Nys Form Tr 960 Consent To Dissolution Of A Corporation

Nys Form Tr 960 Consent To Dissolution Of A Corporation - Get your online template and fill it in using progressive features. Web step 1 depending on your organization's status, you may be required to send the following documents to the tax department: Web web instructions are more accessible, easier to understand, and easier to navigate. Web this procedure involves the following steps: How a new york corporation can be reinstated after it has. Approved by all 50 states. The telephone number, fax number, and address where you can. Web request for consent of the commissioner of finance for the dissolution of: We'll help with all the paperwork you need to officially close your business. Web the tax department will issue either a consent to dissolution of a domestic corporation or a letter detailing what needs to be done before the consent can be issued.

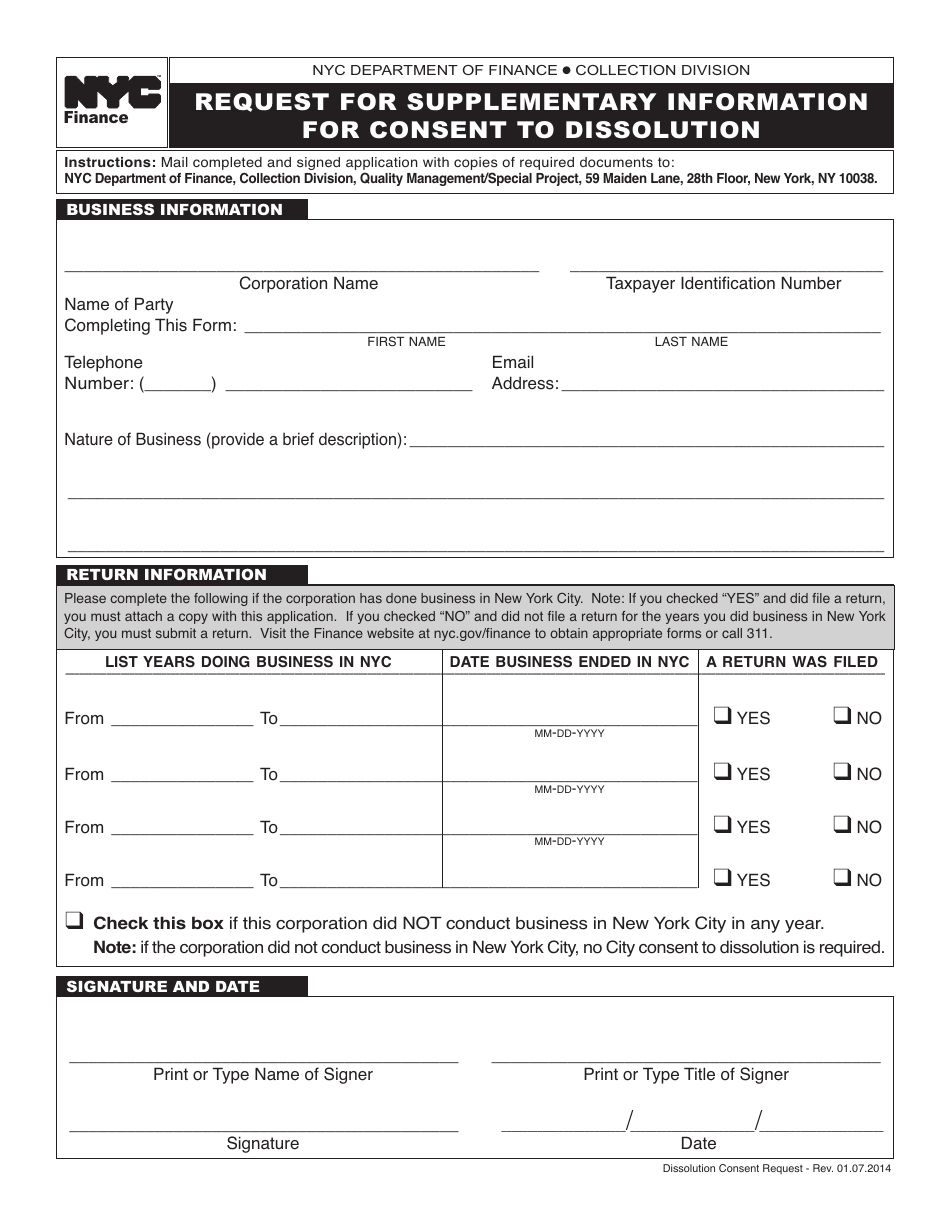

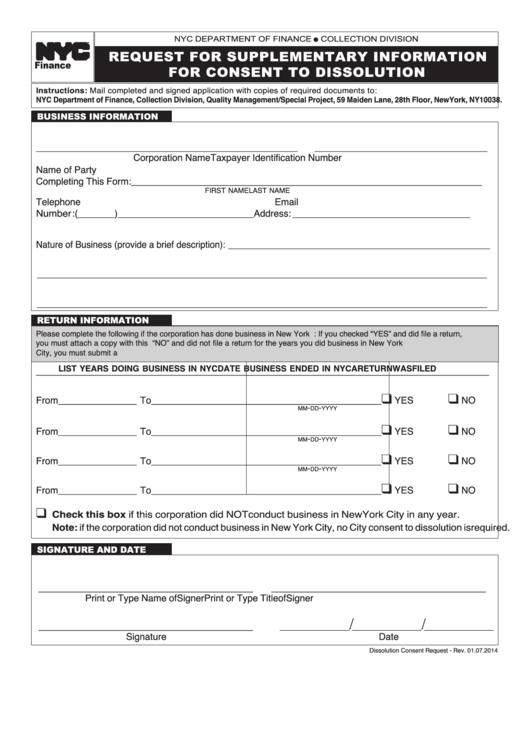

And.a check for $60 payable to the new. Web the tax department will issue either a consent to dissolution of a domestic corporation or a letter detailing what needs to be done before the consent can be issued. Get your online template and fill it in using progressive features. Easily fill out pdf blank, edit, and sign them. Web consent of the new york city commissioner of finance must be attached to the certificate of dissolution if the corporation has done business in and incurred tax liability to the city. Web complete the request for consent to dissolution form. Web request for consent of the commissioner of finance for the dissolution of: The telephone number, fax number, and address where you can. We'll help with all the paperwork you need to officially close your business. Web ★ 4.8 satisfied 58 votes how to fill out and sign ny certificate of dissolution online?

Save or instantly send your ready documents. Web the certificate of dissolution requires the consent of the new york state department of taxation and finance. The telephone number, fax number, and address where you can. Easily fill out pdf blank, edit, and sign them. Web step 1 depending on your organization's status, you may be required to send the following documents to the tax department: The document has moved here. How a new york corporation can be reinstated after it has. Ad simply answer a few questions. Edit your tr 960 consent to dissolution of a corporation online type text, add images, blackout confidential details, add comments, highlights and more. Use ctrl + f to search for specific content in the instructions.

