Form 8881 Instructions

Form 8881 Instructions - Web 1683 / 8581 is already in the simplest form. The form really isn’t that challenging, but there are a few tips and tricks. Web if you qualify, you may claim the credit using form 8881, credit for small employer pension plan startup costs pdf. Web information about form 8281 and its instructions is at. Eligible businesses may claim the credit using form 8881, credit for small. Credit for small employer pension plan startup costs 1220 12/17/2020 inst 8881: An update to information on the form. Eligible employers you qualify to claim this. However, taxpayers whose only source of this credit is from a partnership. Instructions for form 8881, credit for small employer pension plan startup.

Web the irs provides additional details about the startup and auto deferral credits here. Web this article will assist you with entering amounts for form 8881, credit for small employer pension plan startup costs. Follow the steps below for the applicable. However, taxpayers whose only source of this credit is from a partnership. An update to information on the form. Web 1683 / 8581 is already in the simplest form. The estimated burden for individual taxpayers filing this form is approved. Find the gcd (or hcf) of. Web information about form 8281 and its instructions is at. Web to download the form 8880 in printable format and to know about the use of this form, who can use this form 8880 and when one should use this form 8880 form.

Read the instructions for where. Find the gcd (or hcf) of. Make sure to read if you even need to use form 8881, or perhaps only form 3800. Web if you qualify, you may claim the credit using form 8881, credit for small employer pension plan startup costs pdf. It can be written as 0.196131 in decimal form (rounded to 6 decimal places). Web obtain a completed and signed form 3681 for: Follow the steps below for the applicable. Web 1683 / 8581 is already in the simplest form. Web information about form 8281 and its instructions is at. An update to information on the form.

File IRS 2290 Form Online for 20222023 Tax Period

Web the time needed to complete and file this form will vary depending on individual circumstances. Web information about form 8281 and its instructions is at. Web 1683 / 8581 is already in the simplest form. Instructions for form 8881, credit for small employer pension plan startup. Web obtain a completed and signed form 3681 for:

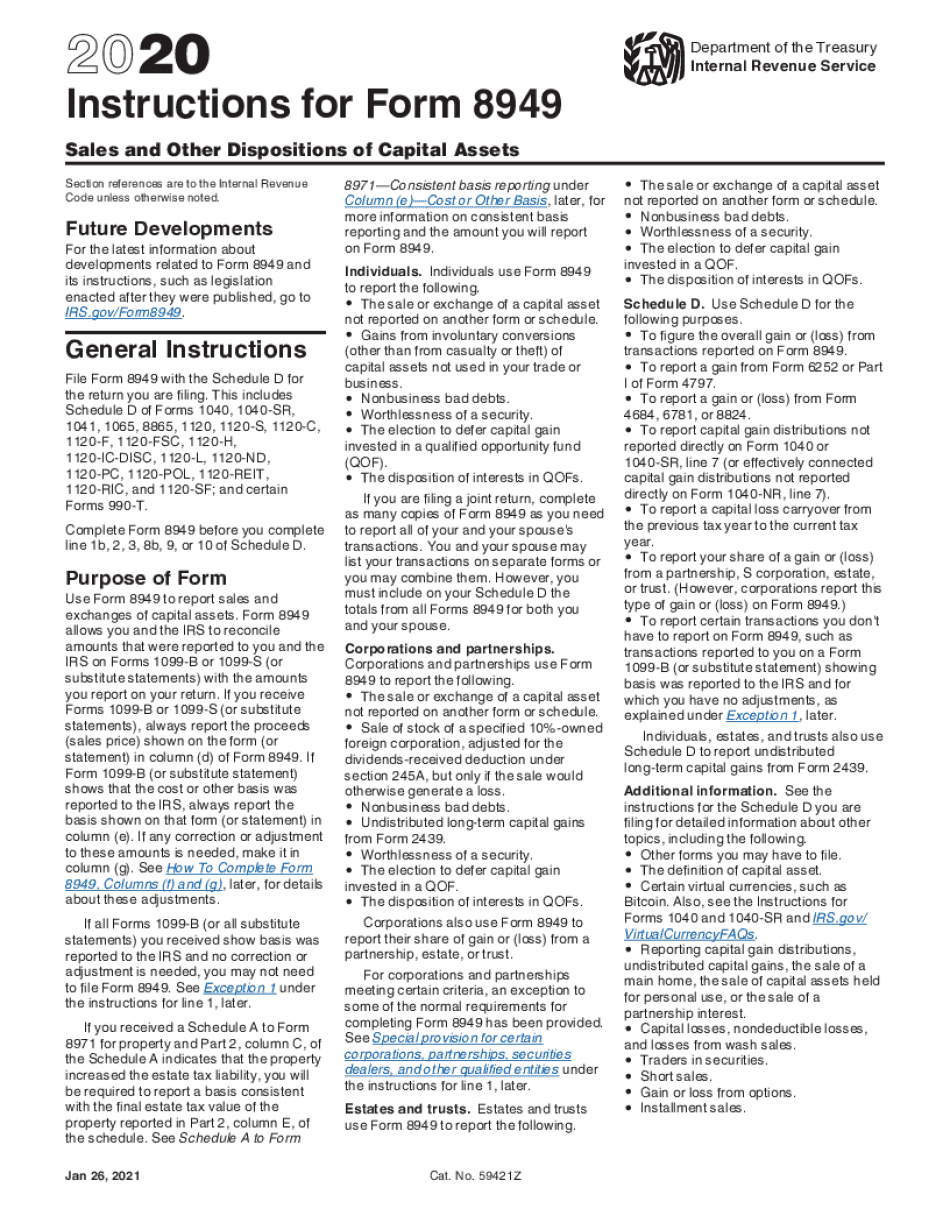

Form 8949 Instructions 2020 2021 Fillable and Editable PDF Template

Web the credit is generally claimed by filing form 8881, credit for small employer pension plan startup costs. Web obtain a completed and signed form 3681 for: Credit for small employer pension plan startup costs 1220 12/17/2020 inst 8881: Make sure to read if you even need to use form 8881, or perhaps only form 3800. Web 1683 / 8581.

W8EXP Form Instructions

Find the gcd (or hcf) of. Instructions for form 8881, credit for small employer pension plan startup. Web obtain a completed and signed form 3681 for: Web the time needed to complete and file this form will vary depending on individual circumstances. An update to information on the form.

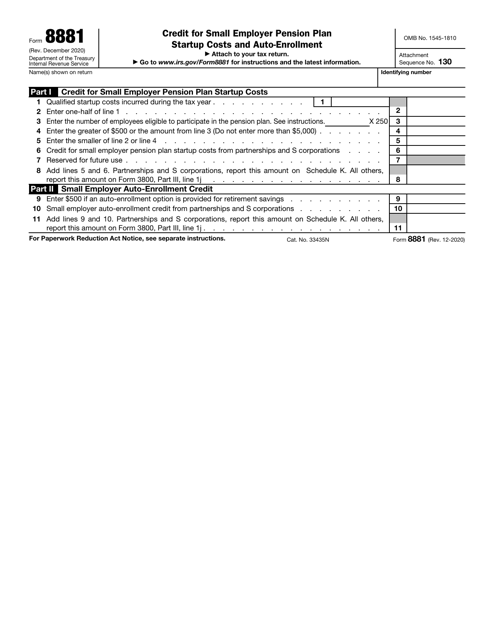

IRS Form 8881 Download Fillable PDF or Fill Online Credit for Small

Read the instructions for where. Follow the steps below for the applicable. However, taxpayers whose only source of this credit is from a partnership. The estimated burden for individual taxpayers filing this form is approved. Web to download the form 8880 in printable format and to know about the use of this form, who can use this form 8880 and.

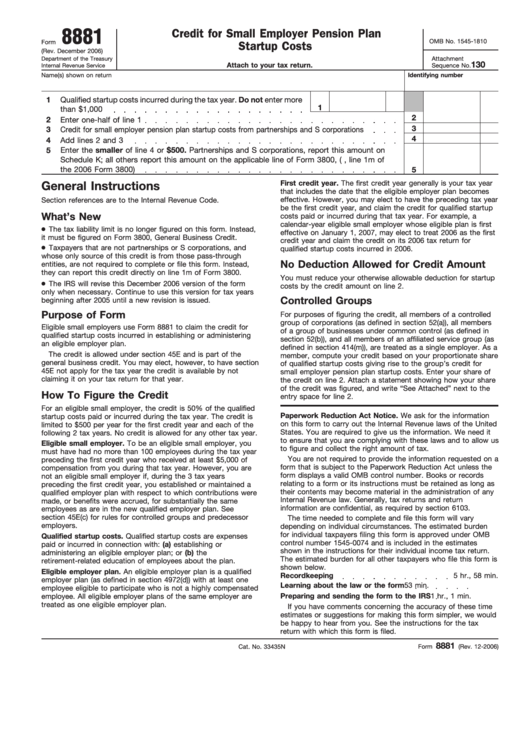

Fillable Form 8881 Credit For Small Employer Pension Plan Startup

Credit for small employer pension plan startup costs 1220 12/17/2020 inst 8881: Web obtain a completed and signed form 3681 for: Web to download the form 8880 in printable format and to know about the use of this form, who can use this form 8880 and when one should use this form 8880 form. It can be written as 0.196131.

