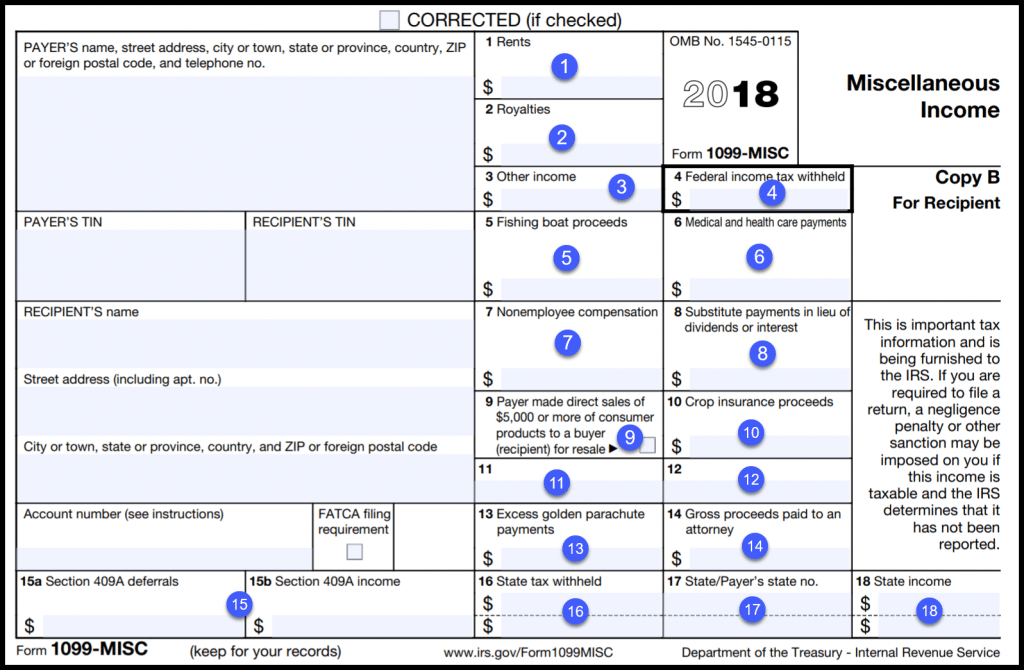

How Do I Fill Out A 1099 Form For Myself

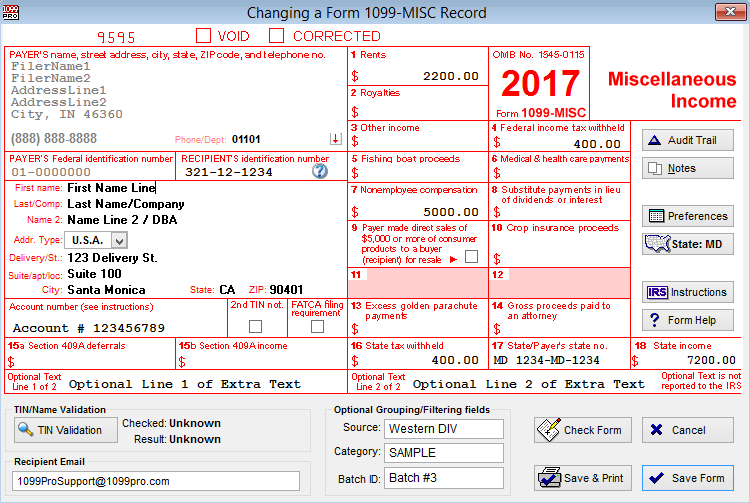

How Do I Fill Out A 1099 Form For Myself - The form reports the interest income you. Se tax is a social security and medicare tax primarily for individuals who. Web january 27, 2020 6:00 pm. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. File your 1099 form corrections in minutes with our online software with any browser Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. You can request a tcc by filling out form 4419and. Best overall payroll software for small businesses by business.com This form must be produced with the help of compatible accountingsoftware.

Web this little known plugin reveals the answer. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. File your 1099 form corrections in minutes with our online software with any browser You do not pay yourself. Complete irs tax forms online or print government tax documents. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Se tax is a social security and medicare tax primarily for individuals who. Web am i required to file a form 1099 or other information return? Web the easiest way to fill a 1099 form is electronically, and you can do so using the irs filing a return electronically (fire) system. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations.