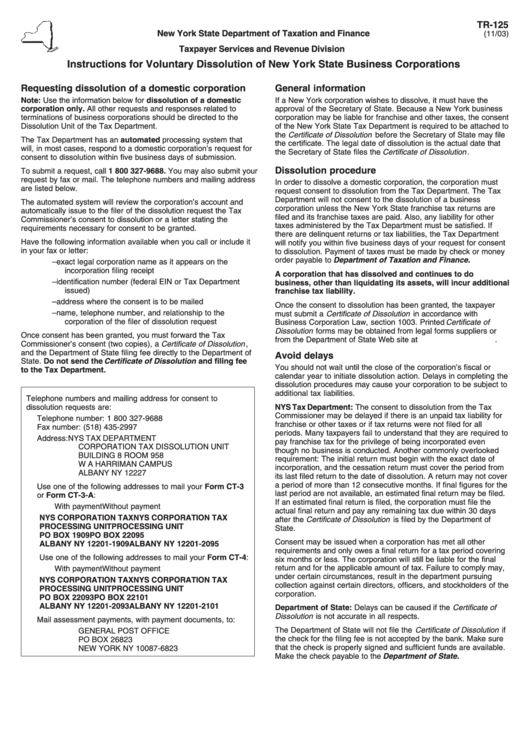

Form tr 125 Fill out & sign online DocHub

If you are filing the request on behalf of a corporation, you must also complete a power of attorney form. We'll create & file the articles of dissolution for you. Web step 1 depending on your organization's status, you may be required to send the following documents to the tax department: Sign it in a few. Web this procedure involves.

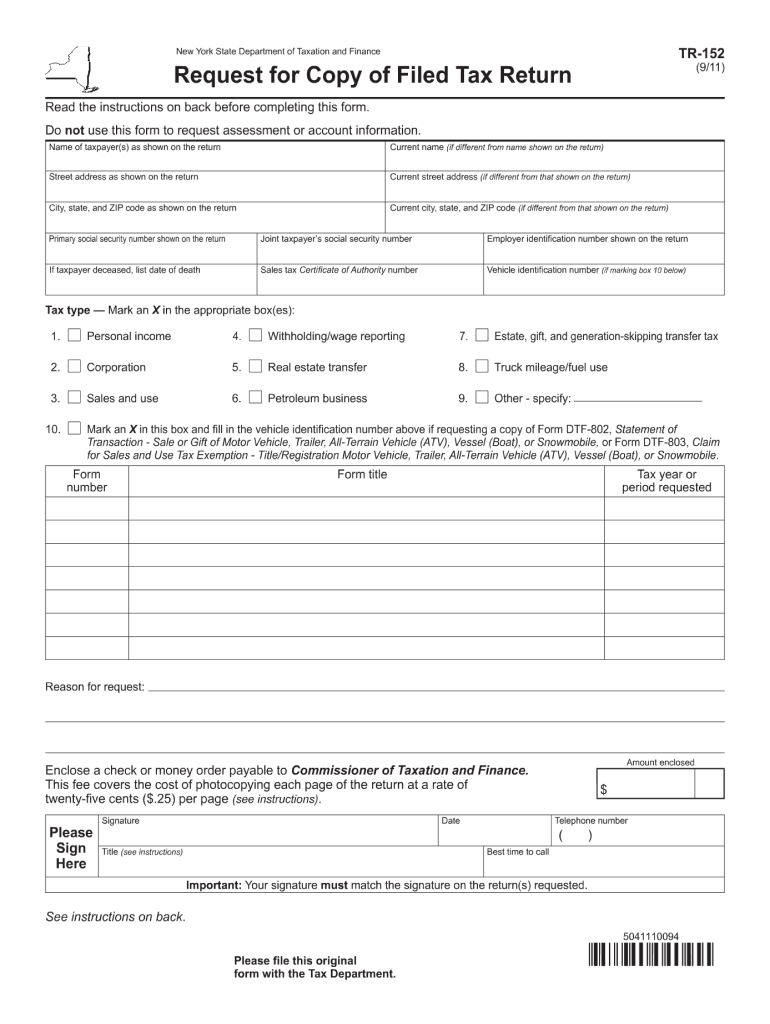

NY DTF TR579IT 2019 Fill out Tax Template Online US Legal Forms

Sign it in a few. We'll help with all the paperwork you need to officially close your business. Web dissolution letter from step 3 (officially named: The telephone number, fax number, and address where you can. If you are filing the request on behalf of a corporation, you must also complete a power of attorney form.

Online Form Tr 960 PDF Fillout

Web within 90 days following the dissolution and the commencement of winding up the limited liability company, or at any other time that there are no members, a domestic limited. The telephone number, fax number, and address where you can. Web consent of the new york city commissioner of finance must be attached to the certificate of dissolution if the.