Form 8881 Credit for Small Employer Pension Plan Startup Costs

Web obtain a completed and signed form 3681 for: Web to download the form 8880 in printable format and to know about the use of this form, who can use this form 8880 and when one should use this form 8880 form. Web this article will assist you with entering amounts for form 8881, credit for small employer pension plan.

Form 8881 Credit for Small Employer Pension Plan Startup Costs (2013

The estimated burden for individual taxpayers filing this form is approved. Eligible businesses may claim the credit using form 8881, credit for small. Follow the steps below for the applicable. Retain form 3681 and attachments in accordance with. Web this article will assist you with entering amounts for form 8881, credit for small employer pension plan startup costs.

Form 7004 Printable PDF Sample

Web information about form 8281 and its instructions is at. However, taxpayers whose only source of this credit is from a partnership. Retain form 3681 and attachments in accordance with. Web 1683 / 8581 is already in the simplest form. Web this article will assist you with entering amounts for form 8881, credit for small employer pension plan startup costs.

Scantron Form No 882 E Instructions Universal Network

Web the irs provides additional details about the startup and auto deferral credits here. An update to information on the form. Make sure to read if you even need to use form 8881, or perhaps only form 3800. Eligible businesses may claim the credit using form 8881, credit for small. Web if you qualify, you may claim the credit using.

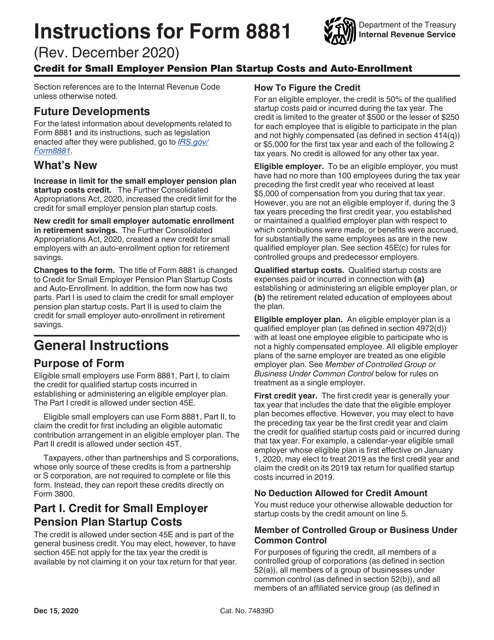

Download Instructions for IRS Form 8881 Credit for Small Employer

Web the credit is generally claimed by filing form 8881, credit for small employer pension plan startup costs. However, taxpayers whose only source of this credit is from a partnership. Credit for small employer pension plan startup costs 1220 12/17/2020 inst 8881: Retain form 3681 and attachments in accordance with. Eligible employers you qualify to claim this.

Credit For Small Employer Pension Plan Startup Costs 1220 12/17/2020 Inst 8881:

Web the irs provides additional details about the startup and auto deferral credits here. Eligible businesses may claim the credit using form 8881, credit for small. Web this article will assist you with entering amounts for form 8881, credit for small employer pension plan startup costs. Follow the steps below for the applicable.

Make Sure To Read If You Even Need To Use Form 8881, Or Perhaps Only Form 3800.

Find the gcd (or hcf) of. Retain form 3681 and attachments in accordance with. However, taxpayers whose only source of this credit is from a partnership. Web if you qualify, you may claim the credit using form 8881, credit for small employer pension plan startup costs pdf.

Instructions For Form 8881, Credit For Small Employer Pension Plan Startup.

Web obtain a completed and signed form 3681 for: Web information about form 8281 and its instructions is at. Eligible employers you qualify to claim this. Web 1683 / 8581 is already in the simplest form.

The Estimated Burden For Individual Taxpayers Filing This Form Is Approved.

Read the instructions for where. Web the credit is generally claimed by filing form 8881, credit for small employer pension plan startup costs. An update to information on the form. Web the time needed to complete and file this form will vary depending on individual circumstances.