Form 990 Employee Retention Credit

Form 990 Employee Retention Credit - Form 990, schedule b — if the amount rises to the level of schedule b reporting based on the general rule ($5,000 or more) or the special rule (2% of form 990, part viii, line 1h. The coronavirus aid, relief, and economic security act (cares act) established the paycheck protection program (ppp) to provide loans to small businesses as a direct incentive to keep their workers on the payroll. Web form 990, schedule a — to the extent that the erc is reported as a government grant, this should not negatively impact the organization’s public charity status. There, you will find responses for. Any qualified wages for which an eligible employer claims against payroll taxes for the new employee retention credit may not be taken into account for purposes of determining other credits. The maximum amount of qualified wages taken into account for 2020 with respect to each employee for all calendar quarters is $10,000, so that the maximum. While there was great excitement when the consolidated appropriations act made the erc available for ppp borrowers, numerous key issues have remained unsolved mysteries, and the irs was. Does my business qualify to receive the employee retention credit? Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) The amount of the credit is 50% of the qualifying wages paid up to $10,000 in total.

Create shortcut the rules to be eligible to take this refundable payroll tax credit are complex. This resource library will help you understand both the retroactive 2020 credit and the 2021 credit. Web as the related article indicates, employers can qualify for up to $5,000 per employee in 2020 and $7,000 per employee per quarter in 2021. Web for 2020, the employee retention credit equals 50% of the qualified wages (including qualified health plan expenses) that an eligible employer pays in a calendar quarter. While there was great excitement when the consolidated appropriations act made the erc available for ppp borrowers, numerous key issues have remained unsolved mysteries, and the irs was. Web for example, many nonprofits took advantage of the employee retention credit (erc) included as part of the cares act. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) There, you will find responses for. Gross receipts measurement for employee retention credits for nonprofits the following tests apply to determine whether the employer suffered a “significant decline” in gross receipts: The maximum amount of qualified wages taken into account for 2020 with respect to each employee for all calendar quarters is $10,000, so that the maximum.

While there was great excitement when the consolidated appropriations act made the erc available for ppp borrowers, numerous key issues have remained unsolved mysteries, and the irs was. The definition of qualifying wages varies by whether an employer had, on average, more or less than 100 employees in 2019. Any qualified wages for which an eligible employer claims against payroll taxes for the new employee retention credit may not be taken into account for purposes of determining other credits. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) The coronavirus aid, relief, and economic security act (cares act) established the paycheck protection program (ppp) to provide loans to small businesses as a direct incentive to keep their workers on the payroll. And before december 31, 2020. The maximum amount of qualified wages taken into account for 2020 with respect to each employee for all calendar quarters is $10,000, so that the maximum. Web from 2020 form 990 instructions, part vii, line 1e, “tip”: Does my business qualify to receive the employee retention credit? Create shortcut the rules to be eligible to take this refundable payroll tax credit are complex.

2017 Form 990 for Davidson Hotel Company Employee Health Care Trust

Web new employee retention credit. Web with a maximum credit of $5,000 per employee in 2020 and $28,000 in 2021, it could provide big help to struggling businesses and nonprofits. Web the internal revenue service (irs) has issued two pieces of new guidance that clear up several questions about the employee retention credit (erc) that have been plaguing taxpayers trying.

What Is A 990 Tax Form For Nonprofits Douroubi

The definition of qualifying wages varies by whether an employer had, on average, more or less than 100 employees in 2019. Any qualified wages for which an eligible employer claims against payroll taxes for the new employee retention credit may not be taken into account for purposes of determining other credits. The coronavirus aid, relief, and economic securities act (cares.

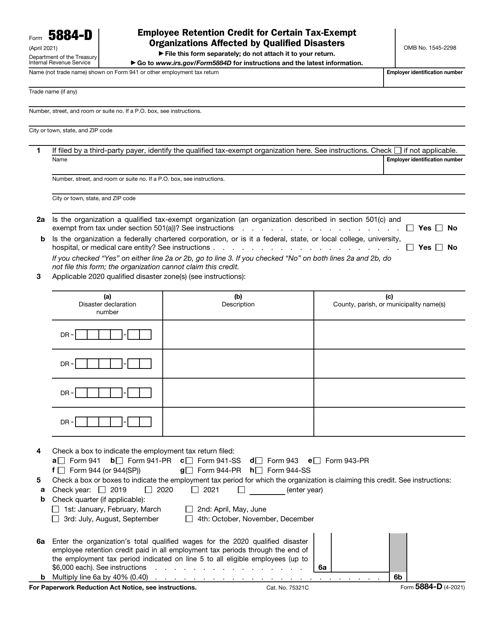

IRS Form 5884D Download Fillable PDF or Fill Online Employee Retention

Web with a maximum credit of $5,000 per employee in 2020 and $28,000 in 2021, it could provide big help to struggling businesses and nonprofits. Gross receipts measurement for employee retention credits for nonprofits the following tests apply to determine whether the employer suffered a “significant decline” in gross receipts: Web as the related article indicates, employers can qualify for.

Employee Retention Credit Form MPLOYME

Web the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help businesses with the cost of keeping staff employed. Businesses that have also obtained the paycheck protection program (ppp) can also benefit from this fully refundable tax credit. The coronavirus aid, relief, and economic securities act (cares act) allows a new employee.

2015 Form 990 by feedingthegulfcoast Issuu

While there was great excitement when the consolidated appropriations act made the erc available for ppp borrowers, numerous key issues have remained unsolved mysteries, and the irs was. Web for example, many nonprofits took advantage of the employee retention credit (erc) included as part of the cares act. Web for 2020, the employee retention credit equals 50% of the qualified.

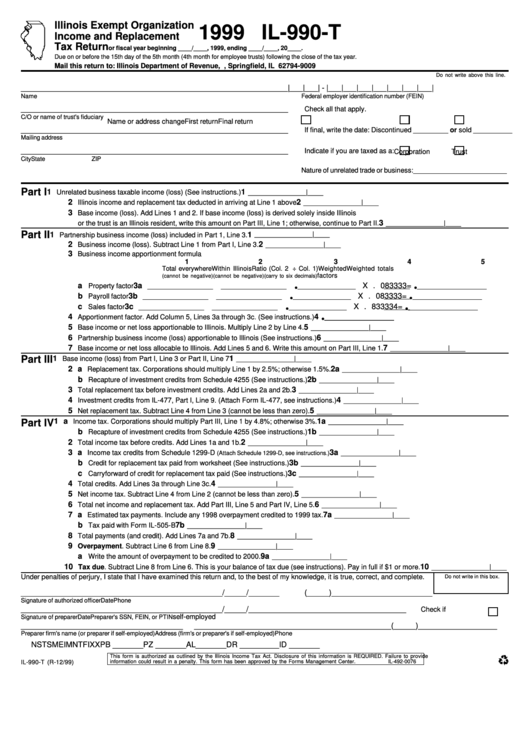

Form Il990T Illinois Exempt Organization And Replacement Tax

And before december 31, 2020. Web as the related article indicates, employers can qualify for up to $5,000 per employee in 2020 and $7,000 per employee per quarter in 2021. It is effective for wages paid after march 13. The maximum amount of qualified wages taken into account for 2020 with respect to each employee for all calendar quarters is.

FY2019 Form 990reduced by feedingthegulfcoast Issuu

This resource library will help you understand both the retroactive 2020 credit and the 2021 credit. Qualified wages significant decline in gross receipts what does the erc mean to your organization? There, you will find responses for. Web calculation of the credit. Form 990, schedule b — if the amount rises to the level of schedule b reporting based on.

Pin on Self care

Web the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help businesses with the cost of keeping staff employed. The coronavirus aid, relief, and economic securities act (cares act) allows a new employee retention credit for qualified wages. While there was great excitement when the consolidated appropriations act made the erc available.

Form 990 or 990EZ (Sch N) Liquidation, Termination, Dissolution, or

Businesses that have also obtained the paycheck protection program (ppp) can also benefit from this fully refundable tax credit. And before december 31, 2020. Does my business qualify to receive the employee retention credit? Any qualified wages for which an eligible employer claims against payroll taxes for the new employee retention credit may not be taken into account for purposes.

Employee Retention Credit Form MPLOYME

Web for example, many nonprofits took advantage of the employee retention credit (erc) included as part of the cares act. The maximum amount of qualified wages taken into account for 2020 with respect to each employee for all calendar quarters is $10,000, so that the maximum. The coronavirus aid, relief, and economic security act (cares act) established the paycheck protection.

Businesses That Have Also Obtained The Paycheck Protection Program (Ppp) Can Also Benefit From This Fully Refundable Tax Credit.

There, you will find responses for. Create shortcut the rules to be eligible to take this refundable payroll tax credit are complex. This resource library will help you understand both the retroactive 2020 credit and the 2021 credit. Web for 2020, the employee retention credit equals 50% of the qualified wages (including qualified health plan expenses) that an eligible employer pays in a calendar quarter.

Does My Business Qualify To Receive The Employee Retention Credit?

The amount of the credit is 50% of the qualifying wages paid up to $10,000 in total. Gross receipts measurement for employee retention credits for nonprofits the following tests apply to determine whether the employer suffered a “significant decline” in gross receipts: Web with a maximum credit of $5,000 per employee in 2020 and $28,000 in 2021, it could provide big help to struggling businesses and nonprofits. Form 990, schedule b — if the amount rises to the level of schedule b reporting based on the general rule ($5,000 or more) or the special rule (2% of form 990, part viii, line 1h.

Web The Internal Revenue Service (Irs) Has Issued Two Pieces Of New Guidance That Clear Up Several Questions About The Employee Retention Credit (Erc) That Have Been Plaguing Taxpayers Trying To Claim The Credit On Their 2020 And 2021 Payroll Tax Returns.

Web from 2020 form 990 instructions, part vii, line 1e, “tip”: The maximum amount of qualified wages taken into account for 2020 with respect to each employee for all calendar quarters is $10,000, so that the maximum. The irs notice addressed the frequently asked question about the “timing of qualified wages deduction disallowance.” Web form 990, schedule a — to the extent that the erc is reported as a government grant, this should not negatively impact the organization’s public charity status.

The Coronavirus Aid, Relief, And Economic Security Act (Cares Act) Established The Paycheck Protection Program (Ppp) To Provide Loans To Small Businesses As A Direct Incentive To Keep Their Workers On The Payroll.

While there was great excitement when the consolidated appropriations act made the erc available for ppp borrowers, numerous key issues have remained unsolved mysteries, and the irs was. Web for example, many nonprofits took advantage of the employee retention credit (erc) included as part of the cares act. Web as the related article indicates, employers can qualify for up to $5,000 per employee in 2020 and $7,000 per employee per quarter in 2021. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations)

.PNG)