Form Nd 1

Form Nd 1 - Forms are listed below by tax type in the current tax year. Enter your north dakota taxable income from line 18 of page 1 21. Complete and send in with your return if you: Web file your north dakota and federal tax returns online with turbotax in minutes. Credit for income tax paid to another state or local jurisdiction (attach schedule nd. Web you may be required to pay estimated income tax to north dakota if you are required to pay federal estimated income tax and you expect your north dakota net tax liability to. Web north dakota has a state income tax that ranges between 1.1% and 2.9%. We last updated the individual income tax return. Read across to the amount shown in the married filing jointly column. Web their north dakota taxable income is $49,935.

Enter your north dakota taxable income from line 18 of page 1 21. Web north dakota has a state income tax that ranges between 1.1% and 2.9%. Web the composite return consists of two forms: Web you may be required to pay estimated income tax to north dakota if you are required to pay federal estimated income tax and you expect your north dakota net tax liability to. Credit for income tax paid to another state or local jurisdiction (attach schedule nd. Forms are listed below by tax type in the current tax year. For more information about the north dakota. Read across to the amount shown in the married filing jointly column. Complete and send in with your return if you: Web their north dakota taxable income is $49,935.

Enter your north dakota taxable income from line 18 of page 1 21. For more information about the north dakota. Web north dakota has a state income tax that ranges between 1.1% and 2.9%. Web the composite return consists of two forms: Credit for income tax paid to another state or local jurisdiction (attach schedule nd. We last updated the individual income tax return. Web file your north dakota and federal tax returns online with turbotax in minutes. Web their north dakota taxable income is $49,935. Read across to the amount shown in the married filing jointly column. Forms are listed below by tax type in the current tax year.

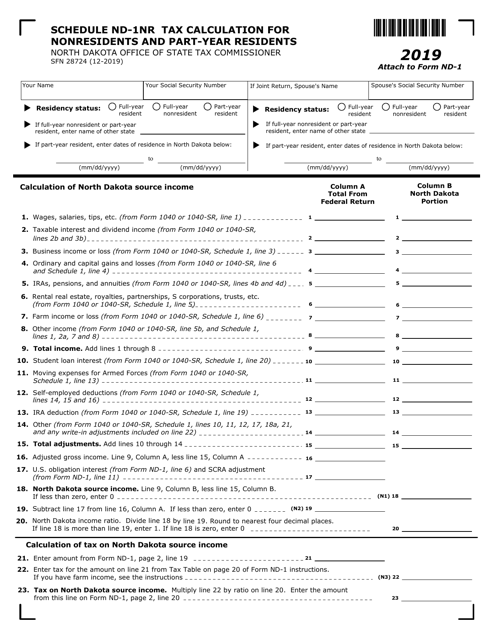

Form ND1 (SFN28724) Schedule NDN1NR Download Fillable PDF or Fill

Web you may be required to pay estimated income tax to north dakota if you are required to pay federal estimated income tax and you expect your north dakota net tax liability to. Forms are listed below by tax type in the current tax year. Web file your north dakota and federal tax returns online with turbotax in minutes. Web.

