Form W8-Ben-E Instructions

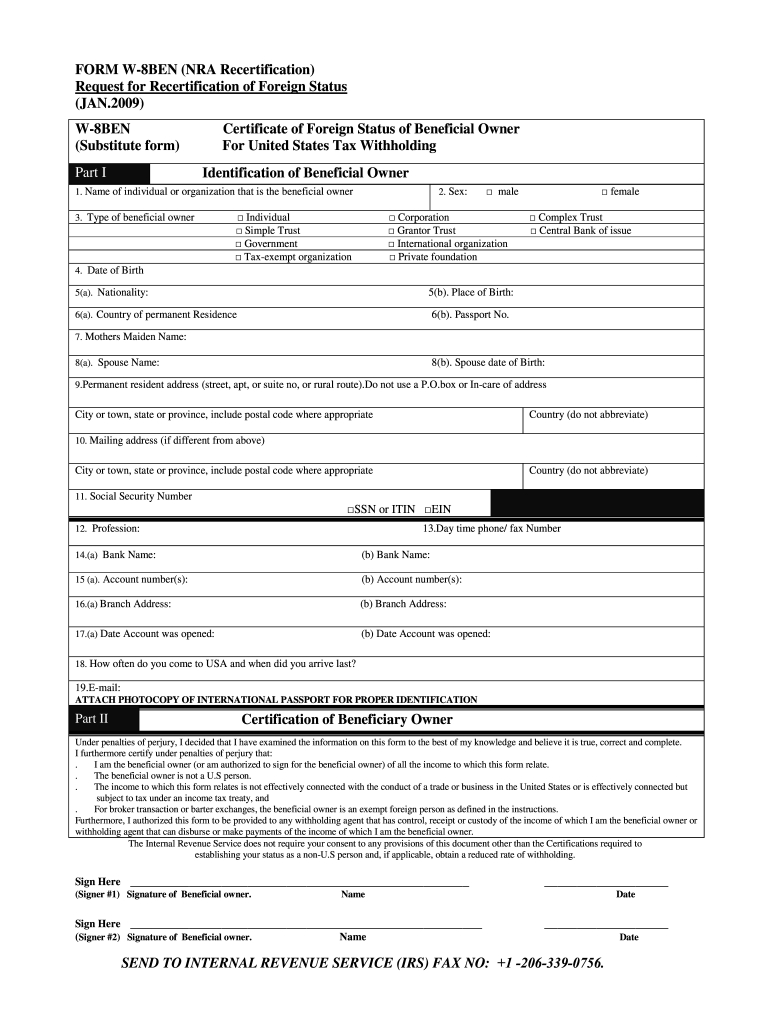

Form W8-Ben-E Instructions - Web you are a foreign entity documenting your foreign status, documenting your chapter 4 status, or claiming treaty benefits. Review the situations listed at the top of the form under the header “do not use this form if.”. It’s best to review the form with your tax advisor in order to. If applicable, the withholding agent may rely on the form w. What's new guidance under section 1446(f). For paperwork reduction act notice, see separate instructions. For general information and the purpose of. October 2021) department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding and. Web below are some brief instructions on how to fill in the top required parts of the form in less than 10 minutes: Instead, give it to the person who is.

What's new guidance under section 1446(f). For general information and the purpose of. Web you are a foreign entity documenting your foreign status, documenting your chapter 4 status, or claiming treaty benefits. It’s best to review the form with your tax advisor in order to. Instead, give it to the person who is. Review the situations listed at the top of the form under the header “do not use this form if.”. Web below are some brief instructions on how to fill in the top required parts of the form in less than 10 minutes: If applicable, the withholding agent may rely on the form w. October 2021) department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding and. For paperwork reduction act notice, see separate instructions.

It’s best to review the form with your tax advisor in order to. For paperwork reduction act notice, see separate instructions. What's new guidance under section 1446(f). Instead, give it to the person who is. If applicable, the withholding agent may rely on the form w. Web you are a foreign entity documenting your foreign status, documenting your chapter 4 status, or claiming treaty benefits. For general information and the purpose of. October 2021) department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding and. Web below are some brief instructions on how to fill in the top required parts of the form in less than 10 minutes: Review the situations listed at the top of the form under the header “do not use this form if.”.

W 8ben Instructions Canada

For paperwork reduction act notice, see separate instructions. It’s best to review the form with your tax advisor in order to. Web you are a foreign entity documenting your foreign status, documenting your chapter 4 status, or claiming treaty benefits. For general information and the purpose of. Instead, give it to the person who is.

W 8ben E Instructions 2014

Web below are some brief instructions on how to fill in the top required parts of the form in less than 10 minutes: October 2021) department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding and. For paperwork reduction act notice, see separate instructions. If applicable, the withholding agent may rely.

W 8ben E Instructions Chapter 4 Status

Review the situations listed at the top of the form under the header “do not use this form if.”. It’s best to review the form with your tax advisor in order to. What's new guidance under section 1446(f). If applicable, the withholding agent may rely on the form w. Web you are a foreign entity documenting your foreign status, documenting.

Irs Form W8 Printable Example Calendar Printable

Web you are a foreign entity documenting your foreign status, documenting your chapter 4 status, or claiming treaty benefits. For paperwork reduction act notice, see separate instructions. Review the situations listed at the top of the form under the header “do not use this form if.”. For general information and the purpose of. If applicable, the withholding agent may rely.

W8BEN Form Instructions for Canadians Cansumer

If applicable, the withholding agent may rely on the form w. For paperwork reduction act notice, see separate instructions. It’s best to review the form with your tax advisor in order to. Review the situations listed at the top of the form under the header “do not use this form if.”. Instead, give it to the person who is.

W8BEN Form Instructions for Canadians Cansumer

Instead, give it to the person who is. For paperwork reduction act notice, see separate instructions. If applicable, the withholding agent may rely on the form w. What's new guidance under section 1446(f). October 2021) department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding and.

W 8ben instructions for canadian corporations

Review the situations listed at the top of the form under the header “do not use this form if.”. For general information and the purpose of. Web you are a foreign entity documenting your foreign status, documenting your chapter 4 status, or claiming treaty benefits. Web below are some brief instructions on how to fill in the top required parts.

W8bene instructions uk 2016

What's new guidance under section 1446(f). For paperwork reduction act notice, see separate instructions. Web you are a foreign entity documenting your foreign status, documenting your chapter 4 status, or claiming treaty benefits. If applicable, the withholding agent may rely on the form w. Instead, give it to the person who is.

Blank 2018 Form W 8ben E 2020 Fill and Sign Printable Template Online

Instead, give it to the person who is. Web below are some brief instructions on how to fill in the top required parts of the form in less than 10 minutes: For general information and the purpose of. If applicable, the withholding agent may rely on the form w. For paperwork reduction act notice, see separate instructions.

Miscellaneous Archives My Sweet Retirement

What's new guidance under section 1446(f). October 2021) department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding and. Review the situations listed at the top of the form under the header “do not use this form if.”. It’s best to review the form with your tax advisor in order to..

Review The Situations Listed At The Top Of The Form Under The Header “Do Not Use This Form If.”.

Web below are some brief instructions on how to fill in the top required parts of the form in less than 10 minutes: For general information and the purpose of. October 2021) department of the treasury internal revenue service certificate of foreign status of beneficial owner for united states tax withholding and. Web you are a foreign entity documenting your foreign status, documenting your chapter 4 status, or claiming treaty benefits.

What's New Guidance Under Section 1446(F).

If applicable, the withholding agent may rely on the form w. Instead, give it to the person who is. For paperwork reduction act notice, see separate instructions. It’s best to review the form with your tax advisor in order to.