Form 945 For 2021

Form 945 For 2021 - If the taxpayer has already made all. Web the finalized 2020 form 945, annual return of withheld federal income tax, and accompanying instructions were released nov. Generally, taxpayers must file irs form 945 by january 31st of the year following the tax year filed. For more information on income tax withholding, see pub. The form 945 must be filed by jan. They tell you who must file form 945, how to complete it line by line, and when and where to file it. The finalized version of form 945 was released by the irs. Web when is irs form 945 due? Ad access irs tax forms. Web any business filing form 945 for 2020 has until february 1, 2021, to file, or february 10 if you’ve made deposits on time in full payment of the year’s taxes.

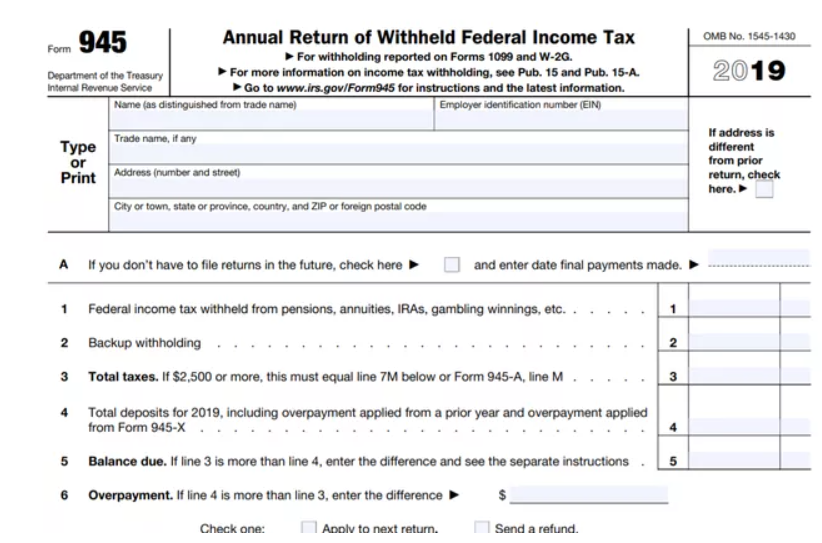

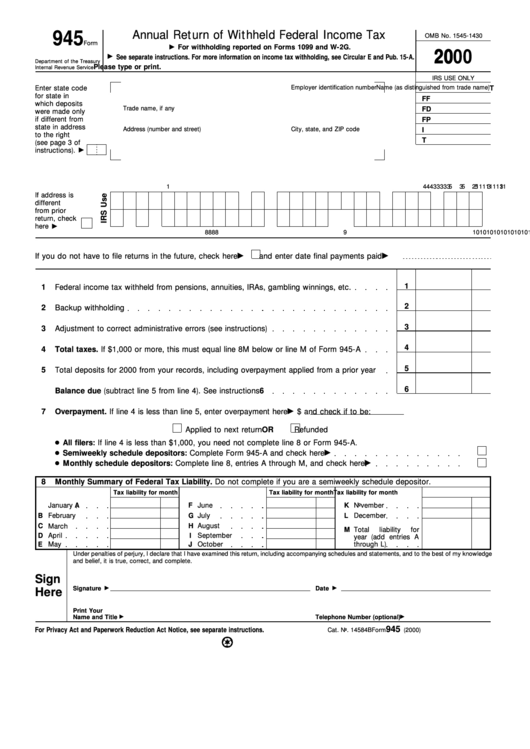

Web any business filing form 945 for 2020 has until february 1, 2021, to file, or february 10 if you’ve made deposits on time in full payment of the year’s taxes. Generally, taxpayers must file irs form 945 by january 31st of the year following the tax year filed. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. Try it for free now! Web use this form to report withheld federal income tax from nonpayroll payments. Upload, modify or create forms. The finalized 2021 form 945, annual return of. The finalized version of form 945 was released by the irs. Web form 945 instructions for 2022.

If the taxpayer has already made all. The form 945 must be filed by jan. Web when is irs form 945 due? The finalized version of form 945 was released by the irs. Generally, taxpayers must file irs form 945 by january 31st of the year following the tax year filed. Web the finalized 2020 form 945, annual return of withheld federal income tax, and accompanying instructions were released nov. Web use this form to report withheld federal income tax from nonpayroll payments. Complete, edit or print tax forms instantly. For more information on income tax withholding, see pub. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient.

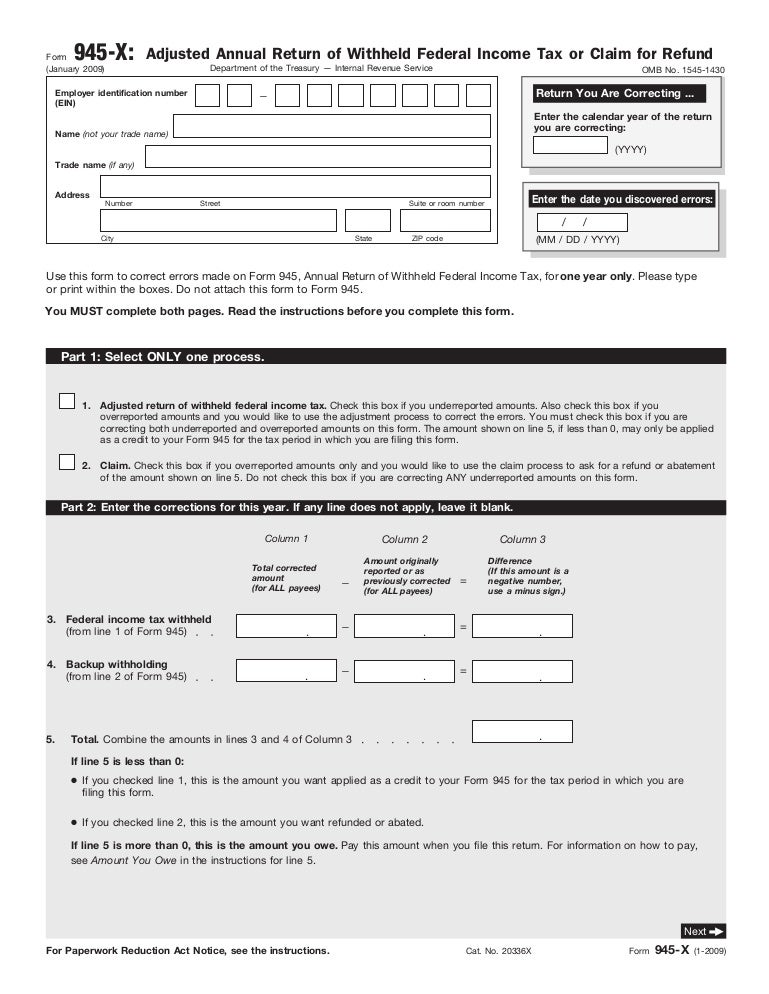

Form 945X Adjusted Annual Return of Withheld Federal Tax or

Web use this form to report withheld federal income tax from nonpayroll payments. Irs 945 2020 get irs 945 2020 how it works open form follow the instructions easily sign the form with your finger. For more information on income tax withholding, see pub. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps.

Form 945 Reporting Withholding for Defined Benefit Plans Saber Pension

Generally, taxpayers must file irs form 945 by january 31st of the year following the tax year filed. Upload, modify or create forms. 4 by the internal revenue service. Web “form 945,” and “2021” on your check or money order. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management.

Form 945X Adjusted Annual Return of Withheld Federal Tax or

Irs 945 2020 get irs 945 2020 how it works open form follow the instructions easily sign the form with your finger. Web form 945 instructions for 2022. The form 945 must be filed by jan. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient..

Form 945 Reporting Withholding for Defined Benefit Plans Saber Pension

They tell you who must file form 945, how to complete it line by line, and when and where to file it. Upload, modify or create forms. Complete, edit or print tax forms instantly. If the taxpayer has already made all. Generally, taxpayers must file irs form 945 by january 31st of the year following the tax year filed.

Things an Employer Must Know About IRS Form 945 in the US!

If the taxpayer has already made all. The finalized 2021 form 945, annual return of. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. Web these instructions give you some background information about form 945. Web when is irs form 945 due?

Form 945 Annual Return Of Withheld Federal Tax 2000

Complete, edit or print tax forms instantly. Web form 945 instructions for 2022. They tell you who must file form 945, how to complete it line by line, and when and where to file it. Web the finalized 2020 form 945, annual return of withheld federal income tax, and accompanying instructions were released nov. Upload, modify or create forms.

Form 945X Adjusted Annual Return of Withheld Federal Tax or

The finalized 2021 form 945, annual return of. Web use this form to report withheld federal income tax from nonpayroll payments. Pensions (including distributions from tax. Web the finalized 2020 form 945, annual return of withheld federal income tax, and accompanying instructions were released nov. 4 by the internal revenue service.

2022 Form 945. Annual Return of Withheld Federal Tax Fill out

Irs 945 2020 get irs 945 2020 how it works open form follow the instructions easily sign the form with your finger. Try it for free now! Web the finalized 2020 form 945, annual return of withheld federal income tax, and accompanying instructions were released nov. Web when is irs form 945 due? Web these instructions give you some background.

Form 945 Edit, Fill, Sign Online Handypdf

They tell you who must file form 945, how to complete it line by line, and when and where to file it. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. Ad access irs tax forms. Web the finalized 2020 form 945, annual return of.

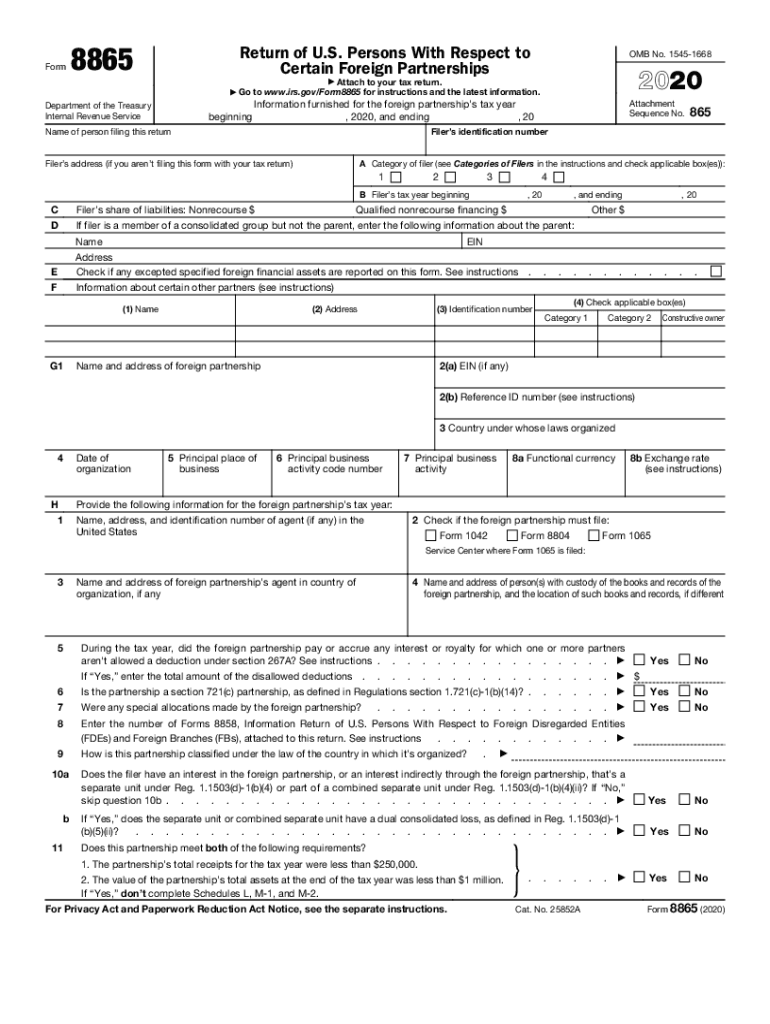

IRS 8865 2020 Fill out Tax Template Online US Legal Forms

If the taxpayer has already made all. Web the finalized 2020 form 945, annual return of withheld federal income tax, and accompanying instructions were released nov. For more information on income tax withholding, see pub. Ad access irs tax forms. 4 by the internal revenue service.

They Tell You Who Must File Form 945, How To Complete It Line By Line, And When And Where To File It.

Web any business filing form 945 for 2020 has until february 1, 2021, to file, or february 10 if you’ve made deposits on time in full payment of the year’s taxes. Web the finalized 2020 form 945, annual return of withheld federal income tax, and accompanying instructions were released nov. The finalized version of form 945 was released by the irs. Web these instructions give you some background information about form 945.

Web When Is Irs Form 945 Due?

Upload, modify or create forms. Generally, taxpayers must file irs form 945 by january 31st of the year following the tax year filed. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. Irs 945 2020 get irs 945 2020 how it works open form follow the instructions easily sign the form with your finger.

Ad Access Irs Tax Forms.

Pensions (including distributions from tax. 4 by the internal revenue service. Web “form 945,” and “2021” on your check or money order. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for.

Web We Last Updated The Annual Return Of Withheld Federal Income Tax In December 2022, So This Is The Latest Version Of Form 945, Fully Updated For Tax Year 2022.

For more information on income tax withholding, see pub. The form 945 must be filed by jan. Web form 945 instructions for 2022. Complete, edit or print tax forms instantly.