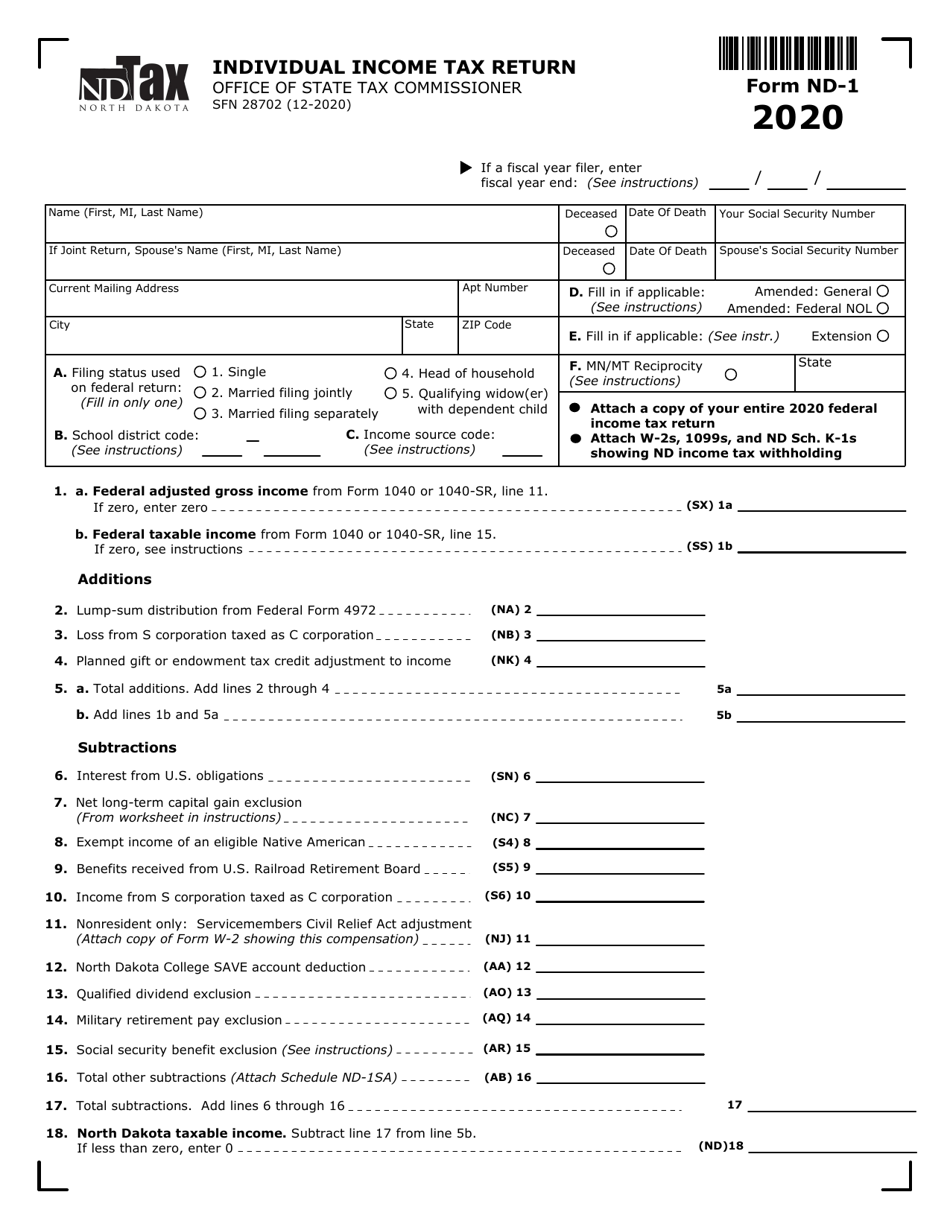

Form ND1 (SFN28702) Download Fillable PDF or Fill Online Individual

Web north dakota has a state income tax that ranges between 1.1% and 2.9%. We last updated the individual income tax return. For more information about the north dakota. Web the composite return consists of two forms: Read across to the amount shown in the married filing jointly column.

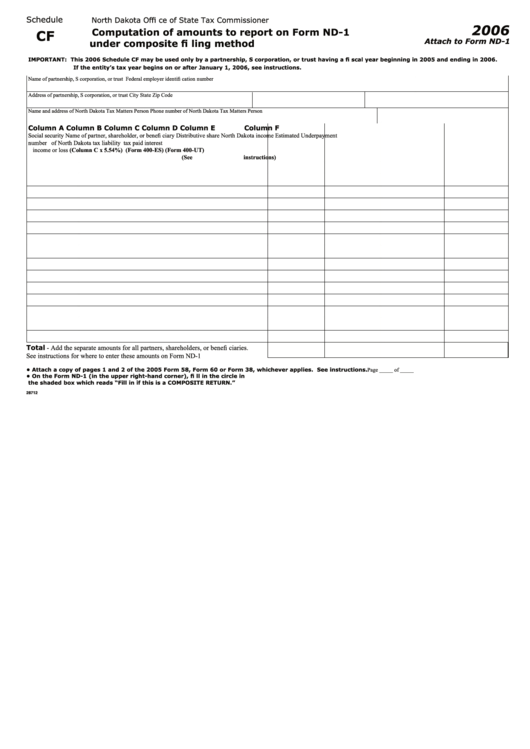

Fillable Form Nd1 Schedule Cf Computation Of Amounts To Report

Web you may be required to pay estimated income tax to north dakota if you are required to pay federal estimated income tax and you expect your north dakota net tax liability to. Web their north dakota taxable income is $49,935. Enter your north dakota taxable income from line 18 of page 1 21. Read across to the amount shown.

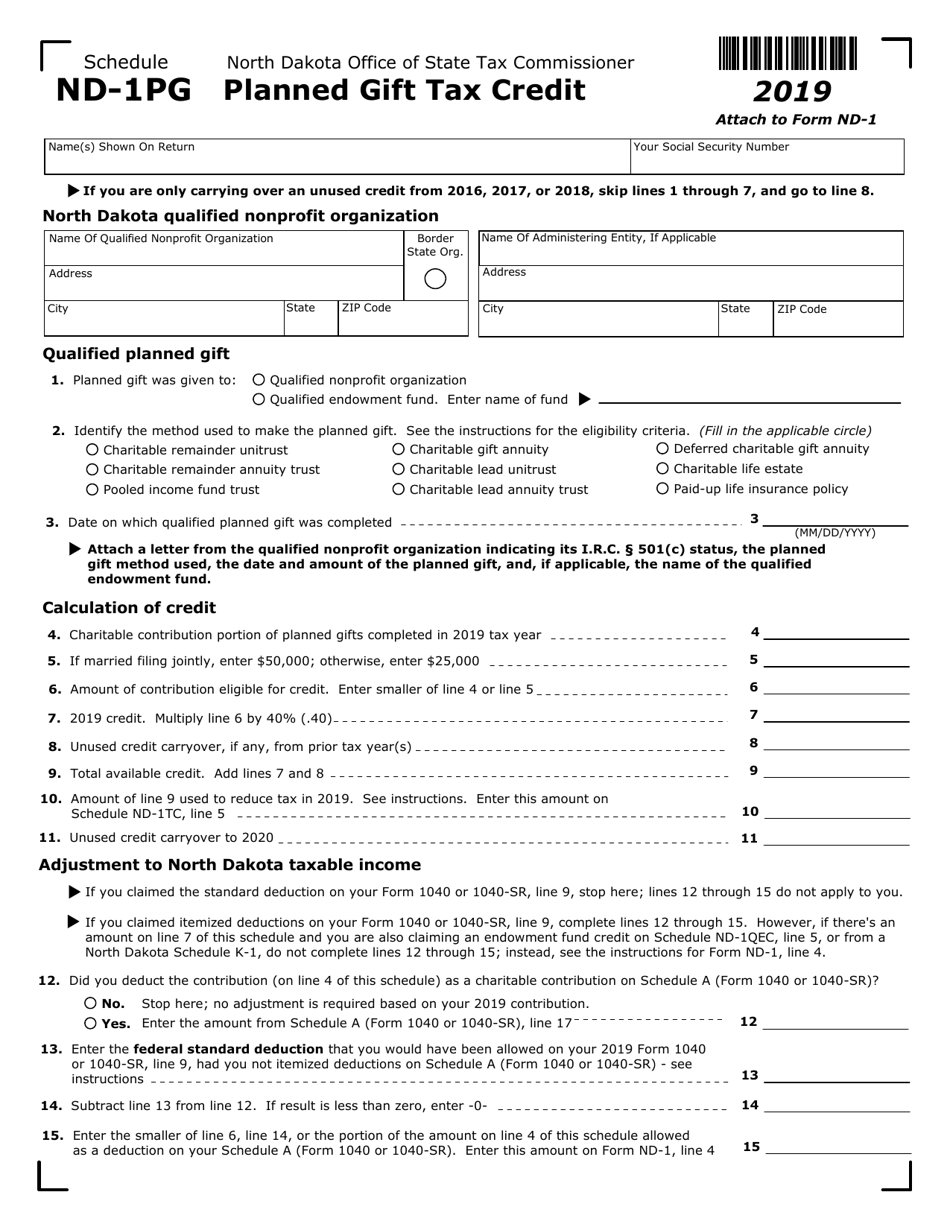

Form ND1 (SFN28705) Schedule ND1PG Download Fillable PDF or Fill

Web the composite return consists of two forms: Read across to the amount shown in the married filing jointly column. Web their north dakota taxable income is $49,935. Credit for income tax paid to another state or local jurisdiction (attach schedule nd. For more information about the north dakota.

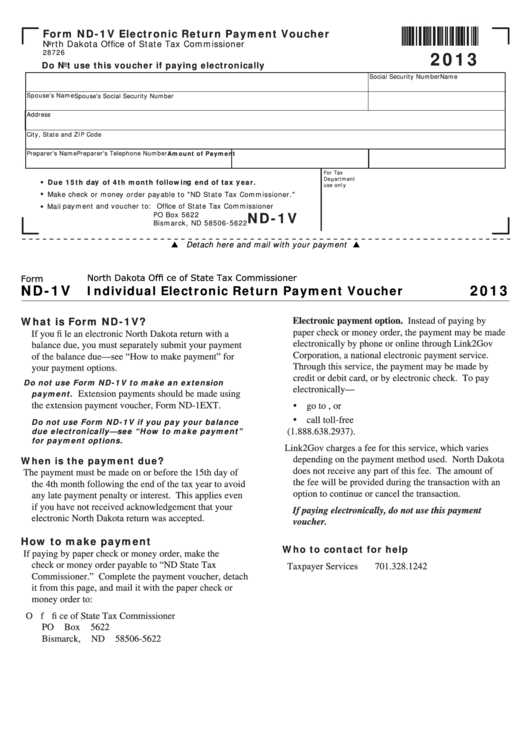

Fillable Form Nd1v Individual Electronic Return Payment Voucher

Web the composite return consists of two forms: Web file your north dakota and federal tax returns online with turbotax in minutes. We last updated the individual income tax return. Enter your north dakota taxable income from line 18 of page 1 21. Credit for income tax paid to another state or local jurisdiction (attach schedule nd.

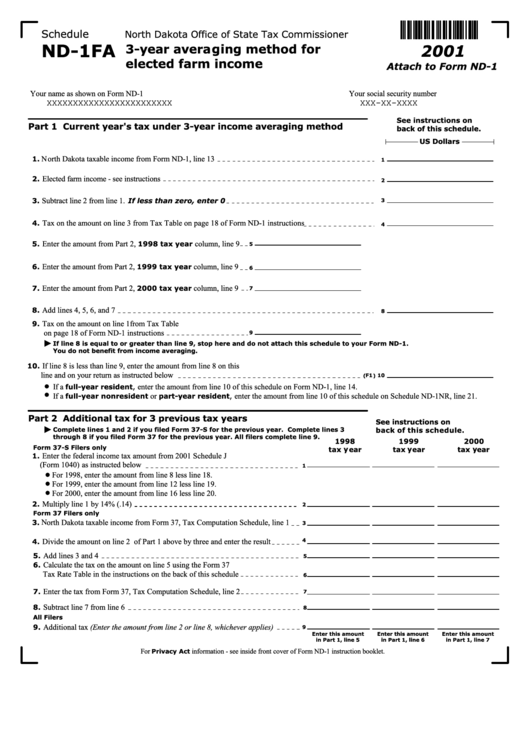

Form Nd1fa 3Year Averaging Method For Elected Farm printable

Web file your north dakota and federal tax returns online with turbotax in minutes. We last updated the individual income tax return. Web north dakota has a state income tax that ranges between 1.1% and 2.9%. Forms are listed below by tax type in the current tax year. Web their north dakota taxable income is $49,935.

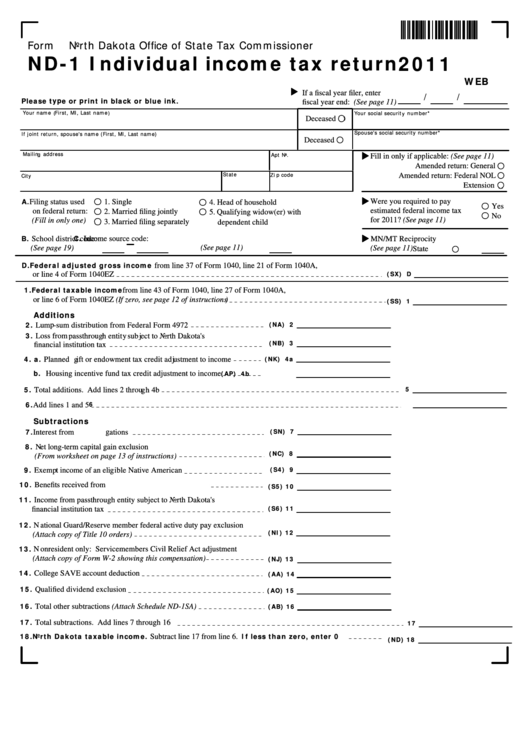

Fillable Form Nd1 Individual Tax Return 2011 printable pdf

For more information about the north dakota. Web you may be required to pay estimated income tax to north dakota if you are required to pay federal estimated income tax and you expect your north dakota net tax liability to. Web the composite return consists of two forms: Credit for income tax paid to another state or local jurisdiction (attach.

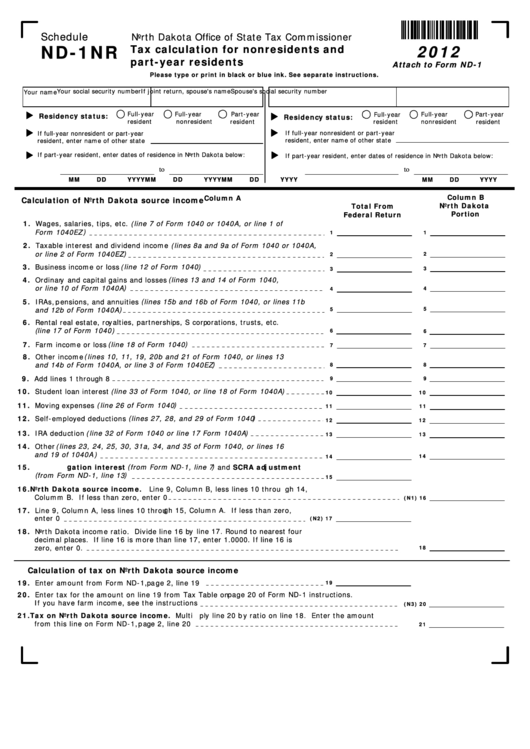

Fillable Schedule Nd1nr Tax Calculation For Nonresidents And Part

Complete and send in with your return if you: Read across to the amount shown in the married filing jointly column. Web north dakota has a state income tax that ranges between 1.1% and 2.9%. Web their north dakota taxable income is $49,935. For more information about the north dakota.

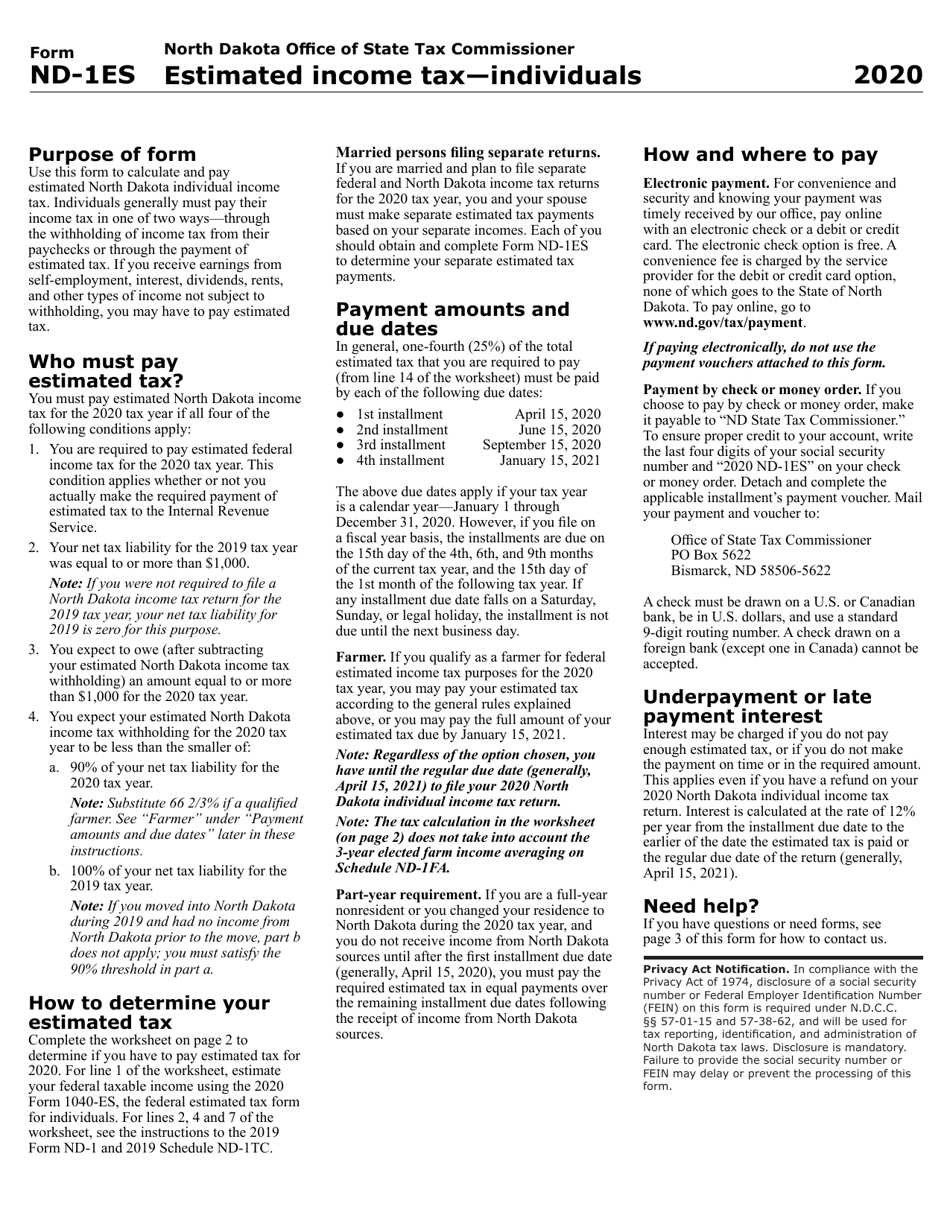

Form ND1ES Download Fillable PDF or Fill Online Estimated Tax

Web north dakota has a state income tax that ranges between 1.1% and 2.9%. Read across to the amount shown in the married filing jointly column. We last updated the individual income tax return. Forms are listed below by tax type in the current tax year. For more information about the north dakota.