Form Tr125 Instructions For Voluntary Dissolution Of New York State

We'll help with all the paperwork you need to officially close your business. Web the tax department will issue either a consent to dissolution of a domestic corporation or a letter detailing what needs to be done before the consent can be issued. Web the certificate of dissolution requires the consent of the new york state department of taxation and.

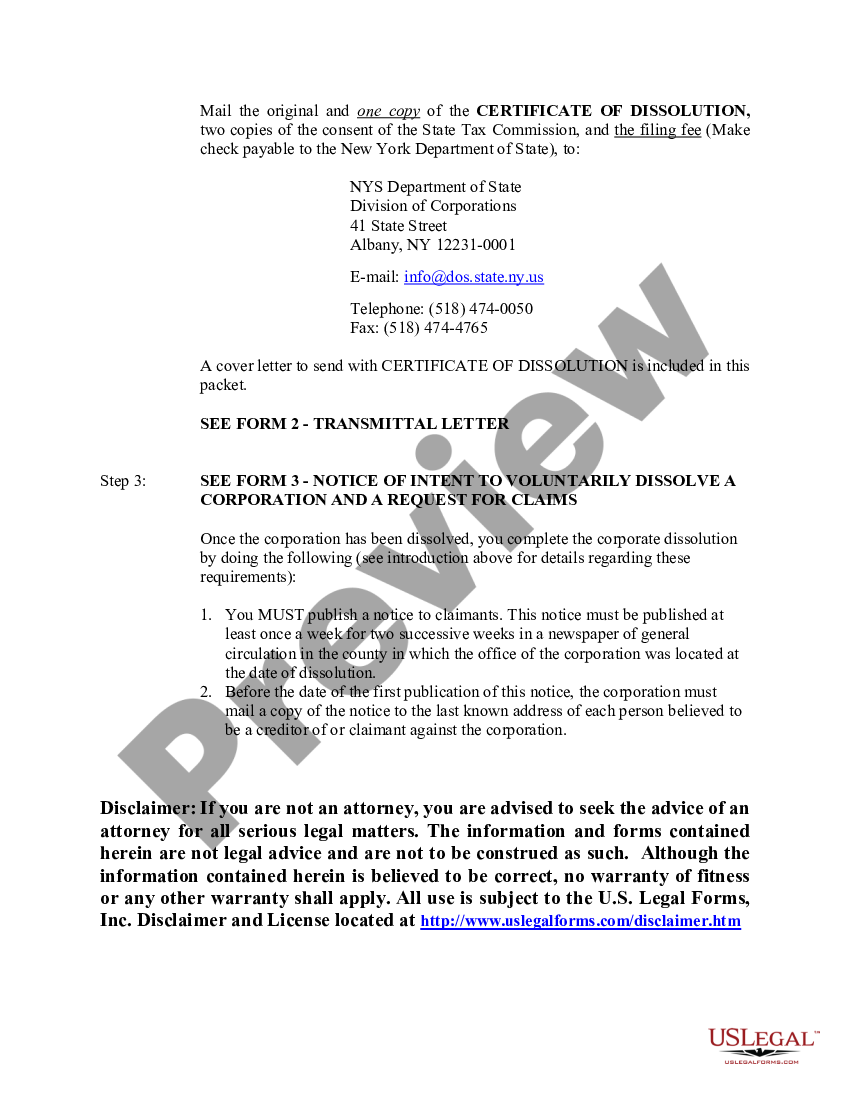

New York Dissolution Package to Dissolve Corporation How To Dissolve

Web dissolution letter from step 3 (officially named: Web consent of the new york city commissioner of finance must be attached to the certificate of dissolution if the corporation has done business in and incurred tax liability to the city. Takes less than one minute. Web complete the request for consent to dissolution form. Web the tax department will issue.

