Sample Of Completed Form 982 For Insolvency

Sample Of Completed Form 982 For Insolvency - Prepare your how to prove insolvency in a few simple steps. Now, you have to prove to the irs that you were insolvent. Certain individuals may need to complete only a few lines on form 982. Web how to claim insolvency. Discovering documents is not the difficult portion in terms of browser document management; The form is located at the irs' website here: Fill out the insolvency worksheet (and keep it in your important paperwork!). Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as explained later). You can quickzoom to that statement from part viii. Web 1 best answer michaeldc new member cancellation of debt and insolvency are a little complex but not complicated.

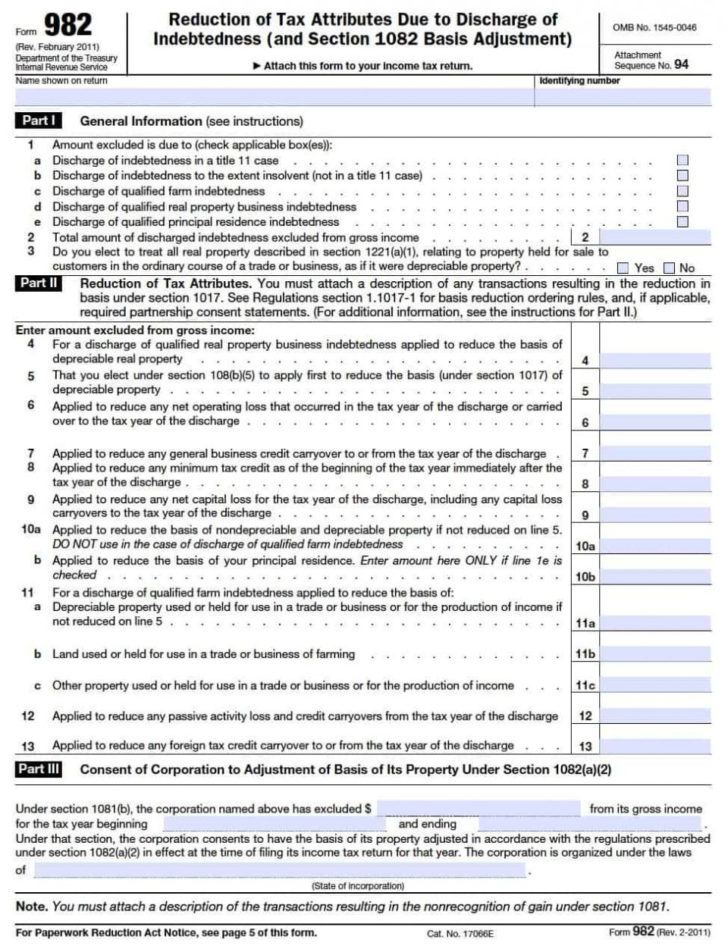

Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as explained later). Web if you had canceled debts in multiple years, you will need to determine if insolvency was a factor for each year. Discovering documents is not the difficult portion in terms of browser document management; Web tom must file form 982, as shown here, with his individual return for the tax year of the debt discharge. Web to open your insolvency worksheet sample filled out form, upload it from your device or cloud storage, or enter the document url. Web 150 votes what makes the form 982 legally valid? Certain individuals may need to complete only a few lines on form 982. When you complete the cancelled debt form, form 982 will also be completed. After you complete all of the required fields within the document and esign it (if that is needed), you can save it or share it with others. Prepare your how to prove insolvency in a few simple steps.

