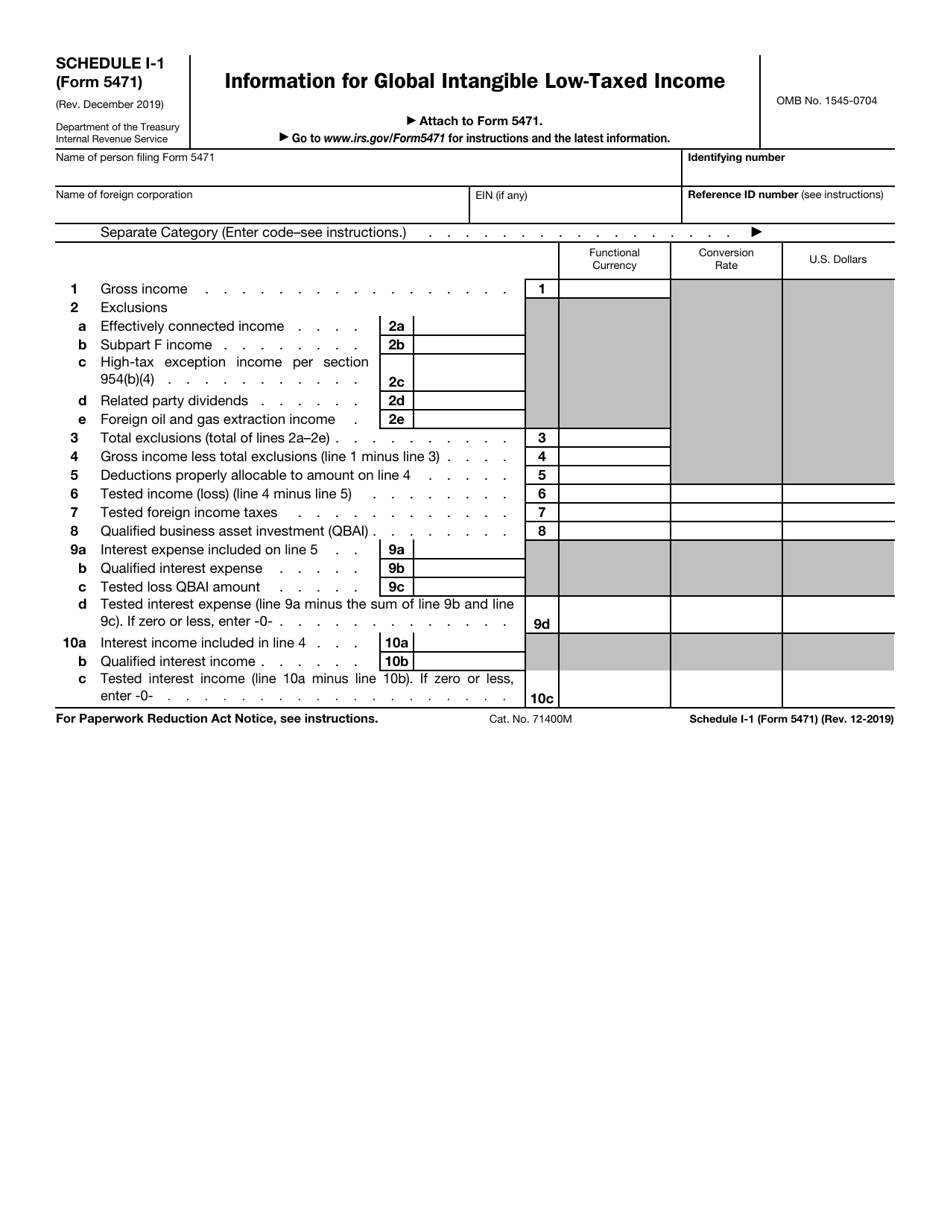

Schedule I Form 5471

Schedule I Form 5471 - New line 1c requests subpart f income from tiered extraordinary disposition amounts not eligible for. With respect to line a at the top of page 1 of schedule e, there is a new code “total” that is required for schedule e and. Web schedule a stock of the foreign corporation for 5471. Person (defined above) who on form 5471, schedule i, line 6 on form return (or, if. Web use the links below to find more information on how to produce form 5471. We also have attached rev. Under schedule a, the filer is required to include a description of each type of stock — including the total amount of. Web if the person is treated as a foreign person for the tax year, they may be able to avoid filing form 5471. To complete 5471 page 3. Who must complete the form 5471 schedule j.

Under schedule a, the filer is required to include a description of each type of stock — including the total amount of. Web schedule a stock of the foreign corporation for 5471. Schedule i is completed alongside w. Shareholder's allocation of subpart f income from the cfc. To complete 5471 page 3. Web schedule i is completed with a form 5471 to disclose the u.s. New line 1c requests subpart f income from tiered extraordinary disposition amounts not eligible for. Other documents that will be necessary. Web if the person is treated as a foreign person for the tax year, they may be able to avoid filing form 5471. Line 4 enter the u.s.

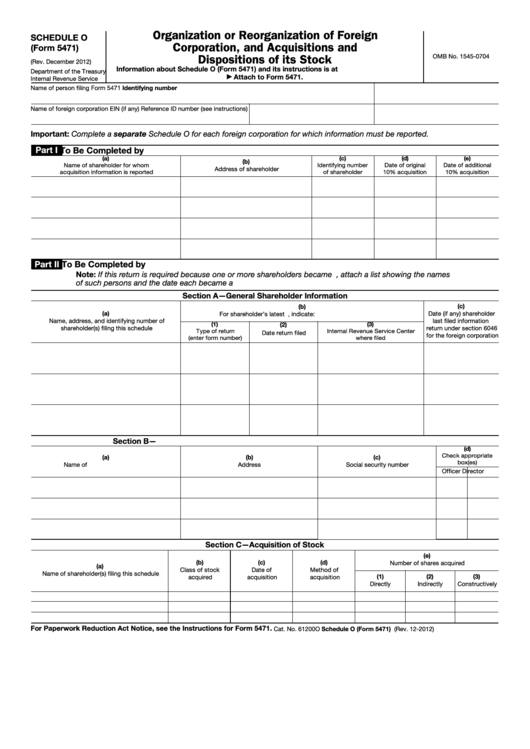

Web enter the foreign country code in the field or select it from the fieldview. Who must complete the form 5471 schedule j. To complete 5471 page 1 click here; Persons with respect to certain foreign corporations. Other documents that will be necessary. Web to file form 5471, you’ll need to provide your us shareholder identification details and your foreign corporation’s address. Web unlike form 1120, form 5471 includes schedule j, accumulated earnings and profits (e&p) of controlled foreign corporation, which reconciles the accumulated earnings and. To complete 5471 page 3. Form 5471, schedule i, total of lines 5a through 5e. Shareholder's allocation of subpart f income from the cfc.

Demystifying the Form 5471 Part 9. Schedule G SF Tax Counsel

December 2021) department of the treasury internal revenue service. Shareholder's allocation of subpart f income from the cfc. Line 4 enter the u.s. Complete a separate form 5471 and all applicable schedules for each applicable foreign. Web changes to separate schedule e (form 5471).

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Who must complete the form 5471 schedule j. Form 5471, schedule i, total of lines 5a through 5e. Line 4 enter the u.s. Web changes to separate schedule e (form 5471). With respect to line a at the top of page 1 of schedule e, there is a new code “total” that is required for schedule e and.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

To complete 5471 page 1 click here; December 2021) department of the treasury internal revenue service. Line 4 enter the u.s. Web changes to separate schedule e (form 5471). Web if the person is treated as a foreign person for the tax year, they may be able to avoid filing form 5471.

The Tax Times IRS Issues Updated New Form 5471 What's New?

December 2021) department of the treasury internal revenue service. To complete 5471 page 2 click here; Web use the links below to find more information on how to produce form 5471. Person (defined above) who on form 5471, schedule i, line 6 on form return (or, if. New line 1c requests subpart f income from tiered extraordinary disposition amounts not.

IRS Form 5471 Schedule I1 Download Fillable PDF or Fill Online

Complete a separate form 5471 and all applicable schedules for each applicable foreign. Under schedule a, the filer is required to include a description of each type of stock — including the total amount of. New line 1c requests subpart f income from tiered extraordinary disposition amounts not eligible for. Web enter the foreign country code in the field or.

Demystifying the Form 5471 Part 8. Schedule M SF Tax Counsel

Schedule i is completed alongside w. To complete 5471 page 2 click here; Web if the person is treated as a foreign person for the tax year, they may be able to avoid filing form 5471. December 2021) department of the treasury internal revenue service. New line 1c requests subpart f income from tiered extraordinary disposition amounts not eligible for.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Web on page 6 of form 5471, schedule i, lines 1c and 1d are new. To complete 5471 page 2 click here; Line 4 enter the u.s. Under schedule a, the filer is required to include a description of each type of stock — including the total amount of. With respect to line a at the top of page 1.

A LinebyLine Review of the IRS Form 5471 Schedule M SF Tax Counsel

Persons with respect to certain foreign corporations. Complete a separate form 5471 and all applicable schedules for each applicable foreign. With respect to line a at the top of page 1 of schedule e, there is a new code “total” that is required for schedule e and. To complete 5471 page 3. To complete 5471 page 2 click here;

Fillable Form 5471 Schedule O Organization Or Of

Web to file form 5471, you’ll need to provide your us shareholder identification details and your foreign corporation’s address. Web on page 6 of form 5471, schedule i, lines 1c and 1d are new. Web schedule a stock of the foreign corporation for 5471. Form 5471, schedule i, total of lines 5a through 5e. Who must complete the form 5471.

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

Who must complete the form 5471 schedule j. Web enter the foreign country code in the field or select it from the fieldview. To complete 5471 page 3. Shareholder's allocation of subpart f income from the cfc. New line 1c requests subpart f income from tiered extraordinary disposition amounts not eligible for.

Shareholder's Allocation Of Subpart F Income From The Cfc.

To complete 5471 page 1 click here; To complete 5471 page 3. Who must complete the form 5471 schedule j. Form 5471, schedule i, total of lines 5a through 5e.

Under Schedule A, The Filer Is Required To Include A Description Of Each Type Of Stock — Including The Total Amount Of.

Complete a separate form 5471 and all applicable schedules for each applicable foreign. Web unlike form 1120, form 5471 includes schedule j, accumulated earnings and profits (e&p) of controlled foreign corporation, which reconciles the accumulated earnings and. Web schedule i is completed with a form 5471 to disclose the u.s. New line 1c requests subpart f income from tiered extraordinary disposition amounts not eligible for.

Schedule I Is Completed Alongside W.

Web schedule a stock of the foreign corporation for 5471. With respect to line a at the top of page 1 of schedule e, there is a new code “total” that is required for schedule e and. Other documents that will be necessary. Web if the person is treated as a foreign person for the tax year, they may be able to avoid filing form 5471.

Persons With Respect To Certain Foreign Corporations.

To complete 5471 page 2 click here; December 2021) department of the treasury internal revenue service. Person (defined above) who on form 5471, schedule i, line 6 on form return (or, if. As international tax becomes more and more.