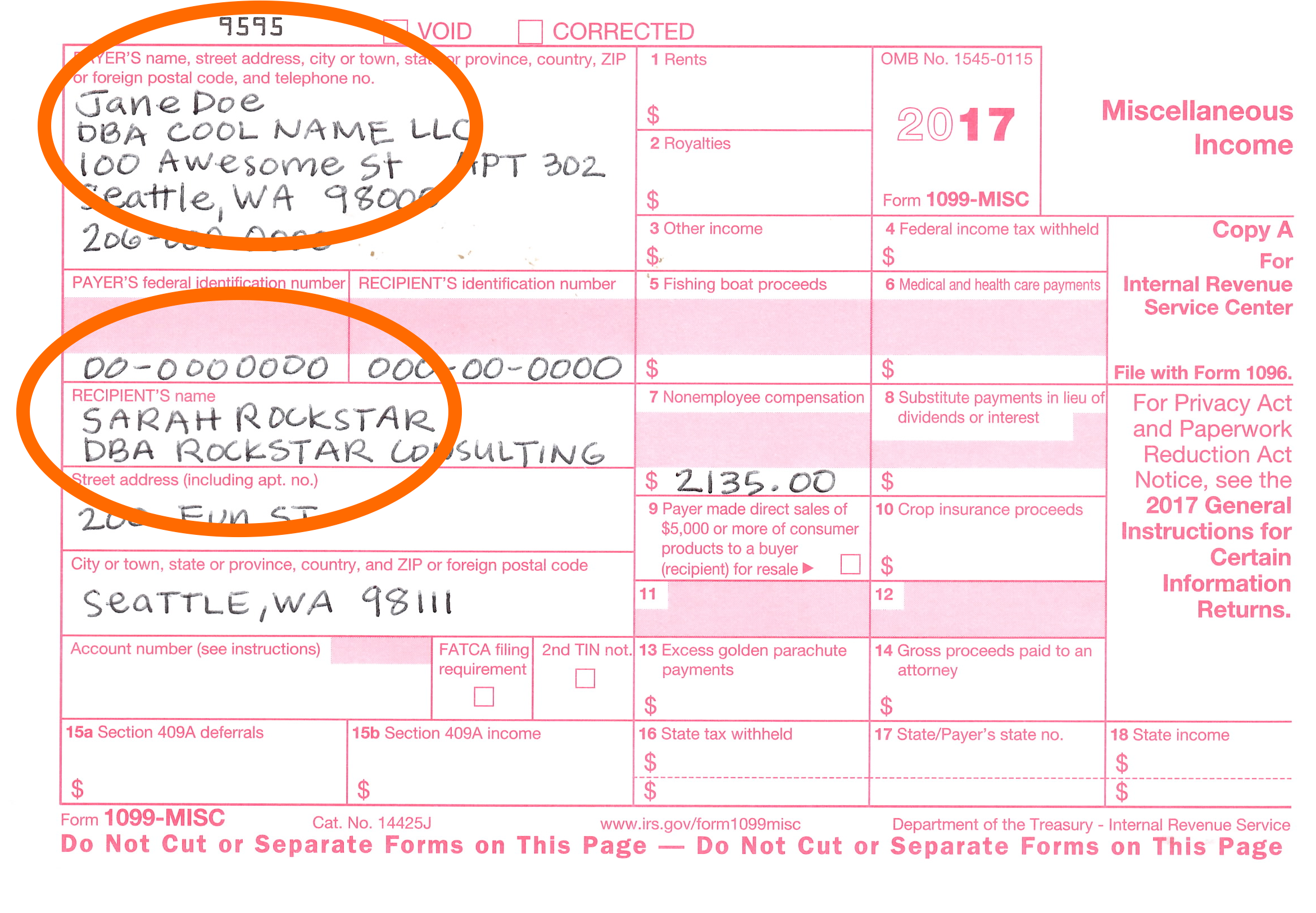

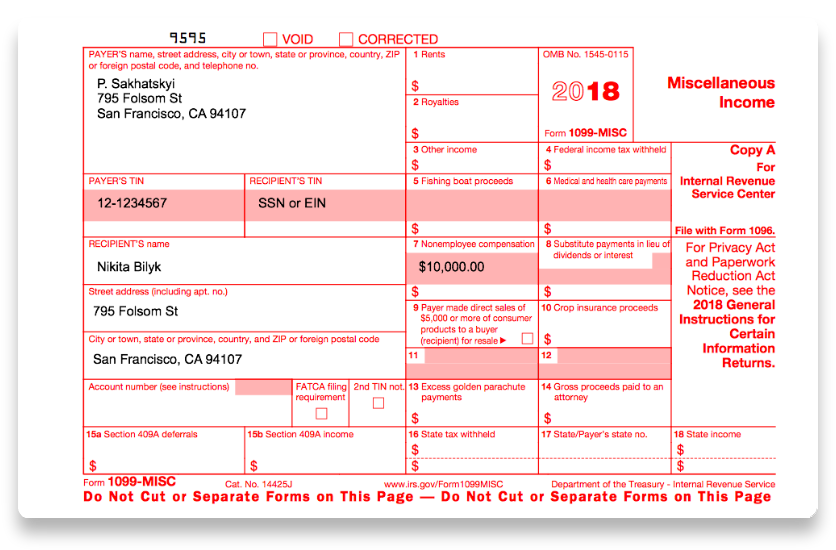

Many other versions of a 1099 form also can. Web this little known plugin reveals the answer. Web who gets a 1099? You do not pay yourself. Se tax is a social security and medicare tax primarily for individuals who. You can request a tcc by filling out form 4419and. Your name, address and taxpayer id number 2. The form detailing any wages you paid in the previous calendar year must be submitted to the payee by january 31 and the irs by. Before doing so, you need to. Web level 15 as the sole proprietor owner of a business, you report the income and expenses as a part of your personal tax return on sch c.

How to PDF Printing 1099misc forms

The form reports the interest income you. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Many other versions of a 1099 form also can. Se tax is a social security and medicare tax primarily for individuals who. You can request a tcc by filling out form 4419and.

Where To Get Blank 1099 Misc Forms Form Resume Examples EZVgexk9Jk

File your 1099 form corrections in minutes with our online software with any browser Web am i required to file a form 1099 or other information return? You do not pay yourself. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Your name, address and taxpayer id number 2.

IRS Form 1099 Reporting for Small Business Owners

Web this little known plugin reveals the answer. Before doing so, you need to. You can request a tcc by filling out form 4419and. You cannot designate a worker, including yourself, as an employee or independent contractor solely by the issuance of form w. Many other versions of a 1099 form also can.

Florida 1099 Form Online Universal Network

Web how do i know if i need to file a 1099? Complete, edit or print tax forms instantly. Web this little known plugin reveals the answer. Complete irs tax forms online or print government tax documents. Before using fire, you need a transmitter control code (tcc).

25 ++ sample completed 1099 misc form 2020 325140How to fill in 1099

Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. The form reports the interest income you. Best overall payroll software for small businesses by business.com Complete, edit or print tax forms instantly. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

1099NEC Software Print & eFile 1099NEC Forms

This form must be produced with the help of compatible accountingsoftware. Web january 27, 2020 6:00 pm. Ad access irs tax forms. Before using fire, you need a transmitter control code (tcc). File your 1099 form corrections in minutes with our online software with any browser

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

Many other versions of a 1099 form also can. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Your name, address and taxpayer id number 2. Web am i required to file a form 1099 or other information return? Best overall payroll software for small businesses by business.com

Free Printable 1099 Misc Forms Free Printable

Your name, address and taxpayer id number 2. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web how do i file the 1099 form? Complete irs tax forms online or print government tax documents. Web january 27, 2020 6:00 pm.

How To Fill Out 1099 Misc Form 2019 Paul Johnson's Templates

Web how do i file the 1099 form? Web the easiest way to fill a 1099 form is electronically, and you can do so using the irs filing a return electronically (fire) system. Web this little known plugin reveals the answer. Web who gets a 1099? Ad access irs tax forms.

1099 Form Independent Contractor Pdf FREE 10+ Sample Independent

Ad access irs tax forms. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web level 15 as the sole proprietor owner of a business, you report the income and expenses as a part of your personal tax return on sch c. Before using fire, you need a transmitter control code.

Web Watch Newsmax Live For The Latest News And Analysis On Today's Top Stories, Right Here On Facebook.

Se tax is a social security and medicare tax primarily for individuals who. Web january 27, 2020 6:00 pm. Web this little known plugin reveals the answer. Web who gets a 1099?

Best Overall Payroll Software For Small Businesses By Business.com

Web how do i file the 1099 form? Web the easiest way to fill a 1099 form is electronically, and you can do so using the irs filing a return electronically (fire) system. Web am i required to file a form 1099 or other information return? Complete, edit or print tax forms instantly.

Before Using Fire, You Need A Transmitter Control Code (Tcc).

Your name, address and taxpayer id number 2. Ad access irs tax forms. The name, address and taxpayer id number of the company or individual who issued the. You cannot designate a worker, including yourself, as an employee or independent contractor solely by the issuance of form w.

You Do Not Pay Yourself.

Before doing so, you need to. File your 1099 form corrections in minutes with our online software with any browser Complete irs tax forms online or print government tax documents. Web level 15 as the sole proprietor owner of a business, you report the income and expenses as a part of your personal tax return on sch c.