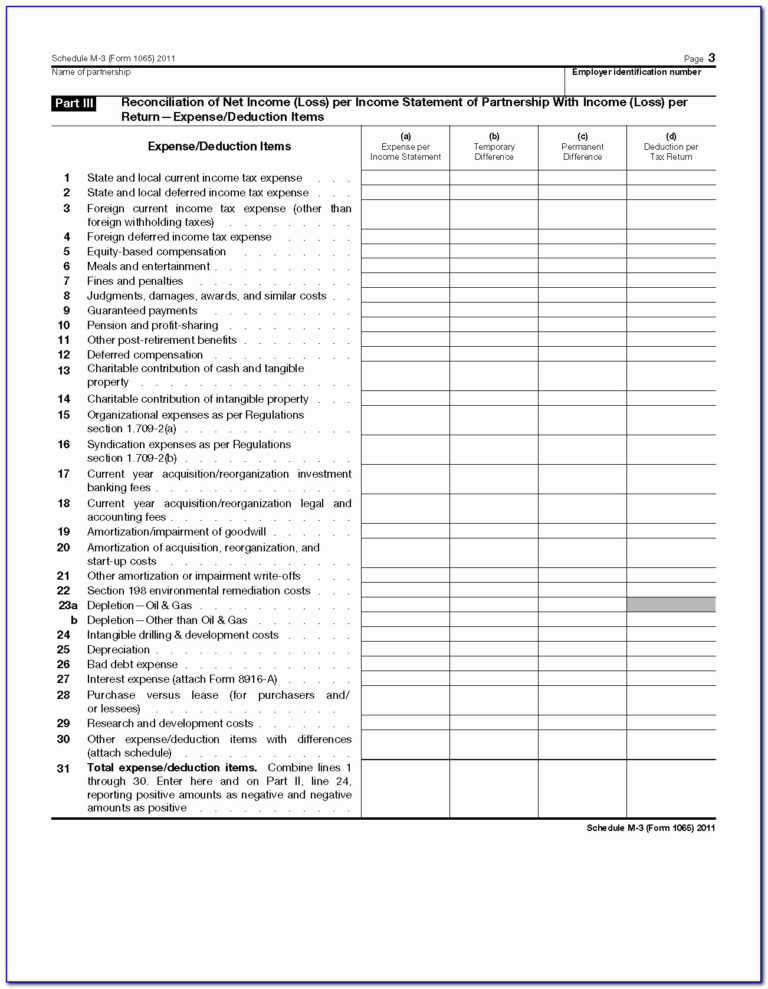

Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). For instructions and the latest information. Here's what you need to do to have the forgiveness excluded as additional income: Simply list the dollar amount shown on the 1099c and indicate 1. Create professional documents with signnow. Qualified real property business indebtedness Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. How it works upload the insolvency worksheet example edit & sign insolvency worksheet fillable from anywhere save your changes and share insolvency worksheet fillable pdf Web 1 best answer michaeldc new member cancellation of debt and insolvency are a little complex but not complicated. Web irs form 982 insolvency worksheet.

Tax form 982 Insolvency Worksheet

Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as explained later). Web fill out the cancelled debt form part viii exclusion for insolvency. If you have any other details regarding this question, please feel free to post them in.

Debt Form 982 Form 982 Insolvency Worksheet —

For instructions and the latest information. Create professional documents with signnow. Get your fillable template and complete it online using the instructions provided. Show details we are not affiliated with any brand or entity on this form. In addition, he must attach a statement describing the debt cancellation transaction and identifying the property to which the basis reduction applies.

Insolvency Worksheet Canceled Debts Fill and Sign Printable Template

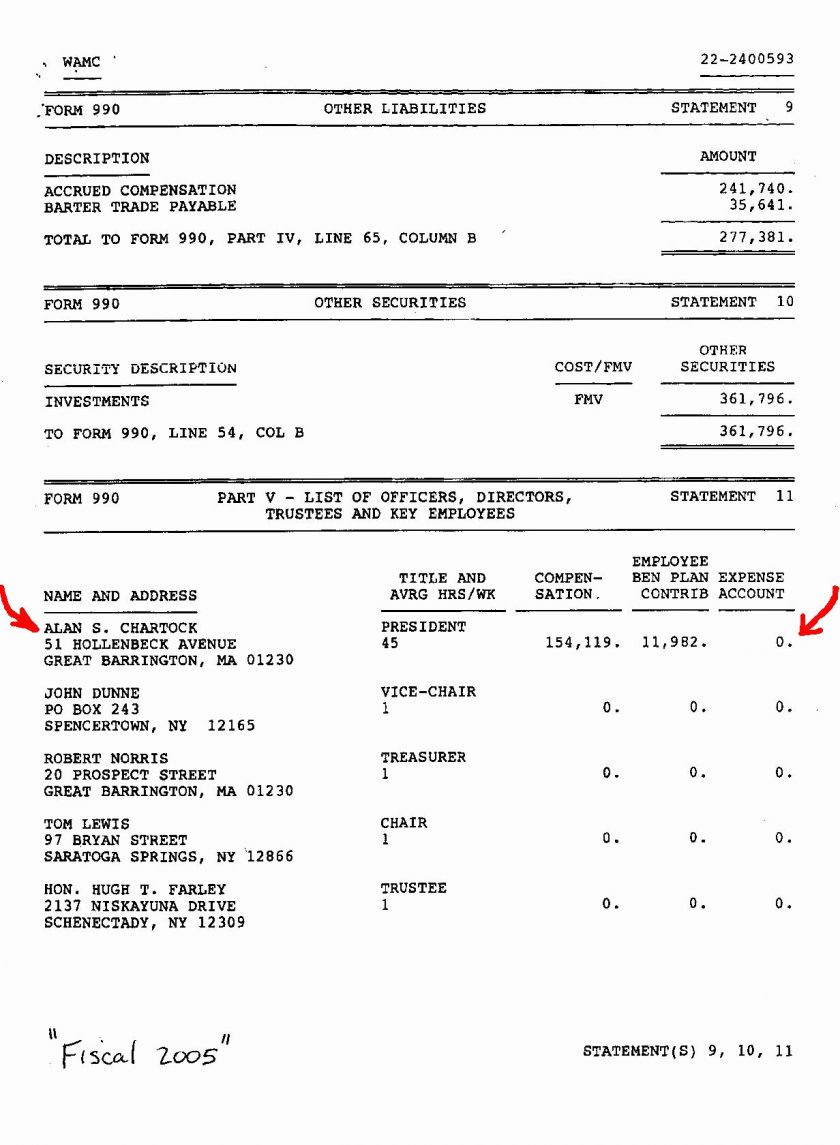

Simply list the dollar amount shown on the 1099c and indicate 1. You do not have to add any information to form 982. Now, you have to prove to the irs that you were insolvent. Write your name and the identifying number in the column provided for both. For example, if you are completing this form because of a discharge.

