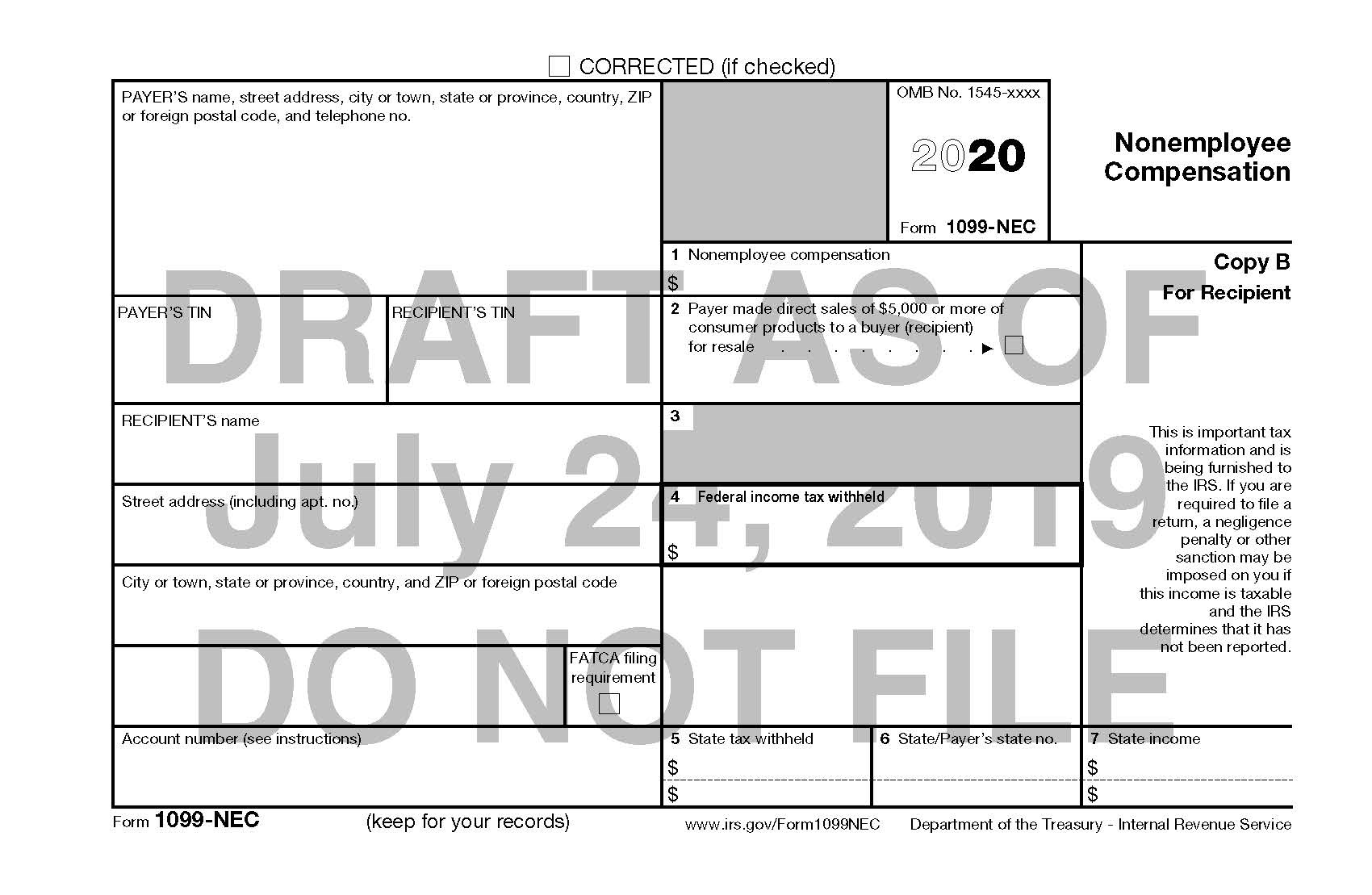

Form 1099 Nec 2020

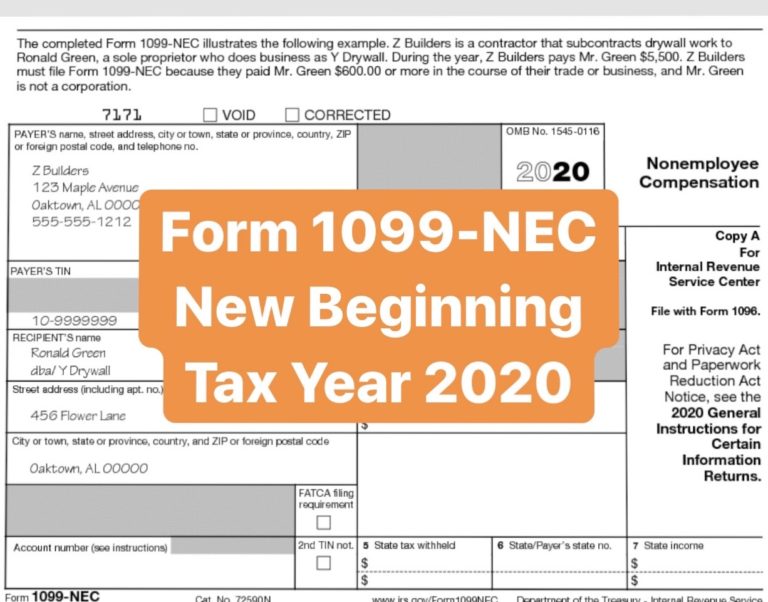

Form 1099 Nec 2020 - File before jan 31st deadline. Web starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee. It exclusively deals with nonemployee compensations. Do not miss the deadline. Complete, edit or print tax forms instantly. Deliver form copies by mail or online. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Starting tax year 2020, any business, regardless of size, that pays at least $600 for services performed in the course of their trade or. Complete, edit or print tax forms instantly. What you need to know.

Do not miss the deadline. The taxpayers use the new form to report the payments made in the 2020 tax. If your business has made. Ad get ready for tax season deadlines by completing any required tax forms today. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Taxpayers must file their forms 1099. This change is for the 2020 tax year, which are filed in. Complete, edit or print tax forms instantly. Ad file form 1099 nec for 2022 with irs & state. Starting tax year 2020, any business, regardless of size, that pays at least $600 for services performed in the course of their trade or.

This change is for the 2020 tax year, which are filed in. Deliver form copies by mail or online. Taxpayers must file their forms 1099. Ad get ready for tax season deadlines by completing any required tax forms today. Starting tax year 2020, any business, regardless of size, that pays at least $600 for services performed in the course of their trade or. Complete, edit or print tax forms instantly. If your business has made. The taxpayers use the new form to report the payments made in the 2020 tax. Ad get ready for tax season deadlines by completing any required tax forms today. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported.

There’s A New Tax Form With Some Changes For Freelancers & Gig

Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. This change is for the 2020 tax year, which are filed in. Ad file form 1099 nec for 2022 with irs & state. If your business has made.

For the Love of 1099s! Preparing for JD Edwards YearEnd Circular

Complete, edit or print tax forms instantly. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Ad get ready for tax season deadlines by completing any required tax forms today. File before jan 31st.

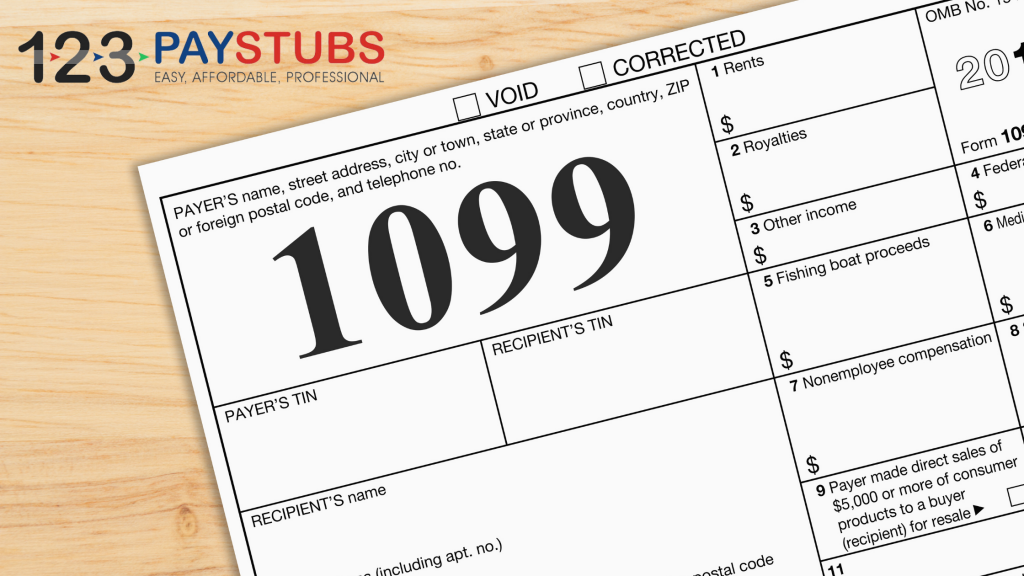

What is Form 1099NEC and Who Needs to File? 123PayStubs Blog

What you need to know. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. Deliver form copies by mail or online. Ad file form 1099 nec for 2022 with irs & state.

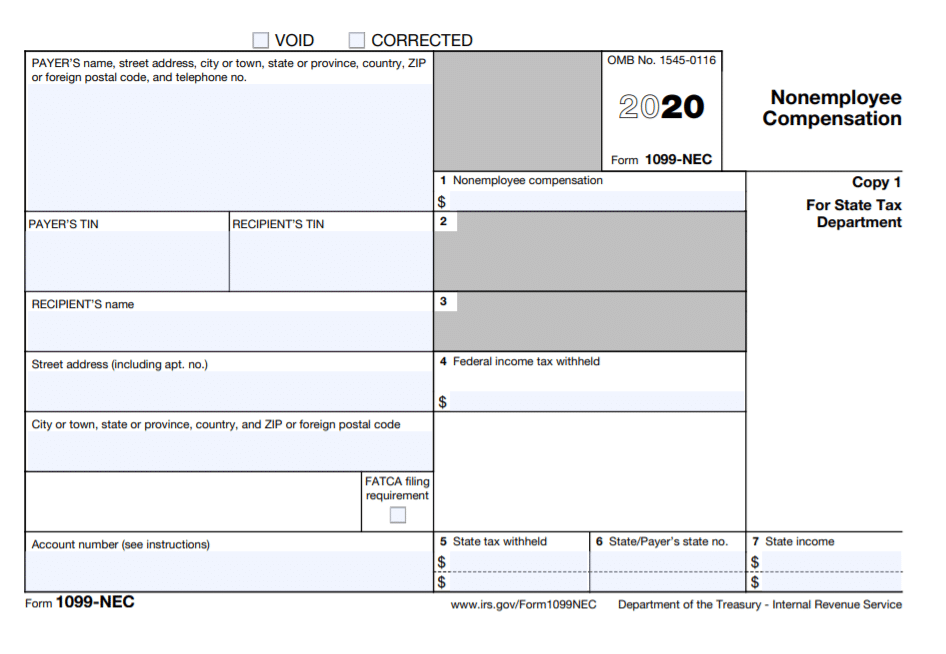

What the 1099NEC Coming Back Means for your Business Chortek

Ad get ready for tax season deadlines by completing any required tax forms today. If your business has made. Complete, edit or print tax forms instantly. Taxpayers must file their forms 1099. Ad get ready for tax season deadlines by completing any required tax forms today.

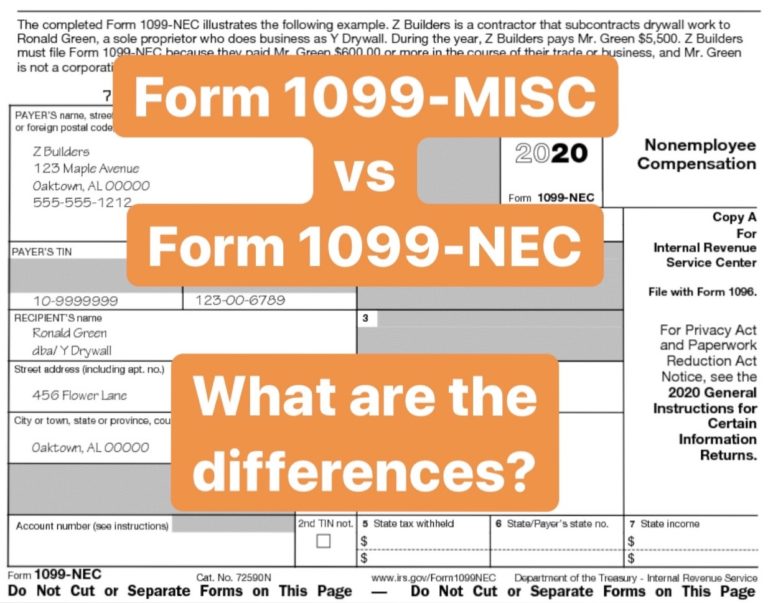

1099NEC or 1099MISC? What has changed and why it matters! Pro News

Starting tax year 2020, any business, regardless of size, that pays at least $600 for services performed in the course of their trade or. The taxpayers use the new form to report the payments made in the 2020 tax. Ad get ready for tax season deadlines by completing any required tax forms today. Ad get ready for tax season deadlines.

IRS to Bring Back Form 1099NEC, Last Used in 1982 — Current Federal

Ad get ready for tax season deadlines by completing any required tax forms today. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Do not miss the deadline. Starting tax year 2020, any business,.

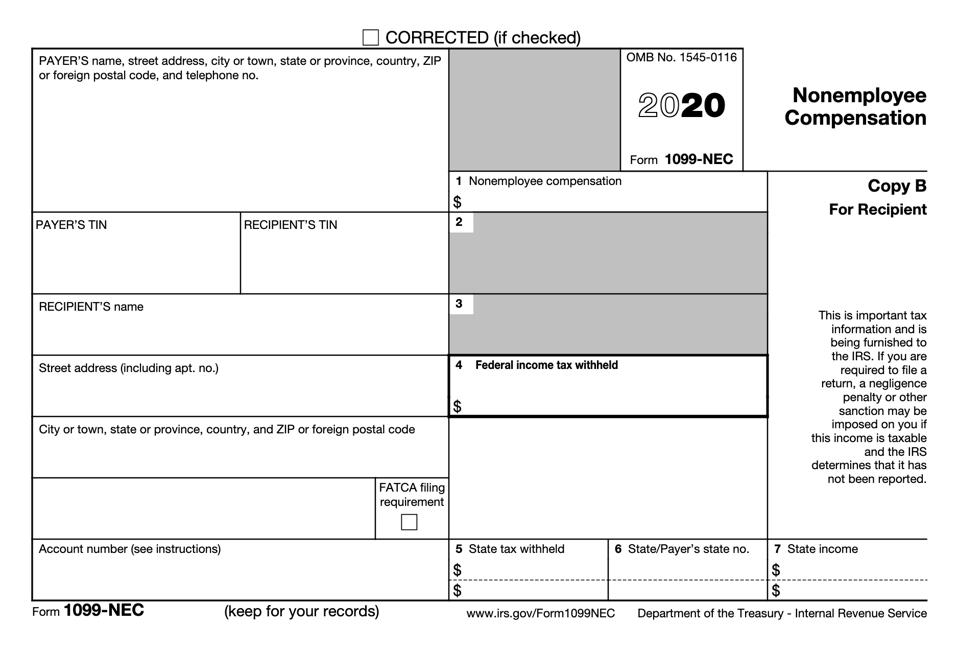

What is Form 1099NEC for Nonemployee Compensation

Web starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee. If your business has made. Starting tax year 2020, any business, regardless of size, that pays at least $600 for services performed in the course of their trade or. Ad get ready for tax season deadlines by completing.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

File before jan 31st deadline. What you need to know. The taxpayers use the new form to report the payments made in the 2020 tax. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported..

Form 1099MISC vs Form 1099NEC How are they Different?

It exclusively deals with nonemployee compensations. Complete, edit or print tax forms instantly. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Do not miss the deadline. What you need to know.

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

File before jan 31st deadline. Starting tax year 2020, any business, regardless of size, that pays at least $600 for services performed in the course of their trade or. It exclusively deals with nonemployee compensations. What you need to know. Complete, edit or print tax forms instantly.

File Before Jan 31St Deadline.

Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Ad file form 1099 nec for 2022 with irs & state. Starting tax year 2020, any business, regardless of size, that pays at least $600 for services performed in the course of their trade or. Web starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee.

Deliver Form Copies By Mail Or Online.

What you need to know. It exclusively deals with nonemployee compensations. The taxpayers use the new form to report the payments made in the 2020 tax. Complete, edit or print tax forms instantly.

Complete, Edit Or Print Tax Forms Instantly.

Ad get ready for tax season deadlines by completing any required tax forms today. This change is for the 2020 tax year, which are filed in. Do not miss the deadline. If your business has made.

Taxpayers Must File Their Forms 1099.

Ad get ready for tax season deadlines by completing any required tax forms today.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)