How Do I Get A 8862 Form

How Do I Get A 8862 Form - Guide to head of household. Web you do not need to file form 8862 in the year the credit was disallowed or reduced. When you should file form 8862 and when you. Web sign in to efile.com. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Married filing jointly vs separately. If you wish to take the credit in a. Irs form 8862 is better known as the information to claim certain credits after disallowance form. December 2021) department of the treasury internal revenue service information to claim certain credits after disallowance earned income credit (eic),. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed.

Start completing the fillable fields and. Web if the irs rejected one or more of these credits: Complete, edit or print tax forms instantly. If you wish to take the credit in a. Number each entry on the statement to correspond with the line number on form 8862. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Web you do not need to file form 8862 in the year the credit was disallowed or reduced. Web turbotax can help you fill out your 8862 form, see below for instructions on how to find this form in turbotax and on how to complete it. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed.

December 2021) department of the treasury internal revenue service information to claim certain credits after disallowance earned income credit (eic),. Web how do i file an irs extension (form 4868) in turbotax online? To find the 8862 in. Use get form or simply click on the template preview to open it in the editor. Web tax tips & video homepage. Web sign in to efile.com. Here's how to file form 8862 in turbotax. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Web you do not need to file form 8862 in the year the credit was disallowed or reduced. Sign in to turbotax and select pick.

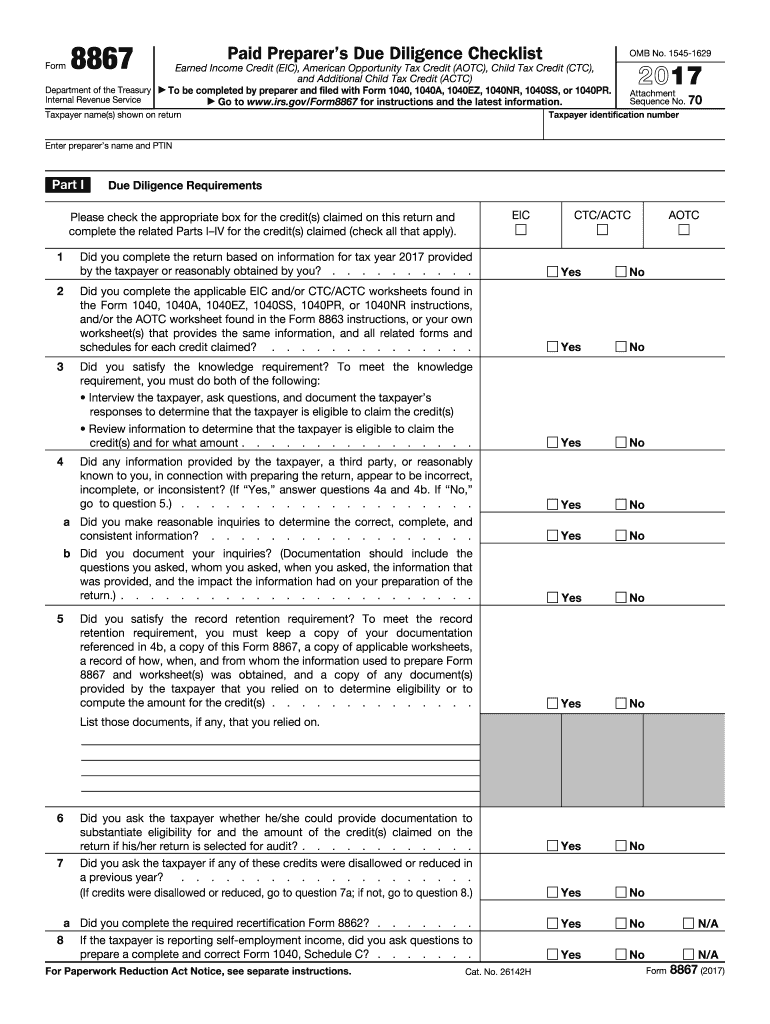

Form 8867 Fill Out and Sign Printable PDF Template signNow

Fill in the applicable credit. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Married filing jointly vs separately. December 2021) department of the treasury internal revenue service information to claim certain credits after disallowance earned income credit (eic),. Sign in to turbotax and select pick.

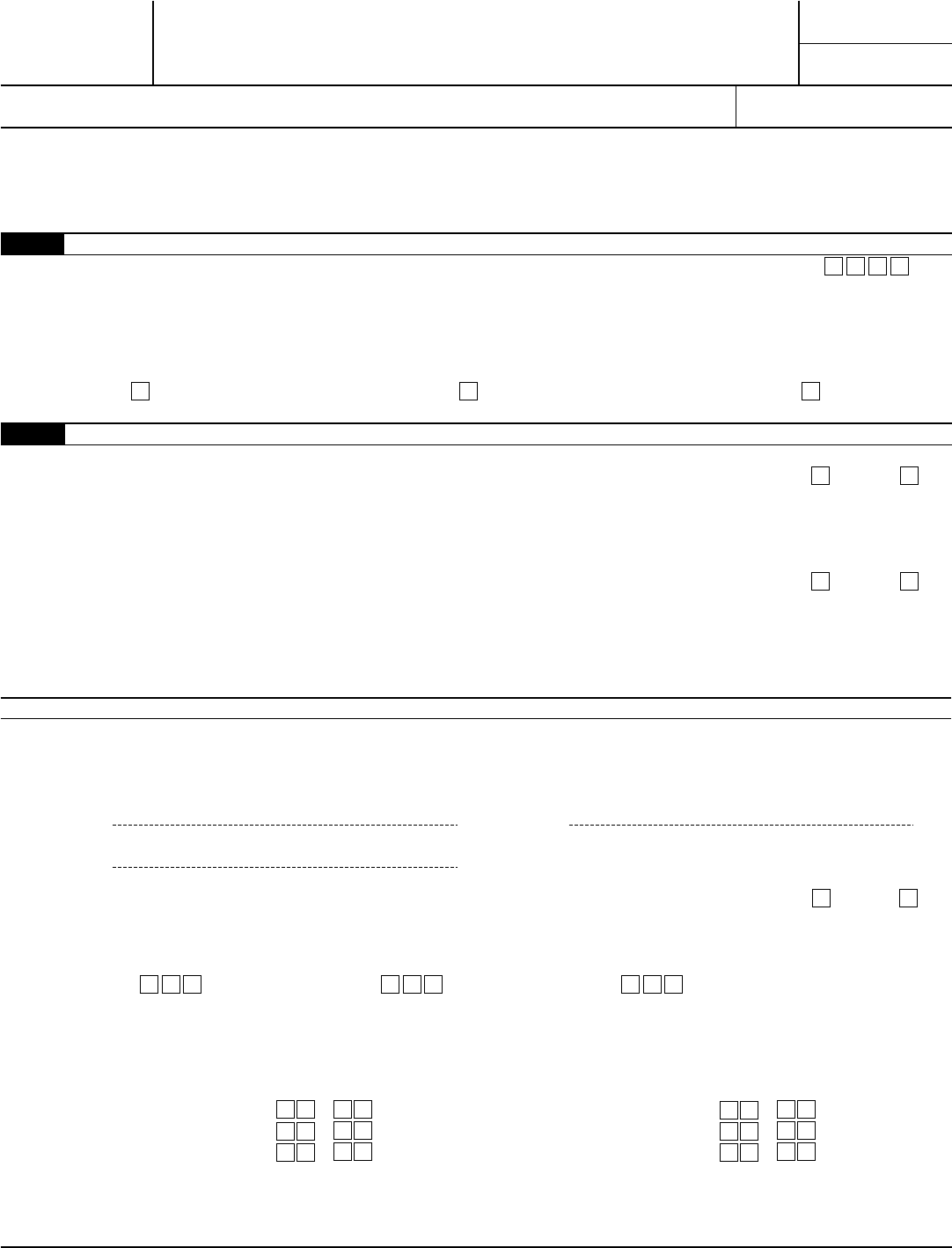

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

Web in this article, we’ll walk through irs form 8862, including: Fill in the applicable credit. Use get form or simply click on the template preview to open it in the editor. Try it for free now! December 2021) department of the treasury internal revenue service information to claim certain credits after disallowance earned income credit (eic),.

Fill Free fillable F8862 Form 8862 (Rev. November 2018) PDF form

When you should file form 8862 and when you. Claiming certain credits after disallowance form 8862;. Start completing the fillable fields and. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. This form is for income earned in tax year 2022, with tax returns due in april.

Form 8862 Claim Earned Credit After Disallowance YouTube

Turbotax self employed online posted june 7, 2019 4:11 pm last updated june 07, 2019 4:11 pm 0 51 52,615 bookmark. Start completing the fillable fields and. Claiming certain credits after disallowance form 8862;. Irs form 8862 is better known as the information to claim certain credits after disallowance form. Sign in to turbotax and select pick.

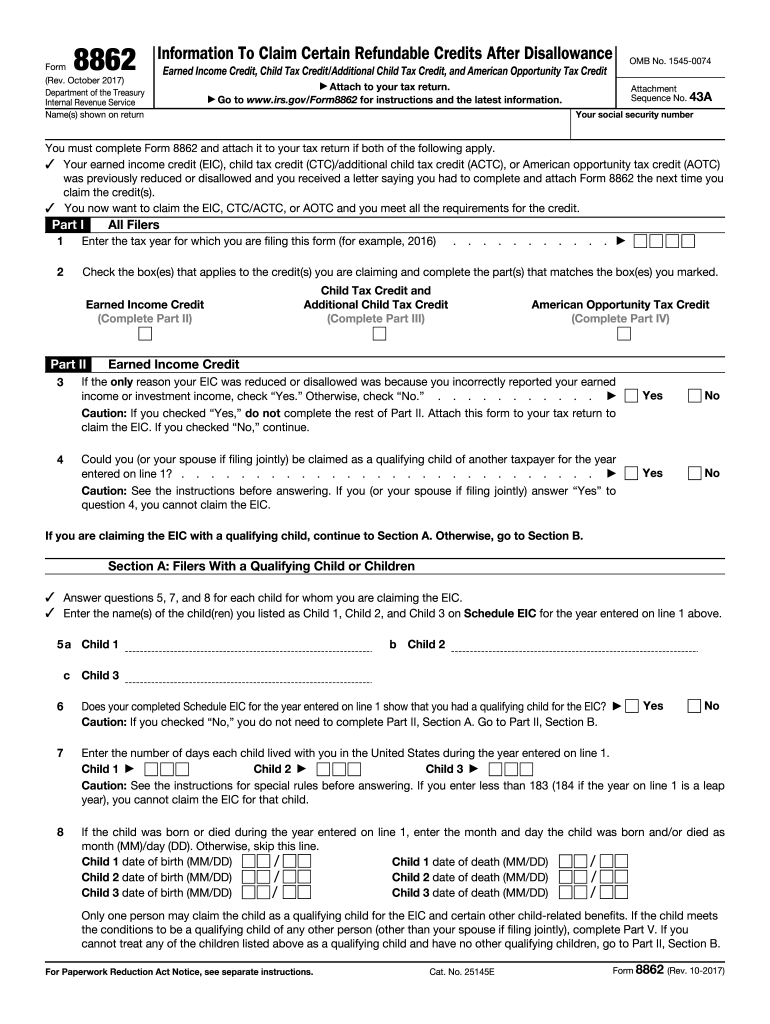

IRS Form 8862 2017 Fill Out and Sign Printable PDF Template signNow

Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Irs form 8862 is better known as the information to claim certain credits after disallowance form. Number each entry on the statement to correspond with the line number on form 8862. Web sign in to efile.com. Claiming certain credits after disallowance form 8862;.

Form 8862 Information to Claim Earned Credit After

Ad download or email irs 8862 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. This form is for income earned in tax year 2022, with tax returns due in april. Try it for free now!

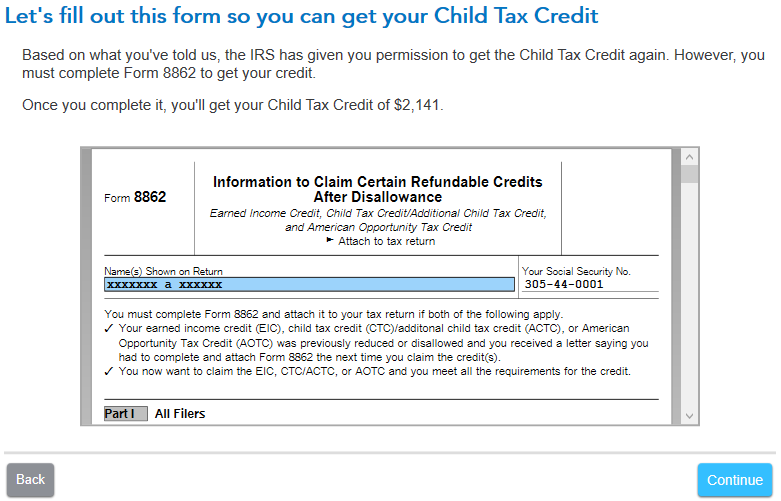

how do i add form 8862 TurboTax® Support

Try it for free now! Web how can i get a copy of my form 8962? Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Web our service proposes the solution to make the mechanism of processing irs documents as easy as possible. Web.

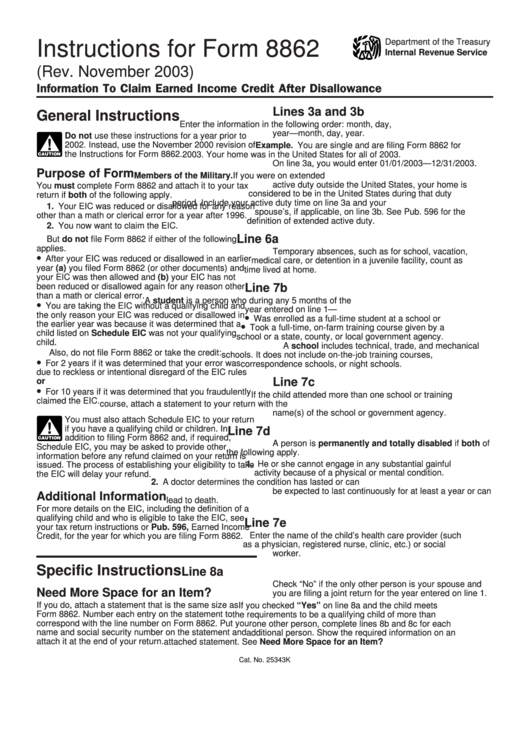

Instructions For Form 8862 Information To Claim Earned Credit

Use get form or simply click on the template preview to open it in the editor. Web in this article, we’ll walk through irs form 8862, including: File an extension in turbotax online before the deadline to avoid a late filing penalty. Web if the irs rejected one or more of these credits: Web for the latest information about developments.

Top 14 Form 8862 Templates free to download in PDF format

Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Number each entry on the statement to correspond with the line number on form 8862. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Web if the irs rejected one.

8862 Tax Form Fill and Sign Printable Template Online US Legal Forms

Start completing the fillable fields and. December 2021) department of the treasury internal revenue service information to claim certain credits after disallowance earned income credit (eic),. When you should file form 8862 and when you. Here's how to file form 8862 in turbotax. Number each entry on the statement to correspond with the line number on form 8862.

Try It For Free Now!

Irs form 8862 is better known as the information to claim certain credits after disallowance form. Web turbotax can help you fill out your 8862 form, see below for instructions on how to find this form in turbotax and on how to complete it. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Put your name and social security number on the statement and attach it at.

Web How Can I Get A Copy Of My Form 8962?

By jason luthor updated may 28, 2019. Click the green button to add information to claim a certain credit after disallowance. Start completing the fillable fields and. Guide to head of household.

Ad Edit, Sign Or Email Irs 8862 & More Fillable Forms, Register And Subscribe Now!

Use get form or simply click on the template preview to open it in the editor. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. Ad download or email irs 8862 & more fillable forms, register and subscribe now! If you wish to take the credit in a.

Web If The Irs Rejected One Or More Of These Credits:

December 2021) department of the treasury internal revenue service information to claim certain credits after disallowance earned income credit (eic),. Web sign in to efile.com. Upload, modify or create forms. This form is for income earned in tax year 2022, with tax returns due in april.