New York City Request for Supplementary Information for Consent to

Save or instantly send your ready documents. Use ctrl + f to search for specific content in the instructions. We'll create & file the articles of dissolution for you. If you are filing the request on behalf of a corporation, you must also complete a power of attorney form. We'll help with all the paperwork you need to officially close.

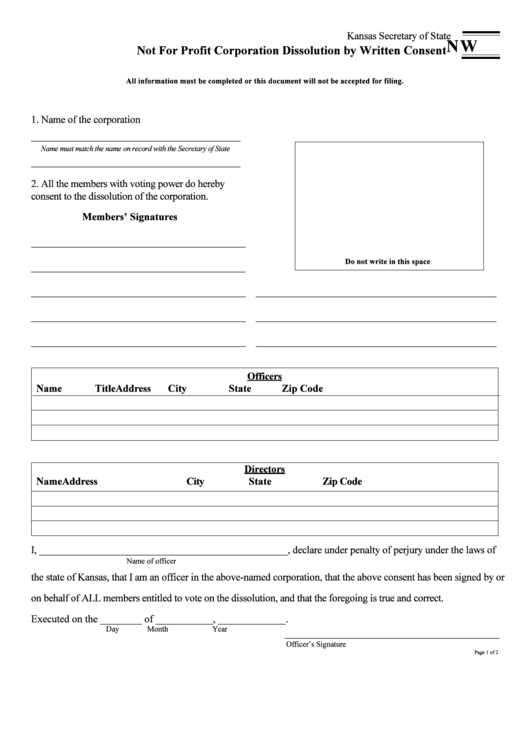

Form Nw Not For Profit Corporation Dissolution By Written Consent

Web this procedure involves the following steps: Written consent to dissolve corporation. Save or instantly send your ready documents. Web request for consent of the commissioner of finance for the dissolution of: Web step 1 depending on your organization's status, you may be required to send the following documents to the tax department:

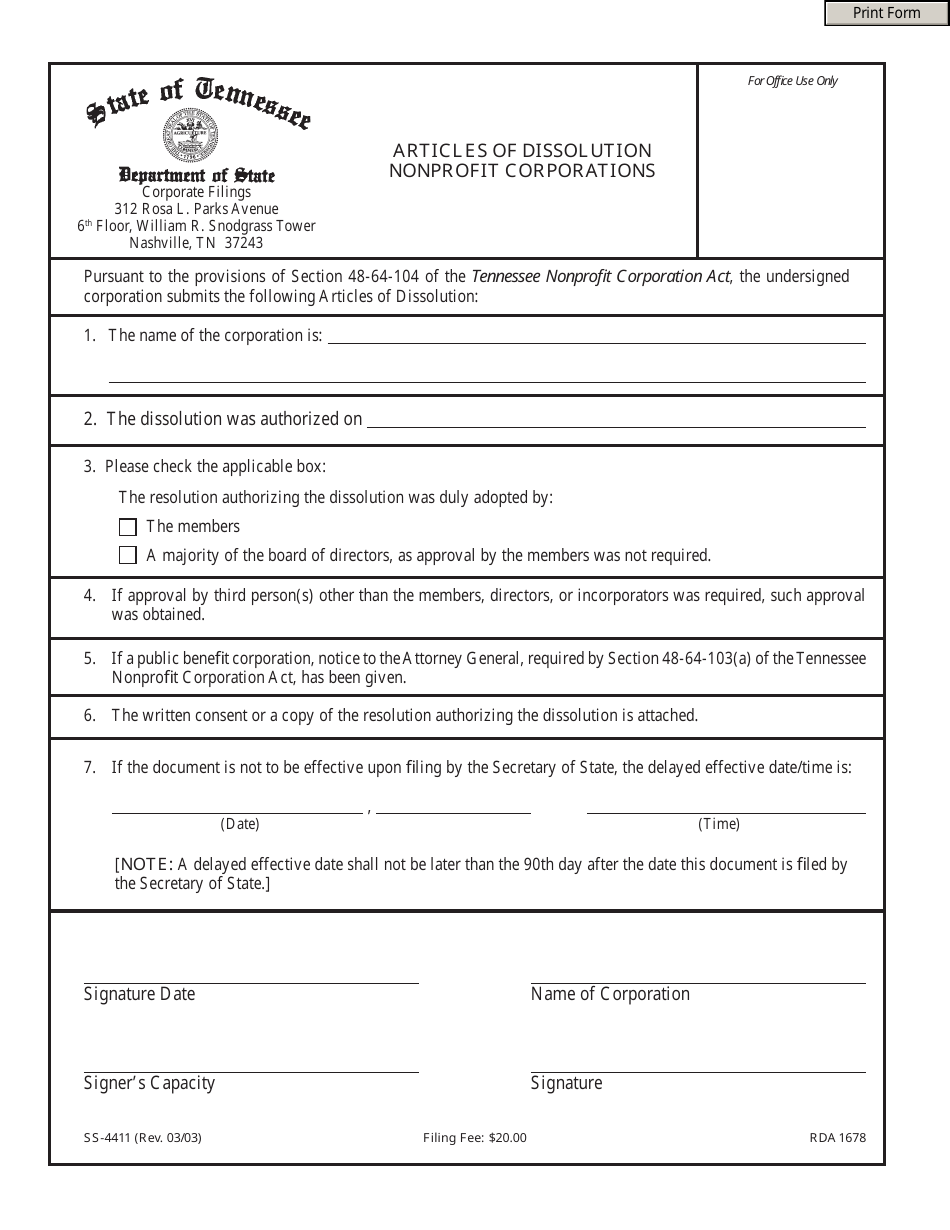

Form SS4411 Download Fillable PDF or Fill Online Articles of

Edit your tr 960 consent to dissolution of a corporation online type text, add images, blackout confidential details, add comments, highlights and more. Web this procedure involves the following steps: Easily fill out pdf blank, edit, and sign them. Web the tax department will issue either a consent to dissolution of a domestic corporation or a letter detailing what needs.

Trust Dissolution Form Fill Online, Printable, Fillable, Blank

Ad simply answer a few questions. Web dissolution letter from step 3 (officially named: Sign it in a few. Web this procedure involves the following steps: Get your online template and fill it in using progressive features.

Y Information For Consent To Dissolution Form Nyc Finance printable pdf

Web the certificate of dissolution requires the consent of the new york state department of taxation and finance. Ad simply answer a few questions. Approved by all 50 states. Web complete the request for consent to dissolution form. The document has moved here.

Written Consent To Dissolve Corporation.

Web this procedure involves the following steps: Get your online template and fill it in using progressive features. Web dissolution letter from step 3 (officially named: Web consent of the new york city commissioner of finance must be attached to the certificate of dissolution if the corporation has done business in and incurred tax liability to the city.

Web ★ 4.8 Satisfied 58 Votes How To Fill Out And Sign Ny Certificate Of Dissolution Online?

Web the tax department will issue either a consent to dissolution of a domestic corporation or a letter detailing what needs to be done before the consent can be issued. If you are filing the request on behalf of a corporation, you must also complete a power of attorney form. Takes less than one minute. We'll create & file the articles of dissolution for you.

Web Within 90 Days Following The Dissolution And The Commencement Of Winding Up The Limited Liability Company, Or At Any Other Time That There Are No Members, A Domestic Limited.

Ad simply answer a few questions. Approved by all 50 states. The corporation obtains written consent from the tax department 1, indicating that the corporation has filed all its returns and paid all. Sign it in a few.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

And.a check for $60 payable to the new. Web step 1 depending on your organization's status, you may be required to send the following documents to the tax department: Web complete the request for consent to dissolution form. Web web instructions are more accessible, easier to understand, and easier to navigate.