Maryland 507 Form 2022

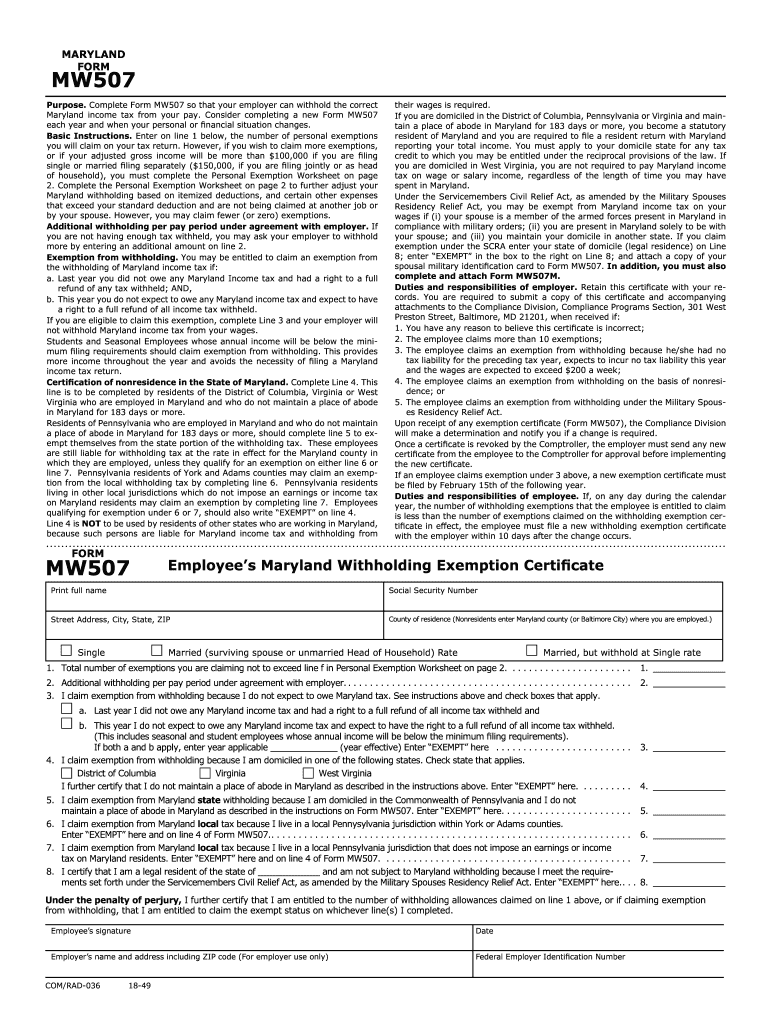

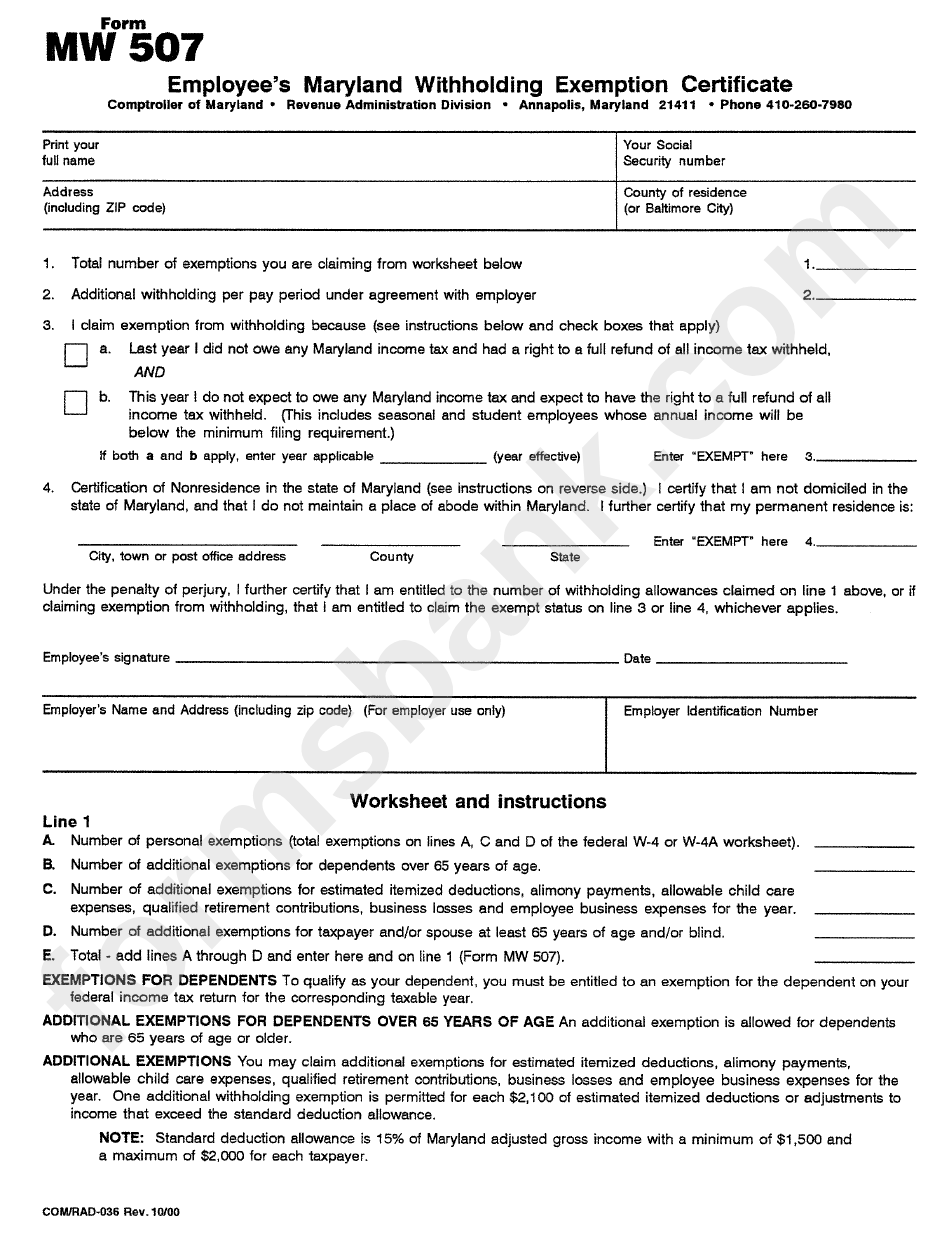

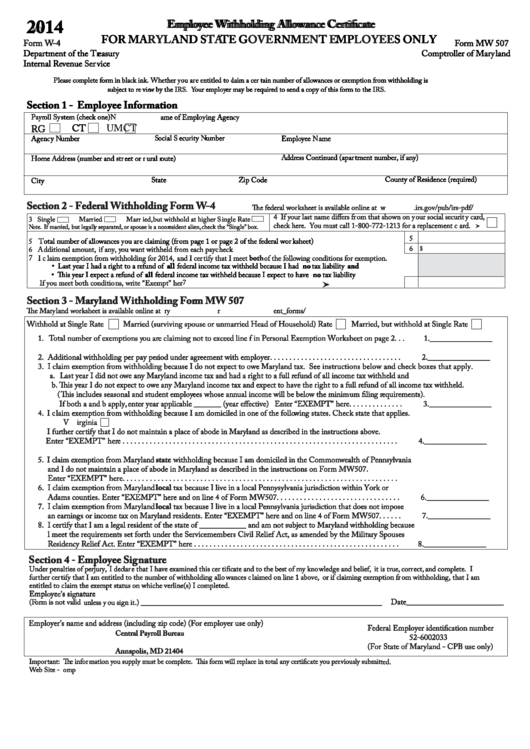

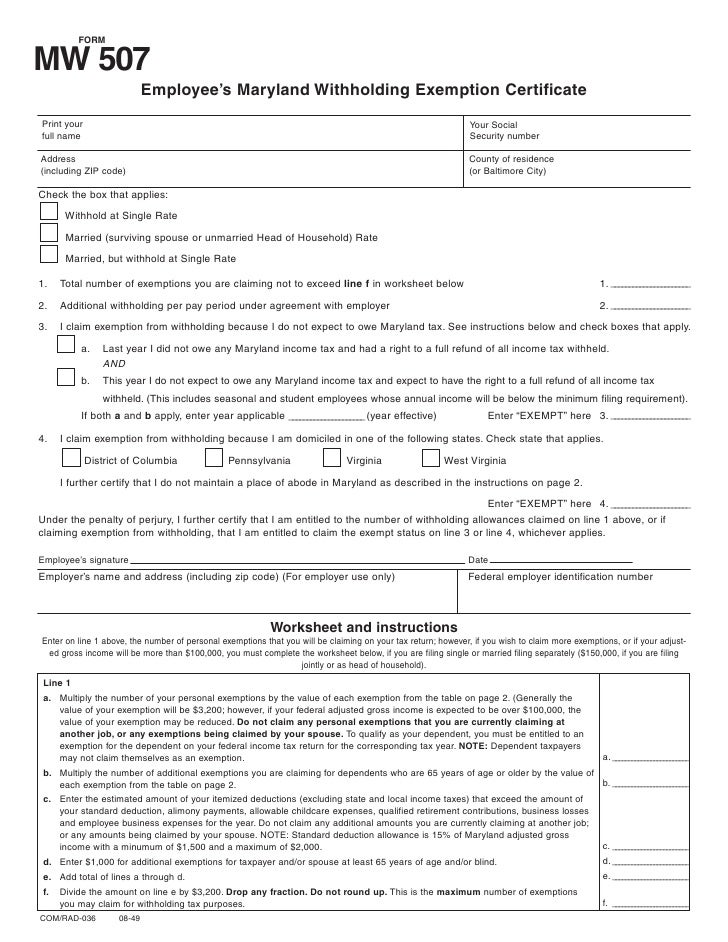

Maryland 507 Form 2022 - Web mw 507 employee’s maryland withholding exemption certificate withhold at single rate married (surviving spouse or unmarried head of household) rate married, but withhold. We last updated the employee's maryland withholding exemption certificate in january. Web mw507, employee’s maryland withholding exemption certificate, is the state withholding form for employees to tell their employers how much state income tax to. Consider completing a new form mw507. Certification of nonresidence in the state of maryland. This form is for income earned in tax year 2022, with tax returns due in april. This form is for income earned in tax year 2022, with tax returns due in april. Web subject to maryland corporation income tax. Web marylandtaxes.gov | welcome to the office of the comptroller Web we last updated maryland mw507m in march 2023 from the maryland comptroller of maryland.

Consider completing a new form mw507. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Web mw507 requires you to list multiple forms of income, such as wages, interest, or alimony. Web marylandtaxes.gov | welcome to the office of the comptroller Certification of nonresidence in the state of maryland. Web mw 507 employee’s maryland withholding exemption certificate withhold at single rate married (surviving spouse or unmarried head of household) rate married, but withhold. I started a new job in july 2022 located in maryland. (1) enter the corporation name,. Use form 500 to calculate the amount of maryland corporation income tax. Annuity and sick pay request for.

Web filing a maryland income tax return. Certification of nonresidence in the state of maryland. Web marylandtaxes.gov | welcome to the office of the comptroller Web form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay. Web mw507 requires you to list multiple forms of income, such as wages, interest, or alimony. Consider completing a new form mw507. Web form mw507 is the state of maryland’s withholding exemption certificate that allows employees to select how much is withheld from their paycheck. We last updated the employee's maryland withholding exemption certificate in january. This line is to be completed by residents of the district of columbia,. I started a new job in july 2022 located in maryland.

Mw507 Fill Out and Sign Printable PDF Template signNow

Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Certification of nonresidence in the state of maryland. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay..

MD Comptroller MW506AE 2019 Fill out Tax Template Online US Legal Forms

This line is to be completed by residents of the district of columbia,. Web accurately completing md state tax form mw507 hello! Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. I claim exemption from maryland state withholding because i am domiciled in the commonwealth of pennsylvania and i do not maintain.

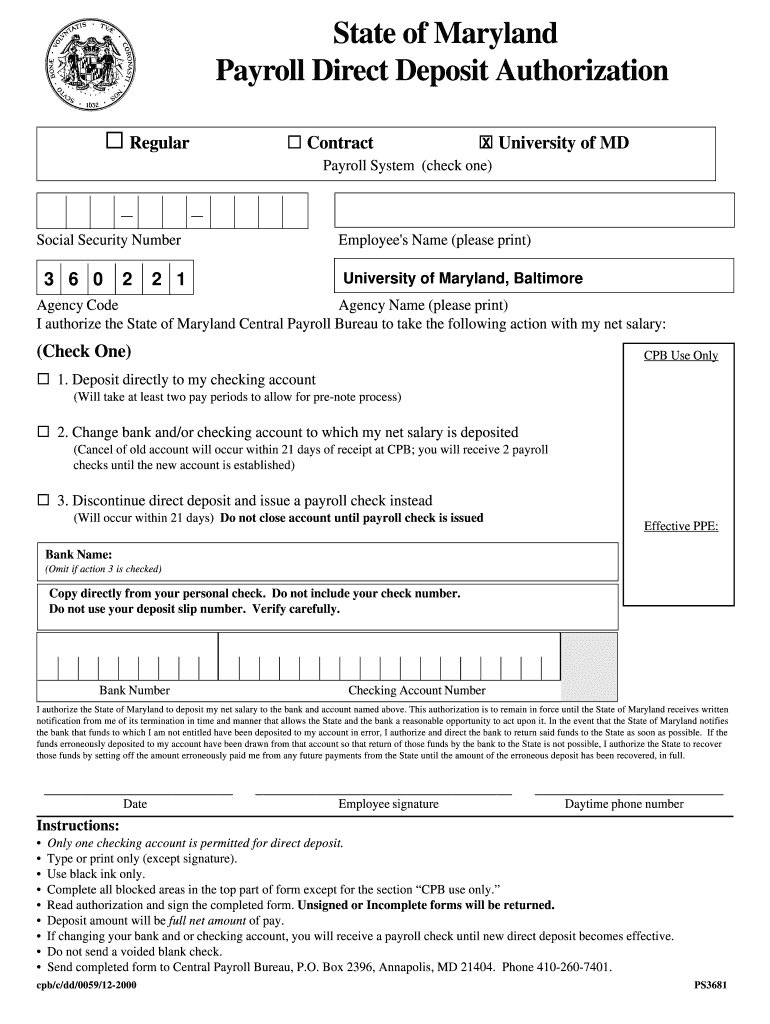

State Of Maryland Payroll Direct Deposit Authorization Fill Out and

We last updated the employee's maryland withholding exemption certificate in january. Web mw507, employee’s maryland withholding exemption certificate, is the state withholding form for employees to tell their employers how much state income tax to. This form is for income earned in tax year 2022, with tax returns due in april. This form is for income earned in tax year.

Form Mw 507 Employee'S Maryland Withholding Exemption Certificate

Consider completing a new form mw507 each. Web i can't fill out the form for you, but here are the instructions for the mw507. Consider completing a new form mw507. Web form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay. Use form 500 to calculate the amount of maryland.

2012 Form MD 502D Fill Online, Printable, Fillable, Blank pdfFiller

Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. (1) enter the corporation name,. Certification of nonresidence in the state of maryland. Use form 500 to calculate the amount of maryland corporation income tax. I claim exemption from maryland state withholding because i am domiciled in the commonwealth of pennsylvania and i.

Fillable Form W4 (Form Mw 507) Employee Withholding Allowance

Web mw507 requires you to list multiple forms of income, such as wages, interest, or alimony. Certification of nonresidence in the state of maryland. Web subject to maryland corporation income tax. Web the maryland form mw 507, employees maryland withholding exemption certificate, must be completed so that you know how much state income tax to withhold from your. Annuity and.

