Schedule O Form 1120

Schedule O Form 1120 - Web schedule o (form 1120) (rev. We reference the new filing requirement for schedule o under line 1 (form 1120 only) and advise members of a controlled group to use schedule o. Web consent plan and apportionment schedule for a controlled group. Web a corporation that is a component member of a controlled group must use schedule o (form 1120) to report the apportionment of taxable income, income tax, and certain. Web thefreedictionary google form 1120 (schedule o) (redirected from 1120 forms (schedule o)) form 1120 (schedule o) a form that a controlled group of corporations. Web schedule o (form 1120). Web form 1120 (schedule o) a form that a controlled group of corporations files with the irs to report how profits , losses , and other things are apportioned out among the members of. Web complete and attach schedule o (form 1120), consent plan and apportionment schedule for a controlled group. December 2009) department of the treasury internal revenue service consent plan and apportionment schedule for a controlled. Complete, edit or print tax forms instantly.

Ad easy guidance & tools for c corporation tax returns. Get ready for tax season deadlines by completing any required tax forms today. Web schedule o (form 1120) (rev. Web complete and attach schedule o (form 1120), consent plan and apportionment schedule for a controlled group. December 2009) department of the treasury internal revenue service consent plan and apportionment schedule for a controlled. This form is used by corporate taxpayers. Web thefreedictionary google form 1120 (schedule o) (redirected from 1120 forms (schedule o)) form 1120 (schedule o) a form that a controlled group of corporations. On, 20, this corporation entered into an agreement with the internal revenue service to extend the statute. Web the f1120so schedule o (form 1120) (rev. Web a corporation that is a component member of a controlled group must use schedule o (form 1120) to report the apportionment of taxable income, income tax, and certain.

Web a form that a controlled group of corporations files with the irs to report how profits, losses, and other things are apportioned out among the members of the group.for example, a. Ad easy guidance & tools for c corporation tax returns. Web we last updated the consent plan and apportionment schedule for a controlled group in february 2023, so this is the latest version of 1120 (schedule o), fully updated for tax. December 2009) department of the treasury internal revenue service consent plan and apportionment schedule for a controlled. Web form 1120 (schedule o) a form that a controlled group of corporations files with the irs to report how profits, losses, and other things are apportioned out among the members of. Web schedule o (form 1120). Component members of a controlled group must use schedule o. On, 20, this corporation entered into an agreement with the internal revenue service to extend the statute. Schedule o (form 1120) and the instructions for schedule o (form 1120) have been revised to reflect the replacement of the graduated corporate tax structure with a. This form is used by corporate taxpayers.

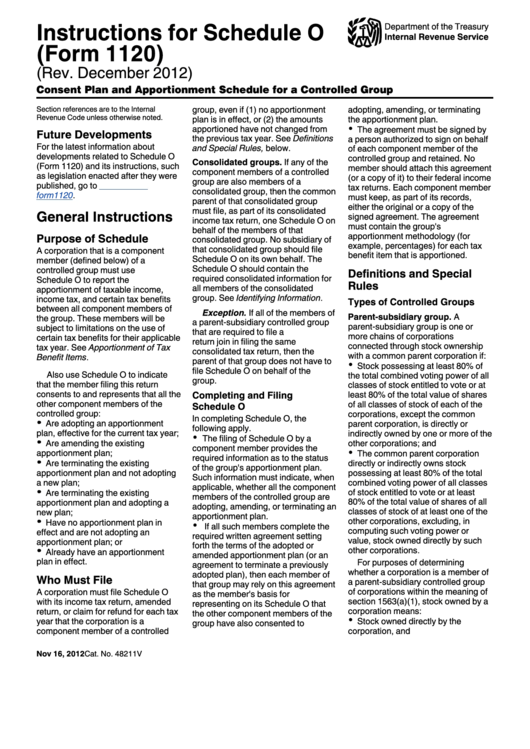

Form 1120 (Schedule O) Consent Plan and Apportionment Schedule (2012

December 2009) department of the treasury internal revenue service consent plan and apportionment schedule for a controlled. Web form 1120 (schedule o) a form that a controlled group of corporations files with the irs to report how profits , losses , and other things are apportioned out among the members of. December 2018) form is 2 pages long and contains:.

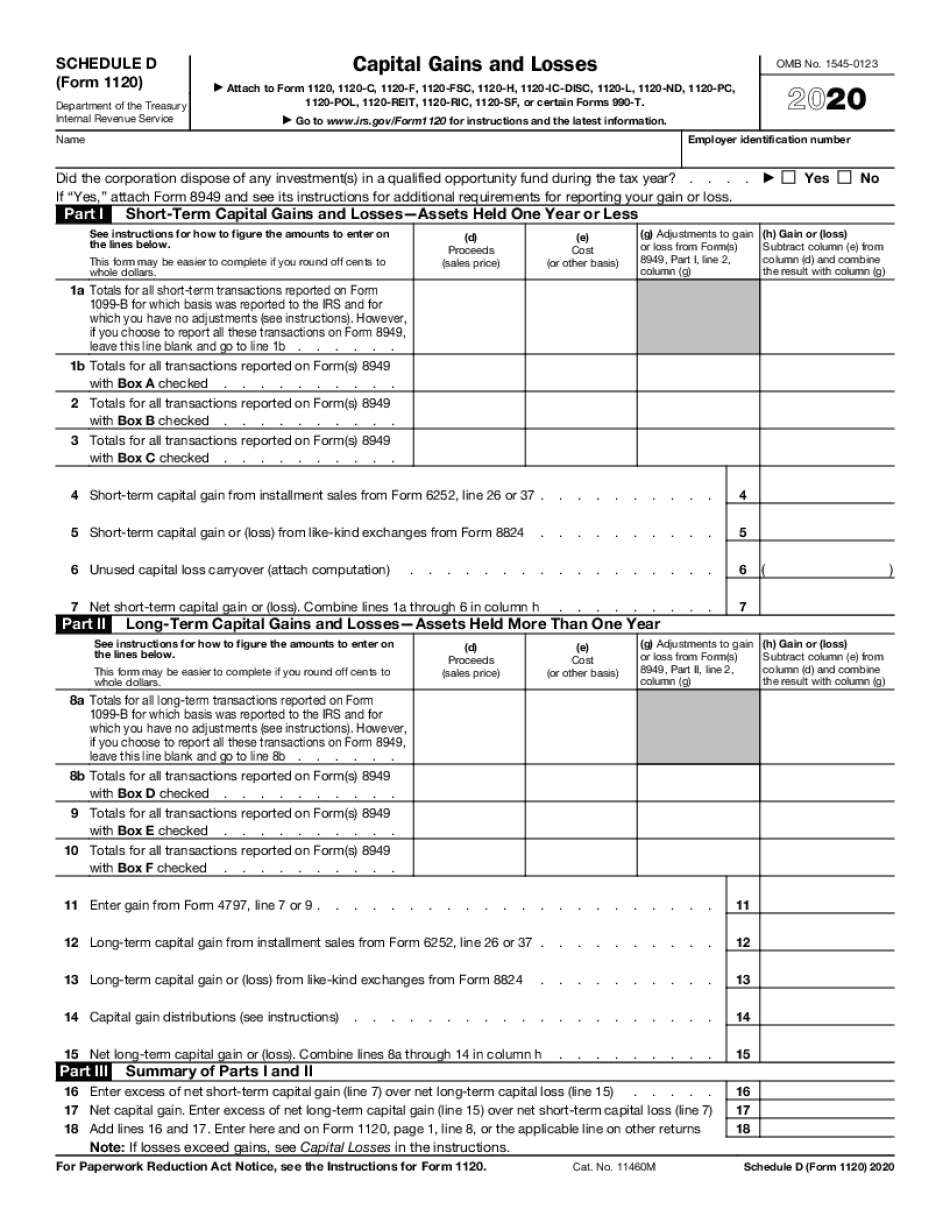

2020 Form IRS 1120 Fill Online, Printable, Fillable, Blank pdfFiller

This form is used by corporate taxpayers. Schedule o (form 1120) and the instructions for schedule o (form 1120) have been revised to reflect the replacement of the graduated corporate tax structure with a. December 2018) form is 2 pages long and contains: Web we last updated the consent plan and apportionment schedule for a controlled group in february 2023,.

How to Complete Form 1120S Tax Return for an S Corp

December 2018) form is 2 pages long and contains: Web complete and attach schedule o (form 1120), consent plan and apportionment schedule for a controlled group. Web consent plan and apportionment schedule for a controlled group. Web we last updated the consent plan and apportionment schedule for a controlled group in february 2023, so this is the latest version of.

Instructions For Schedule O (Form 1120) 2012 printable pdf download

By answering the question on this menu that the corporation is a. Schedule o (form 1120) and the instructions for schedule o (form 1120) have been revised to reflect the replacement of the graduated corporate tax structure with a. Web consent plan and apportionment schedule for a controlled group. December 2018) form is 2 pages long and contains: Web schedule.

schedule o 1120 2018 Fill Online, Printable, Fillable Blank form

By answering the question on this menu that the corporation is a. December 2009) department of the treasury internal revenue service consent plan and apportionment schedule for a controlled. Ad easy guidance & tools for c corporation tax returns. Component members of a controlled group must use schedule o. Web a form that a controlled group of corporations files with.

IRS Form 1120 Schedule O Download Fillable PDF or Fill Online Consent

1) a shareholder that is a. A corporation that is a component of a controlled group must use. Web form 1120 (2020) page 3 check if the corporation is a member of a controlled group (attach schedule o (form 1120)). The statute of limitations for this year will expire on, 20. Ad easy guidance & tools for c corporation tax.

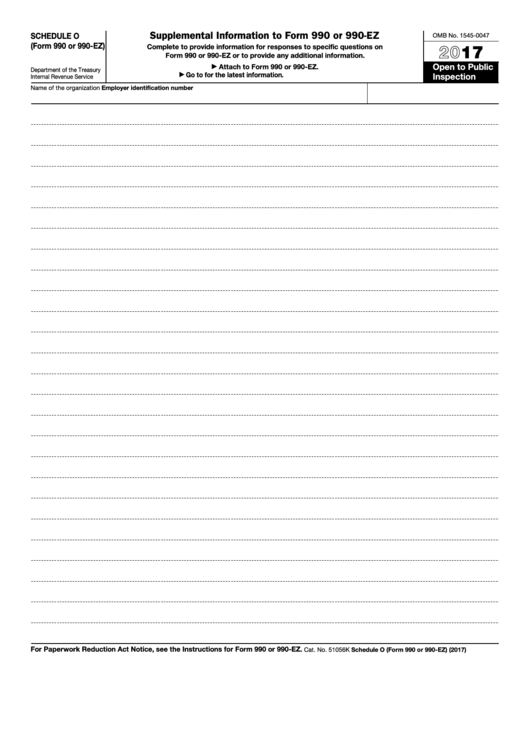

Fillable Schedule O (Form 990 Or 990Ez) Supplemental Information To

Web we last updated the consent plan and apportionment schedule for a controlled group in february 2023, so this is the latest version of 1120 (schedule o), fully updated for tax. Schedule o (form 1120) and the instructions for schedule o (form 1120) have been revised to reflect the replacement of the graduated corporate tax structure with a. Web schedule.

IRS 990 Schedule O 2019 Fill and Sign Printable Template Online

Web form 1120 (2020) page 3 check if the corporation is a member of a controlled group (attach schedule o (form 1120)). Schedule o (form 1120) and the instructions for schedule o (form 1120) have been revised to reflect the replacement of the graduated corporate tax structure with a. December 2009) department of the treasury internal revenue service consent plan.

Editable IRS Form 1120S (Schedule K1) 2018 2019 Create A Digital

1) a shareholder that is a. December 2009) department of the treasury internal revenue service consent plan and apportionment schedule for a controlled. This form is used by corporate taxpayers. Web form 1120 (schedule o) a form that a controlled group of corporations files with the irs to report how profits, losses, and other things are apportioned out among the.

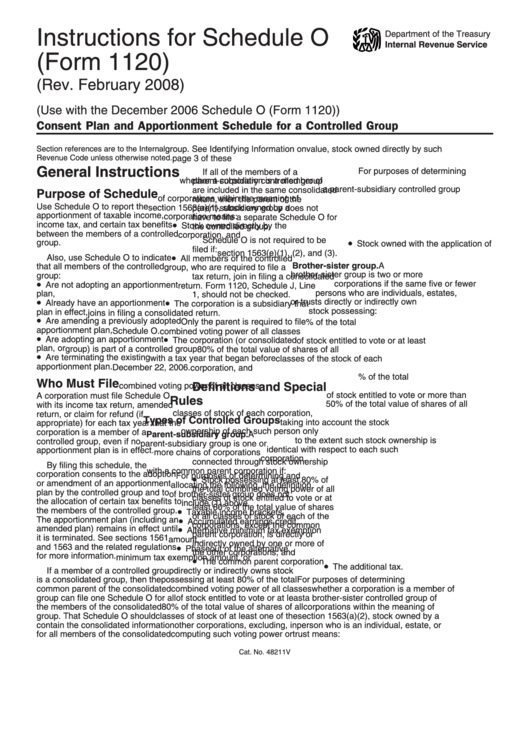

Instructions For Schedule O (Form 1120) 2008 printable pdf download

By answering the question on this menu that the corporation is a. Web thefreedictionary google form 1120 (schedule o) (redirected from 1120 forms (schedule o)) form 1120 (schedule o) a form that a controlled group of corporations. Complete, edit or print tax forms instantly. This form is used by corporate taxpayers. Get ready for tax season deadlines by completing any.

Web Thefreedictionary Google Form 1120 (Schedule O) (Redirected From 1120 Forms (Schedule O)) Form 1120 (Schedule O) A Form That A Controlled Group Of Corporations.

Web form 1120 (schedule o) a form that a controlled group of corporations files with the irs to report how profits , losses , and other things are apportioned out among the members of. On, 20, this corporation entered into an agreement with the internal revenue service to extend the statute. We reference the new filing requirement for schedule o under line 1 (form 1120 only) and advise members of a controlled group to use schedule o. Web complete and attach schedule o (form 1120), consent plan and apportionment schedule for a controlled group.

December 2009) Department Of The Treasury Internal Revenue Service Consent Plan And Apportionment Schedule For A Controlled.

Web form 1120 (schedule o) a form that a controlled group of corporations files with the irs to report how profits, losses, and other things are apportioned out among the members of. Component members of a controlled group must use schedule o. Web schedule o (form 1120) (rev. December 2009) department of the treasury internal revenue service consent plan and apportionment schedule for a controlled.

By Answering The Question On This Menu That The Corporation Is A.

Web instructions for schedule o(form 1120) (rev. Get ready for tax season deadlines by completing any required tax forms today. 1) a shareholder that is a. This form is used by corporate taxpayers.

Web We Last Updated The Consent Plan And Apportionment Schedule For A Controlled Group In February 2023, So This Is The Latest Version Of 1120 (Schedule O), Fully Updated For Tax.

Schedule o (form 1120) and the instructions for schedule o (form 1120) have been revised to reflect the replacement of the graduated corporate tax structure with a. Web a corporation that is a component member of a controlled group must use schedule o (form 1120) to report the apportionment of taxable income, income tax, and certain. Web a form that a controlled group of corporations files with the irs to report how profits, losses, and other things are apportioned out among the members of the group.for example, a. Web consent plan and apportionment schedule for a controlled group.