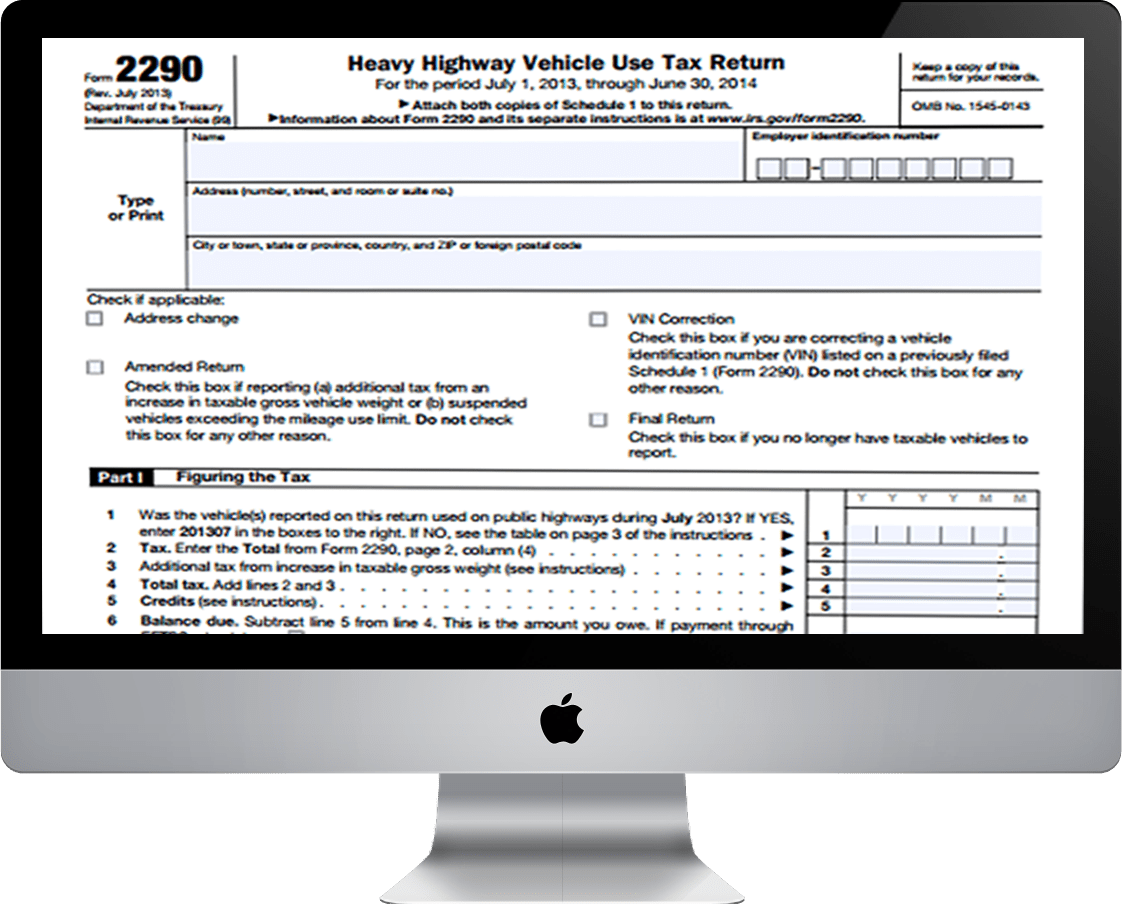

How Often Do You Have To File Form 2290

How Often Do You Have To File Form 2290 - Form 2290 must be filed by the last day of the month following the month of first use (as shown in. File your 2290 online & get schedule 1 in minutes. Figure and pay the tax due on highway motor vehicles used during the period with a. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is. Regardless of the vehicle’s registration renewal date, you must file form 2290 by the last day of the month. Ad need help with irs form 2290 tax filing? File your 2290 online & get schedule 1 in minutes. The irs mandates that everyone who owns a heavy vehicle. Web about form 2290, heavy highway vehicle use tax return. Web anyone who registers a heavy highway motor vehicle in their name with a taxable gross weight of 55,000 pounds or more must file form 2290 and pay the tax.

Figure and pay the tax due on highway motor vehicles used during the period with a. With 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Web the form 2290 must be filed by the last day of the month following the month of first use. Web claiming a refund. If you are filing a form 2290 paper return: Do your truck tax online & have it efiled to the irs! The irs mandates that everyone who owns a heavy vehicle. If you will not be filing another form 2290 in the future, or if you prefer to receive a check from the irs for your overpayment, you can file form. What is form 2290 used for? Easy, fast, secure & free to try.

File your 2290 online & get schedule 1 in minutes. Web form 2290 is an annual return that needs to be filed every year. Web find out where to mail your completed form. The fum of your vehicle is considered the first month your vehicle is operated on the public highway during the tax year. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is. The filing rules apply whether you are paying the tax or. Regardless of the vehicle’s registration renewal date, you must file form 2290 by the last day of the month. Web you can file form 2290 online using www.form2290.com regardless how many trucks you want to file online; Web the form 2290 must be filed by the last day of the month following the month of first use. If you will not be filing another form 2290 in the future, or if you prefer to receive a check from the irs for your overpayment, you can file form.

Less than 48 hours remaining to Efile Form 2290 for 2018 2019

The irs mandates that everyone who owns a heavy vehicle. Web form 2290 is an annual return that needs to be filed every year. Web you can file form 2290 online using www.form2290.com regardless how many trucks you want to file online; With 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Web.