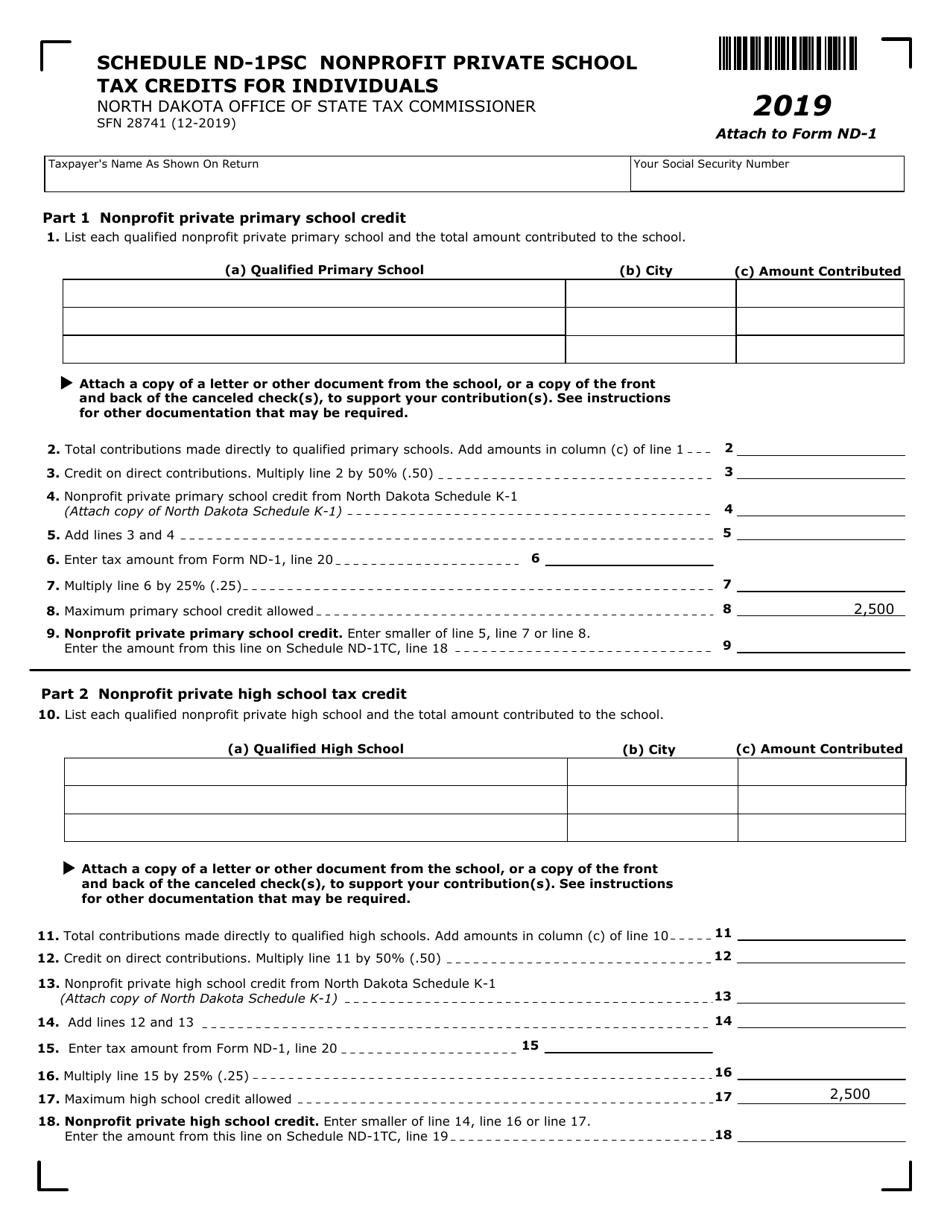

Form ND1 (SFN28741) Schedule ND1PSC Download Fillable PDF or Fill

Web file your north dakota and federal tax returns online with turbotax in minutes. Web you may be required to pay estimated income tax to north dakota if you are required to pay federal estimated income tax and you expect your north dakota net tax liability to. Web the composite return consists of two forms: Forms are listed below by.

Credit For Income Tax Paid To Another State Or Local Jurisdiction (Attach Schedule Nd.

Web file your north dakota and federal tax returns online with turbotax in minutes. Web their north dakota taxable income is $49,935. Read across to the amount shown in the married filing jointly column. For more information about the north dakota.

Web The Composite Return Consists Of Two Forms:

Enter your north dakota taxable income from line 18 of page 1 21. We last updated the individual income tax return. Web you may be required to pay estimated income tax to north dakota if you are required to pay federal estimated income tax and you expect your north dakota net tax liability to. Complete and send in with your return if you:

Forms Are Listed Below By Tax Type In The Current Tax Year.

Web north dakota has a state income tax that ranges between 1.1% and 2.9%.