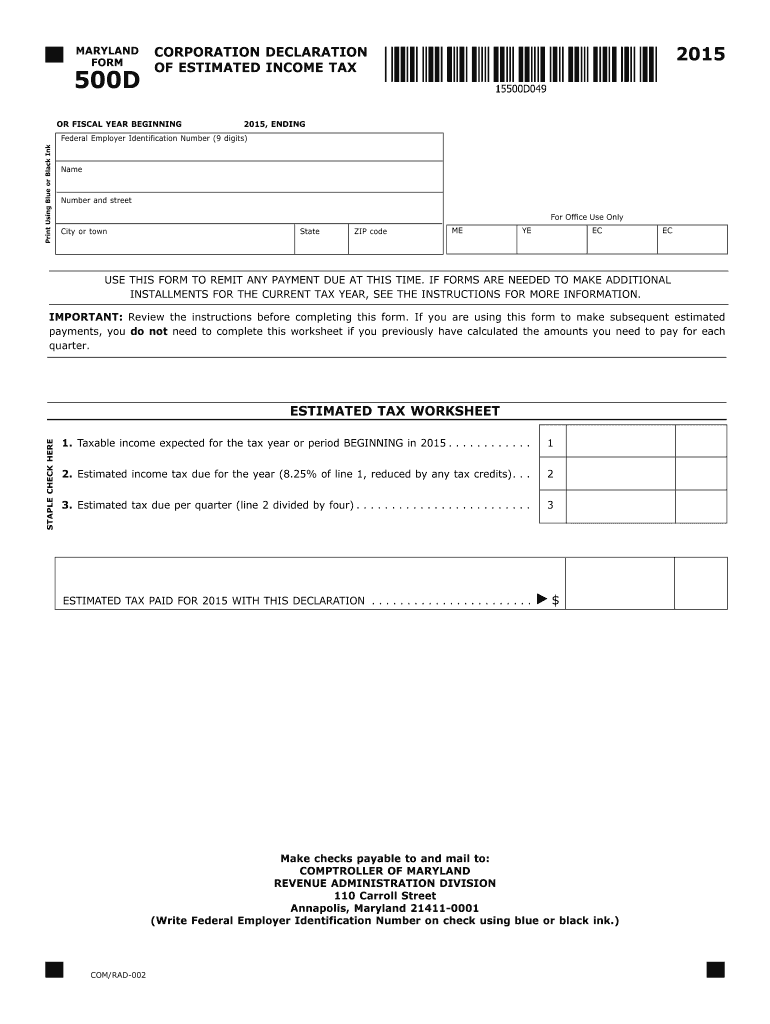

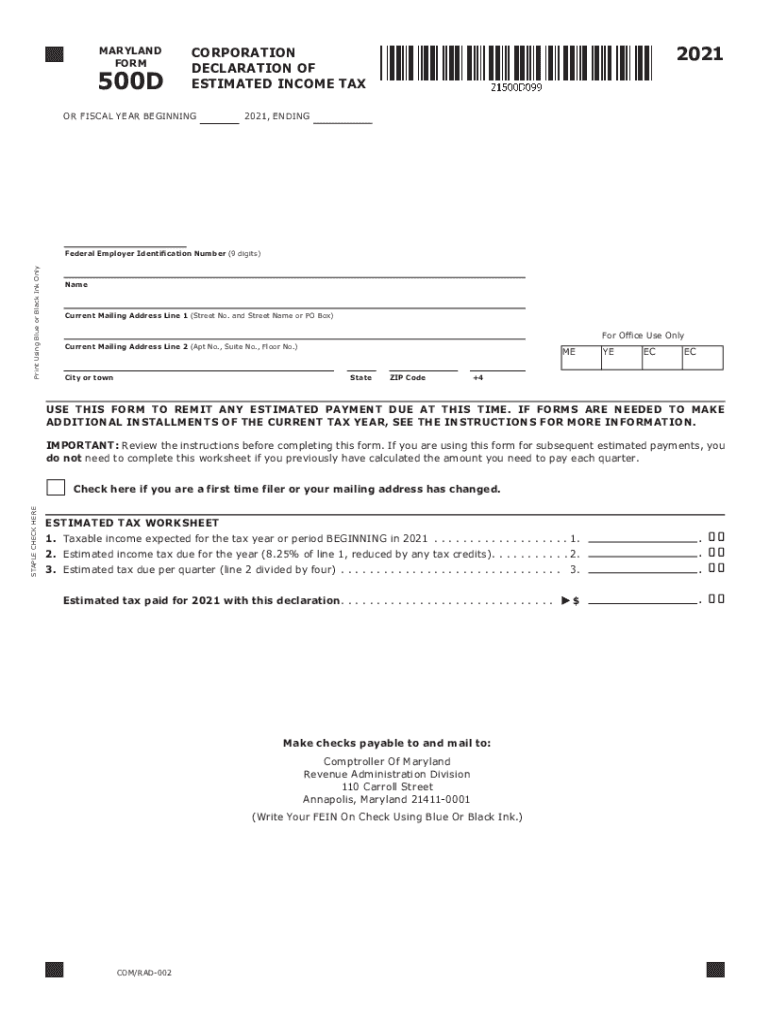

Maryland Form 500D Fill Out and Sign Printable PDF Template signNow

Web the maryland form mw 507, employees maryland withholding exemption certificate, must be completed so that you know how much state income tax to withhold from your. Web we last updated maryland mw507 in january 2023 from the maryland comptroller of maryland. Certification of nonresidence in the state of maryland. Web we last updated maryland mw507m in march 2023 from.

Mw507 Personal Exemptions Worksheet

Web marylandtaxes.gov | welcome to the office of the comptroller Web we last updated maryland mw507m in march 2023 from the maryland comptroller of maryland. This form is for income earned in tax year 2022, with tax returns due in april. This form is for income earned in tax year 2022, with tax returns due in april. Web form mw507.

2021 Md Estimated Fill Out and Sign Printable PDF Template signNow

Web the maryland form mw 507, employees maryland withholding exemption certificate, must be completed so that you know how much state income tax to withhold from your. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Web filing a maryland income tax return. Web mw507, employee’s maryland withholding exemption certificate, is the state withholding.

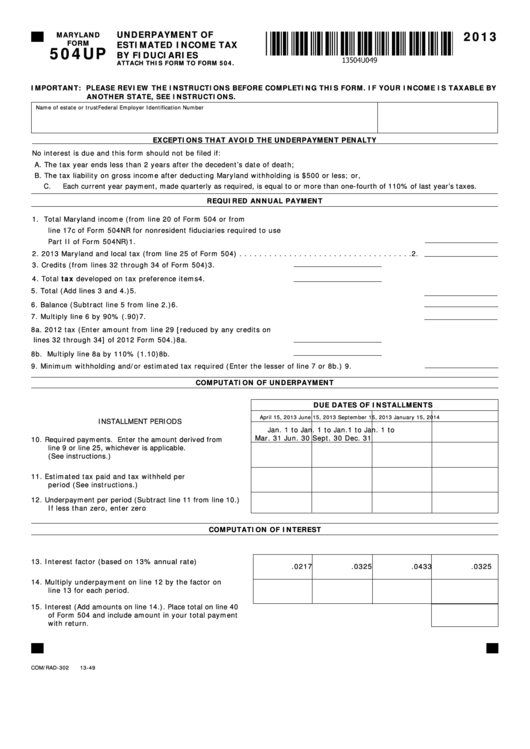

Fillable Maryland Form 504up Underpayment Of Estimated Tax By

Web filing a maryland income tax return. Web mw 507 employee’s maryland withholding exemption certificate withhold at single rate married (surviving spouse or unmarried head of household) rate married, but withhold. Consider completing a new form mw507 each. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs This line is to be completed by.

Consider Completing A New Form Mw507 Each.

Web maryland form mw507 employee’s maryland withholding exemption certiicate form mw507 print full name social security number street address, city, state, zip county. Web we last updated maryland mw507 in january 2023 from the maryland comptroller of maryland. Web i can't fill out the form for you, but here are the instructions for the mw507. Certification of nonresidence in the state of maryland.

We Last Updated The Employee's Maryland Withholding Exemption Certificate In January.

Consider completing a new form mw507. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as. Web filing a maryland income tax return. Web form mw507 is the state of maryland’s withholding exemption certificate that allows employees to select how much is withheld from their paycheck.

Web The Maryland Form Mw 507, Employees Maryland Withholding Exemption Certificate, Must Be Completed So That You Know How Much State Income Tax To Withhold From Your.

Web i certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil relief act, as. Web we last updated maryland mw507m in march 2023 from the maryland comptroller of maryland. I claim exemption from maryland state withholding because i am domiciled in the commonwealth of pennsylvania and i do not maintain a place of abode in maryland as. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay.

This Line Is To Be Completed By Residents Of The District Of Columbia,.

(1) enter the corporation name,. Use form 500 to calculate the amount of maryland corporation income tax. This form is for income earned in tax year 2022, with tax returns due in april. Web mw 507 employee’s maryland withholding exemption certificate withhold at single rate married (surviving spouse or unmarried head of household) rate married, but withhold.