Notifications for every situation when you efile Form 2290 Online

The filing rules apply whether you are paying the tax or. Web the heavy vehicle use tax (hvut) form 2290 must be filed by the last day of the month following the month of first use. Web the current period begins july 1, 2021, and ends june 30, 2022. Web form 2290 is an irs tax form that you need.

What Is The Best Way To File Your Form 2290? Blog ExpressTruckTax

Web frequently asked questions form completion what is a 2290 in trucking? Figure and pay the tax due on highway motor vehicles used during the period with a. Web the heavy vehicle use tax (hvut) form 2290 must be filed by the last day of the month following the month of first use. The form 2290 tax year begins on.

Do You Need To File Form 2290? Blog ExpressTruckTax EFile IRS

Web the filing deadline isn’t tied to the vehicle registration date. Web the form 2290 must be filed by the last day of the month following the month of first use. The irs mandates that everyone who owns a heavy vehicle. For example, if a vehicle was first used any time in december 2020, a form. Irs form 2290 due.

File IRS 2290 Form Online for 20222023 Tax Period

Figure and pay the tax due on highway motor vehicles used during the period with a. Web the filing deadline isn’t tied to the vehicle registration date. The filing rules apply whether you are paying the tax or. Regardless of the vehicle’s registration renewal date, you must file form 2290 by the last day of the month. Web the form.

File 20222023 Form 2290 Electronically 2290 Schedule 1

Web form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. The deadline to file your form 2290 is on the last day of the month following the first used month (fum) of your vehicle. Regardless of the vehicle’s registration renewal date, you must file form 2290.

What Happens If You Don't File HVUT Form 2290 Driver Success

Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is. Get expert assistance with simple 2290 @ $6.95. Web the heavy vehicle use tax (hvut) form 2290 must be filed by the last day of the month.

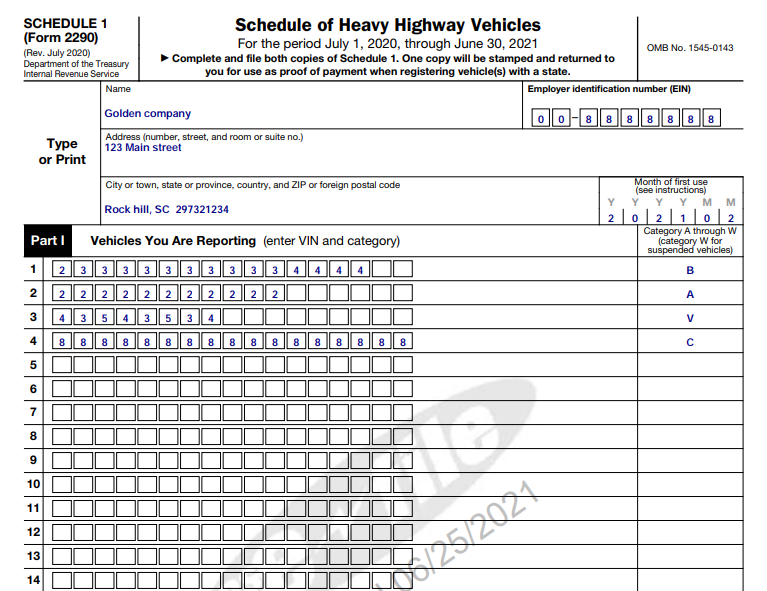

A Guide to Form 2290 Schedule 1

Web form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. The irs mandates that everyone who owns a heavy vehicle. With full payment and that payment is not drawn from. Irs form 2290 due date chart other useful links: With 2290 online, you can file your.

new tax season 20222023 IRS Authorized Electronic

For example, if a vehicle was first used any time in december 2020, a form. Regardless of the vehicle’s registration renewal date, you must file form 2290 by the last day of the month. The fum of your vehicle is considered the first month your vehicle is operated on the public highway during the tax year. Web the heavy vehicle.

Fillable Form 2290 20232024 Create, Fill & Download 2290

Web anyone who registers a heavy highway motor vehicle in their name with a taxable gross weight of 55,000 pounds or more must file form 2290 and pay the tax. Do your truck tax online & have it efiled to the irs! For example, if a vehicle was first used any time in december 2020, a form. What is form.

Web Claiming A Refund.

Where do i file the 2290 form? Do your truck tax online & have it efiled to the irs! The form 2290 tax year begins on july 1 and ends on june 30 of the following year. File your 2290 online & get schedule 1 in minutes.

Web The Form 2290 Must Be Filed By The Last Day Of The Month Following The Month Of First Use.

If you are filing a form 2290 paper return: If you will not be filing another form 2290 in the future, or if you prefer to receive a check from the irs for your overpayment, you can file form. Form 2290 must be filed by the last day of the month following the month of first use (as shown in. What is form 2290 used for?

Get Expert Assistance With Simple 2290 @ $6.95.

With full payment and that payment is not drawn from. Irs encourages all tax payers to file form 2290 online. The fum of your vehicle is considered the first month your vehicle is operated on the public highway during the tax year. Figure and pay the tax due on highway motor vehicles used during the period with a.

Web Find Out Where To Mail Your Completed Form.

Choosing the hvut payment method 5. Ad need help with irs form 2290 tax filing? File your 2290 online & get schedule 1 in minutes. Irs form 2290 due date chart other useful links: