Practice W2 Form

Practice W2 Form - 2 federal income tax withheld: For teachers for schools for. Correctly classify your workers the irs requires that you classify your workers correctly:. Web the united states social security administration Also available as an interactive quiz, this tool can reveal what. The advanced tools of the editor will lead. Enter this amount on the wages line of your tax return. Claiming child tax credit and additional child tax. Lawrence red owl simulation 1: To start the blank, use the fill camp;

1 wages, tips, other compensation: Web use form 4137 to figure the social security and medicare tax owed on tips you didn’t report to your employer. For teachers for schools for. You enter information that is already. Sign online button or tick the preview image of the form. 2 federal income tax withheld: Claiming child tax credit and additional child tax. Web how to complete the w 2 form on the web: Dollar sign, 48, comma, 000. Enter this amount on the wages line of your tax return.

Web the united states social security administration Claiming child tax credit and additional child tax. 1 wages, tips, other compensation: Web use form 4137 to figure the social security and medicare tax owed on tips you didn’t report to your employer. For teachers for schools for. 2 federal income tax withheld: Dollar sign, 48, comma, 000. The advanced tools of the editor will lead. To start the blank, use the fill camp; Web how to complete the w 2 form on the web:

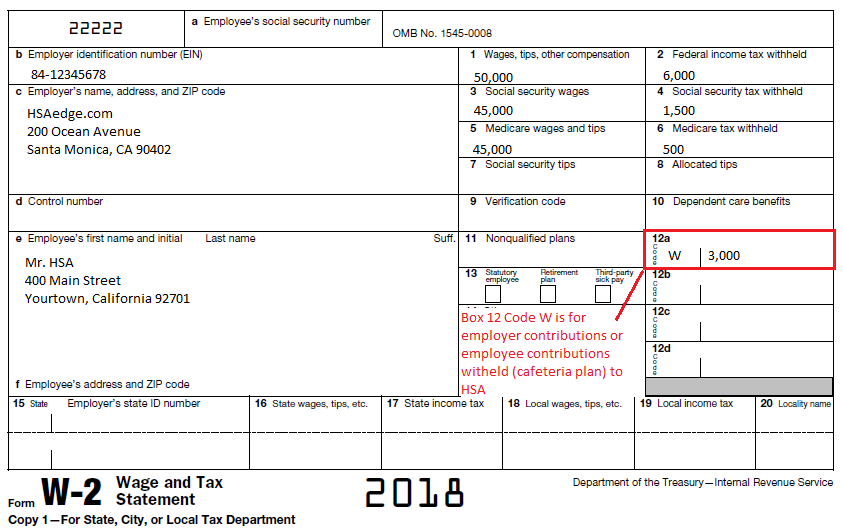

W2 Form Copy A 2018 Form Resume Examples MeVRB6LjVD

Claiming child tax credit and additional child tax. Web how to complete the w 2 form on the web: Web use form 4137 to figure the social security and medicare tax owed on tips you didn’t report to your employer. 2 federal income tax withheld: Lawrence red owl simulation 1:

Form W2 Easy to Understand Tax Guidelines 2020

Enter this amount on the wages line of your tax return. Web use form 4137 to figure the social security and medicare tax owed on tips you didn’t report to your employer. Claiming child tax credit and additional child tax. The advanced tools of the editor will lead. Web how to complete the w 2 form on the web:

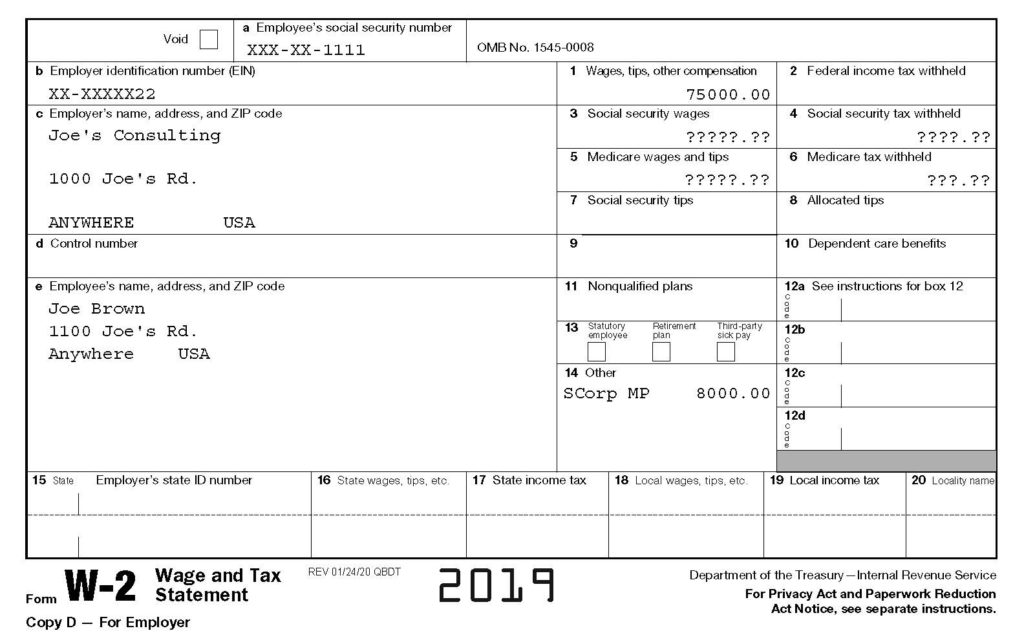

W2 Form Sample Tax Year 2019 CPA, Certified Public Accountant,

Web how to complete the w 2 form on the web: You enter information that is already. Lawrence red owl simulation 1: Enter this amount on the wages line of your tax return. Correctly classify your workers the irs requires that you classify your workers correctly:.

Understanding Your Tax Forms The W2

Correctly classify your workers the irs requires that you classify your workers correctly:. The advanced tools of the editor will lead. Sign online button or tick the preview image of the form. Enter this amount on the wages line of your tax return. For teachers for schools for.

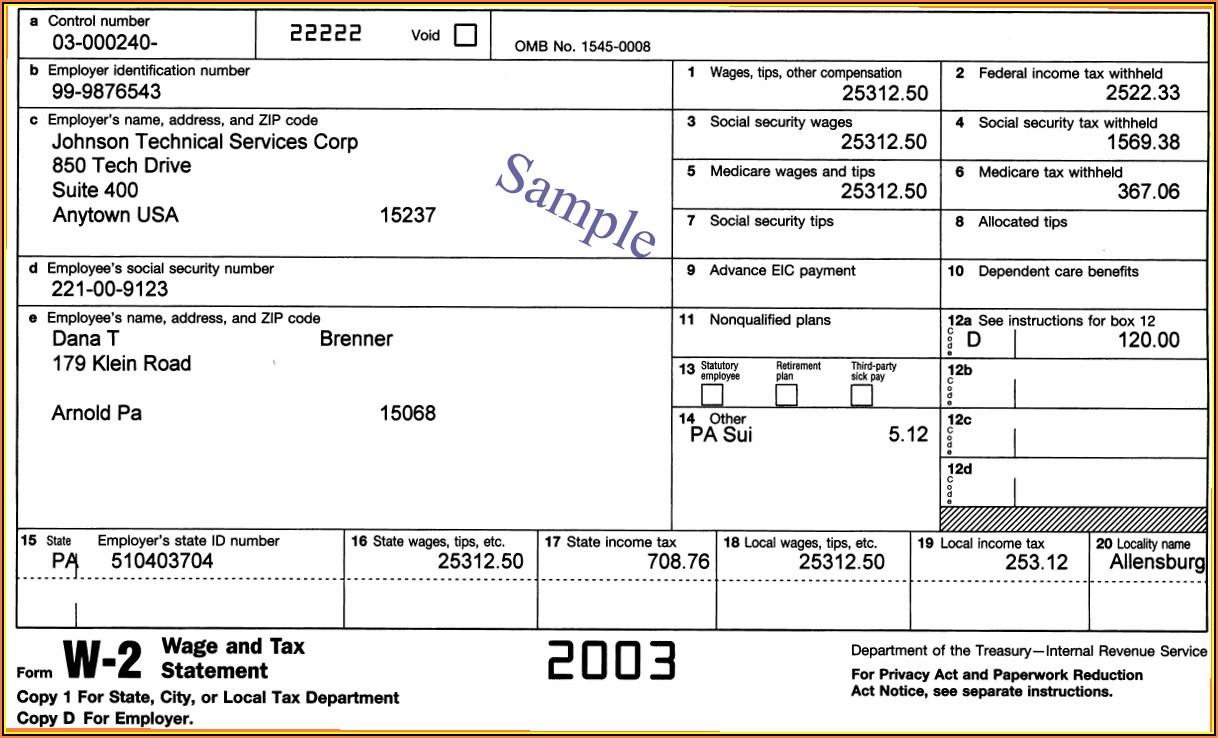

Sample W2 Government Form Eclipse Corporation

The advanced tools of the editor will lead. Claiming child tax credit and additional child tax. Sign online button or tick the preview image of the form. For teachers for schools for. You enter information that is already.

