How Long Does It Take To Process Form 15111

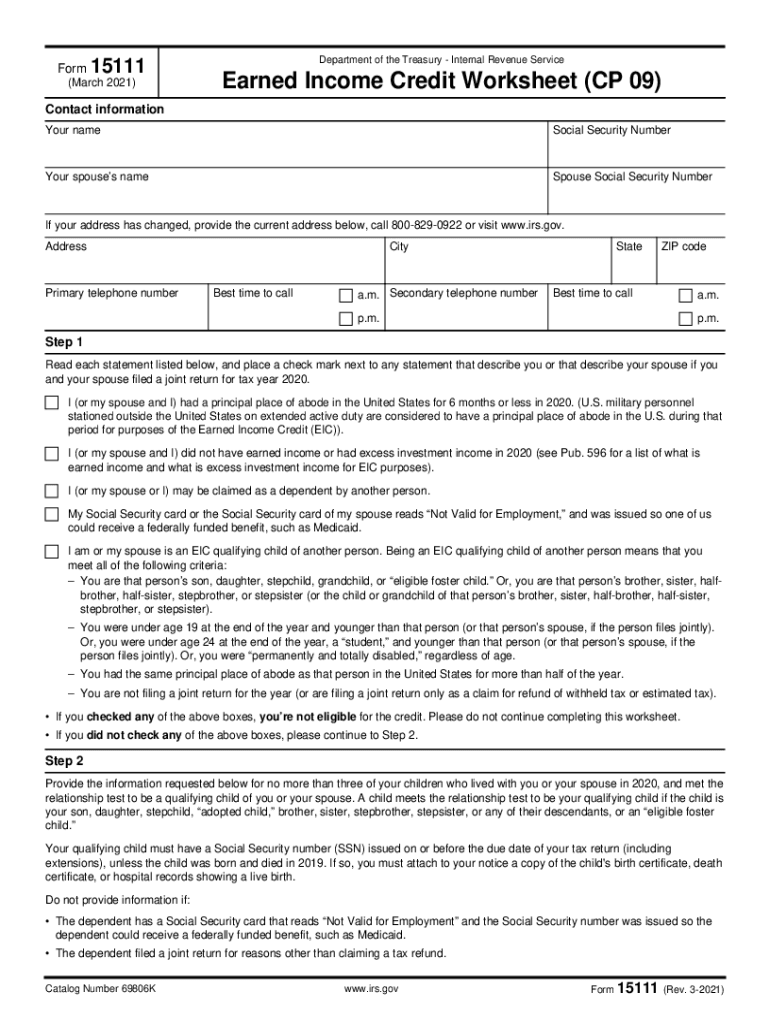

How Long Does It Take To Process Form 15111 - Web 44 reviews 23 ratings 15,005 10,000,000+ 303 100,000+ users here's how it works 02. Web irs form 15111 2022 irs form 15111 status 2022 form 15111 march 2022 form 15111 instructions where to mail form 15111 how long does it take to process form 15111. Earned income credit worksheet (cp 09) (irs) on average this form takes 9 minutes to complete. Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check to the. Web how long does it take to get my refund? Enter the access code from your notice to use the tool. Web if you amend your return to include the earned income credit, there is no reason to send back irs form 15111. Mid march i recieved a letter from the irs about submitting a form 15111 for our missing 6700$ of earned income credit. Makes sense, i was so confused on how we only got 2k. The irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much.

Simply enter your social security. It’s hard to be patient but more so i’m worried because there’s no way to track it or see. Web irs form 15111 2022 irs form 15111 status 2022 form 15111 march 2022 form 15111 instructions where to mail form 15111 how long does it take to process form 15111. Web understanding your cp27 notice what this notice is about we've sent you this notice because our records indicate you may be eligible for the earned income credit (eic) but. Web received a form 15111 for eitc. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. You can click here to find out when you will receive the eitc refund. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device. I already filed an amended return to claim it before this form was sent. Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check to the.

It’s hard to be patient but more so i’m worried because there’s no way to track it or see. Web if you mail your paper return, it may take up to 4 weeks to get processed. Web received a form 15111 for eitc. Web how long does it take to process form 15111? They will expect you to. Earned income credit worksheet (cp 09) (irs) on average this form takes 9 minutes to complete. This is an irs internal form. Web the form does not exist on the irs website. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. I already filed an amended return to claim it before this form was sent.

Tax Return For Expats In Germany Wallpaper

Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Web level 1 received notice cp09 to fill out form 15111 i filed my taxes at the end of january and received my return at the beginning of february. Earned income credit worksheet (cp 09)..

How Long Does It Take to Form A Habit?

If your friend received a notice from the irs then they should call the irs using the phone number on the notice. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. I already filed an amended return to claim it before this form was.

2021 Form IRS 15111 Fill Online, Printable, Fillable, Blank pdfFiller

Form 15111 is a worksheet to help you determine. Web if you mail your paper return, it may take up to 4 weeks to get processed. Web understanding your cp27 notice what this notice is about we've sent you this notice because our records indicate you may be eligible for the earned income credit (eic) but. Web form 15111 is.

How Long Does the Probate Process Take? Hopler, Wilms, & Hanna

Web how long does it take to process form 15111? Web level 1 received notice cp09 to fill out form 15111 i filed my taxes at the end of january and received my return at the beginning of february. Enter the access code from your notice to use the tool. Send us your documents using the documentation upload toolwithin 30.

Form 15111? r/IRS

Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Send us your documents using the documentation upload toolwithin 30 days from the date of this notice. The irs will use the information in form 15111 along with the tax return to determine if the.

How Long Does It Take to Process Tomato Sauce in Pressure Canner?

Simply enter your social security. Web the form does not exist on the irs website. They will expect you to. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device. Web how long does it take to get my refund?

How long does it normally take for the IRS to proc... Fishbowl

Web that notice could very well be a scam since there is no such irs form 15111. I already filed an amended return to claim it before this form was sent. Web bookmark icon lenah expert alumni turbotax will automatically calculate the earned income credit to your return and guide your through the correct screens, if. Web received a form.

How Long Does it Take for YouTube to Process a Video?

They will expect you to. If your friend received a notice from the irs then they should call the irs using the phone number on the notice. Web understanding your cp27 notice what this notice is about we've sent you this notice because our records indicate you may be eligible for the earned income credit (eic) but. Form 15111 is.

How Long Does An Unemployment Claim Take Need to know how to claim

Web irs form 15111 2022 irs form 15111 status 2022 form 15111 march 2022 form 15111 instructions where to mail form 15111 how long does it take to process form 15111. Web bookmark icon lenah expert alumni turbotax will automatically calculate the earned income credit to your return and guide your through the correct screens, if. The irs will use.

How Long Does It Take to Process a Rental Application? (Answered by a

Web how long does it take to get my refund? Earned income credit worksheet (cp 09). Makes sense, i was so confused on how we only got 2k. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Web irs form 15111 2022 irs form.

Web Understanding Your Cp27 Notice What This Notice Is About We've Sent You This Notice Because Our Records Indicate You May Be Eligible For The Earned Income Credit (Eic) But.

It’s hard to be patient but more so i’m worried because there’s no way to track it or see. Earned income credit worksheet (cp 09). Form 15111 is a worksheet to help you determine. I already filed an amended return to claim it before this form was sent.

Web That Notice Could Very Well Be A Scam Since There Is No Such Irs Form 15111.

Mid march i recieved a letter from the irs about submitting a form 15111 for our missing 6700$ of earned income credit. Enter the access code from your notice to use the tool. Earned income credit worksheet (cp 09) (irs) on average this form takes 9 minutes to complete. Web received a form 15111 for eitc.

Send Us Your Documents Using The Documentation Upload Toolwithin 30 Days From The Date Of This Notice.

Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check to the taxpayer within 6. Web irs form 15111 2022 irs form 15111 status 2022 form 15111 march 2022 form 15111 instructions where to mail form 15111 how long does it take to process form 15111. This is an irs internal form. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

The Irs Will Use The Information In Form 15111 Along With The Tax Return To Determine If The Taxpayer Qualifies For Eic And For How Much.

If your friend received a notice from the irs then they should call the irs using the phone number on the notice. Web 44 reviews 23 ratings 15,005 10,000,000+ 303 100,000+ users here's how it works 02. Web the form does not exist on the irs website. Web if you amend your return to include the earned income credit, there is no reason to send back irs form 15111.