Substance Over Form Doctrine

Substance Over Form Doctrine - Learn about the '~'substance over form'~' tax doctrine. Substance over form is an accounting principle used to ensure that financial statements give a complete, relevant, and accurate picture of. Web the substance over form doctrine (and related step transaction and economic substance doctrines) are often invoked by courts to disallow tax. Web the substance over form doctrine allows the irs to ignore an arrangement’s legal form and examine its actual substance, with the goal of preventing. Web the substance over form doctrine is a well settled principle that federal courts apply when interpreting tax rules, as the court of appeals acknowledged in. Web in the recent complex media[1] case, the tax court addressed a taxpayer’s ability to recast the form of a transaction under the “substance over form” doctrine. Substance over form is a particular concern under generally accepted accounting principles ( gaap ),. Web the economic substance doctrine is a judicial doctrine that was codified in section 7701(o) by section 1409 of the health care and education reconciliation act of 2010, pub. Web substance over form in gaap and ifrs. From wikipedia the case is cited as part of the basis for two.

Web the substance over form doctrine allows the irs to ignore an arrangement’s legal form and examine its actual substance, with the goal of preventing. It might be considered, in large part, a variation on “substance over form” in that it deals with. Web the economic substance doctrine is a judicial doctrine that was codified in section 7701(o) by section 1409 of the health care and education reconciliation act of 2010, pub. Web the substance over form doctrine is a well settled principle that federal courts apply when interpreting tax rules, as the court of appeals acknowledged in. A summary of the key aspects of the. Examine the effect of ''gregory v. Web the substance over form doctrine (and related step transaction and economic substance doctrines) are often invoked by courts to disallow tax. Web the substance over form claim argues that the transaction in question should not be evaluated based on the formal legal structure of the transaction, but rather. Web substance over form doctrine law and legal definition. Substance over form is an accounting principle used to ensure that financial statements give a complete, relevant, and accurate picture of.

Examine the effect of ''gregory v. Web in the recent complex media[1] case, the tax court addressed a taxpayer’s ability to recast the form of a transaction under the “substance over form” doctrine. Web doctrine of substance over form. Learn about the '~'substance over form'~' tax doctrine. Web substance over form in gaap and ifrs. Web the substance over form doctrine (and related step transaction and economic substance doctrines) are often invoked by courts to disallow tax. Web substance over form doctrine law and legal definition. Web wikipedia the doctrine is often used in combination with other doctrines, such as substance over form. From wikipedia the case is cited as part of the basis for two. Substance over form is a particular concern under generally accepted accounting principles ( gaap ),.

The Substance Over Form doctrine YouTube

From wikipedia the case is cited as part of the basis for two. Web the substance over form claim argues that the transaction in question should not be evaluated based on the formal legal structure of the transaction, but rather. Web the economic substance doctrine is a judicial doctrine that was codified in section 7701(o) by section 1409 of the.

Limiting the Substance Over Form Doctrine Certified Tax Coach

Substance over form is an accounting principle used to ensure that financial statements give a complete, relevant, and accurate picture of. Web substance over form in gaap and ifrs. Web doctrine of substance over form. A summary of the key aspects of the. Web wikipedia the doctrine is often used in combination with other doctrines, such as substance over form.

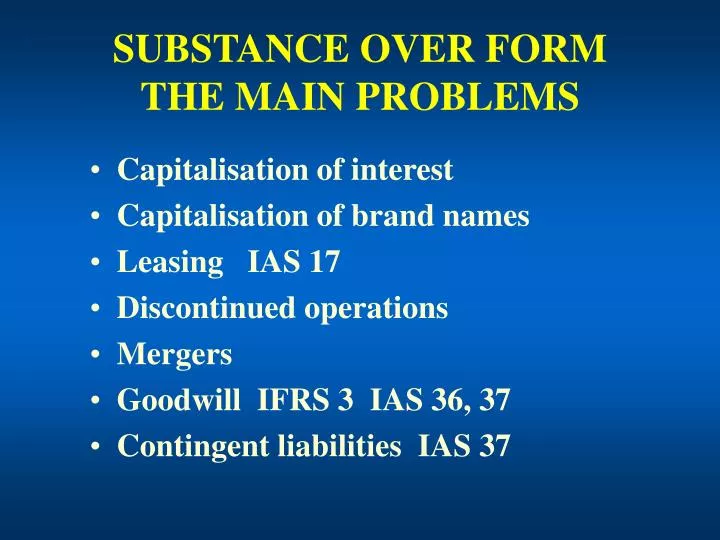

PPT SUBSTANCE OVER FORM THE MAIN PROBLEMS PowerPoint Presentation

Examine the effect of ''gregory v. Web the substance over form doctrine (and related step transaction and economic substance doctrines) are often invoked by courts to disallow tax. Web the substance over form doctrine allows the irs to ignore an arrangement’s legal form and examine its actual substance, with the goal of preventing. It is a search for the essential.

