest version of form 8886, fully updated for tax year 2022. Web the instructions to form 8886, reportable transaction disclosure statement..

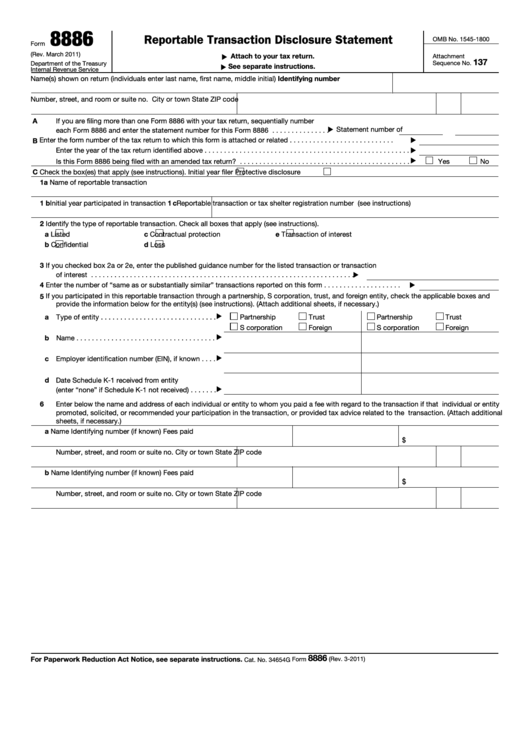

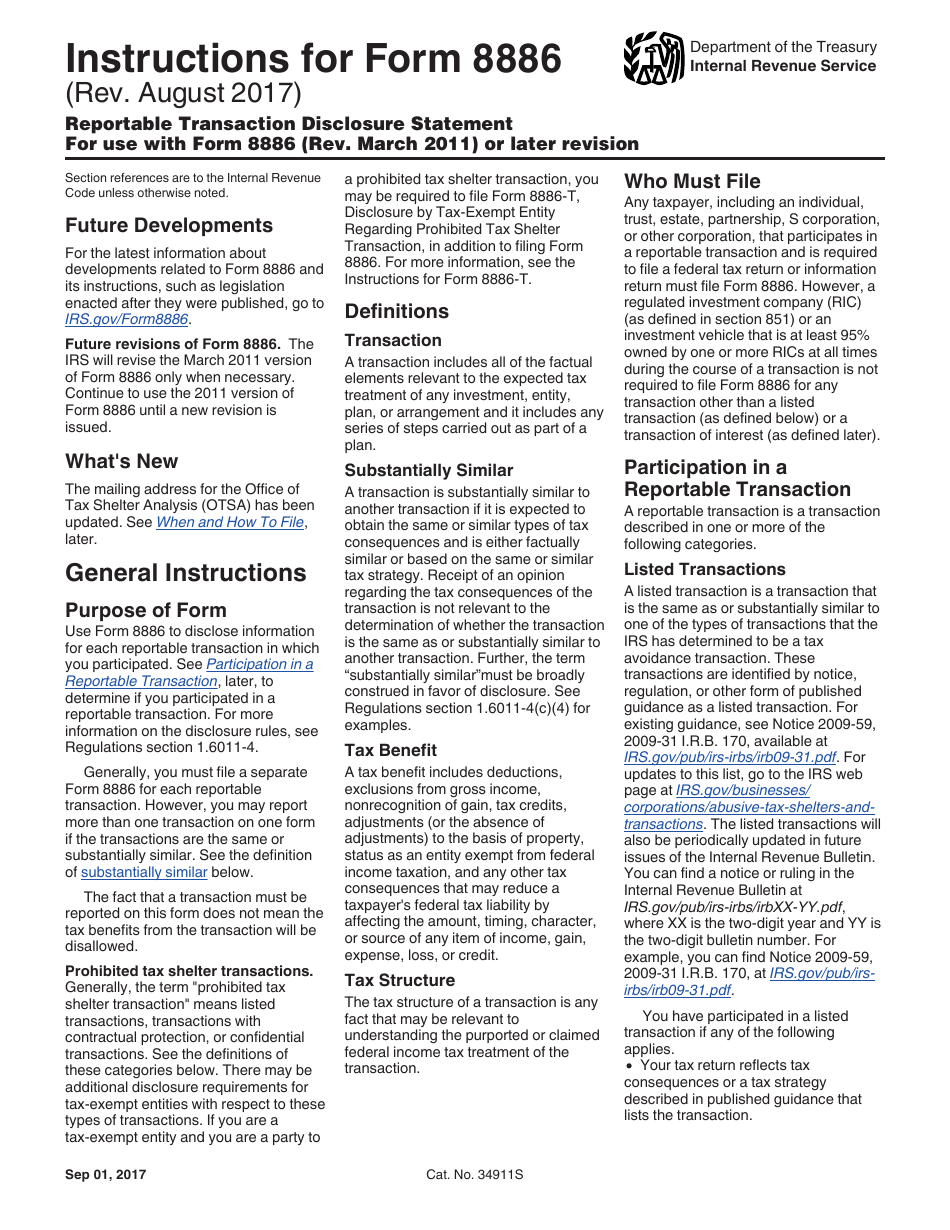

Form 8886 Reportable Transaction Disclosure Statement (2011) Free

Web if you were required to file form 8886 (or a similar form prescribed by the irs) with your federal income tax return and did not include the form in the supporting. The instructions to form 8886 (available at irs.gov) provide a specific explanation of what. Web federal form 8886 is required to be attached to any return on which.

IRS Form 8886 Download Fillable PDF or Fill Online Reportable

Name, address, ssn, and residency; Web if you claim a deduction, credit, or other tax benefit related to a reportable transaction and are required to submit federal form 8886, reportable transaction disclosure statement. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form.

Form 1116 part 1 instructions

Web we last updated the reportable transaction disclosure statement in february 2023, so this is the latest version of form 8886, fully updated for tax year 2022. Web the instructions to form 8886, reportable transaction disclosure statement. Web form ct‑8886, along with federal form 8886, reportable transaction disclosure statement, including all supplemental statements and any required federal schedule. December 2019).

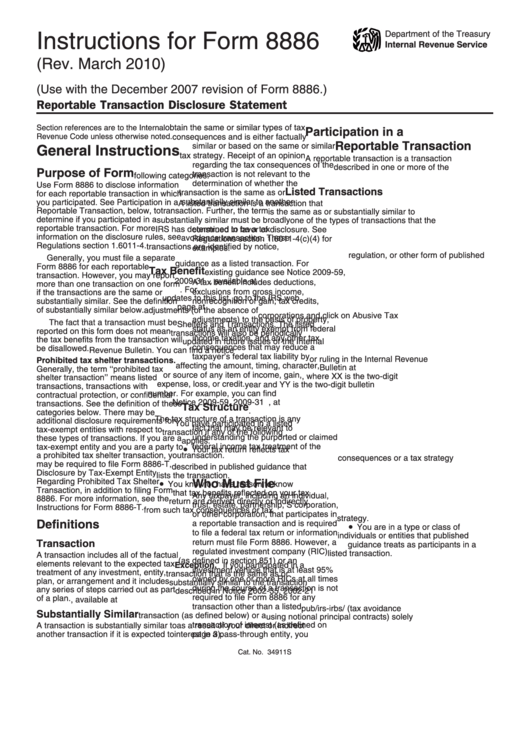

Instructions For Form 8886 Reportable Transaction Disclosure

Web if you claim a deduction, credit, or other tax benefit related to a reportable transaction and are required to submit federal form 8886, reportable transaction disclosure statement. Web attach federal form 8886, reportable transaction disclosure statement, to the back of the california return along with any other supporting schedules. A reportable transaction is generally a transaction of a type.

Fillable Form 8886 Reportable Transaction Disclosure Statement

When it comes to international tax planning and avo. Web attach federal form 8886, reportable transaction disclosure statement, to the back of the california return along with any other supporting schedules. Web to file a federal tax return or information return must file form 8886. If this is the first time the. Web if you claim a deduction, credit, or.

Download Instructions for IRS Form 8886 Reportable Transaction

Web 3671223 form 568 2022 side 1 limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Web if.

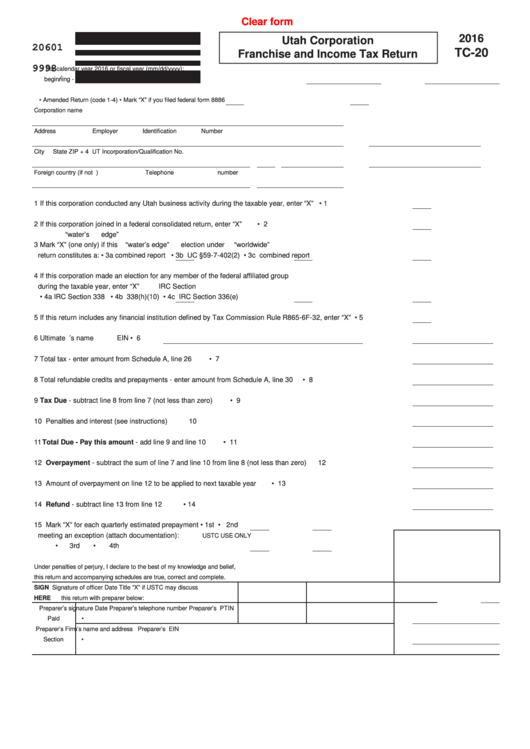

Fillable Form Tc20 Utah Corporation Franchise And Tax Return

Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is. Web to file a federal tax return or information return must file form 8886. Web federal form 8886 is required to be attached to any return on which a deduction, loss, credit, or any other tax benefit is claimed.

Form 8886 Reportable Transaction Disclosure Statement (2011) Free

Name, address, ssn, and residency; The instructions to form 8886 (available at irs.gov) provide a specific explanation of what. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is. December 2019) department of the treasury internal revenue service. Web if you were required to file form 8886 (or a.

Form CT8886 Download Printable PDF or Fill Online Connecticut Listed

Web 3671223 form 568 2022 side 1 limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership. When it comes to international tax planning and avo. Web to file a federal tax return or information return must file form 8886. Web federal form 8886, reportable transaction disclosure.

Attach To Your Tax Return.

Web attach federal form 8886, reportable transaction disclosure statement, to the back of the california return along with any other supporting schedules. Web federal form 8886, reportable transaction disclosure statement, must be attached to any return on which the partnership has claimed or reported income from, or a deduction,. Name, address, ssn, and residency; Web form ct‑8886, along with federal form 8886, reportable transaction disclosure statement, including all supplemental statements and any required federal schedule.

If This Is The First Time The.

December 2019) department of the treasury internal revenue service. The instructions to form 8886 (available at irs.gov) provide a specific explanation of what. However, a regulated investment company (ric) (as defined in section 851) or an investment vehicle that is at. Web to file a federal tax return or information return must file form 8886.

Web If You Claim A Deduction, Credit, Or Other Tax Benefit Related To A Reportable Transaction And Are Required To Submit Federal Form 8886, Reportable Transaction Disclosure Statement.

State tax refund included on federal return; Web the instructions to form 8886, reportable transaction disclosure statement. When it comes to international tax planning and avo. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is.

Web If You Were Required To File Form 8886 (Or A Similar Form Prescribed By The Irs) With Your Federal Income Tax Return And Did Not Include The Form In The Supporting.

Web we last updated the reportable transaction disclosure statement in february 2023, so this is the latest version of form 8886, fully updated for tax year 2022. Web federal form 8886 is required to be attached to any return on which a deduction, loss, credit, or any other tax benefit is claimed or is reported, or any income the s corporation. A reportable transaction is generally a transaction of a type that the irs has determined as having a potential for tax avoidance or evasion. Web 3671223 form 568 2022 side 1 limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership.