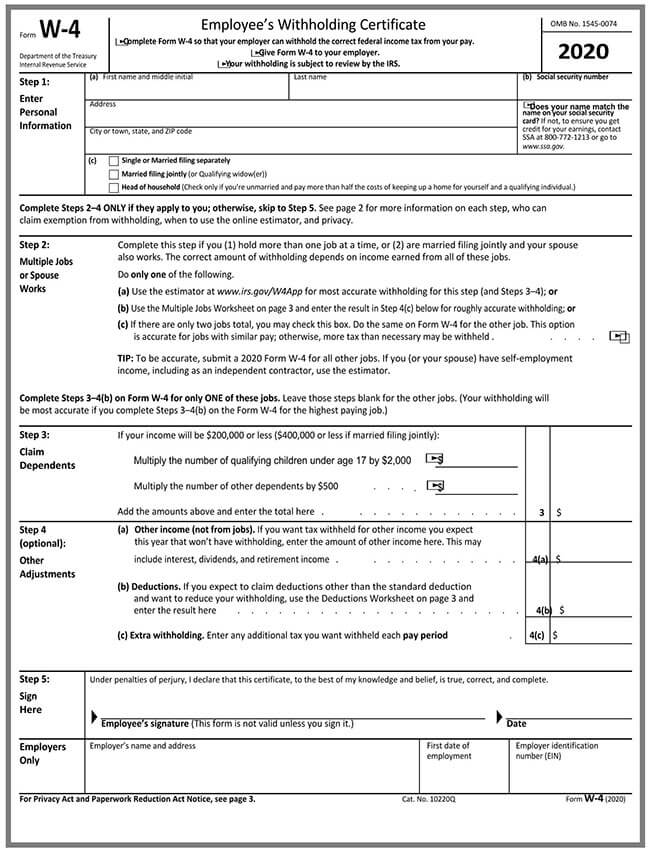

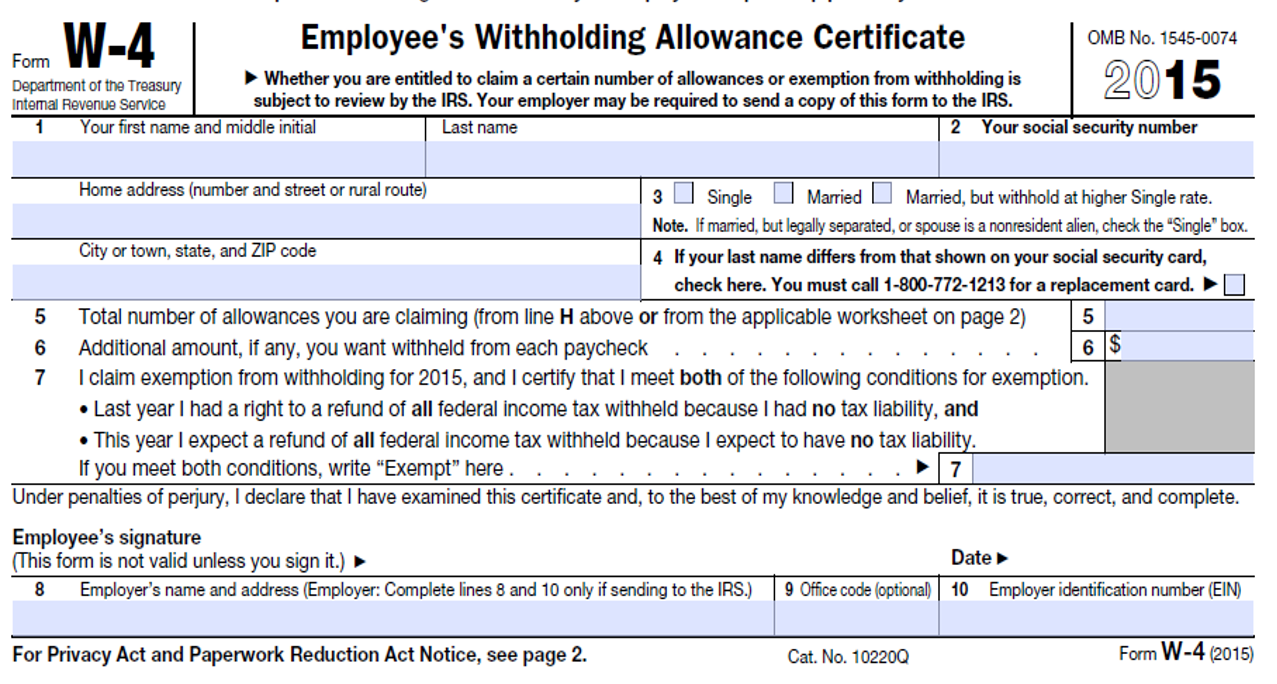

W 4 Form 2015

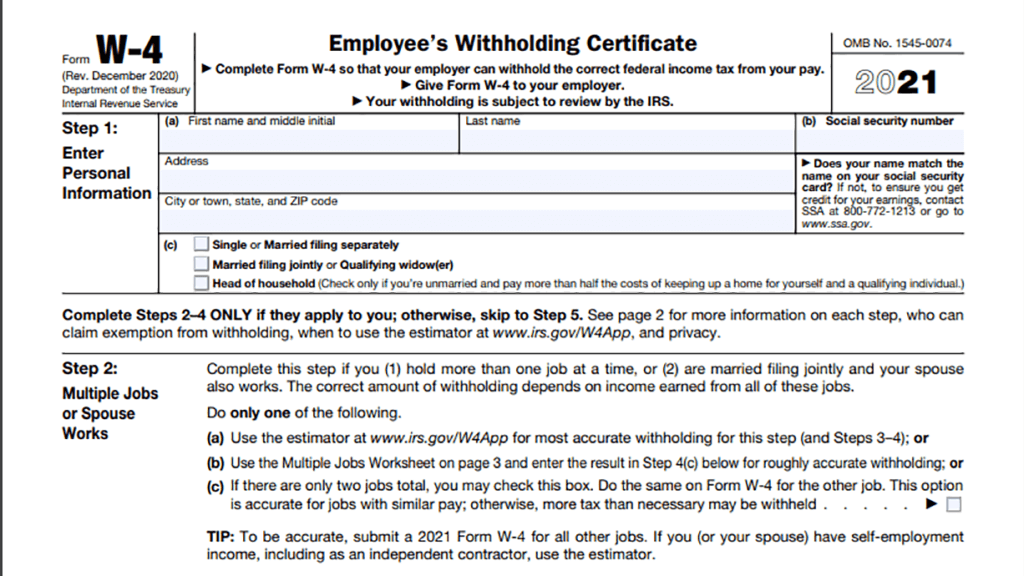

W 4 Form 2015 - There are new ways to figure out your withholding amount, including an online. If you are exempt, complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it. The new form changes single to single or married filing separately and includes head of. This form is crucial in determining. Fill in your chosen form Web the form has steps 1 through 5 to guide employees through it. Forms for wilmington university browse wilmington university forms fill has a huge library of thousands of forms all set up to be filled in easily and signed. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Change the blanks with exclusive fillable fields. Your withholding is subject to review by the irs.

The new form changes single to single or married filing separately and includes head of. Fill in your chosen form Involved parties names, addresses and phone numbers etc. Web the form has steps 1 through 5 to guide employees through it. This form is crucial in determining. If too much is withheld, you will generally be due a refund. Get your online template and fill it in using progressive features. There are new ways to figure out your withholding amount, including an online. Change the blanks with exclusive fillable fields. Deductions, adjustments and additional income worksheet

If you are exempt, complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it. It tells the employer how much to withhold from an employee’s paycheck for taxes. If you are exempt, complete One difference from prior forms is the expected filing status. This form is crucial in determining. This form tells your employer how much federal income tax withholding to keep from each paycheck. If too much is withheld, you will generally be due a refund. Deductions, adjustments and additional income worksheet If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Web the form has steps 1 through 5 to guide employees through it.

Fill Free fillable Form W4 2015 PDF form

Your withholding is subject to review by the irs. If too much is withheld, you will generally be due a refund. Forms for wilmington university browse wilmington university forms fill has a huge library of thousands of forms all set up to be filled in easily and signed. Involved parties names, addresses and phone numbers etc. If you are exempt,.

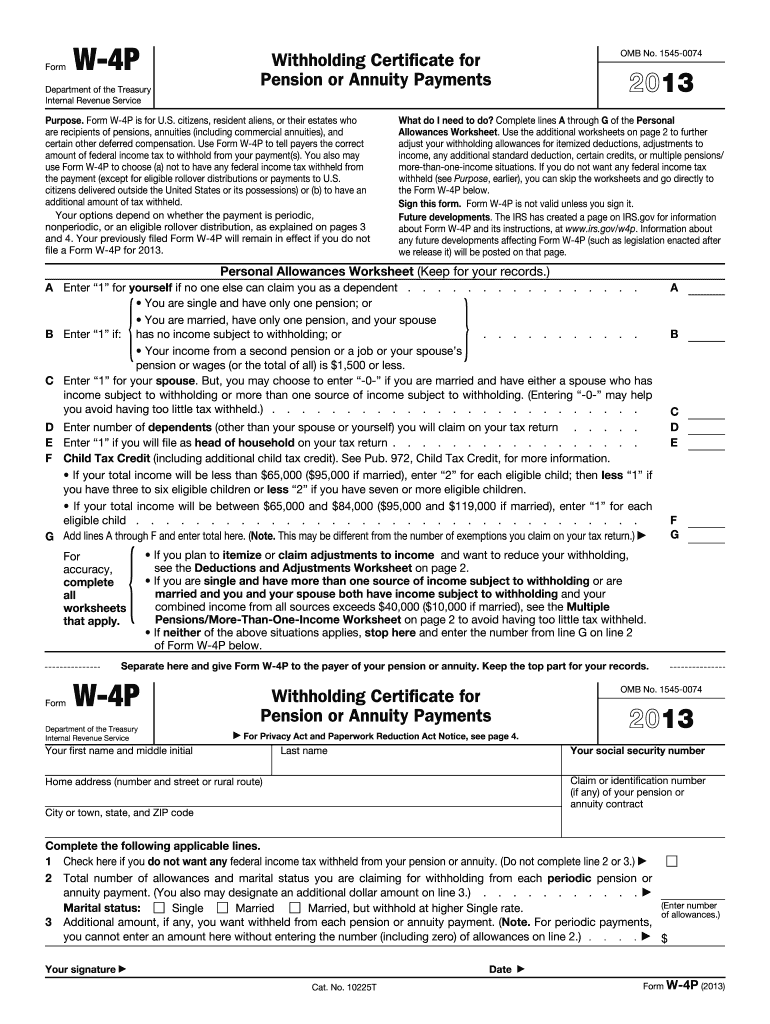

Form W 4v Fill Online, Printable, Fillable, Blank pdfFiller

There are new ways to figure out your withholding amount, including an online. If too much is withheld, you will generally be due a refund. Involved parties names, addresses and phone numbers etc. If you are exempt, complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it. It tells the employer how much to.

What Is a W4 Form?

Deductions, adjustments and additional income worksheet If too much is withheld, you will generally be due a refund. Change the blanks with exclusive fillable fields. Get ready for this year's tax season quickly and safely with pdffiller! There are new ways to figure out your withholding amount, including an online.

Form w4

If you are exempt, complete It tells the employer how much to withhold from an employee’s paycheck for taxes. One difference from prior forms is the expected filing status. Deductions, adjustments and additional income worksheet This form is crucial in determining.

How to Fill a W4 Form (with Guide)

There are new ways to figure out your withholding amount, including an online. Deductions, adjustments and additional income worksheet Web the form has steps 1 through 5 to guide employees through it. Get your online template and fill it in using progressive features. Involved parties names, addresses and phone numbers etc.

W 4p Form Fill Out and Sign Printable PDF Template signNow

Involved parties names, addresses and phone numbers etc. This form is crucial in determining. Deductions, adjustments and additional income worksheet If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. There are new ways to figure out your withholding amount, including an online.

State W4 Form Detailed Withholding Forms by State Chart

This form is crucial in determining. If too much is withheld, you will generally be due a refund. One difference from prior forms is the expected filing status. This form tells your employer how much federal income tax withholding to keep from each paycheck. Involved parties names, addresses and phone numbers etc.

W4 2015 Form Printable W4 Form 2021

Forms for wilmington university browse wilmington university forms fill has a huge library of thousands of forms all set up to be filled in easily and signed. This form tells your employer how much federal income tax withholding to keep from each paycheck. There are new ways to figure out your withholding amount, including an online. This form is crucial.

TakeOneForTheMoney Taking 1 Smart Financial Step At a Time

If you are exempt, complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it. Web the form has steps 1 through 5 to guide employees through it. The new form changes single to single or married filing separately and includes head of. Forms for wilmington university browse wilmington university forms fill has a huge.

What you should know about the new Form W4 Atlantic Payroll Partners

Get ready for this year's tax season quickly and safely with pdffiller! Change the blanks with exclusive fillable fields. If too much is withheld, you will generally be due a refund. Web the form has steps 1 through 5 to guide employees through it. If you are exempt, complete only lines 1, 2, 3, 4, and 7 and sign the.

Fill In Your Chosen Form

Involved parties names, addresses and phone numbers etc. Your withholding is subject to review by the irs. If too much is withheld, you will generally be due a refund. Deductions, adjustments and additional income worksheet

Web The Form Has Steps 1 Through 5 To Guide Employees Through It.

If you are exempt, complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it. The new form changes single to single or married filing separately and includes head of. If you are exempt, complete There are new ways to figure out your withholding amount, including an online.

Get Your Online Template And Fill It In Using Progressive Features.

Download & print with other fillable us tax forms in pdf. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Change the blanks with exclusive fillable fields. This form is crucial in determining.

One Difference From Prior Forms Is The Expected Filing Status.

It tells the employer how much to withhold from an employee’s paycheck for taxes. Forms for wilmington university browse wilmington university forms fill has a huge library of thousands of forms all set up to be filled in easily and signed. This form tells your employer how much federal income tax withholding to keep from each paycheck. Get ready for this year's tax season quickly and safely with pdffiller!