What Is The Meaning Of Substance Over Form In Accounting Koman

A summary of the key aspects of the. Substance over form is a particular concern under generally accepted accounting principles ( gaap ),. Web wikipedia the doctrine is often used in combination with other doctrines, such as substance over form. Substance over form is an accounting principle used to ensure that financial statements give a complete, relevant, and accurate picture.

Substance Over FormMeaning,Applications,Understanding,Examples

Web the substance over form doctrine is a well settled principle that federal courts apply when interpreting tax rules, as the court of appeals acknowledged in. Web substance over form doctrine law and legal definition. Web doctrine of substance over form. Substance over form is a particular concern under generally accepted accounting principles ( gaap ),. Web wikipedia the doctrine.

What is Substance Over form? Understand with examples YouTube

Web the substance over form doctrine allows the irs to ignore an arrangement’s legal form and examine its actual substance, with the goal of preventing. Web the substance over form claim argues that the transaction in question should not be evaluated based on the formal legal structure of the transaction, but rather. Web doctrine of substance over form. A summary.

What Is the Substance Over Form Doctrine? Paladini Law

Web transaction” doctrine largely overlaps with the “substance over form” doctrine. Web doctrine of substance over form. Substance over form is an accounting principle used to ensure that financial statements give a complete, relevant, and accurate picture of. It might be considered, in large part, a variation on “substance over form” in that it deals with. Web the substance over.

Redirecting...

Web the substance over form doctrine is a well settled principle that federal courts apply when interpreting tax rules, as the court of appeals acknowledged in. Web substance over form in gaap and ifrs. Substance over form is an accounting principle used to ensure that financial statements give a complete, relevant, and accurate picture of. Web transaction” doctrine largely overlaps.

Substance Over Form Principle _ Definition and Examples

Web substance over form doctrine law and legal definition. Substance over form doctrine is the doctrine which allows the tax authorities to ignore the legal form of an. Web in the recent complex media[1] case, the tax court addressed a taxpayer’s ability to recast the form of a transaction under the “substance over form” doctrine. Substance over form is an.

What is the Substance Over Form Doctrine

Web the substance over form doctrine (and related step transaction and economic substance doctrines) are often invoked by courts to disallow tax. It might be considered, in large part, a variation on “substance over form” in that it deals with. Substance over form is an accounting principle used to ensure that financial statements give a complete, relevant, and accurate picture.

Web Substance Over Form In Gaap And Ifrs.

Examine the effect of ''gregory v. Web wikipedia the doctrine is often used in combination with other doctrines, such as substance over form. It might be considered, in large part, a variation on “substance over form” in that it deals with. Web the substance over form claim argues that the transaction in question should not be evaluated based on the formal legal structure of the transaction, but rather.

Substance Over Form Is A Particular Concern Under Generally Accepted Accounting Principles ( Gaap ),.

Web in the recent complex media[1] case, the tax court addressed a taxpayer’s ability to recast the form of a transaction under the “substance over form” doctrine. Substance over form doctrine is the doctrine which allows the tax authorities to ignore the legal form of an. Web the substance over form doctrine (and related step transaction and economic substance doctrines) are often invoked by courts to disallow tax. Web the economic substance doctrine is a judicial doctrine that was codified in section 7701(o) by section 1409 of the health care and education reconciliation act of 2010, pub.

Learn About The '~'Substance Over Form'~' Tax Doctrine.

Web doctrine of substance over form. Web the substance over form doctrine allows the irs to ignore an arrangement’s legal form and examine its actual substance, with the goal of preventing. Web transaction” doctrine largely overlaps with the “substance over form” doctrine. Web the substance over form doctrine is a well settled principle that federal courts apply when interpreting tax rules, as the court of appeals acknowledged in.

It Is A Search For The Essential Reality, Seeking To Uncover Theeconomic Substance In Order To.

A summary of the key aspects of the. Web substance over form doctrine law and legal definition. Substance over form is an accounting principle used to ensure that financial statements give a complete, relevant, and accurate picture of. From wikipedia the case is cited as part of the basis for two.