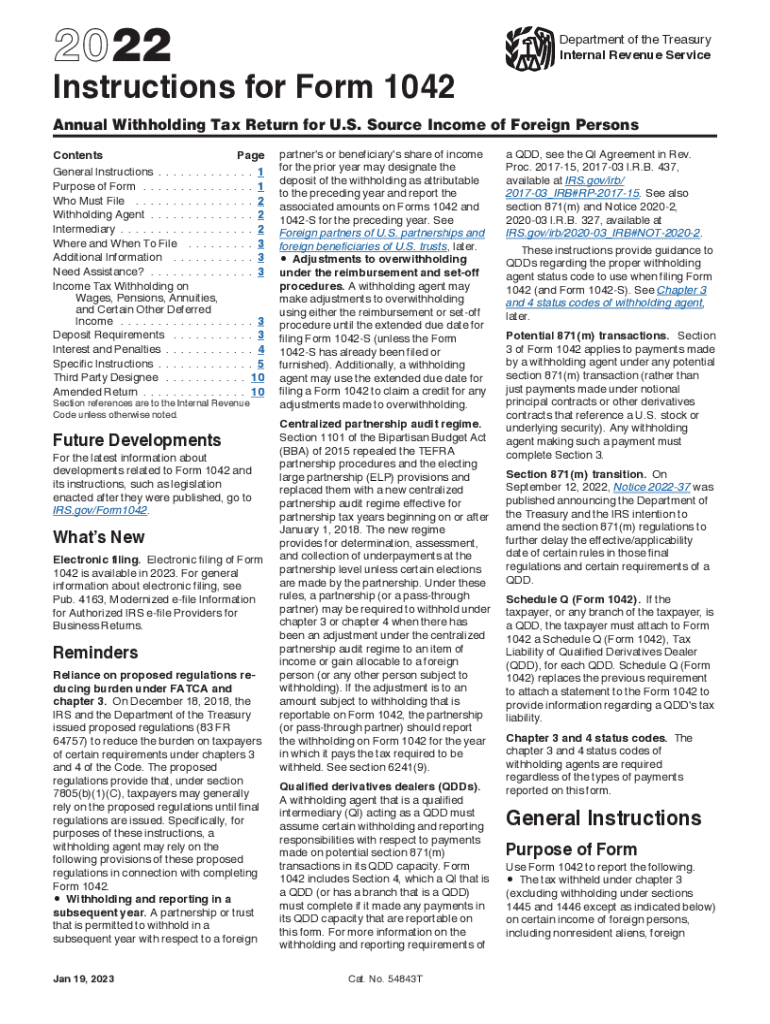

Form 1042-S Instructions 2022

Form 1042-S Instructions 2022 - Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. Home office reflected on the form. Financial institution should continue to use its own withholding agent chapter 4 status code (code 01) for purposes of completing form 1042 if there are any payments made by the u.s. Form 1042 is also required to be filed by a withholding agent when it pays gross investment income to a foreign private foundation subject to section 4948 (a). Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Web information about form 1042, annual withholding tax return for u.s. Source income of foreign persons go to www.irs.gov/form1042 for instructions and the latest information. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Use form 1042 to report tax withheld on certain income of foreign persons.

Home office reflected on the form. Web 2022 form 1042 form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Form 1042 is also required to be filed by a withholding agent when it pays gross investment income to a foreign private foundation subject to section 4948 (a). Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Web information about form 1042, annual withholding tax return for u.s. Source income subject to withholding. Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. Citizens from certain accounts, including iras. Financial institution should continue to use its own withholding agent chapter 4 status code (code 01) for purposes of completing form 1042 if there are any payments made by the u.s.

Financial institution should continue to use its own withholding agent chapter 4 status code (code 01) for purposes of completing form 1042 if there are any payments made by the u.s. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Source income of foreign persons go to www.irs.gov/form1042 for instructions and the latest information. Use form 1042 to report tax withheld on certain income of foreign persons. Citizens from certain accounts, including iras. Home office reflected on the form. Form 1042 is also required to be filed by a withholding agent when it pays gross investment income to a foreign private foundation subject to section 4948 (a). Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Source income subject to withholding.

1042 S Form slideshare

Use form 1042 to report tax withheld on certain income of foreign persons. Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Financial institution should continue to use its own withholding agent chapter 4 status code (code 01) for purposes of completing form 1042 if there are any payments made by the u.s..

IRS Form 1042s What It is & 1042s Instructions Tipalti

Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Financial institution should continue to use its own withholding agent chapter 4 status code (code 01) for purposes of completing form 1042 if there are any payments made by the u.s. Source income subject to withholding, including recent updates, related forms, and instructions on.

Bigger Social Security benefits bump could end up in yearend

Web 2022 form 1042 form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Source income of foreign persons go to www.irs.gov/form1042 for instructions and the latest information. Source income subject to withholding. Web information about form 1042, annual.

The Newly Issued Form 1042S Foreign Person's U.S. Source

Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Citizens from certain accounts, including iras. Source income of foreign persons go to www.irs.gov/form1042 for instructions and the latest information. Form 1042 is also required to be.

tax payer access point Piers Ross

Citizens from certain accounts, including iras. Web 2022 form 1042 form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Form 1042 is also required to be filed by a withholding agent when it pays gross investment income to a foreign private foundation subject to section 4948 (a). Source income of foreign persons, including recent.

Form 1042s 2022 instructions Fill online, Printable, Fillable Blank

Citizens from certain accounts, including iras. Web information about form 1042, annual withholding tax return for u.s. Web 2022 form 1042 form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Financial institution should continue to use its own withholding agent chapter 4 status code (code 01) for purposes of completing form 1042 if there.

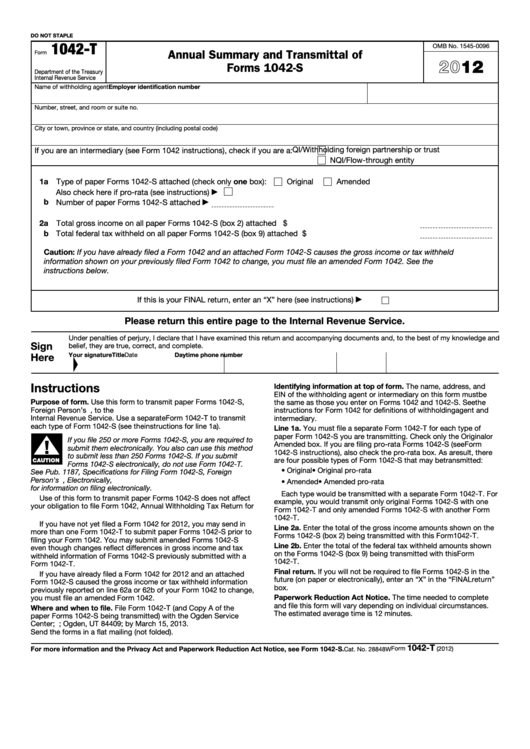

Fillable Form 1042T Annual Summary And Transmittal Of Forms 1042S

Financial institution should continue to use its own withholding agent chapter 4 status code (code 01) for purposes of completing form 1042 if there are any payments made by the u.s. Source income of foreign persons go to www.irs.gov/form1042 for instructions and the latest information. Web 2022 form 1042 form 1042 department of the treasury internal revenue service annual withholding.

Instructions for Form 1042 Internal Revenue Service Fill Out and Sign

Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. Source income of foreign persons go to www.irs.gov/form1042 for instructions and the latest information. Source income subject to withholding. Form 1042.

1042 S Form slideshare

Web 2022 form 1042 form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Financial institution should continue to use its own withholding agent chapter 4 status code (code 01) for purposes of completing form 1042 if there are any payments made by the u.s. Use form 1042 to report tax withheld on certain income.

8867 Form 2022 2023

Use form 1042 to report tax withheld on certain income of foreign persons. Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. Source income of foreign persons go to www.irs.gov/form1042 for instructions and the latest information. Form 1042 is also required to be filed by a.

Home Office Reflected On The Form.

Citizens from certain accounts, including iras. Source income subject to withholding. Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s.

Web Information About Form 1042, Annual Withholding Tax Return For U.s.

Web 2022 form 1042 form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Financial institution should continue to use its own withholding agent chapter 4 status code (code 01) for purposes of completing form 1042 if there are any payments made by the u.s. Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Source income subject to withholding, including recent updates, related forms, and instructions on how to file.

Form 1042 Is Also Required To Be Filed By A Withholding Agent When It Pays Gross Investment Income To A Foreign Private Foundation Subject To Section 4948 (A).

Use form 1042 to report tax withheld on certain income of foreign persons. Source income of foreign persons go to www.irs.gov/form1042 for instructions and the latest information.