Insolvency Worksheet Example Studying Worksheets

How to complete the form tip: Use form 982 to claim insolvency. Web how to file irs form 982 after receiving a 1099c tweet when a debt is settled (irs says, forgiven) for more than $600, you may receive a form 1099c that seems to say that you are going to have to pay more tax! Simply list the dollar.

Form 982 Insolvency Worksheet —

Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related forms, and instructions on how to file. Obtain the form at the irs website. Fill out the insolvency worksheet (and.

Form 982 Insolvency Worksheet —

Show details we are not affiliated with any brand or entity on this form. Here's what you need to do to have the forgiveness excluded as additional income: Web tom must file form 982, as shown here, with his individual return for the tax year of the debt discharge. One of the easiest methods is to claim you are insolvent..

Publication 908 (02/2022), Bankruptcy Tax Guide Internal Revenue Service

You probably received a cp2000 and if you did this is only a proposal. Web below are five scenarios where an exclusion from taxable income could be applicable by utilizing a properly reported form 982: Web tom must file form 982, as shown here, with his individual return for the tax year of the debt discharge. Certain individuals may need.

Form 982 Insolvency Worksheet

Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Reduce document preparation complexity by getting the most out of this helpful video guide. Following the reasoning and steps below will keep things straight for you, produce a clean return and.

Remplir Formulaire 982 de l'IRS correctement

How to complete the form tip: Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). Web to open your insolvency worksheet sample filled out form, upload it from your device or cloud storage, or enter the document url. You can quickzoom to that statement from part viii. In addition, he must attach a statement describing.

Tax Form 982 Insolvency Worksheet

Obtain the form at the irs website. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Get your fillable template and complete it online using the instructions provided. Certain individuals may need to complete only a few lines on form.

Web You Must File Form 982 To Report The Exclusion And The Reduction Of Certain Tax Attributes Either Dollar For Dollar Or 33 1 / 3 Cents Per Dollar (As Explained Later).

Write your name and the identifying number in the column provided for both. Web convert and save your insolvency worksheet form as pdf (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Web if you had canceled debts in multiple years, you will need to determine if insolvency was a factor for each year. The first task is to analyze the actual relevance of the form you plan using.

So For 2021 I Had Forgiven Credit Card Debt And Have Completed Form 982 For Insolvency.

Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained below). However, ensure you read the instructions properly before proceeding. Obtain the form at the irs website. If you have any other details regarding this question, please feel free to post them in the comment section.

Create Professional Documents With Signnow.

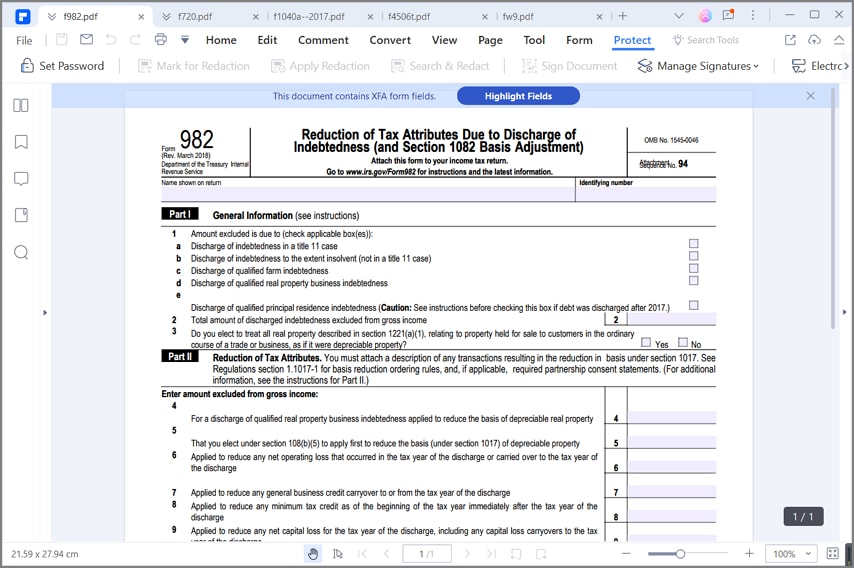

March 2018) department of the treasury internal revenue service. Certain individuals may need to complete only a few lines on form 982. Web irs form 982 insolvency worksheet. Simply list the dollar amount shown on the 1099c and indicate 1.

Get Your Fillable Template And Complete It Online Using The Instructions Provided.

Use form 982 to claim insolvency. Web video instructions and help with filling out and completing sample of completed form 982 for insolvency. Attach this form to your income tax return. Reduce document preparation complexity by getting the most out of this helpful video guide.