W2 View

Web use form 4137 to figure the social security and medicare tax owed on tips you didn’t report to your employer. 2 federal income tax withheld: Enter this amount on the wages line of your tax return. Dollar sign, 48, comma, 000. Correctly classify your workers the irs requires that you classify your workers correctly:.

An Employer’s Guide to Easily Completing a W2 Form Gift CPAs

Web the united states social security administration Correctly classify your workers the irs requires that you classify your workers correctly:. 2 federal income tax withheld: Web use form 4137 to figure the social security and medicare tax owed on tips you didn’t report to your employer. Dollar sign, 48, comma, 000.

W2 Form Statutory Employee Form Resume Examples mx2Wxez96E

For teachers for schools for. Correctly classify your workers the irs requires that you classify your workers correctly:. 2 federal income tax withheld: Web use form 4137 to figure the social security and medicare tax owed on tips you didn’t report to your employer. Web the united states social security administration

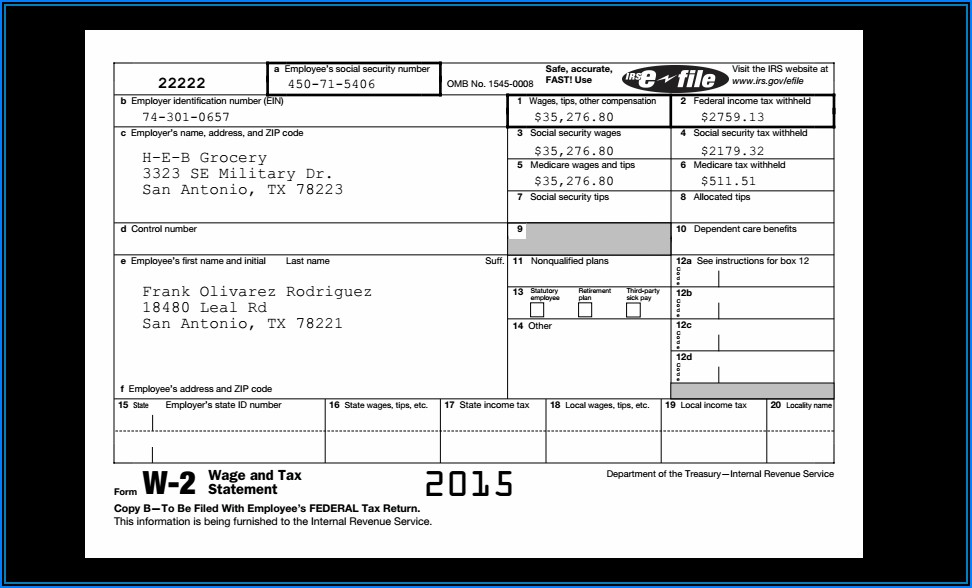

2015 W2 Fillable form Understanding 2015 W 2 forms Fillable forms

Correctly classify your workers the irs requires that you classify your workers correctly:. Dollar sign, 48, comma, 000. Claiming child tax credit and additional child tax. 1 wages, tips, other compensation: For teachers for schools for.

Dollar Sign, 48, Comma, 000.

1 wages, tips, other compensation: Claiming child tax credit and additional child tax. For teachers for schools for. Sign online button or tick the preview image of the form.

Web How To Complete The W 2 Form On The Web:

You enter information that is already. To start the blank, use the fill camp; 2 federal income tax withheld: Lawrence red owl simulation 1:

Correctly Classify Your Workers The Irs Requires That You Classify Your Workers Correctly:.

Web the united states social security administration Also available as an interactive quiz, this tool can reveal what. Enter this amount on the wages line of your tax return. The advanced tools of the editor will lead.